Wrapping up Q2 earnings, we look at the numbers and key takeaways for the sales and marketing software stocks, including Braze (NASDAQ:BRZE) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Thankfully, sales and marketing software stocks have been resilient with share prices up 6.6% on average since the latest earnings results.

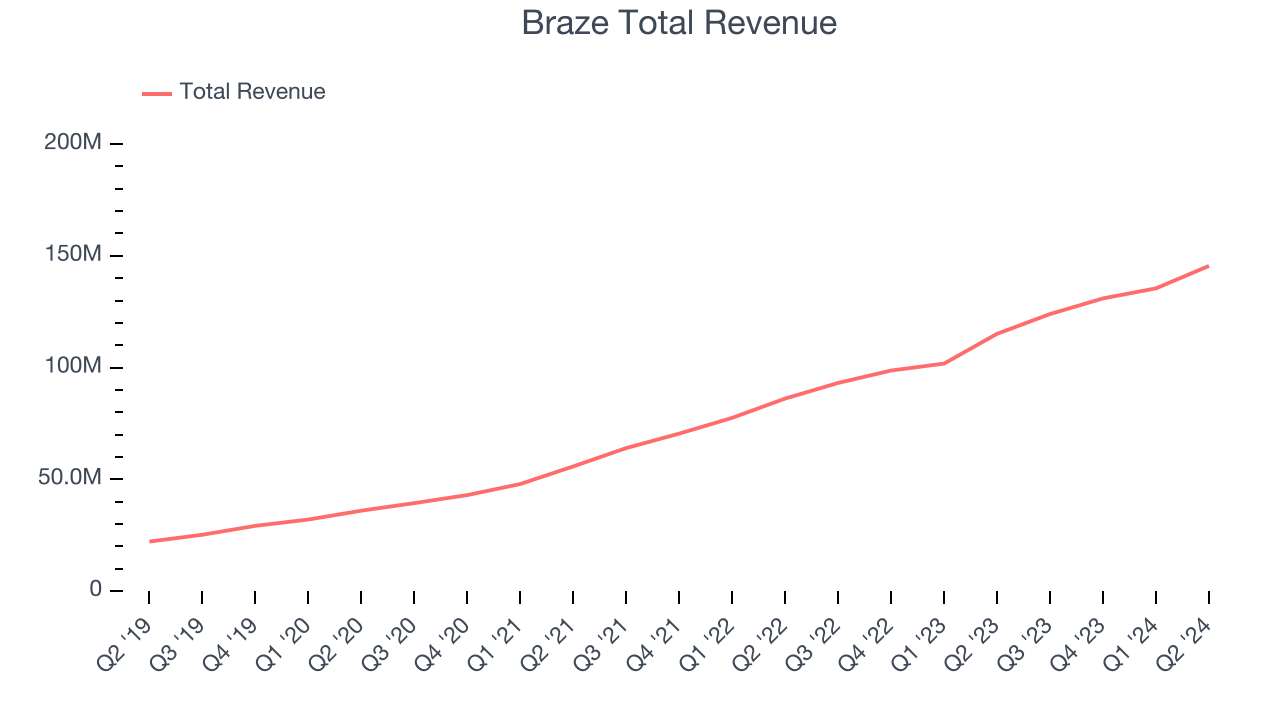

Braze (NASDAQ:BRZE)

Founded in 2011 after the co-founders met at NYC Disrupt Hackathon, Braze (NASDAQ:BRZE) is a customer engagement software platform that allows brands to connect with customers through data-driven and contextual marketing campaigns.

Braze reported revenues of $145.5 million, up 26.4% year on year. This print exceeded analysts’ expectations by 3%. Despite the top-line beat, it was still a mixed quarter for the company with a significant improvement in its gross margin but a miss of analysts’ billings estimates.

“We delivered a great second quarter, demonstrating strong top-line growth while driving efficiency in our business, achieving our first quarter of non-GAAP operating income profitability and non-GAAP net income profitability. Our results demonstrate our effective execution and continued demand for the Braze Customer Engagement Platform,” said Bill Magnuson, cofounder and CEO of Braze.

Unsurprisingly, the stock is down 24.1% since reporting and currently trades at $33.55.

Is now the time to buy Braze? Access our full analysis of the earnings results here, it’s free.

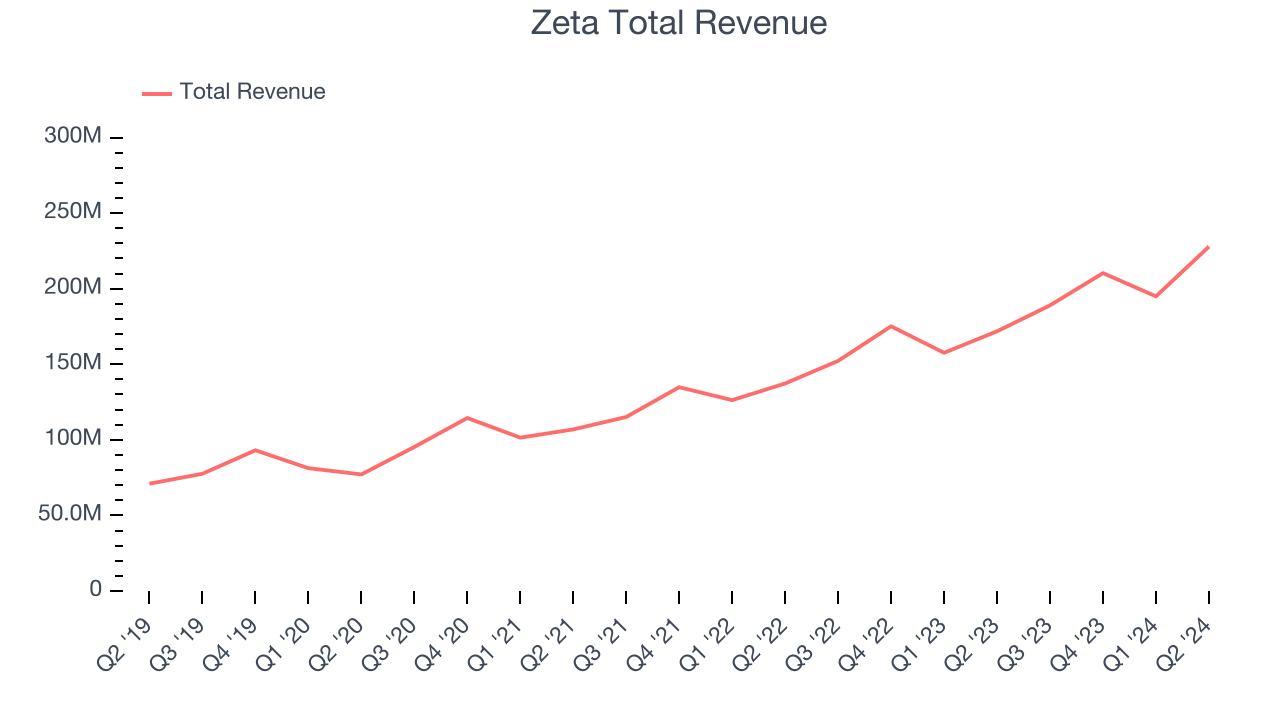

Best Q2: Zeta (NYSE:ZETA)

Co-founded by former Apple CEO John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $227.8 million, up 32.6% year on year, outperforming analysts’ expectations by 7.2%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and optimistic revenue guidance for the next quarter.

Zeta delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 38.1% since reporting. It currently trades at $29.65.

Is now the time to buy Zeta? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: PubMatic (NASDAQ:PUBM)

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $67.27 million, up 6.2% year on year, falling short of analysts’ expectations by 4.1%. It was a disappointing quarter as it posted underwhelming revenue guidance for the next quarter.

As expected, the stock is down 27.2% since the results and currently trades at $14.26.

Read our full analysis of PubMatic’s results here.

Freshworks (NASDAQ:FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium-sized businesses.

Freshworks reported revenues of $174.1 million, up 20% year on year. This number surpassed analysts’ expectations by 3%. It was a very strong quarter as it also put up accelerating growth in large customers and an impressive beat of analysts’ billings estimates.

The company added 1,195 enterprise customers paying more than $5,000 annually to reach a total of 21,744. The stock is down 16.1% since reporting and currently trades at $11.15.

Read our full, actionable report on Freshworks here, it’s free.

VeriSign (NASDAQ:VRSN)

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ:VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

VeriSign reported revenues of $387.1 million, up 4.1% year on year. This print met analysts’ expectations. Zooming out, it was a decent quarter, showing the company is staying on target.

The stock is up 3.3% since reporting and currently trades at $182.39.

Read our full, actionable report on VeriSign here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.