As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today we are looking at the consumer internet stocks, starting with Booking (NASDAQ:BKNG).

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 34 consumer internet stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 2.57%, while on average next quarter revenue guidance was 1.21% under consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021, but consumer internet stocks held their ground better than others, with the share prices up 2.75% since the previous earnings results, on average.

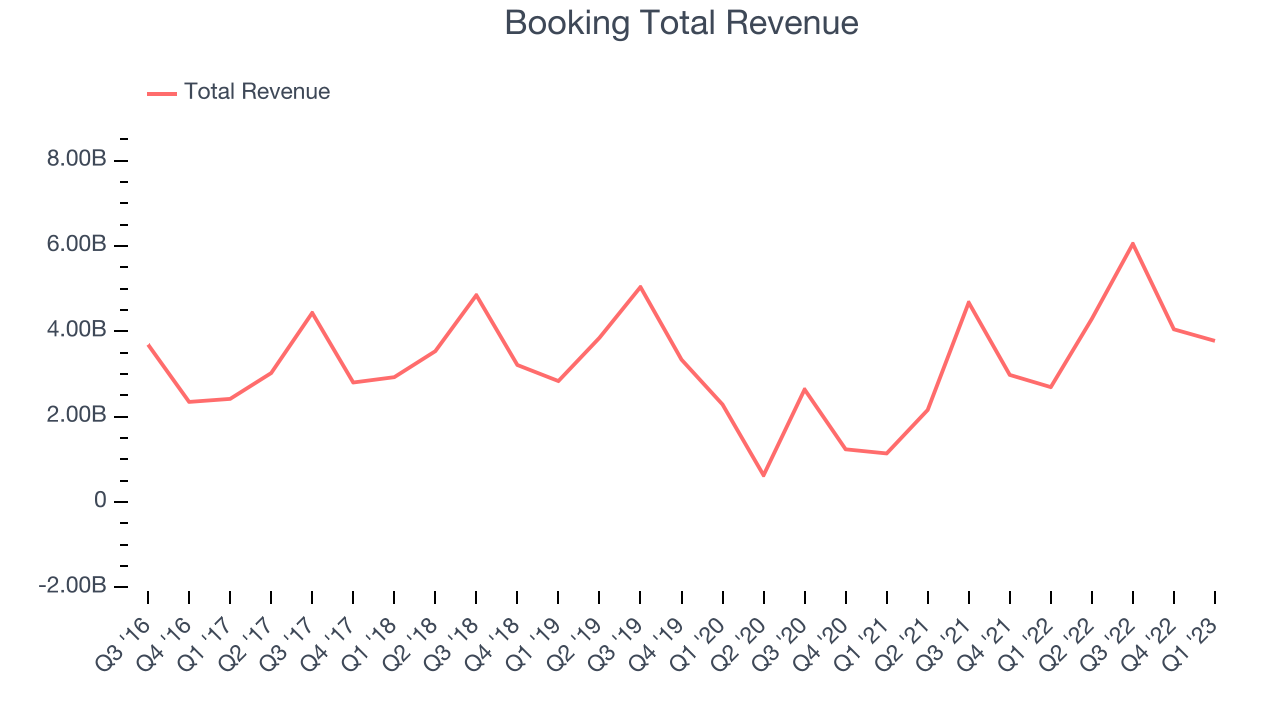

Booking (NASDAQ:BKNG)

Formerly known as The Priceline Group, Booking Holdings (NASDAQ: BKNG) is the world’s largest online travel agency.

Booking reported revenues of $3.78 billion, up 40.2% year on year, in line with analyst expectations. It was a very strong quarter for the company, with growing number of users and exceptional revenue growth.

Booking scored the fastest revenue growth of the whole group. The company reported 274 million nights booked, up 38.4% year on year. The stock is down 1.86% since the results and currently trades at $2,553.97.

Read why we think that Booking is one of the best consumer internet stocks, our full report is free.

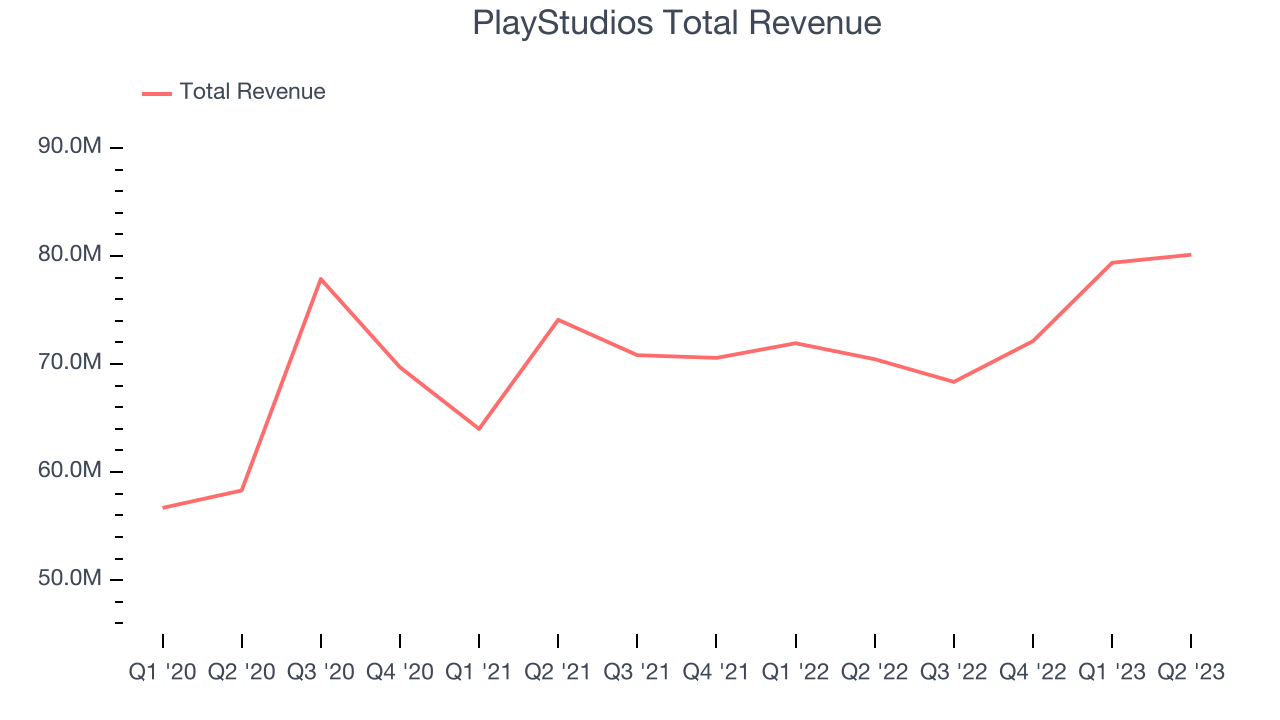

Best Q1: PlayStudios (NASDAQ:MYPS)

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

PlayStudios reported revenues of $80.1 million, up 13.7% year on year, beating analyst expectations by 9.12%. It was a very strong quarter for the company, with growing number of users and an impressive beat of analyst estimates.

PlayStudios scored the strongest analyst estimates beat and highest full year guidance raise among its peers. The company reported 13.1 million monthly active users, up 89.2% year on year. The stock is up 2.8% since the results and currently trades at $4.4.

Is now the time to buy PlayStudios? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $44.4 million, down 52.5% year on year, missing analyst expectations by 0.59%. It was a weak quarter for the company, with a declining number of users and revenue.

Skillz had the slowest revenue growth in the group. The company reported 214 thousand monthly active users, down 62.5% year on year. The stock is down 19.5% since the results and currently trades at $0.47.

Read our full analysis of Skillz's results here.

Farfetch (NYSE:FTCH)

Inspired by the idea of allowing anyone to buy clothes from landmark boutiques of cities like Paris or Milan without having to leave their couch, Farfetch (NYSE: FTCH) is a global marketplace for luxury fashion, connecting boutiques, brands and consumers.

Farfetch reported revenues of $556.4 million, up 8.08% year on year, beating analyst expectations by 7.96%. It was a decent quarter for the company, with an impressive beat of analyst estimates but slow revenue growth.

The company reported 3.99 million active buyers, up 4.45% year on year. The stock is up 13.8% since the results and currently trades at $4.95.

Read our full, actionable report on Farfetch here, it's free.

MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) today is a one-stop e-commerce marketplace in Latin America.

MercadoLibre reported revenues of $3.04 billion, up 35.1% year on year, beating analyst expectations by 5.22%. It was a very strong quarter for the company, with growing number of users.

The company reported 101 million daily active users, up 24.7% year on year. The stock is down 1.77% since the results and currently trades at $1,260.98.

Read our full, actionable report on MercadoLibre here, it's free.

The author has no position in any of the stocks mentioned