Infrastructure design software provider Bentley Systems (NASDAQ:BSY) missed analysts' expectations in Q1 CY2024, with revenue up 7.4% year on year to $337.8 million. It made a non-GAAP profit of $0.31 per share, improving from its profit of $0.25 per share in the same quarter last year.

Bentley (BSY) Q1 CY2024 Highlights:

- Revenue: $337.8 million vs analyst estimates of $340.1 million (small miss)

- EPS (non-GAAP): $0.31 vs analyst estimates of $0.26 (18.4% beat)

- Gross Margin (GAAP): 81.7%, up from 78.6% in the same quarter last year

- Free Cash Flow of $201.4 million, up 149% from the previous quarter

- Annual Recurring Revenue: $1.19 billion at quarter end, up 10.8% year on year

- Net Revenue Retention Rate: 108%, in line with the previous quarter

- Market Capitalization: $16.99 billion

Founded by brothers Keith and Barry Bentley, Bentley Systems (NASDAQ:BSY) offers a software-as-a-service platform that addresses the lifecycle of infrastructure projects such as road networks, tunnel systems, and wastewater facilities.

The company's key product suite consists of software applications such as MicroStation, OpenRoads, and ProjectWise. MicroStation is CAD (computer-aided design) software that enables the creation and editing of 2D and 3D designs. OpenRoads allows engineers to design and model roadway networks (roads, streets, highways, and their interaction with other infrastructure). ProjectWise provides a collaborative platform for team members to work together on on projects so communication is seamless.

Bentley’s software helps manage infrastructure projects more efficiently, reduce costs, and improve overall outcomes. The software does this by addressing the specific needs of infrastructure design professionals, which the company is intimately familiar with because it only serves this market. It is a one-stop shop to manage all aspects of a project–from planning and design to construction and maintenance–in a single platform. Additionally, the platform also enables collaboration and project maintenance, which means that less is lost in translation across different teams involved in a project and deliverables/budgets can be managed and tracked.

Bentley Systems generates revenue through the sale of its software licenses and subscriptions. The company also offers training and consulting services to its customers to ensure long-term user satisfaction and success.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Competitors in engineering and design software include Aspen Technology (NASDAQ:AZPN), Cadence Design Systems (NASDAQ:CDNS), and Altair Engineering (NASDAQ:ALTR).Sales Growth

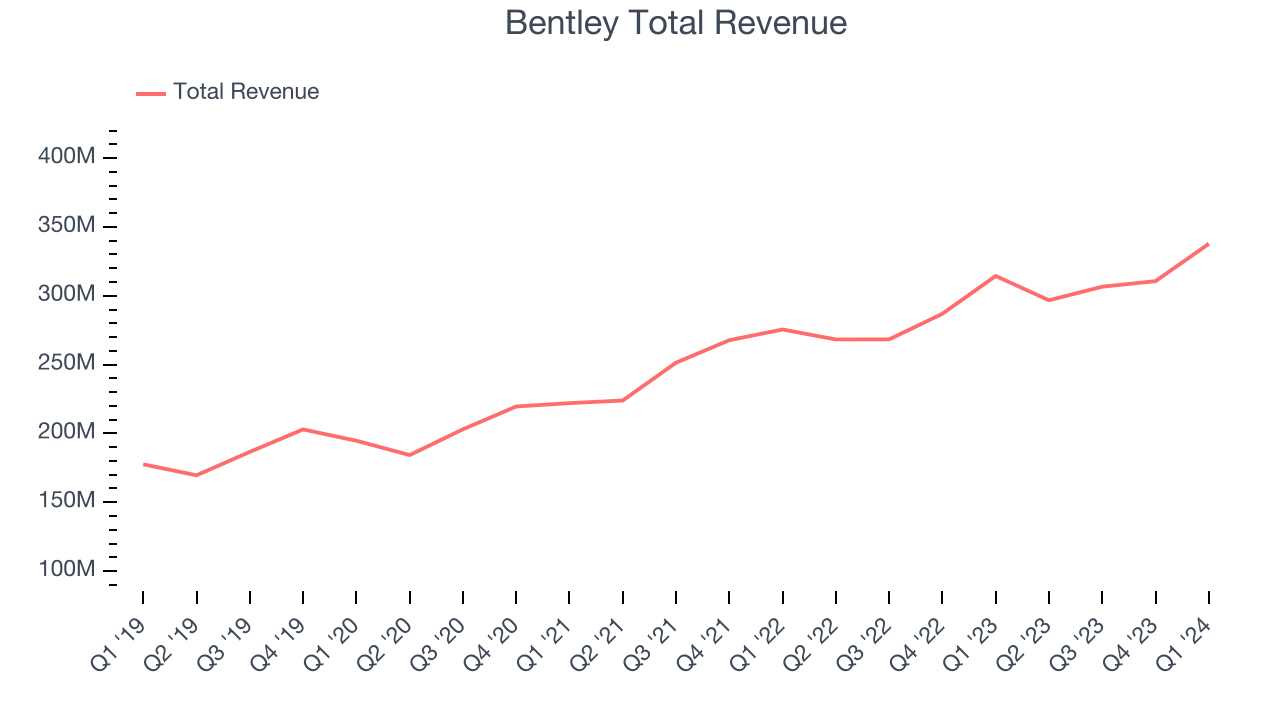

As you can see below, Bentley's revenue growth has been mediocre over the last three years, growing from $222 million in Q1 2021 to $337.8 million this quarter.

Bentley's quarterly revenue was only up 7.4% year on year, which might disappoint some shareholders. However, we can see that the company's revenue grew by $27.12 million quarter on quarter, accelerating from $4.03 million in Q4 CY2023.

Looking ahead, analysts covering the company were expecting sales to grow 11.6% over the next 12 months before the earnings results announcement.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

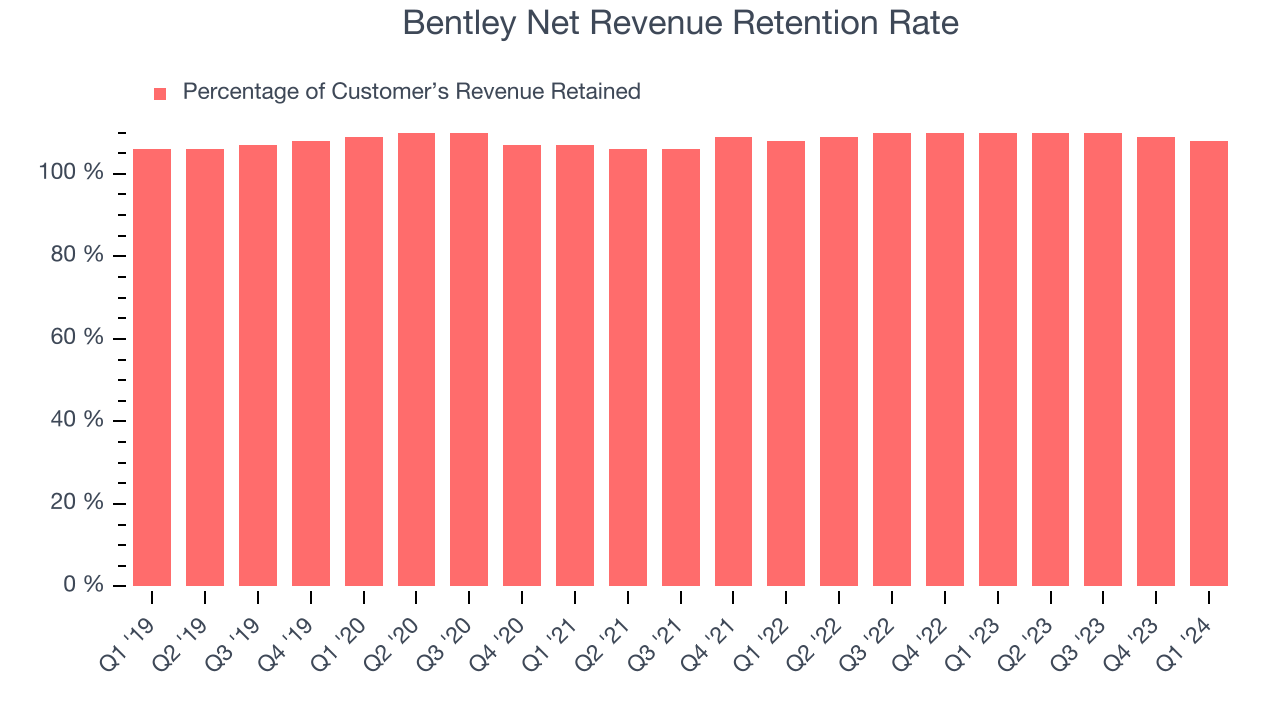

Bentley's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 108% in Q1. This means that even if Bentley didn't win any new customers over the last 12 months, it would've grown its revenue by 8%.

Bentley has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

Profitability

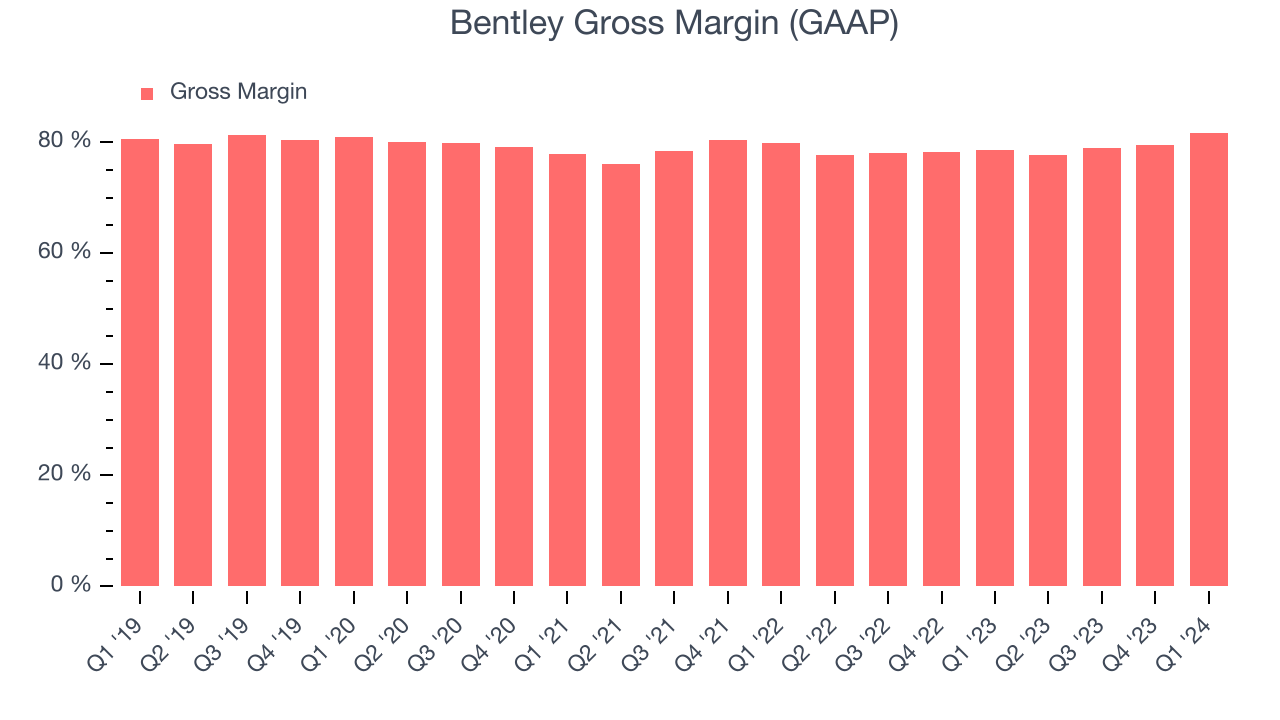

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Bentley's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 81.7% in Q1.

That means that for every $1 in revenue the company had $0.82 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Bentley's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

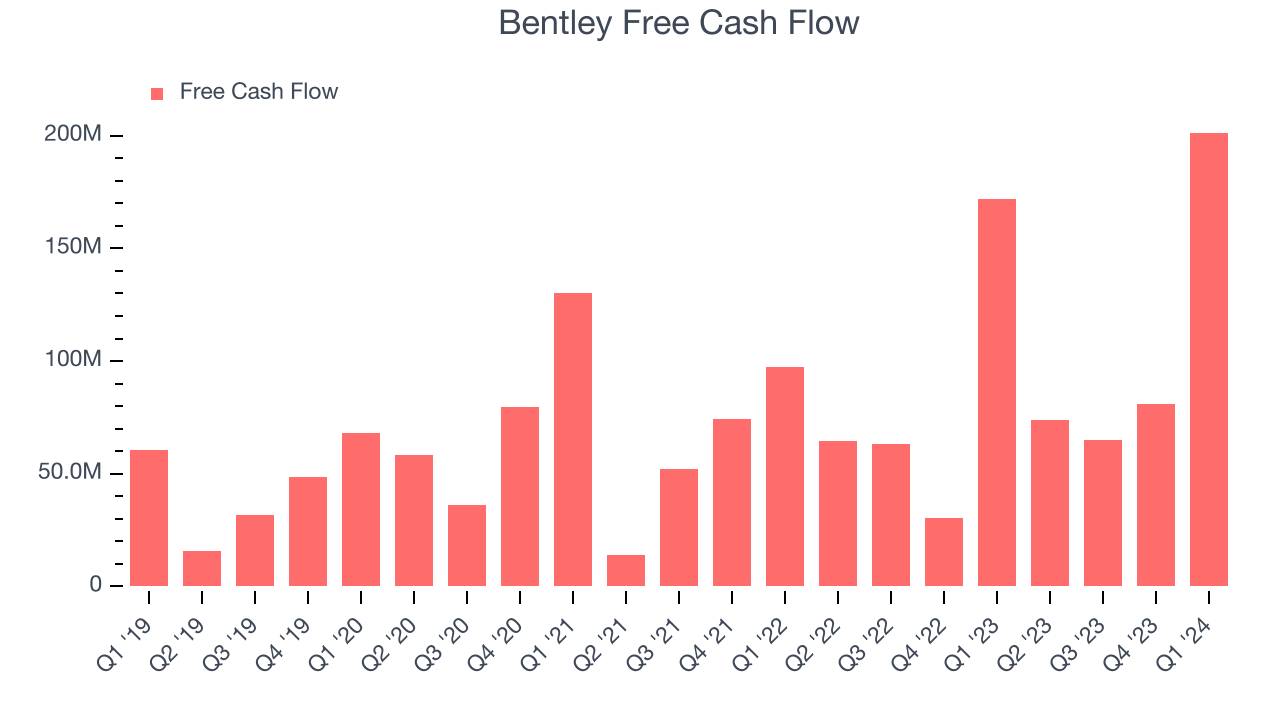

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Bentley's free cash flow came in at $201.4 million in Q1, up 17.1% year on year.

Bentley has generated $421.1 million in free cash flow over the last 12 months, an eye-popping 33.6% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Bentley's Q1 Results

We were impressed by how significantly Bentley blew past analysts' EPS estimates this quarter, driven partly by its gross margin improvement. On the other hand, its revenue slightly missed Wall Street's expectations. Looking ahead, COO Nicholas Cumins will assume the CEO role on July 1st after current CEO Greg Bentley steps into the Executive Chair role. Overall, this was a decent quarter for Bentley. The stock is flat after reporting and currently trades at $53.54 per share.

Is Now The Time?

When considering an investment in Bentley, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that Bentley isn't a bad business. Although its revenue growth has been uninspiring over the last three years with analysts expecting growth to slow from here, its bountiful generation of free cash flow empowers it to invest in growth initiatives.

Bentley's price-to-sales ratio of 12.8x based on the next 12 months indicates the market is definitely optimistic about its growth prospects. There are things to like about Bentley, and there's no doubt it's a bit of a market darling, at least for some. However, we think there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $58.32 right before these results (compared to the current share price of $53.54).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.