As Q4 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the finance and hr software stocks, including BlackLine (NASDAQ:BL) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 14 finance and HR software stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 5.01%, while on average next quarter revenue guidance was 3.19% above consensus. Tech stocks have been hit the hardest as investors start to value profits over growth, but finance and HR software stocks held their ground better than others, with share prices down 0.44% since the previous earnings results, on average.

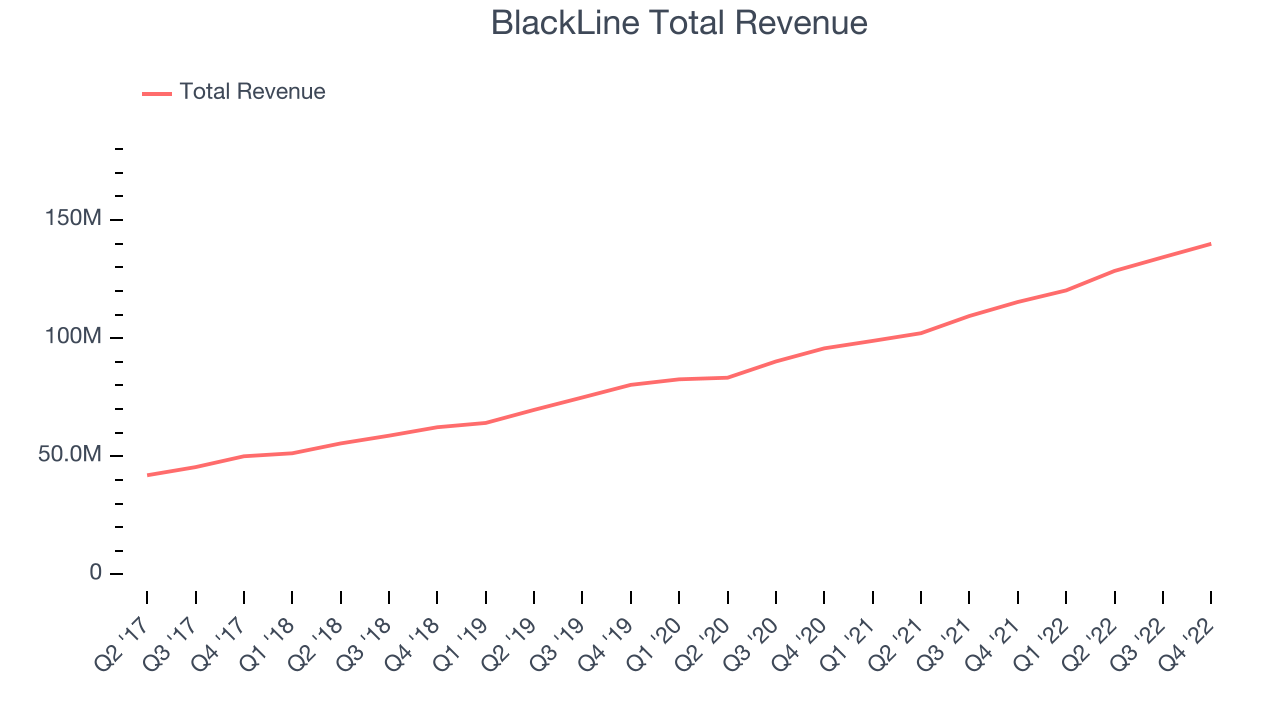

BlackLine (NASDAQ:BL)

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

BlackLine reported revenues of $140 million, up 21.4% year on year, in line with analyst expectations. It was a weaker quarter for the company, with a full year guidance missing analysts' expectations.

"BlackLine reported solid financial results this quarter, as we continued to deliver against our goal of driving profitable growth," said Marc Huffman, CEO of BlackLine.

BlackLine delivered the weakest performance against analyst estimates and weakest full year guidance update of the whole group. The company added 128 customers to a total of 4,188. The stock is down 6.8% since the results and currently trades at $67.59.

Read our full report on BlackLine here, it's free.

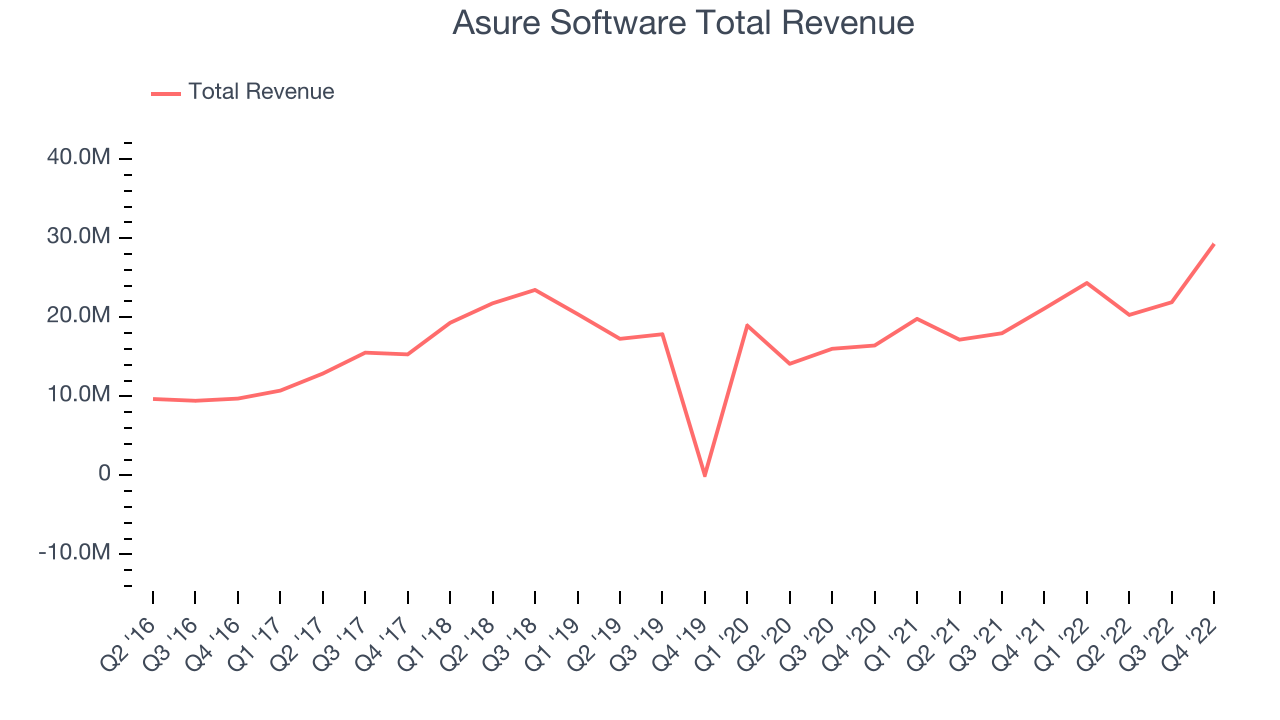

Best Q4: Asure Software (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure Software reported revenues of $29.3 million, up 38.7% year on year, beating analyst expectations by 23.3%. It was an impressive quarter for the company, with a significant improvement in gross margin and a solid beat of analyst estimates.

Asure Software delivered the strongest analyst estimates beat among its peers. The stock is up 28.8% since the results and currently trades at $14.46.

Is now the time to buy Asure Software? Access our full analysis of the earnings results here, it's free.

Paychex (NASDAQ:PAYX)

One of the oldest payroll service providers, Paychex provides payroll and human resource (HR) solutions.

Paychex reported revenues of $1.38 billion, up 8.23% year on year, beating analyst expectations by 2.4%. It was a solid quarter for the company, with a significant improvement in gross margin.

Paychex had the slowest revenue growth in the group. The stock is up 5.09% since the results and currently trades at $114.48.

Read our full analysis of Paychex's results here.

Workday (NASDAQ:WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Workday reported revenues of $1.65 billion, up 19.6% year on year, in line with analyst expectations. It was a strong quarter for the company with a decent beat of revenue and profitability estimates.

The stock is up 9.05% since the results and currently trades at $201.71.

Read our full, actionable report on Workday here, it's free.

Flywire (NASDAQ:FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $73.1 million, up 42.1% year on year, beating analyst expectations by 11.5%. It was a strong quarter for the company, with an impressive beat of analyst estimates and revenue guidance for the next quarter above analysts' estimates.

Flywire scored the highest full year guidance raise among the peers. The stock is up 17.3% since the results and currently trades at $29.01.

Read our full, actionable report on Flywire here, it's free.

The author has no position in any of the stocks mentioned