Online travel agency Booking Holdings (NASDAQ:BKNG) reported results ahead of analysts' expectations in Q3 FY2023, with revenue up 21.3% year on year to $7.34 billion. Turning to EPS, Booking made a non-GAAP profit of $72.32 per share, improving from its profit of $41.98 per share in the same quarter last year.

Is now the time to buy Booking? Find out by accessing our full research report, it's free.

Booking (BKNG) Q3 FY2023 Highlights:

- Revenue: $7.34 billion vs analyst estimates of $7.26 billion (1.07% beat)

- EPS (non-GAAP): $72.32 vs analyst estimates of $67.92 (6.49% beat)

- Free Cash Flow of $1.3 billion, down 20.9% from the previous quarter

- Room Nights Booked: 276 million, up 36 million year on year

"We are pleased to report record quarterly room nights, gross bookings, revenue, and net income driven by a strong summer travel season," said Glenn Fogel, Chief Executive Officer of Booking Holdings.

Formerly known as The Priceline Group, Booking Holdings (NASDAQ:BKNG) is the world’s largest online travel agency.

Online Travel

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead.

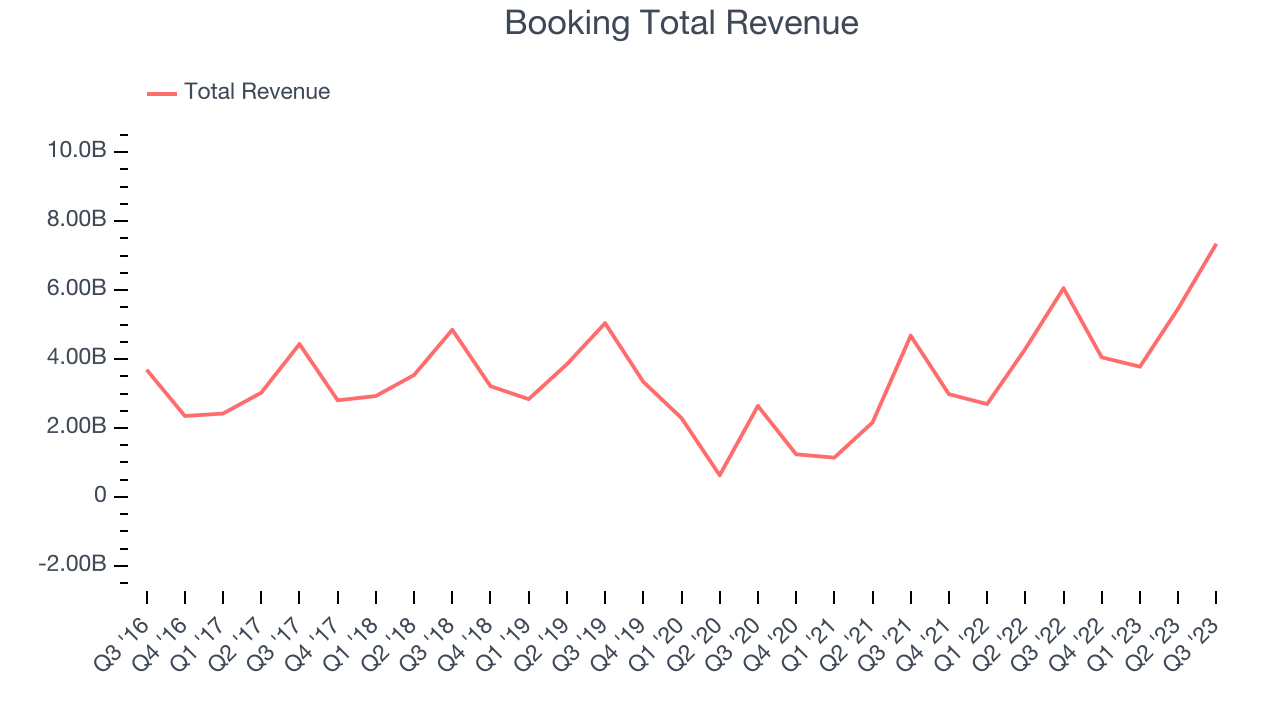

Sales Growth

Booking's revenue growth over the last three years has been incredible, averaging 61.4% annually. This quarter, Booking beat analysts' estimates and reported decent 21.3% year-on-year revenue growth.

Ahead of the earnings results, analysts covering the company were projecting sales to grow 11.6% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Usage Growth

As an online travel company, Booking generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Booking's nights booked, a key performance metric for the company, grew 48.6% annually to 276 million. This is among the fastest growth rates of any consumer internet company, indicating that users are excited about its offerings.

In Q3, Booking added 36 million nights booked, translating into 15% year-on-year growth.

Key Takeaways from Booking's Q3 Results

With a market capitalization of $98.7 billion, a $13.9 billion cash balance, and positive free cash flow over the last 12 months, we're confident that Booking has the resources needed to pursue a high-growth business strategy.

It was great to see Booking's strong user growth this quarter. We were also happy its revenue and EPS outperformed Wall Street's estimates, driven by better-than-expected gross travel bookings. Management cited that even in a weak macroeconomic environment, demand for travel and leisure activities remains resilient. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The market was likely expecting more, however, and the stock is down 3.84% after reporting, trading at $2,730 per share.

So should you invest in Booking right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.