E-commerce software platform provider BigCommerce (NASDAQ: BIGC) beat analysts' expectations in Q1 CY2024, with revenue up 12% year on year to $80.36 million. The company expects next quarter's revenue to be around $80.8 million, in line with analysts' estimates. It made a non-GAAP profit of $0.06 per share, improving from its loss of $0.30 per share in the same quarter last year.

Is now the time to buy BigCommerce? Find out by accessing our full research report, it's free.

BigCommerce (BIGC) Q1 CY2024 Highlights:

- Revenue: $80.36 million vs analyst estimates of $77.26 million (4% beat)

- EPS (non-GAAP): $0.06 vs analyst estimates of $0.04 ($0.02 beat)

- Revenue Guidance for Q2 CY2024 is $80.8 million at the midpoint, roughly in line with what analysts were expecting (operating income guidance for Q2 missed)

- The company reconfirmed its revenue guidance for the full year of $332.7 million at the midpoint (operating income guidance for 2024 ahead)

- Gross Margin (GAAP): 77.1%, up from 75.7% in the same quarter last year

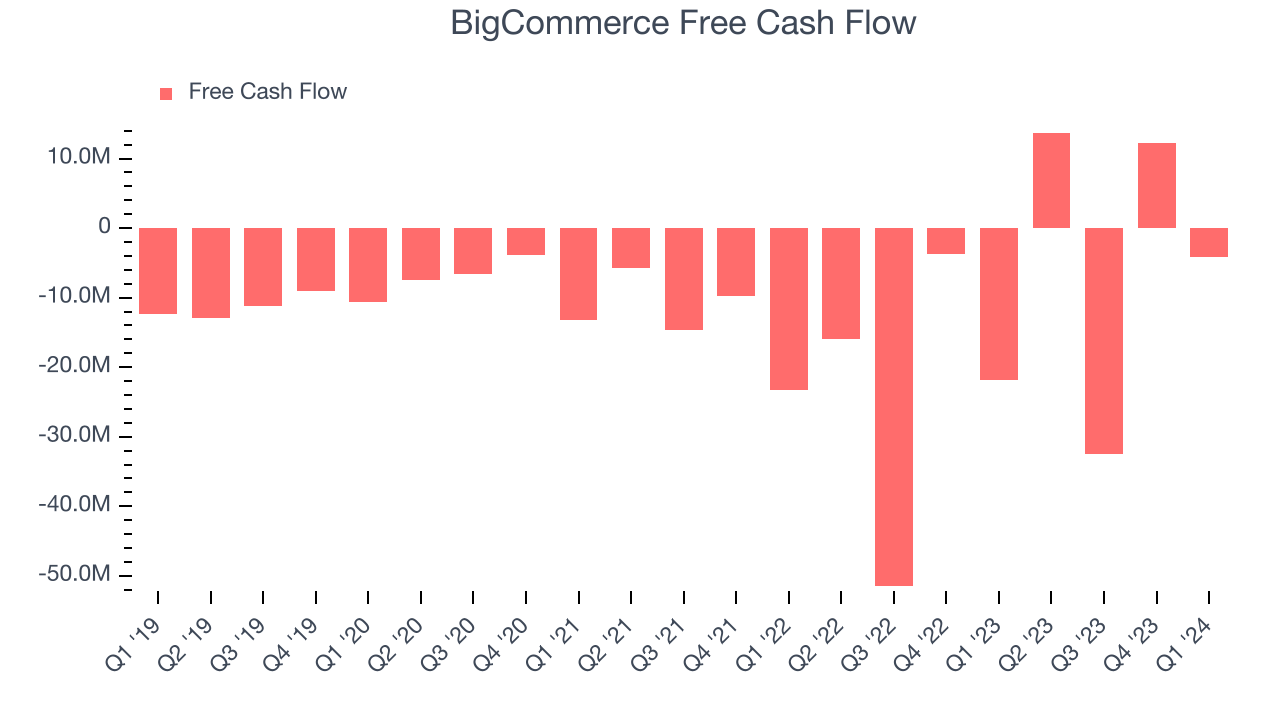

- Free Cash Flow was -$4.22 million, down from $12.24 million in the previous quarter

- Annual Recurring Revenue: $340.1 million at quarter end, up 7.4% year on year (in line)

- Market Capitalization: $513.8 million

“Our first quarter results reflect a good start to the year as our total revenue exceeded $80 million, up 12% year-over-year. We also delivered strong profit improvement, with net income gaining nearly 23 points as a percent of revenue compared to last year,” said Brent Bellm, CEO of BigCommerce.

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Sales Growth

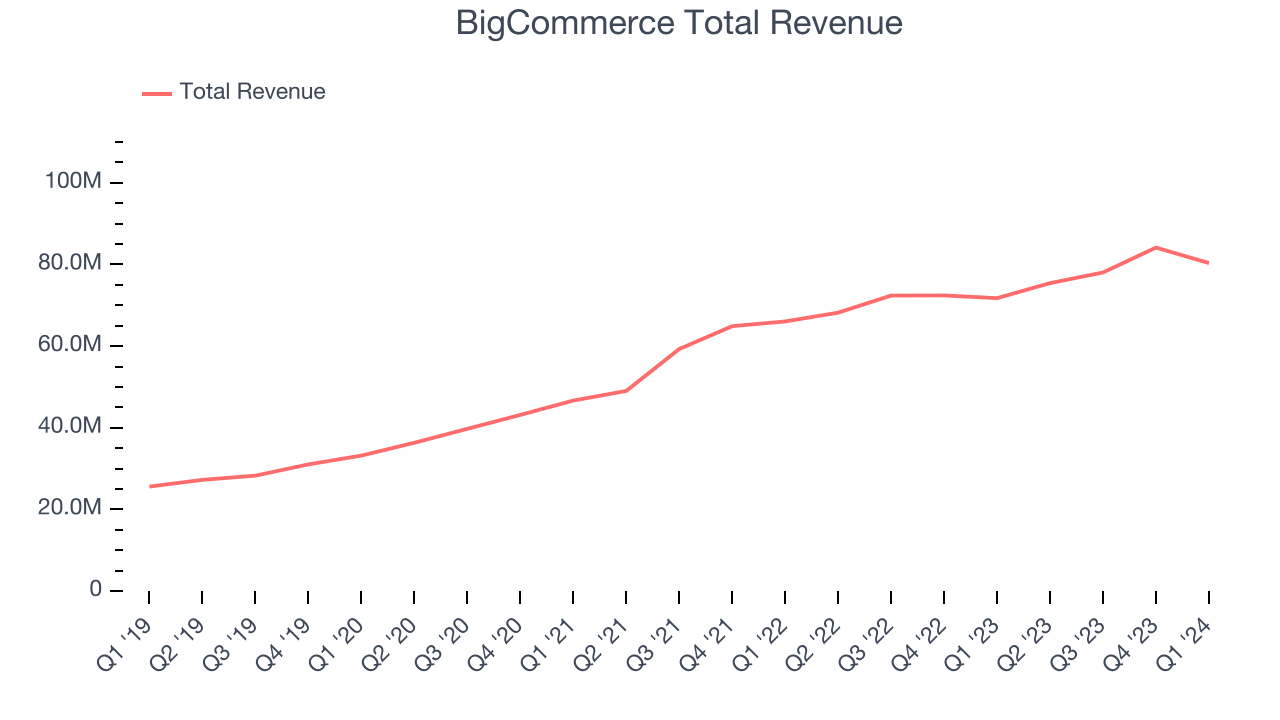

As you can see below, BigCommerce's revenue growth has been strong over the last three years, growing from $46.66 million in Q1 2021 to $80.36 million this quarter.

This quarter, BigCommerce's quarterly revenue was once again up 12% year on year. However, the company's revenue actually decreased by $3.79 million in Q1 compared to the $6.10 million increase in Q4 CY2023. Sales also dropped by a similar amount a year ago and management is guiding for revenue to rebound in the coming quarter, which might hint at an emerging seasonal pattern.

Next quarter's guidance suggests that BigCommerce is expecting revenue to grow 7.1% year on year to $80.8 million, slowing down from the 10.6% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 6.8% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. BigCommerce burned through $4.22 million of cash in Q1 , increasing its cash burn by 80.7% year on year.

BigCommerce has burned through $10.75 million of cash over the last 12 months, resulting in a negative 3.4% free cash flow margin. This low FCF margin stems from BigCommerce's constant need to reinvest in its business to stay competitive.

Key Takeaways from BigCommerce's Q1 Results

It was good to see BigCommerce beat analysts' revenue expectations this quarter. However, ARR was only in line. Guidance was mixed, with revenue guidance for Q2 and the full year roughly in line while operating profit guidance for Q2 was slightly below expectations. Zooming out, we think this was a mixed quarter. The stock is flat after reporting and currently trades at $6.76 per share.

So should you invest in BigCommerce right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.