As we reflect back on the just completed Q4 consumer internet sector earnings season, we dig into the relative performance of Booking (NASDAQ:BKNG) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 17 consumer internet stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 2.91%, while on average next quarter revenue guidance was 0.08% under consensus. Tech stocks have been under pressure since the end of last year , but consumer internet stocks held their ground better than others, with share price down 8.67% since earnings, on average.

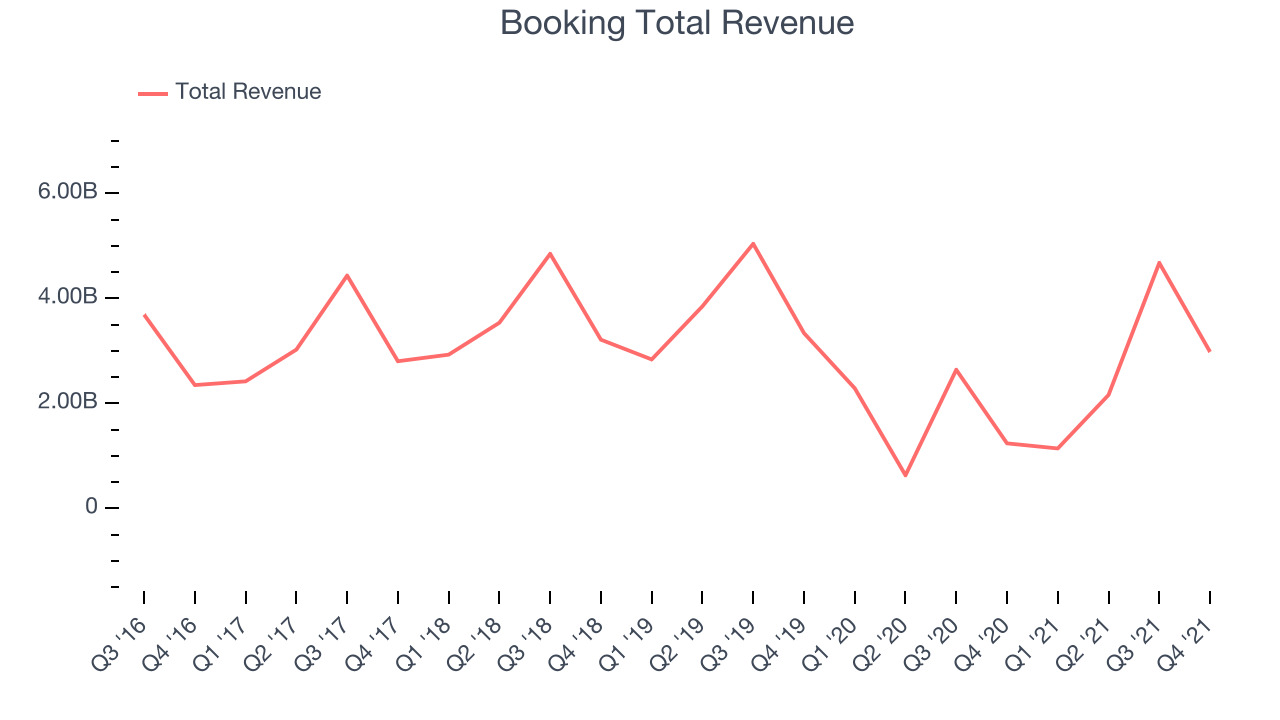

Booking (NASDAQ:BKNG)

Formerly known as The Priceline Group, Booking Holdings (NASDAQ: BKNG) is the world’s largest online travel agency.

Booking reported revenues of $2.98 billion, up 140% year on year, beating analyst expectations by 4.49%. It was a very strong quarter for the company, with an exceptional revenue growth and growing number of users.

The company reported 151 million nights booked, up 98.6% year on year. The stock is down 9.87% since the results and currently trades at $2,230.

Is now the time to buy Booking? Access our full analysis of the earnings results here, it's free.

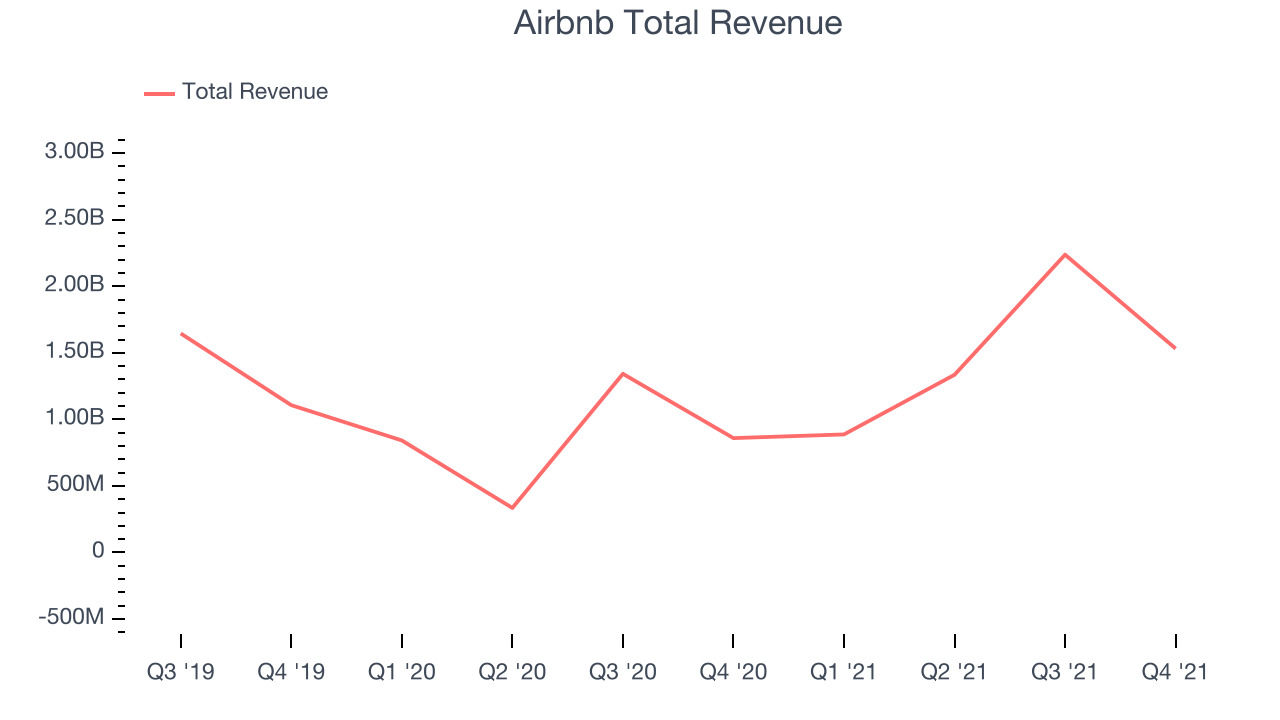

Best Q4: Airbnb (NASDAQ:ABNB)

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $1.53 billion, up 78.3% year on year, beating analyst expectations by 5.02%. It was a stunning quarter for the company, with a very optimistic guidance for the next quarter and an exceptional revenue growth.

The company reported 73.4 million nights booked, up 58.5% year on year.The stock is down 5.2% since the results and currently trades at $170.70.

Is now the time to buy Airbnb? Access our full analysis of the earnings results here, it's free.

Slowest Q4: Wayfair (NYSE:W)

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $3.25 billion, down 11.5% year on year, missing analyst expectations by 0.75%. It was a weak quarter for the company, with declining number of users and a slow revenue growth.

Wayfair had the slowest revenue growth in the group. The company reported 27.3 million active buyers, down 12.5% year on year. The stock is down 9.78% since the results and currently trades at $109.51.

Read our full analysis of Wayfair's results here.

Lyft (NASDAQ:LYFT)

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

Lyft reported revenues of $969.9 million, up 70.1% year on year, beating analyst expectations by 3.08%. It was an impressive quarter for the company, with an exceptional revenue growth.

The company reported 18.7 million paying users, up 49.2% year on year. The stock is down 14.6% since the results and currently trades at $35.22.

Read our full, actionable report on Lyft here, it's free.

Etsy (NASDAQ:ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $717.1 million, up 16.1% year on year, beating analyst expectations by 4.62%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

The company reported 90.1 million active buyers, up 10% year on year. The stock is down 9.86% since the results and currently trades at $115.79.

Read our full, actionable report on Etsy here, it's free.

The author has no position in any of the stocks mentioned