The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the sales and marketing software stocks have fared in Q4, starting with Braze (NASDAQ:BRZE).

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 26 sales and marketing software stocks we track reported a weaker Q4; on average, revenues beat analyst consensus estimates by 1.76%, while on average next quarter revenue guidance was 1.09% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital, but sales and marketing software stocks held their ground better than others, with the share prices up 2.81% since the previous earnings results, on average.

Braze (NASDAQ:BRZE)

Founded in 2011 after the co-founders met at NYC Disrupt Hackathon, Braze (NASDAQ:BRZE) is a customer engagement software platform that allows brands to connect with customers through data-driven and contextual marketing campaigns.

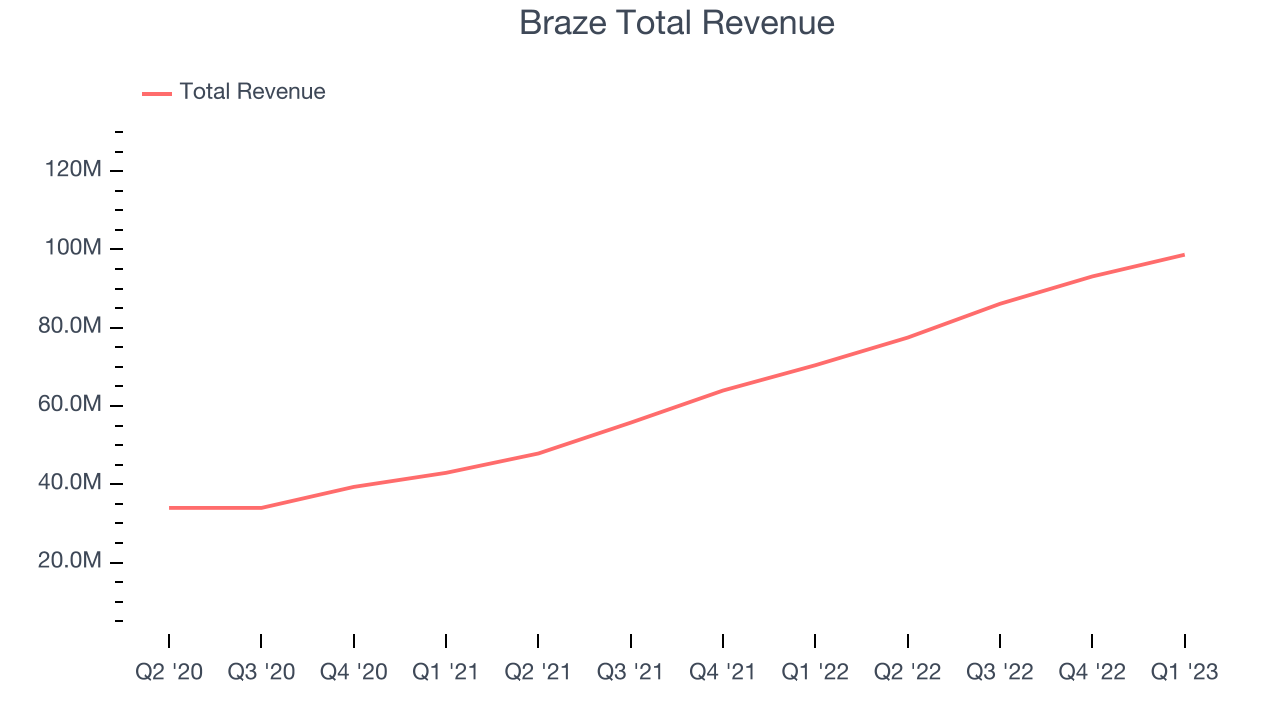

Braze reported revenues of $98.7 million, up 40.1% year on year, beating analyst expectations by 3.05%. It was a weak quarter for the company, with revenue guidance for the next quarter and full year missing analysts' expectations.

“In the past year, we continued to strengthen our position as a market leader by finding the opportunities in change, expanding our customer base by 29% and our revenue by nearly 50%,” said Bill Magnuson, cofounder and CEO of Braze.

Braze achieved the fastest revenue growth of the whole group. The company added 55 customers to a total of 1,770. The stock is up 1.27% since the results and currently trades at $32.

Read our full report on Braze here, it's free.

Best Q4: Shopify (NYSE:SHOP)

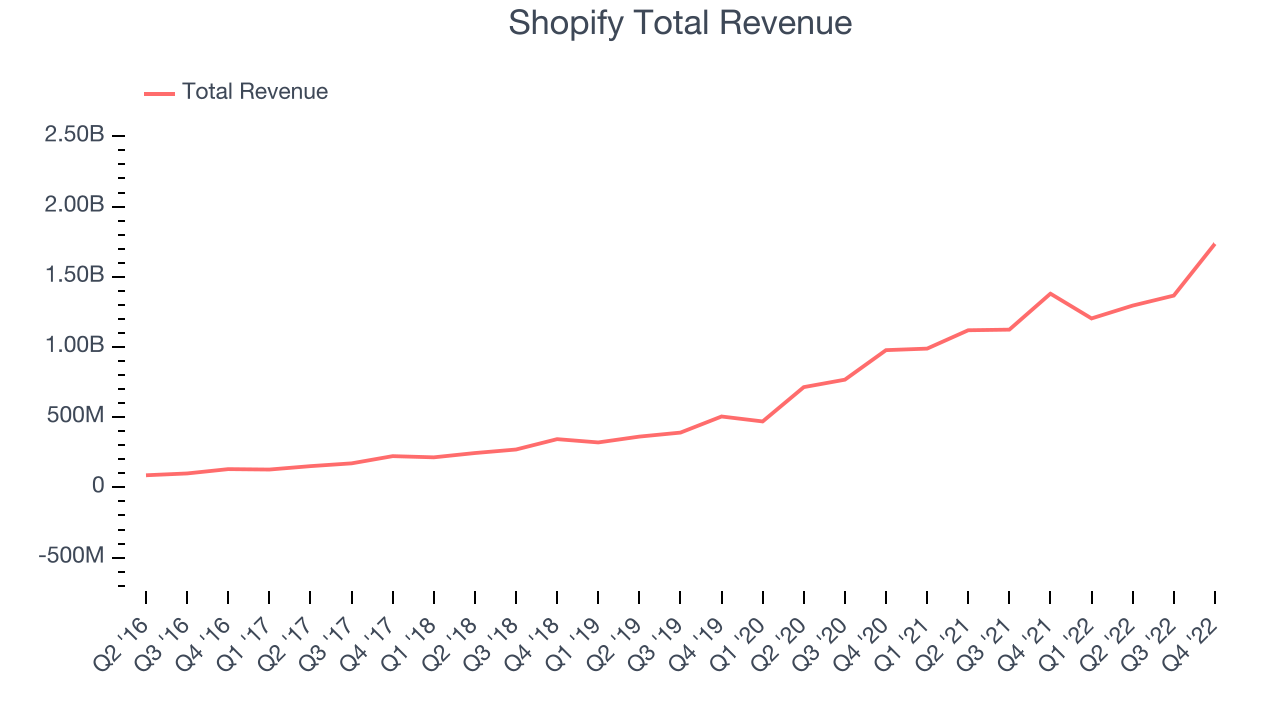

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

Shopify reported revenues of $1.73 billion, up 25.7% year on year, beating analyst expectations by 5.11%. It was a strong quarter for the company, with a decent beat of analyst estimates and solid revenue growth.

The stock is down 14.6% since the results and currently trades at $45.58.

Is now the time to buy Shopify? Access our full analysis of the earnings results here, it's free.

Weakest Q4: BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $72.4 million, up 11.6% year on year, missing analyst expectations by 1.24%. It was a weak quarter for the company, with revenue guidance for the next quarter and full year missing analysts' expectations.

The stock is down 27.1% since the results and currently trades at $8.27.

Read our full analysis of BigCommerce's results here.

HubSpot (NYSE:HUBS)

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software as a service platform that helps small and medium-size businesses sell, market themselves, and get found on the internet.

HubSpot reported revenues of $469.7 million, up 27.2% year on year, beating analyst expectations by 5.3%. It was a mixed quarter for the company, with a solid beat of analyst estimates but underwhelming guidance for the next year.

The company added 8,481 customers to a total of 167,386. The stock is up 14% since the results and currently trades at $413.66.

Read our full, actionable report on HubSpot here, it's free.

Squarespace (NYSE:SQSP)

Founded in New York City in 2003, Squarespace (NYSE:SQSP) is a platform for small businesses and creators to build their digital presences online.

Squarespace reported revenues of $228.8 million, up 10.3% year on year, beating analyst expectations by 2.99%. It was a solid quarter for the company, with very strong guidance for the next year.

The stock is up 35.3% since the results and currently trades at $32.52.

Read our full, actionable report on Squarespace here, it's free.

The author has no position in any of the stocks mentioned