Infrastructure design software provider Bentley Systems (NASDAQ:BSY) beat analysts' expectations in Q3 FY2023, with revenue up 14.3% year on year to $306.6 million. Turning to EPS, Bentley made a GAAP profit of $0.16 per share, improving from its profit of $0.12 per share in the same quarter last year.

Is now the time to buy Bentley? Find out by accessing our full research report, it's free.

Bentley (BSY) Q3 FY2023 Highlights:

- Revenue: $306.6 million vs analyst estimates of $299.6 million (ARR or annual recurring revenue also beat)

- EPS (non-GAAP): $0.22 vs analyst estimates of $0.19 (14% beat)

- Free Cash Flow of $65.2 million, down 11.5% from the previous quarter

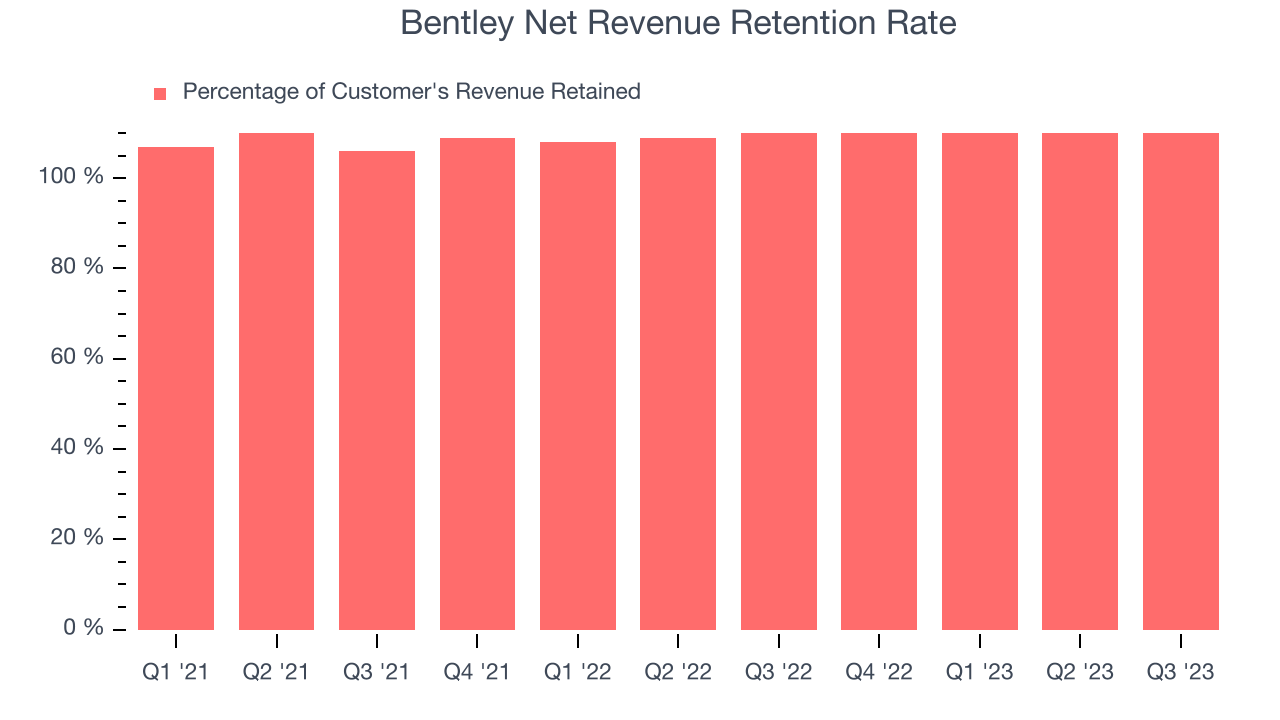

- Net Revenue Retention Rate: 110%, in line with the previous quarter (slight beat vs. expectations of 109%)

- Gross Margin (GAAP): 78.9%, up from 77.9% in the same quarter last year

CEO Greg Bentley said, “Our operating results this quarter demonstrate the sustainability of our more broadly balanced growth contributors. Year-over-year ARR growth (business performance in constant currency) remained strong at 12.5% despite fewer calendar workdays and an upsurge in perpetual license purchases. Continuing growth drivers include the Infrastructure Investment and Jobs Act in the U.S., expansion of E365 as our enterprise accounts accelerate going digital, and Virtuosity’s momentum in penetrating small and medium-sized business prospects.

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ:BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Sales Growth

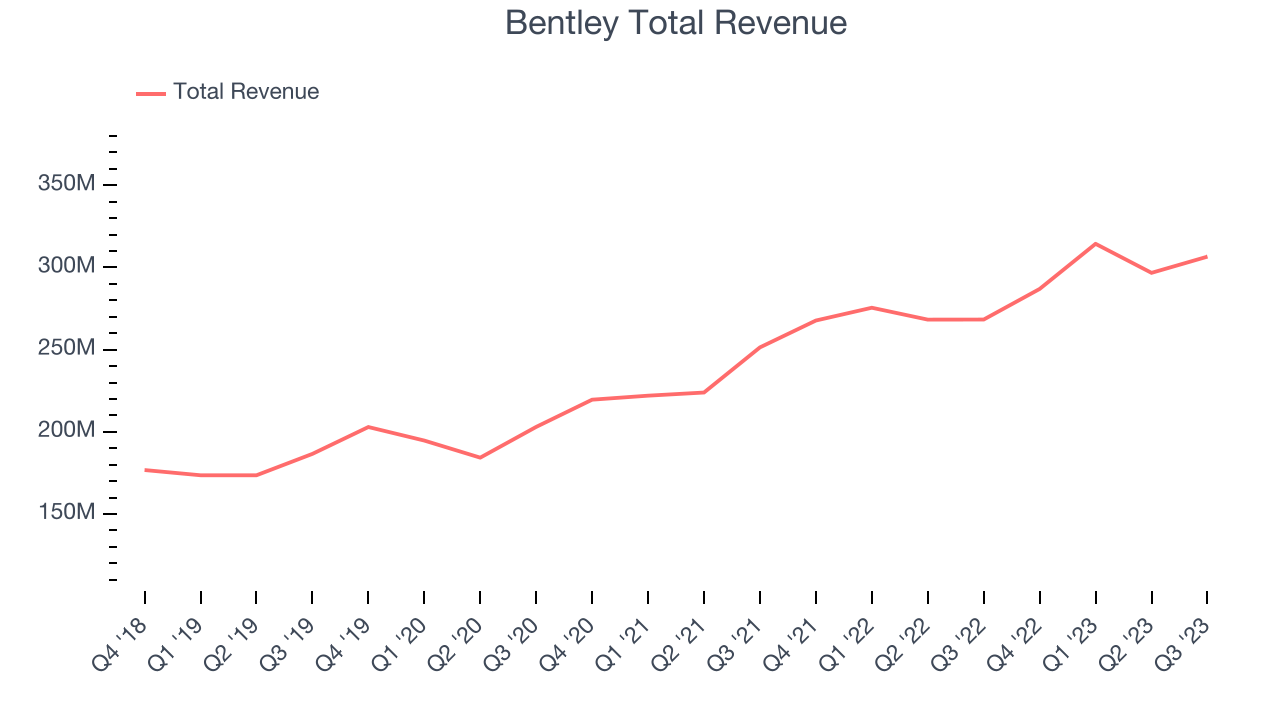

As you can see below, Bentley's revenue growth has been mediocre over the last two years, growing from $251.4 million in Q3 FY2021 to $306.6 million this quarter.

This quarter, Bentley's quarterly revenue was once again up 14.3% year on year. On top of that, its revenue increased $9.9 million quarter on quarter, a strong improvement from the $17.7 million decrease in Q2 2023. This is a sign of acceleration of growth and very nice to see indeed.

Looking ahead, analysts covering the company were expecting sales to grow 10% over the next 12 months before the earnings results announcement.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Bentley's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 110% in Q3. This means that even if Bentley didn't win any new customers over the last 12 months, it would've grown its revenue by 10%.

Bentley has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

Key Takeaways from Bentley's Q3 Results

Sporting a market capitalization of $15 billion, more than $67 million in cash on hand, and positive free cash flow over the last 12 months, we believe that Bentley is attractively positioned to invest in growth.

It was good to see Bentley beat analysts' revenue expectations this quarter, driven by an ARR (annual recurring revenue) beat. We were also glad its gross margin improved and adjusted operating income beat. Overall, this quarter's results were solid and shareholders should feel optimistic, although no financial outlook was given in the release. The stock is flat after reporting and currently trades at $47.98 per share.

So should you invest in Bentley right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.