Infrastructure design software provider Bentley Systems (NASDAQ:BSY) reported results ahead of analysts' expectations in Q2 CY2024, with revenue up 11.3% year on year to $330.3 million. It made a non-GAAP profit of $0.31 per share, improving from its profit of $0.24 per share in the same quarter last year.

Is now the time to buy Bentley? Find out by accessing our full research report, it's free.

Bentley (BSY) Q2 CY2024 Highlights:

- Revenue: $330.3 million vs analyst estimates of $325.1 million (1.6% beat)

- Adjusted Operating Income: $117.1 million vs analyst estimates of $101.1 million (15.9% beat)

- EPS (non-GAAP): $0.31 vs analyst estimates of $0.23 (33.2% beat)

- Gross Margin (GAAP): 80.9%, up from 77.6% in the same quarter last year

- Free Cash Flow of $59.5 million, down 70.5% from the previous quarter

- Annual Recurring Revenue: $1.22 billion at quarter end, up 9.9% year on year

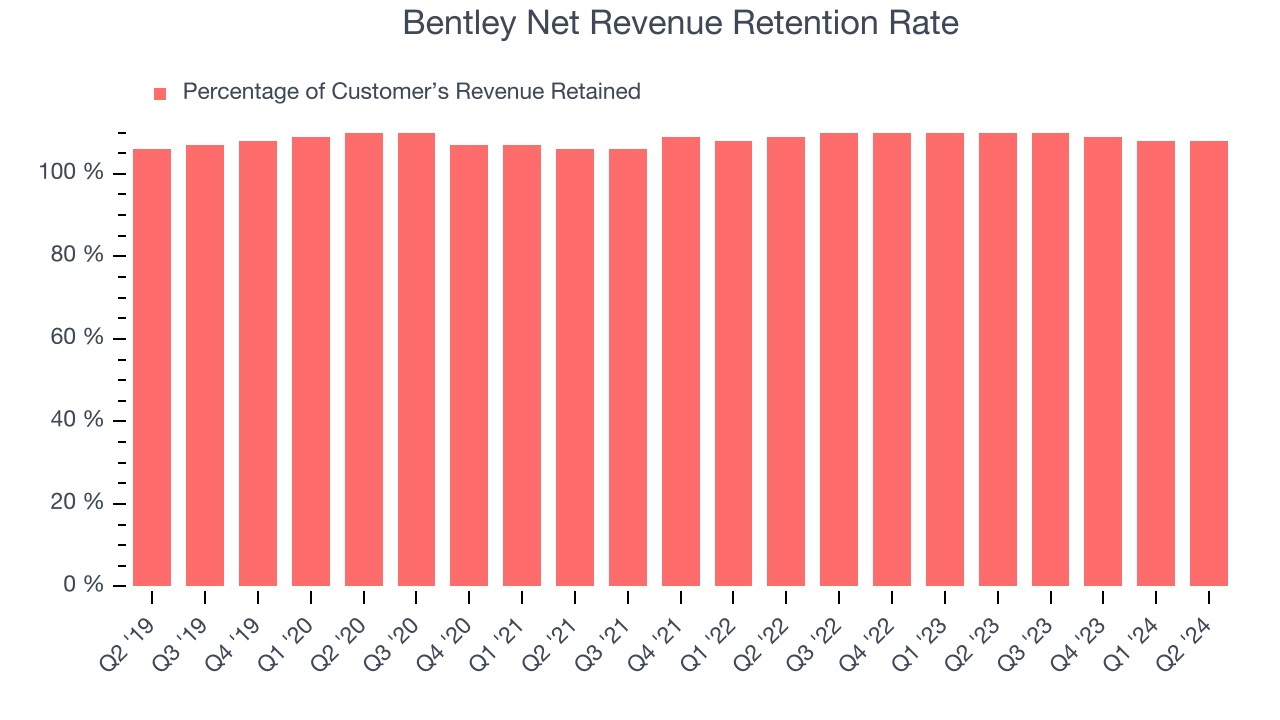

- Net Revenue Retention Rate: 108%, in line with the previous quarter

- Billings: $324.7 million at quarter end, up 10.5% year on year

- Market Capitalization: $14.19 billion

CEO Nicholas Cumins said, “Our performance in 24Q2 and the first half provides a solid foundation for the full year, with very positive end-market and operational momentum. Our year-over-year ARR growth of 11% on a constant currency basis (11.5% excluding China) is consistent with the previous quarter. Public Works / Utilities and North America remained the main growth drivers, and we continued to add new small- and medium-sized accounts at a rapid pace, reflecting healthy market conditions."

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ:BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Sales Growth

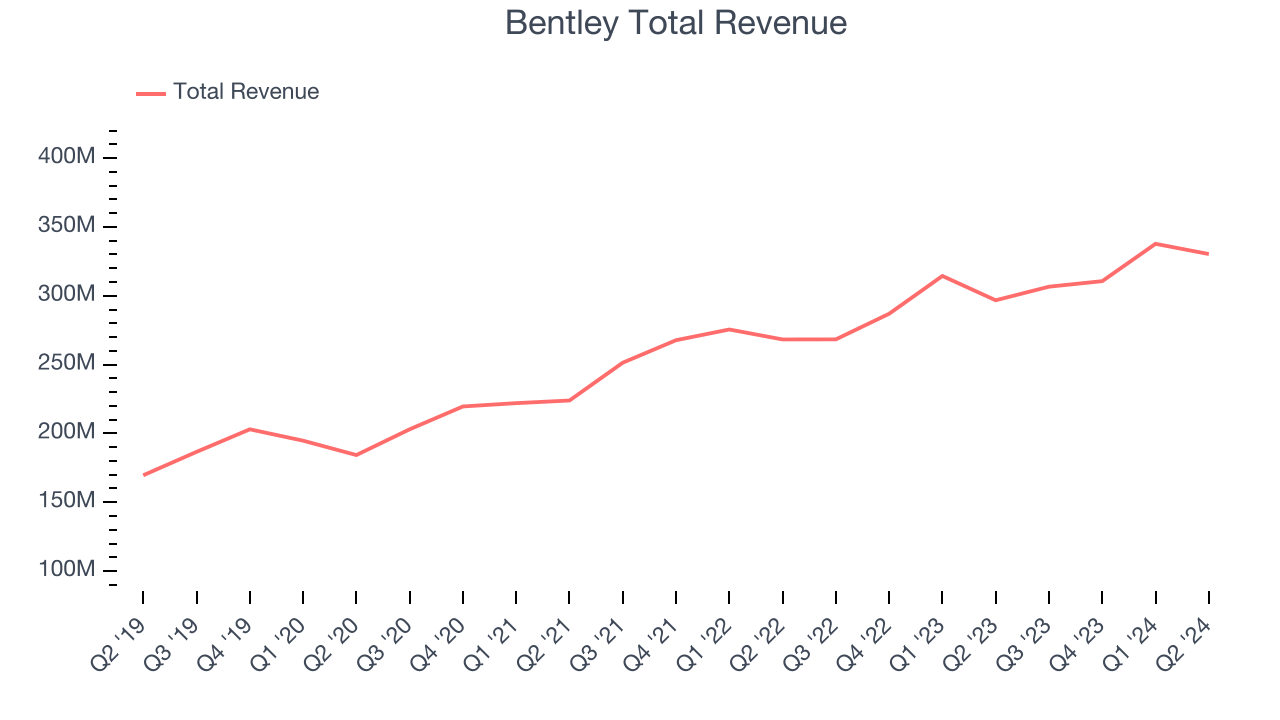

As you can see below, Bentley's revenue growth has been sluggish over the last three years, growing from $223.9 million in Q2 2021 to $330.3 million this quarter.

This quarter, Bentley's quarterly revenue was once again up 11.3% year on year. However, the company's revenue actually decreased by $7.43 million in Q2 compared to the $27.12 million increase in Q1 CY2024. This situation is worth monitoring as Bentley's sales have historically followed a seasonal pattern but management is guiding for a further revenue drop in the next quarter.

Looking ahead, analysts covering the company were expecting sales to grow 11.5% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Bentley's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 108% in Q2. This means that even if Bentley didn't win any new customers over the last 12 months, it would've grown its revenue by 8%.

Bentley has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

Key Takeaways from Bentley's Q2 Results

It was encouraging to see Bentley narrowly top analysts' revenue expectations this quarter, driven by better-than-anticipated billings. We were also happy its adjusted operating income and EPS outperformed Wall Street's estimates. On the other hand, its ARR (annual recurring revenue, a leading indicator) fell short and its gross margin decreased. Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on track. The stock remained flat at $44.50 immediately following the results.

So should you invest in Bentley right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.