Accounting automation software maker Blackline (NASDAQ:BL) reported results ahead of analysts' expectations in Q2 CY2024, with revenue up 11% year on year to $160.5 million. The company expects next quarter's revenue to be around $163 million, in line with analysts' estimates. It made a non-GAAP profit of $0.58 per share, improving from its profit of $0.41 per share in the same quarter last year.

Is now the time to buy BlackLine? Find out by accessing our full research report, it's free.

BlackLine (BL) Q2 CY2024 Highlights:

- Revenue: $160.5 million vs analyst estimates of $158.2 million (1.4% beat)

- Adjusted Operating Income: $31.73 million vs analyst estimates of $26.98 million (17.6% beat)

- EPS (non-GAAP): $0.58 vs analyst estimates of $0.50 (15.2% beat)

- Revenue Guidance for Q3 CY2024 is $163 million at the midpoint, roughly in line with what analysts were expecting

- The company slightly lifted its revenue guidance for the full year from $645.5 million to $649 million at the midpoint

- Gross Margin (GAAP): 74.9%, in line with the same quarter last year

- Free Cash Flow of $34.38 million, down 21.3% from the previous quarter

- Net Revenue Retention Rate: 104%, down from 105% in the previous quarter

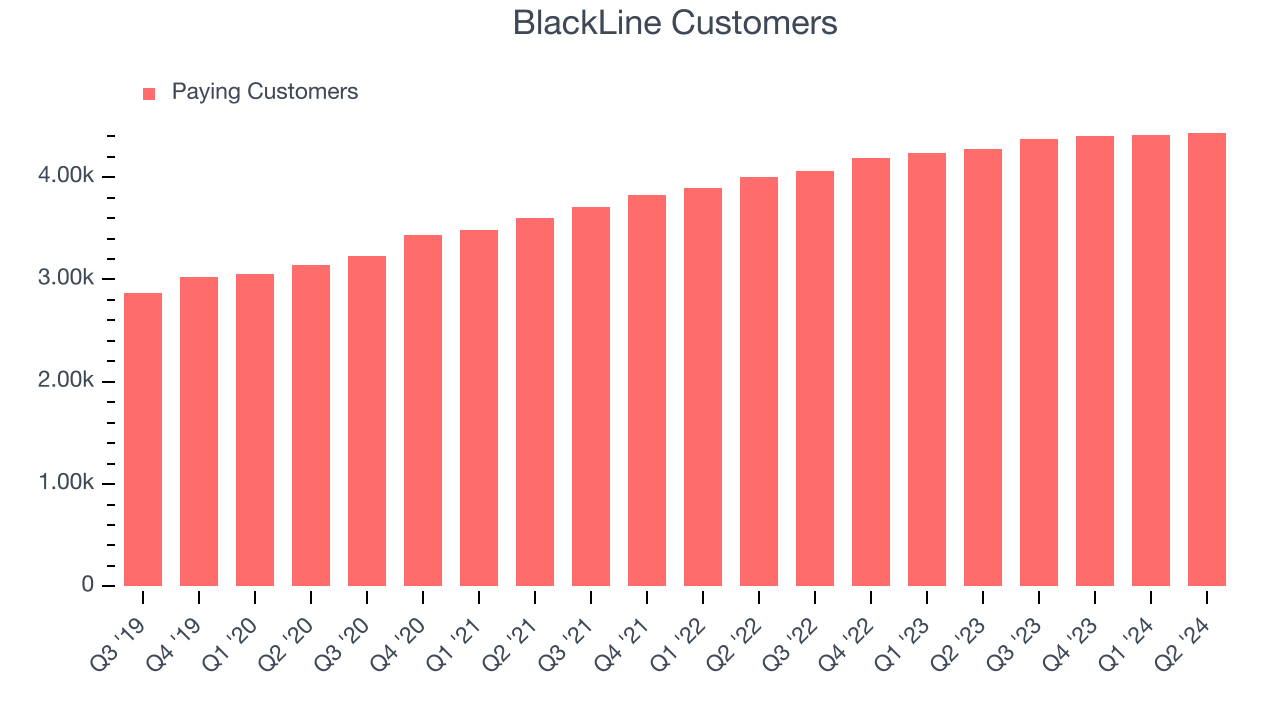

- Customers: 4,435, up from 4,411 in the previous quarter

- Billings: $164.5 million at quarter end, up 11.6% year on year

- Market Capitalization: $2.70 billion

“BlackLine delivered solid results this quarter, exceeding our revenue and profitability expectations, while continuing to generate robust free cash flow,” said Owen Ryan, co-CEO of BlackLine.

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

Tax Software

The demand for easy to use, integrated cloud based finance software that integrates tax and accounting operations continues to rise in tandem with the difficulty workers find trying to use existing accounting tools like spreadsheets given the growing volume of finance data littered across a multitude of enterprise applications. A related demand driver is the secular increase of e-commerce and rising adoption of modern point of sales and payments platforms which easily integrate with backend financial software.

Sales Growth

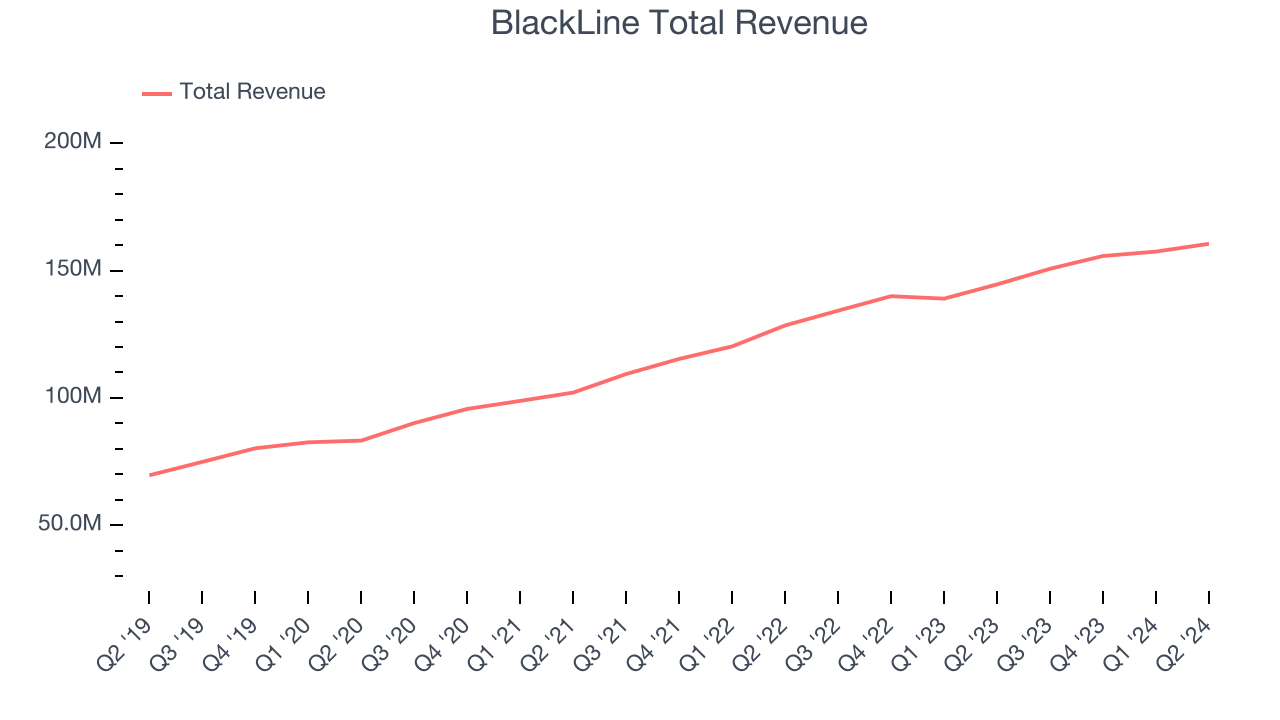

As you can see below, BlackLine's revenue growth has been mediocre over the last three years, growing from $102.1 million in Q2 2021 to $160.5 million this quarter.

This quarter, BlackLine's quarterly revenue was once again up 11% year on year. We can see that BlackLine's revenue increased by $3.05 million quarter on quarter, which is a solid improvement from the $1.73 million increase in Q1 CY2024. This acceleration of growth was a great sign.

Next quarter's guidance suggests that BlackLine is expecting revenue to grow 8.2% year on year to $163 million, slowing down from the 12.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 7.9% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Customer Growth

BlackLine reported 4,435 customers at the end of the quarter, an increase of 24 from the previous quarter. That's a little better customer growth than last quarter but a bit below what we've typically seen over the last year, suggesting that the company may be reinvigorating growth.

Key Takeaways from BlackLine's Q2 Results

We were impressed by BlackLine's strong growth in customers this quarter. We were also glad its billings outperformed Wall Street's estimates. Overall, this quarter seemed fairly positive and shareholders should feel optimistic. The stock remained flat at $44.09 immediately following the results.

So should you invest in BlackLine right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.