Online travel agency Booking Holdings (NASDAQ:BKNG) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 16.9% year on year to $4.42 billion. It made a non-GAAP profit of $20.39 per share, improving from its profit of $11.58 per share in the same quarter last year.

Is now the time to buy Booking? Find out by accessing our full research report, it's free.

Booking (BKNG) Q1 CY2024 Highlights:

- Revenue: $4.42 billion vs analyst estimates of $4.26 billion (3.7% beat)

- Adjusted EBITDA: $898 million vs analyst estimates of $721 million (large beat)

- EPS (non-GAAP): $20.39 vs analyst estimates of $14.19 (43.7% beat)

- Free Cash Flow of $2.57 billion, up 106% from the previous quarter

- Room Nights Booked: 297 million, up 23 million year on year

- Market Capitalization: $116.7 billion

Formerly known as The Priceline Group, Booking Holdings (NASDAQ:BKNG) is the world’s largest online travel agency.

Online Travel

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead.

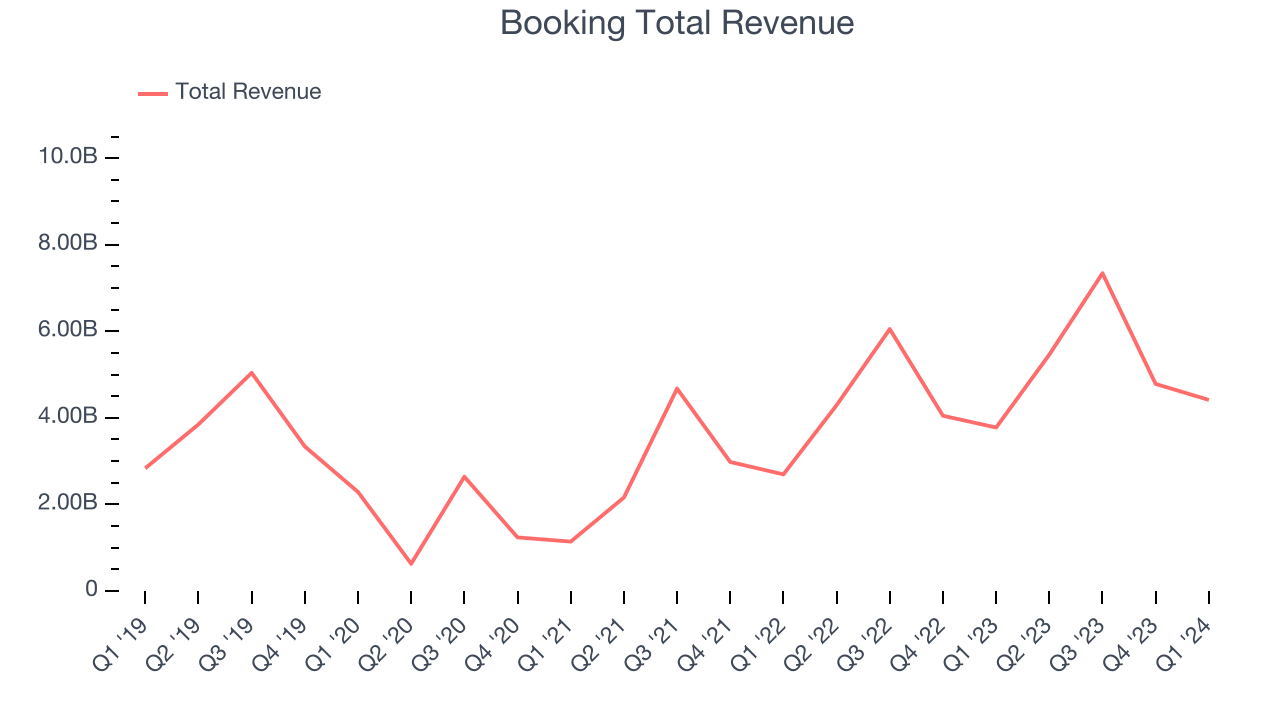

Sales Growth

Booking's revenue growth over the last three years has been incredible, averaging 73.7% annually. This quarter, Booking beat analysts' estimates and reported 16.9% year-on-year revenue growth.

Ahead of the earnings results, analysts were projecting sales to grow 6.3% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Usage Growth

As an online travel company, Booking generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Booking's nights booked, a key performance metric for the company, grew 26% annually to 297 million. This is fast growth for a consumer internet company.

In Q1, Booking added 23 million nights booked, translating into 8.4% year-on-year growth.

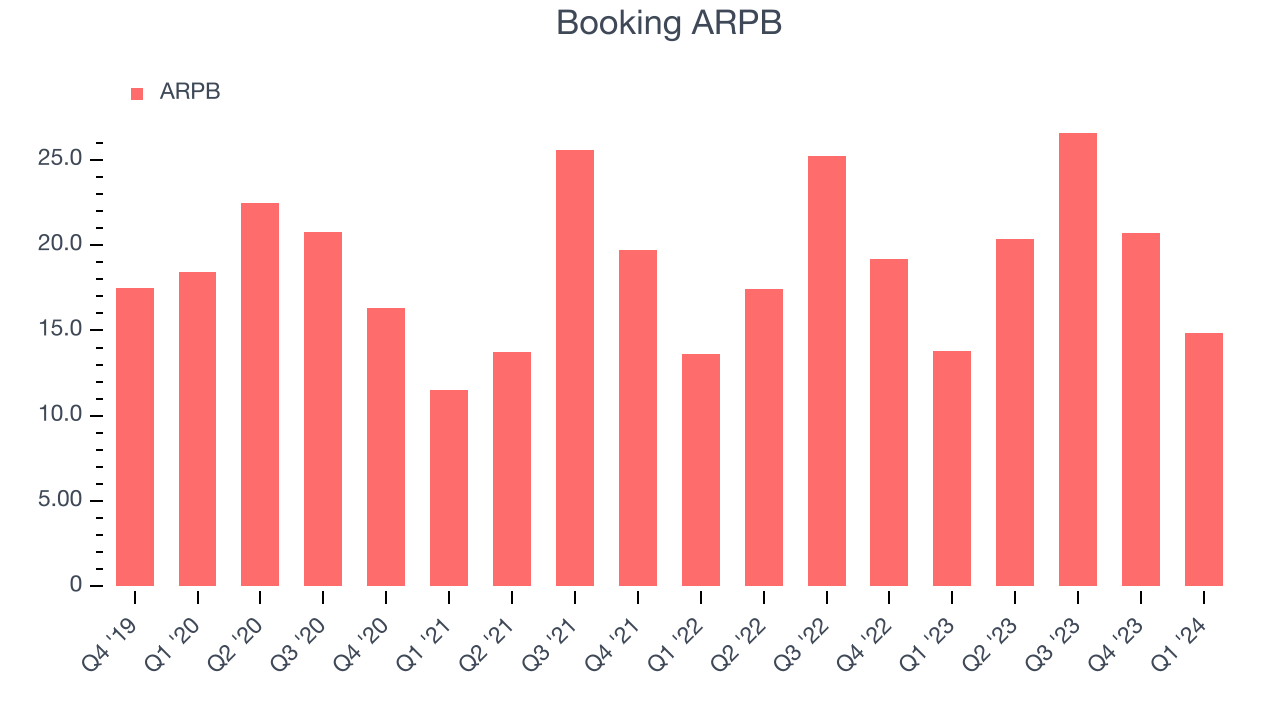

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track for consumer internet businesses like Booking because it not only measures how much users book on its platform but also the commission that Booking can charge.

Booking's ARPB growth has been decent over the last two years, averaging 7.8%. The company's ability to increase prices while constantly growing its nights booked demonstrates the value of its platform. This quarter, ARPB grew 7.8% year on year to $14.87 per booking.

Key Takeaways from Booking's Q1 Results

It was great to see Booking beat analysts' revenue expectations this quarter. The company also smashed adjusted EBITDA estimates. Overall, this quarter's results were great and shareholders should feel optimistic. The stock is up 5.9% after reporting and currently trades at $3,688.02 per share.

So should you invest in Booking right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.