Accounting automation software maker Blackline (NASDAQ:BL) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 10.1% year on year to $165.9 million. The company expects next quarter’s revenue to be around $168 million, close to analysts’ estimates. Its non-GAAP profit of $0.60 per share was also 16.2% above analysts’ consensus estimates.

Is now the time to buy BlackLine? Find out by accessing our full research report, it’s free.

BlackLine (BL) Q3 CY2024 Highlights:

- Revenue: $165.9 million vs analyst estimates of $163.1 million (1.7% beat)

- Adjusted EPS: $0.60 vs analyst estimates of $0.52 (16.2% beat)

- Adjusted Operating Income: $37.62 million vs analyst estimates of $32.02 million (17.5% beat)

- Revenue Guidance for Q4 CY2024 is $168 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 75.2%, in line with the same quarter last year

- Operating Margin: 5%, up from -0.7% in the same quarter last year

- Free Cash Flow Margin: 29.8%, up from 21.4% in the previous quarter

- Net Revenue Retention Rate: 105%, up from 104% in the previous quarter

- Customers: 4,433, down from 4,435 in the previous quarter

- Billings: $154.9 million at quarter end, up 4.3% year on year

- Market Capitalization: $3.65 billion

“BlackLine delivered another quarter of solid financial results, exceeding our financial guidance while achieving record free cash flow generation," said Owen Ryan, co-CEO of BlackLine.

Company Overview

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

Tax Software

The demand for easy to use, integrated cloud based finance software that integrates tax and accounting operations continues to rise in tandem with the difficulty workers find trying to use existing accounting tools like spreadsheets given the growing volume of finance data littered across a multitude of enterprise applications. A related demand driver is the secular increase of e-commerce and rising adoption of modern point of sales and payments platforms which easily integrate with backend financial software.

Sales Growth

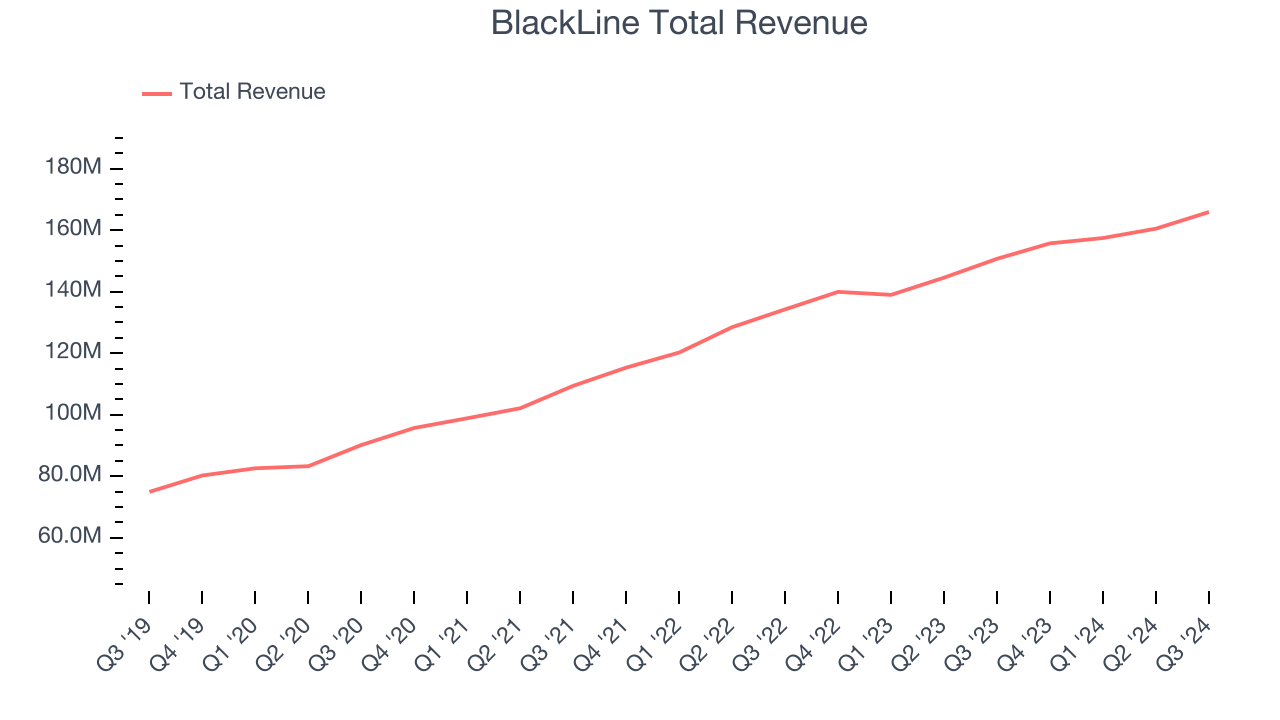

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, BlackLine grew its sales at a tepid 16.3% compounded annual growth rate.

This quarter, BlackLine reported year-on-year revenue growth of 10.1%, and its $165.9 million of revenue exceeded Wall Street’s estimates by 1.7%. Management is currently guiding for a 7.9% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.4% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and illustrates the market believes its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

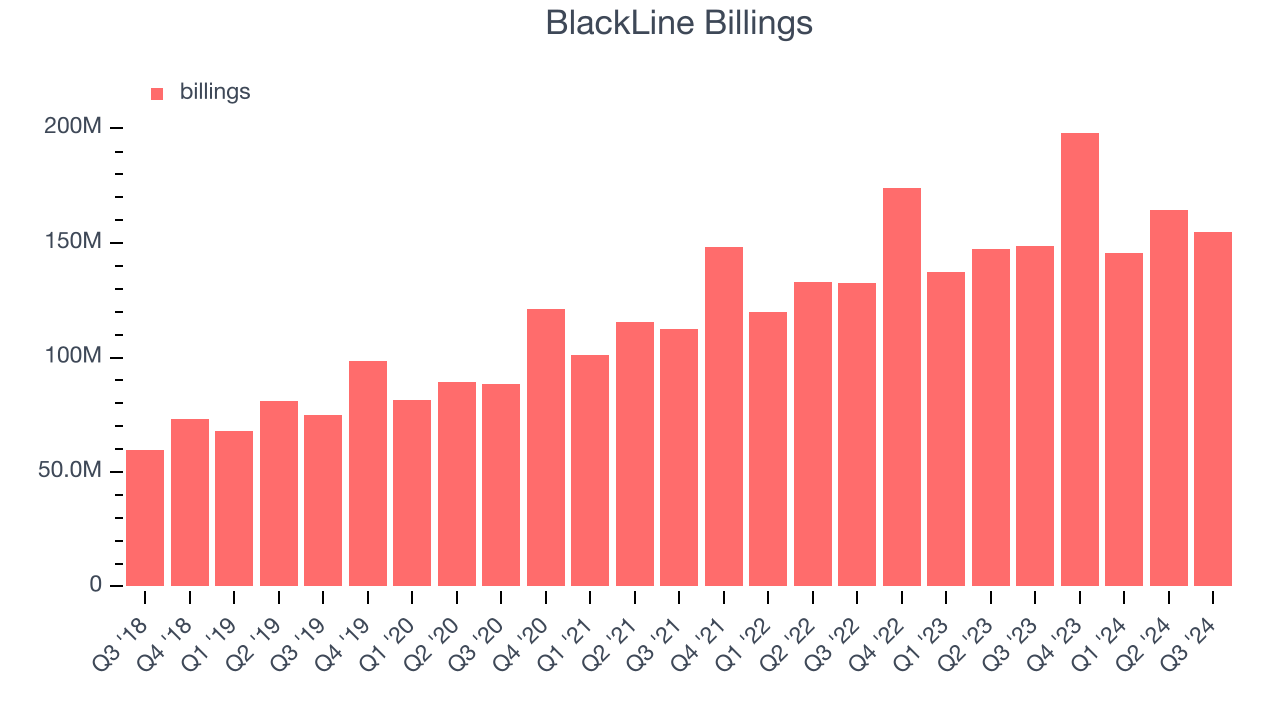

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on BlackLine’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, BlackLine’s billings growth has poor, averaging 9% year-on-year increases and coming in at $154.9 million in the latest quarter. This alternate topline metric has been growing slower than revenue, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

Customer Retention

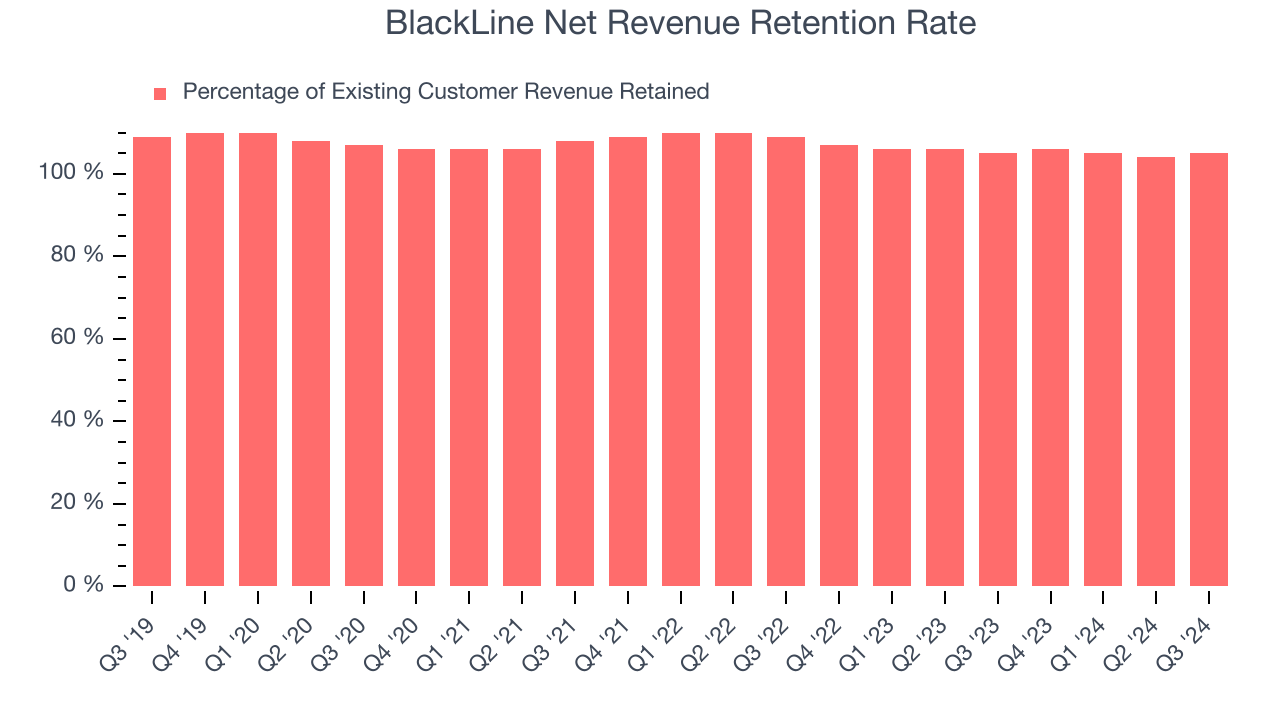

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

BlackLine’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 105% in Q3. This means that even if BlackLine didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 5%.

BlackLine has an adequate net retention rate, showing us that it generally keeps but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Key Takeaways from BlackLine’s Q3 Results

It was encouraging to see BlackLine narrowly top analysts’ revenue expectations this quarter. On the other hand, its customer growth slowed and its billings missed Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $59.45 immediately following the results.

BlackLine’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.