Accounting automation software maker Blackline (NASDAQ:BL) announced better-than-expected results in Q1 CY2024, with revenue up 13.3% year on year to $157.5 million. The company expects next quarter's revenue to be around $158 million, in line with analysts' estimates. It made a non-GAAP profit of $0.54 per share, improving from its profit of $0.34 per share in the same quarter last year.

BlackLine (BL) Q1 CY2024 Highlights:

- Revenue: $157.5 million vs analyst estimates of $155.1 million (1.5% beat)

- EPS (non-GAAP): $0.54 vs analyst estimates of $0.47 (15% beat)

- Revenue Guidance for Q2 CY2024 is $158 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $645.5 million at the midpoint

- Gross Margin (GAAP): 75.2%, in line with the same quarter last year

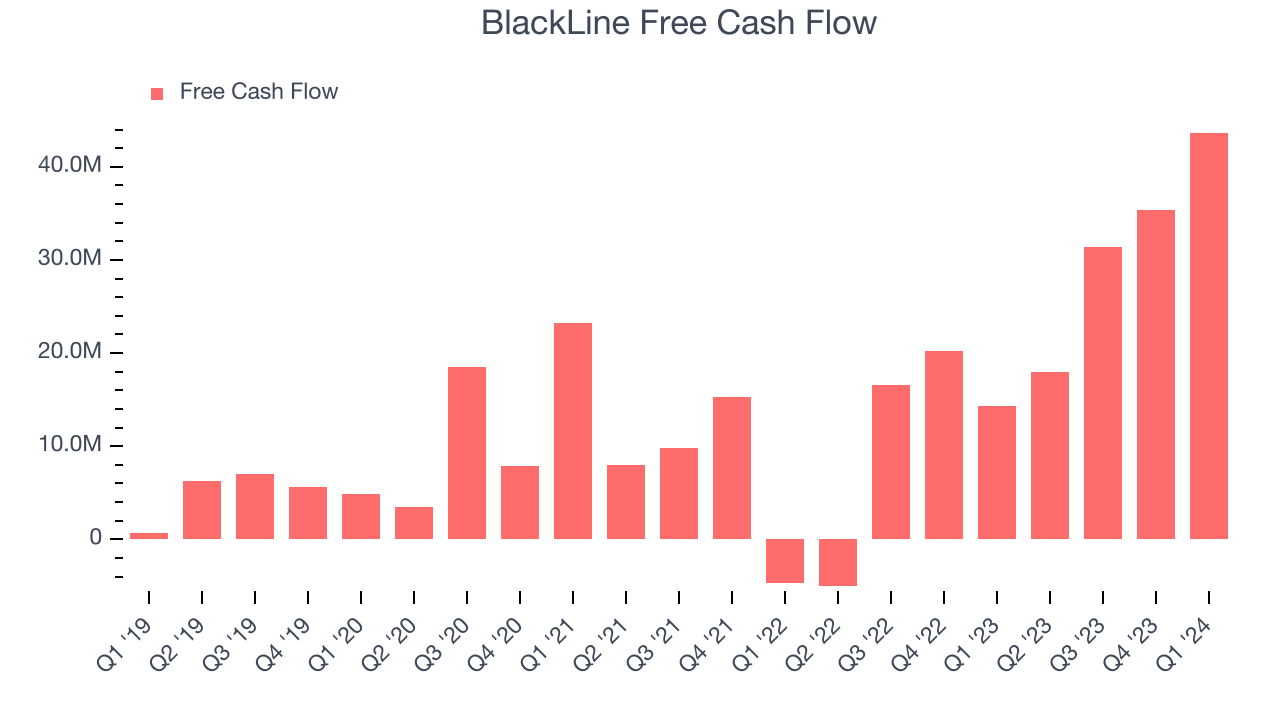

- Free Cash Flow of $43.68 million, up 23.6% from the previous quarter

- Net Revenue Retention Rate: 105%, in line with the previous quarter

- Customers: 4,411, up from 4,398 in the previous quarter

- Market Capitalization: $3.75 billion

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

Accountants still rely on spreadsheets to validate, reconcile, and close their books. At the end of the month, these spreadsheets are manually uploaded to a shared drive where the balance on each account is merged. This process is error prone and leads to rows and columns being deleted by mistake and also consumes a lot of time that can be spent doing more productive work.

To solve these problems, BlackLine provides cloud-based software as a service to automate routine accounting processes so that accountants can focus on more important tasks. The software provides a central place to unify data across multiple departments and business applications such as resource planning systems, making it faster to validate and reconcile financial transactions with customers and partners. It also gives organizations better visibility into their financial health by providing dashboards to quickly identify business risks and tasks to prioritize and this can be accessed by anyone from anywhere.

Book reconciliations are one of the most time demanding parts of accountant’s job and finance managers often hold multiple meetings in a week to close their accounts. With BlackLine, companies can automate more than 50% of the account reconciliation work and as a result, accountants can focus on analysis, risk mitigation, and exception handling.

Tax Software

The demand for easy to use, integrated cloud based finance software that integrates tax and accounting operations continues to rise in tandem with the difficulty workers find trying to use existing accounting tools like spreadsheets given the growing volume of finance data littered across a multitude of enterprise applications. A related demand driver is the secular increase of e-commerce and rising adoption of modern point of sales and payments platforms which easily integrate with backend financial software.

Competitors include large software vendors such as Oracle (NYSE:ORCL) and SAP (NYSE:SAP) as well as cloud software providers such as Workiva (NYSE:WK), Anaplan (NYSE:PLAN), and Workday (NASDAQ:WDAY).

Sales Growth

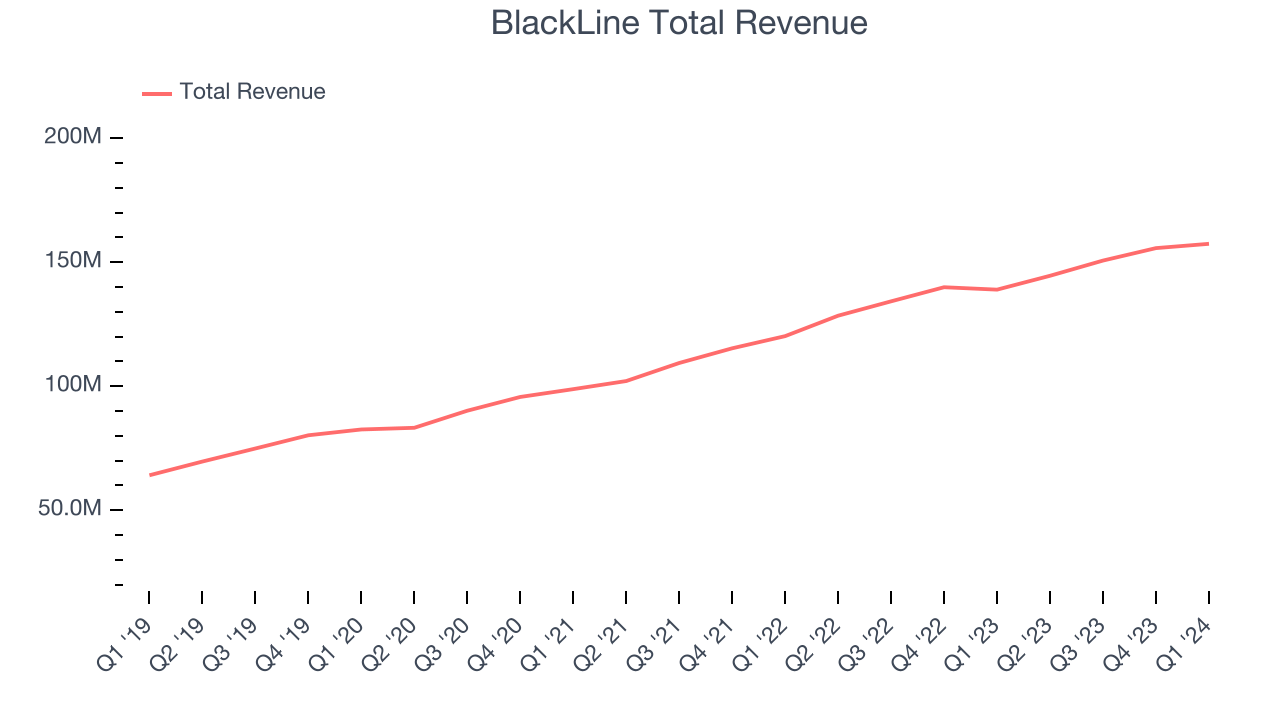

As you can see below, BlackLine's revenue growth has been solid over the last three years, growing from $98.86 million in Q1 2021 to $157.5 million this quarter.

This quarter, BlackLine's quarterly revenue was once again up 13.3% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $1.73 million in Q1 compared to $5.02 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that BlackLine is expecting revenue to grow 9.3% year on year to $158 million, slowing down from the 12.5% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 8.3% over the next 12 months before the earnings results announcement.

Customer Growth

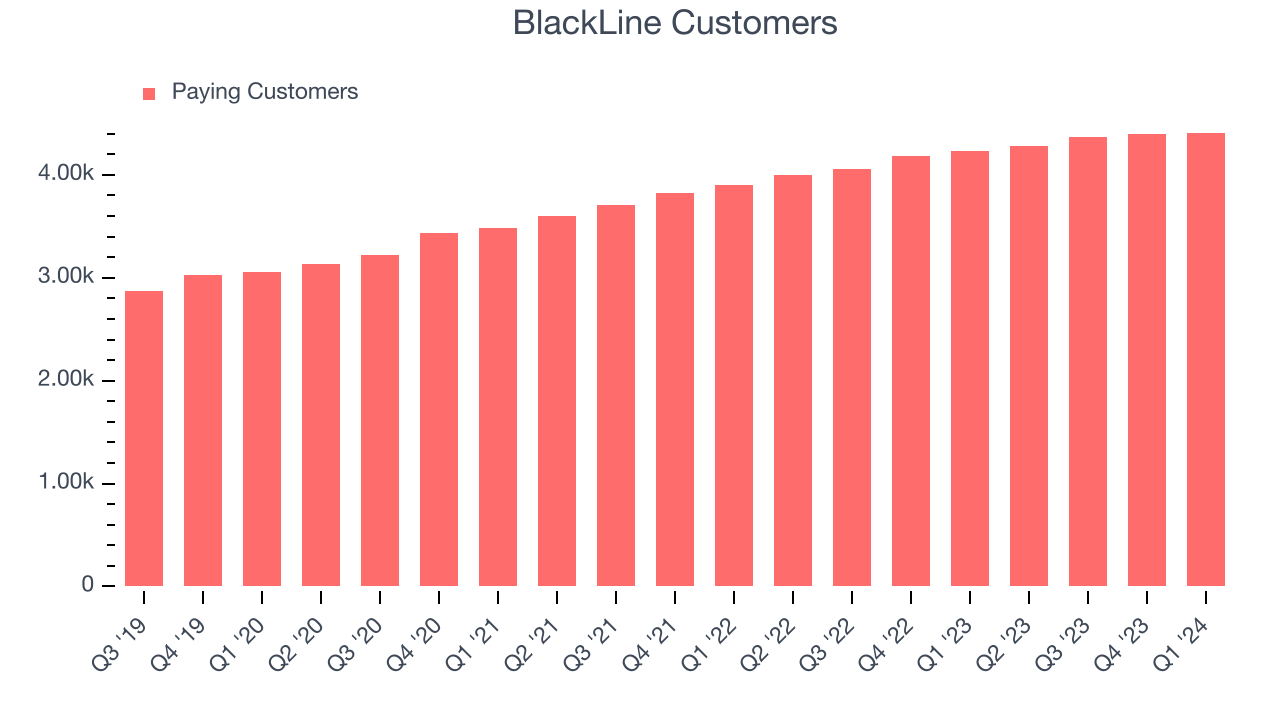

BlackLine reported 4,411 customers at the end of the quarter, an increase of 13 from the previous quarter, suggesting that the company's customer acquisition momentum is slowing.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

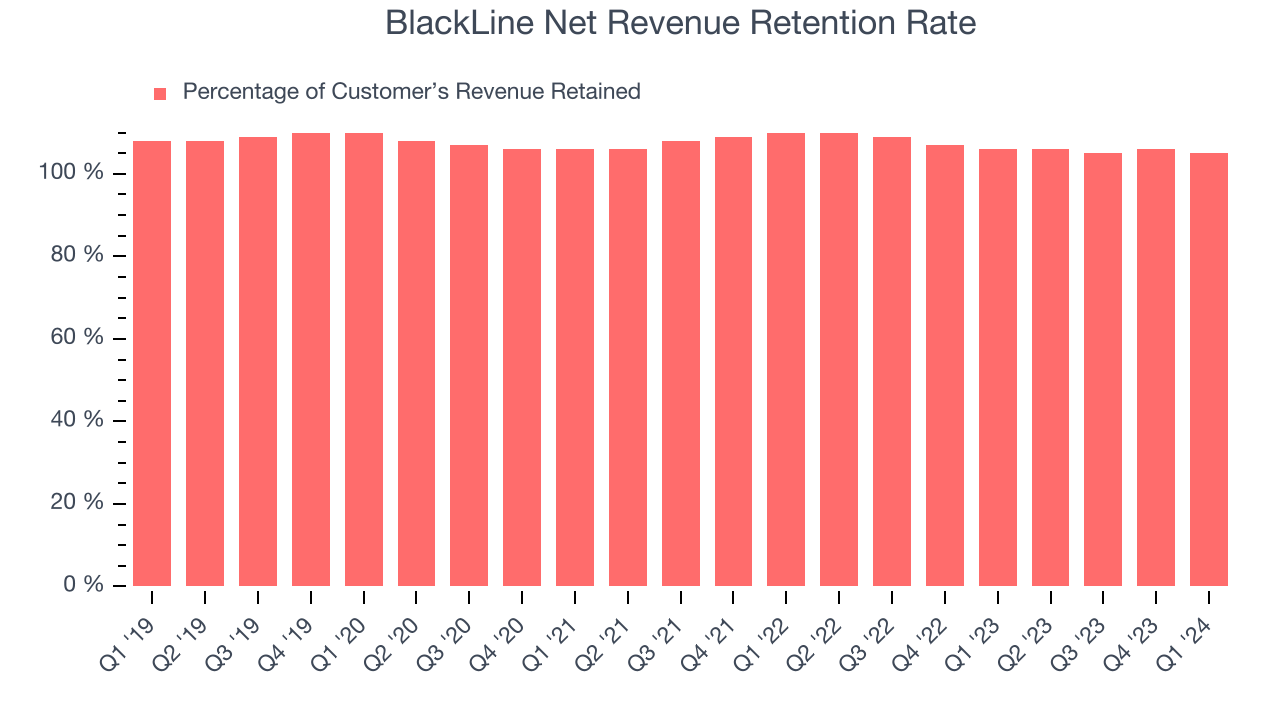

BlackLine's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 105% in Q1. This means that even if BlackLine didn't win any new customers over the last 12 months, it would've grown its revenue by 5%.

BlackLine has an adequate net retention rate, showing us that it generally keeps but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Profitability

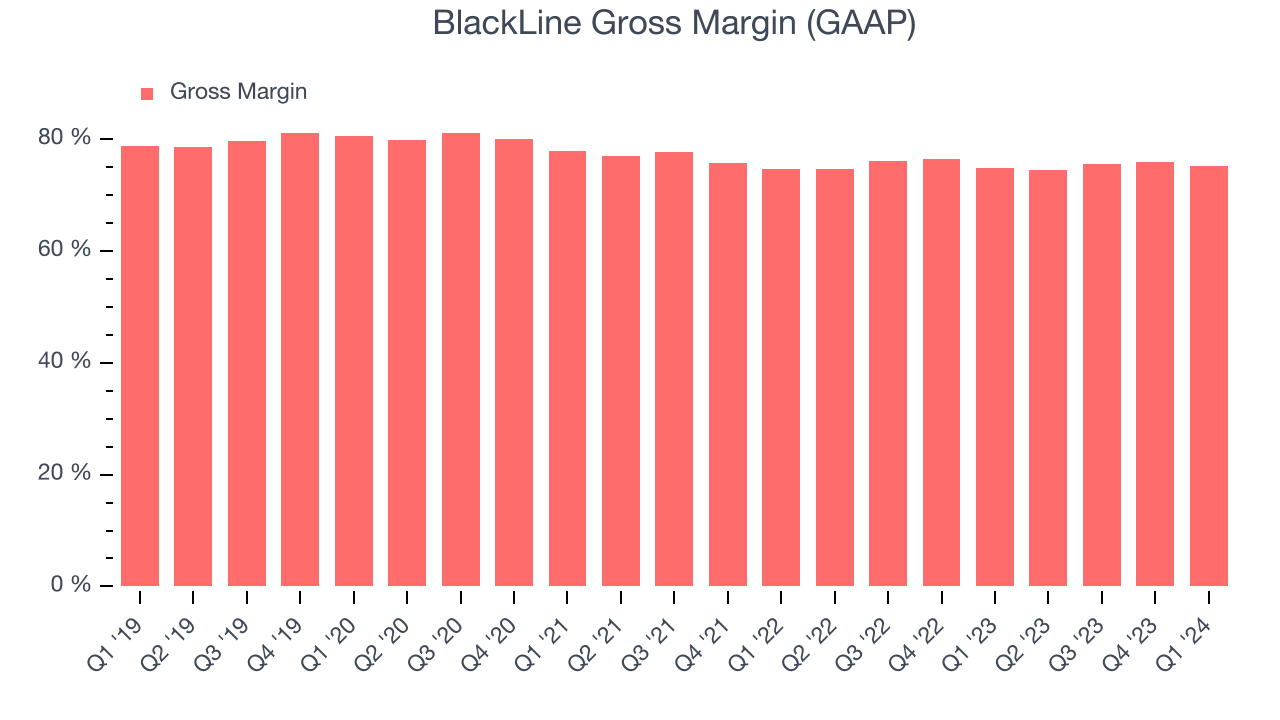

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. BlackLine's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 75.2% in Q1.

That means that for every $1 in revenue the company had $0.75 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite the recent drop, BlackLine still has an excellent gross margin that allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. BlackLine's free cash flow came in at $43.68 million in Q1, up 205% year on year.

BlackLine has generated $128.4 million in free cash flow over the last 12 months, an impressive 21.1% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from BlackLine's Q1 Results

It was encouraging to see BlackLine narrowly top analysts' revenue expectations this quarter while also growing free cash. On the other hand, its customer growth slowed and its billings missed Wall Street's estimates. Overall, this was a mixed quarter for BlackLine. The company is down 4.1% on the results and currently trades at $58 per share.

Is Now The Time?

When considering an investment in BlackLine, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although BlackLine isn't a bad business, it probably wouldn't be one of our picks. Its revenue growth has been a little slower over the last three years, and analysts expect growth to deteriorate from here.

Given its price-to-sales ratio of 6.7x based on the next 12 months, the market is certainly expecting long-term growth from BlackLine. We can find things to like about BlackLine, and there's no doubt it's a bit of a market darling, at least for some. However, we think there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $61.30 right before these results (compared to the current share price of $58).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.