Online dating app Bumble (NASDAQ:BMBL) fell short of analysts' expectations in Q4 FY2023, with revenue up 13.2% year on year to $273.6 million. Next quarter's revenue guidance of $265 million also underwhelmed, coming in 4.6% below analysts' estimates. It made a GAAP loss of $0.19 per share, down from its profit of $10.37 per share in the same quarter last year.

Is now the time to buy Bumble? Find out by accessing our full research report, it's free.

Bumble (BMBL) Q4 FY2023 Highlights:

- Revenue: $273.6 million vs analyst estimates of $275.3 million (0.6% miss)

- EPS: -$0.19 vs analyst estimates of $0.12 (-$0.31 miss)

- Revenue Guidance for Q1 2024 is $265 million at the midpoint, below analyst estimates of $277.8 million

- Free Cash Flow of $61.25 million, similar to the previous quarter

- Gross Margin (GAAP): 70.6%, down from 71.9% in the same quarter last year

- Total Paying Users (inc Bumble and Badoo users): 3.97 million, up 559,800 year on year

- Market Capitalization: $1.74 billion

“Today, we announced solid full-year results and a bold plan to transform Bumble and lead the company to its next phase of growth and innovation,” said Lidiane Jones, CEO of Bumble Inc.

Founded by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ:BMBL) is a leading dating app built with women at the center.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

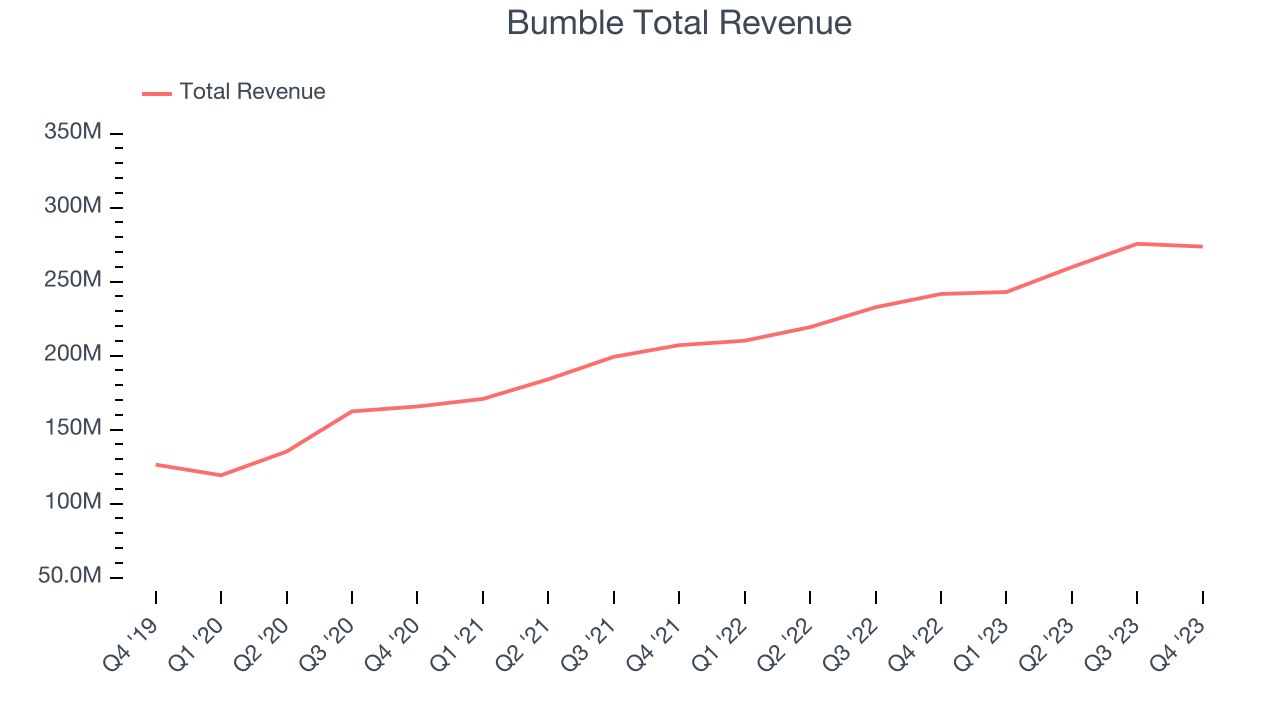

Sales Growth

Bumble's revenue growth over the last three years has been strong, averaging 22.4% annually. This quarter, Bumble reported mediocre 13.2% year-on-year revenue growth, missing Wall Street's expectations.

Guidance for the next quarter indicates Bumble is expecting revenue to grow 9.1% year on year to $265 million, slowing down from the 15.7% year-on-year increase it recorded in the same quarter last year.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Usage Growth

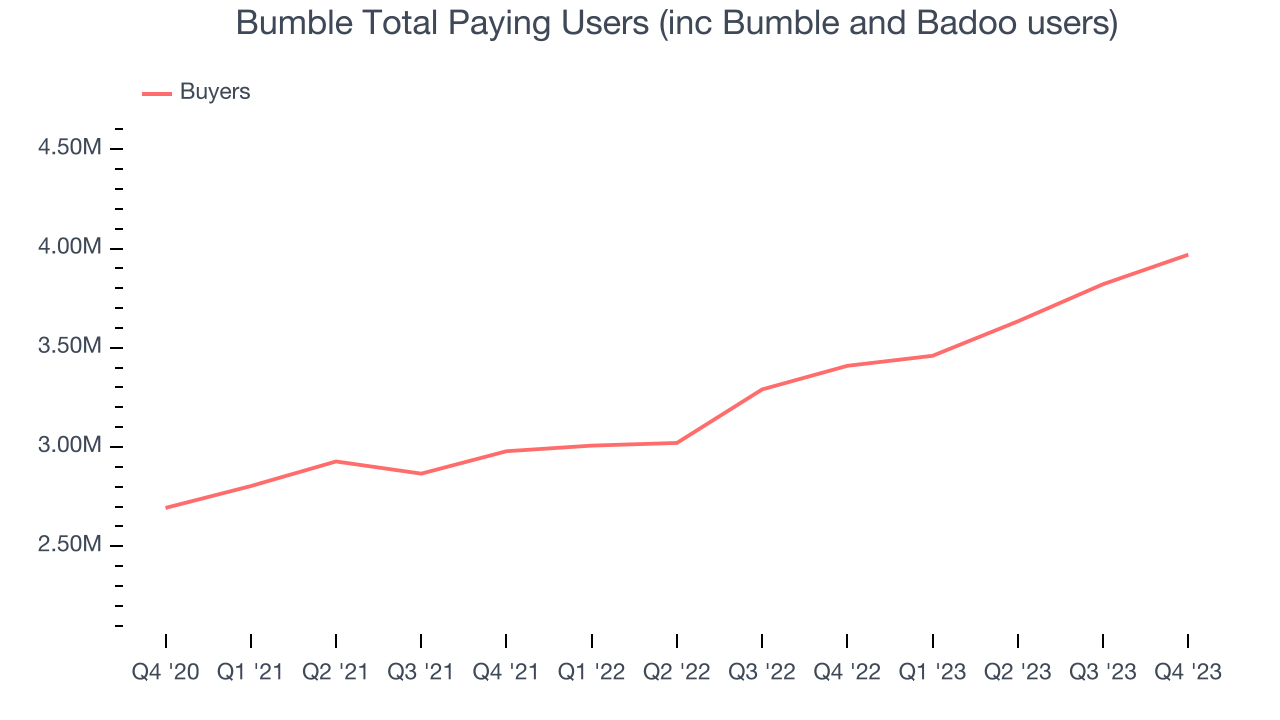

As a subscription-based app, Bumble generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Bumble's active buyers, a key performance metric for the company, grew 13.4% annually to 3.97 million. This is solid growth for a consumer internet company.

In Q4, Bumble added 559,800 active buyers, translating into 16.4% year-on-year growth.

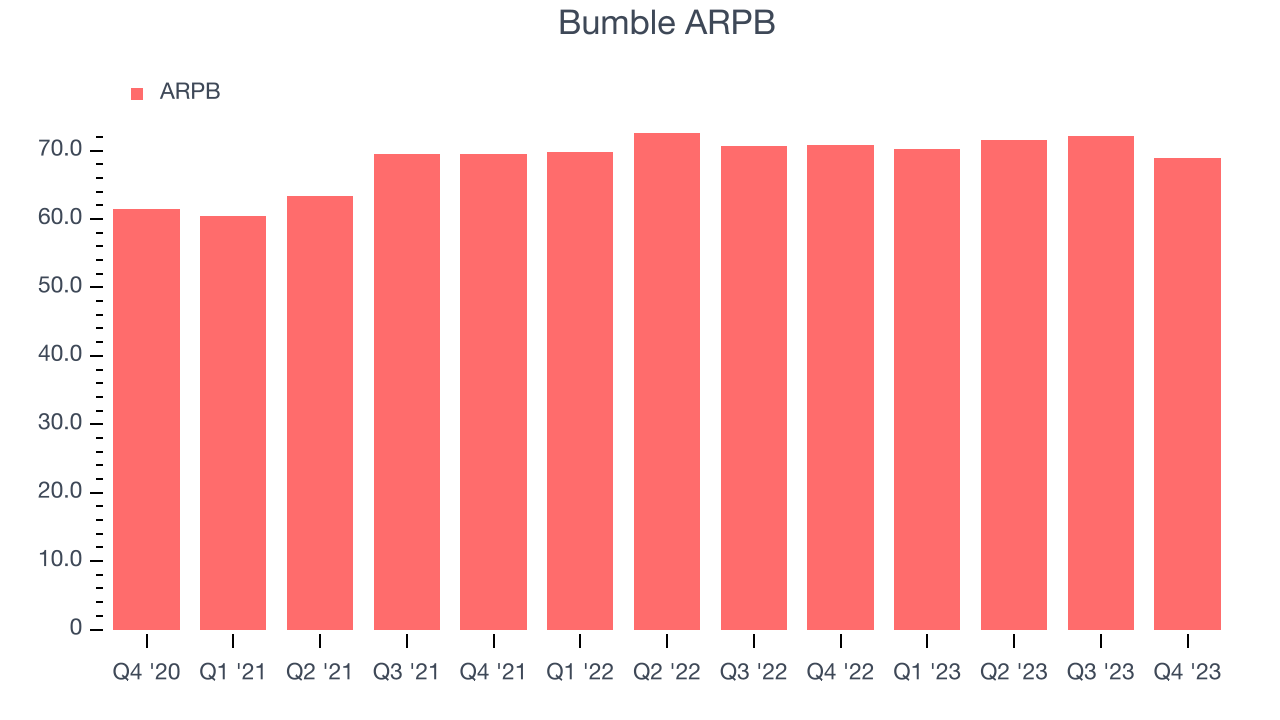

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Bumble because it measures how much the average buyer spends. ARPB is also a key indicator of how valuable its buyers are (and can be over time).

Bumble's ARPB growth has been mediocre over the last two years, averaging 4%. However, the company's ability to continue increasing prices while growing its active buyers shows that buyers still find value in its platform. This quarter, ARPB declined 2.7% year on year to $68.94 per buyer.

Key Takeaways from Bumble's Q4 Results

It was great to see Bumble's strong user growth this quarter. On the other hand, its revenue in Q4 and revenue guidance missed Wall Street's estimates. Overall, this was a mixed quarter for Bumble. The company is down 6.7% on the results and currently trades at $12.3 per share.

Bumble may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.