E-commerce software platform provider BigCommerce (NASDAQ: BIGC) reported results ahead of analyst expectations in the Q3 FY2022 quarter, with revenue up 22.1% year on year to $72.3 million. Guidance for the full year also exceeded estimates, however the guidance for the next quarter was less impressive, coming in at $73.3 million, 3.79% below analyst estimates. BigCommerce made a GAAP loss of $30.2 million, down on its loss of $21.6 million, in the same quarter last year.

Is now the time to buy BigCommerce? Access our full analysis of the earnings results here, it's free.

BigCommerce (BIGC) Q3 FY2022 Highlights:

- Revenue: $72.3 million vs analyst estimates of $69.6 million (3.97% beat)

- EPS (non-GAAP): -$0.15 vs analyst estimates of -$0.21

- Revenue guidance for Q4 2022 is $73.3 million at the midpoint, below analyst estimates of $76.1 million

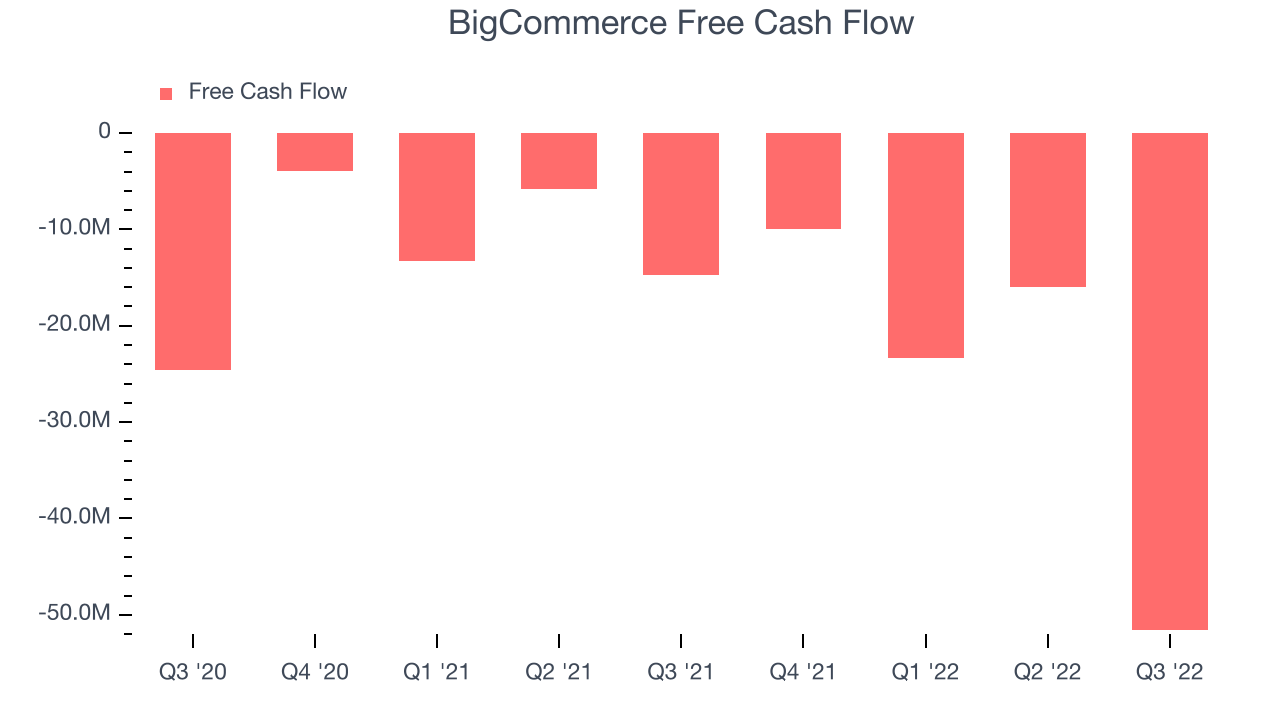

- Free cash flow was negative $51.5 million, compared to negative free cash flow of $16 million in previous quarter

- Gross Margin (GAAP): 75.7%, down from 79% same quarter last year

“BigCommerce’s third quarter growth continued to outpace that of global ecommerce,” said Brent Bellm, CEO at BigCommerce.

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

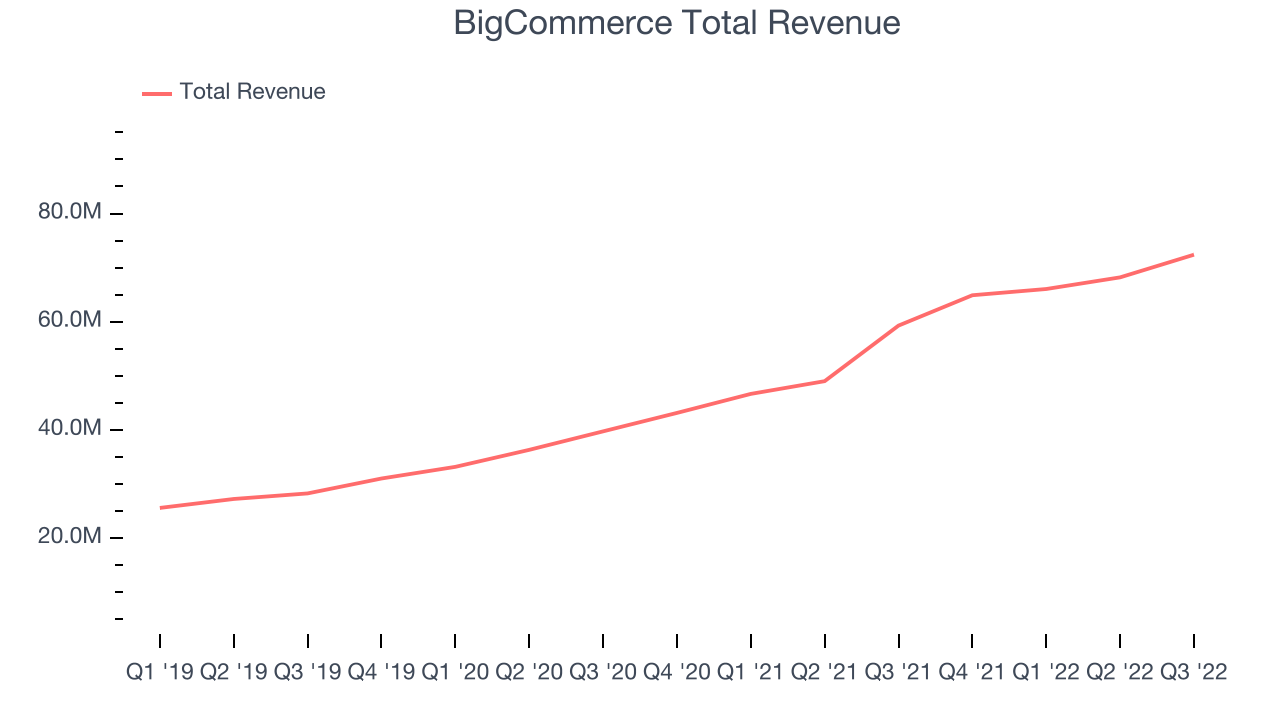

Sales Growth

As you can see below, BigCommerce's revenue growth has been very strong over the last two years, growing from quarterly revenue of $39.7 million in Q3 FY2020, to $72.3 million.

This quarter, BigCommerce's quarterly revenue was once again up a very solid 22.1% year on year. On top of that, revenue increased $4.18 million quarter on quarter, a very strong improvement on the $2.15 million increase in Q2 2022, which shows re-acceleration of growth, and is great to see.

Guidance for the next quarter indicates BigCommerce is expecting revenue to grow 12.9% year on year to $73.3 million, slowing down from the 50.4% year-over-year increase in revenue the company had recorded in the same quarter last year. Ahead of the earnings results the analysts covering the company were estimating sales to grow 18.5% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

Cash Is King

If you follow StockStory for a while, you know that we put an emphasis on cash flow. Why, you ask? We believe that in the end cash is king, as you can't use accounting profits to pay the bills. BigCommerce burned through $51.5 million in Q3, increasing the cash burn by 250% year on year.

BigCommerce has burned through $100.7 million in cash over the last twelve months, a negative 37.1% free cash flow margin. This low FCF margin is a result of BigCommerce's need to still heavily invest in the business.

Key Takeaways from BigCommerce's Q3 Results

Since it has still been burning cash over the last twelve months it is worth keeping an eye on BigCommerce’s balance sheet, but we note that with a market capitalization of $1 billion and more than $306.7 million in cash, the company has the capacity to continue to prioritise growth over profitability.

It was good to see BigCommerce outperform Wall St’s revenue expectations this quarter. That feature of these results really stood out as a positive. On the other hand, it was unfortunate to see that the revenue guidance for the next quarter missed analysts' expectations. Overall, this quarter's results could have been better. The company is down 9.05% on the results and currently trades at $12.05 per share.

BigCommerce may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.