Plant-based protein company Beyond Meat (NASDAQGS:BYND) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 18% year on year to $75.6 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $330 million at the midpoint. It made a non-GAAP loss of $0.72 per share, improving from its loss of $0.91 per share in the same quarter last year.

Beyond Meat (BYND) Q1 CY2024 Highlights:

- Revenue: $75.6 million vs analyst estimates of $75.72 million (small miss)

- Adjusted EBITDA: ($32.9) million loss vs analyst estimates of ($29.4) million loss (miss)

- EPS (non-GAAP): -$0.72 vs analyst estimates of -$0.66

- The company reconfirmed its revenue guidance for the full year of $330 million at the midpoint

- Gross Margin (GAAP): 4.9%, down from 6.7% in the same quarter last year

- Free Cash Flow was -$33 million compared to -$30.54 million in the previous quarter

- Sales Volumes were down 16.1% year on year

- Market Capitalization: $536.9 million

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQGS:BYND) is a food company crafting innovative, sustainable, and delicious alternatives to traditional meat products.

The company was founded in 2009 by Ethan Brown, who had a background in clean energy and realized that animal agriculture was a leading contributor to greenhouse gas emissions. He believed that by creating plant-based alternatives indistinguishable from animal meat in terms of taste and texture, he could improve both the environment and animal welfare.

Brown assembled a team of scientists, researchers, and chefs to execute his vision and began experimenting with various plant ingredients. They focused on understanding the molecular composition of meat, including its proteins, fats, and trace elements, and recreated these components using plant sources.

Years of research and development led to the creation of Beyond Meat's first flagship product, the Beyond Burger, which launched in 2016. The Beyond Burger made waves in the food industry for its uncanny resemblance to traditional beef burgers and can now be found in grocery stores, restaurants, and fast-food chains around the world.

Beyond Meat has also expanded in other categories like plant-based sausage, meatballs, and chicken, which are all made with peas, mung beans, and brown rice. The company invests heavily into research and development to enhance its products and create new offerings.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Competitors include private company Impossible Foods and public companies Conagra (NYSE:CAG), which owns Gardein, and Kellanova (NYSE:K), which owns MorningStar Farms, and Maple Leaf Foods (TSX:MFI).Sales Growth

Beyond Meat is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

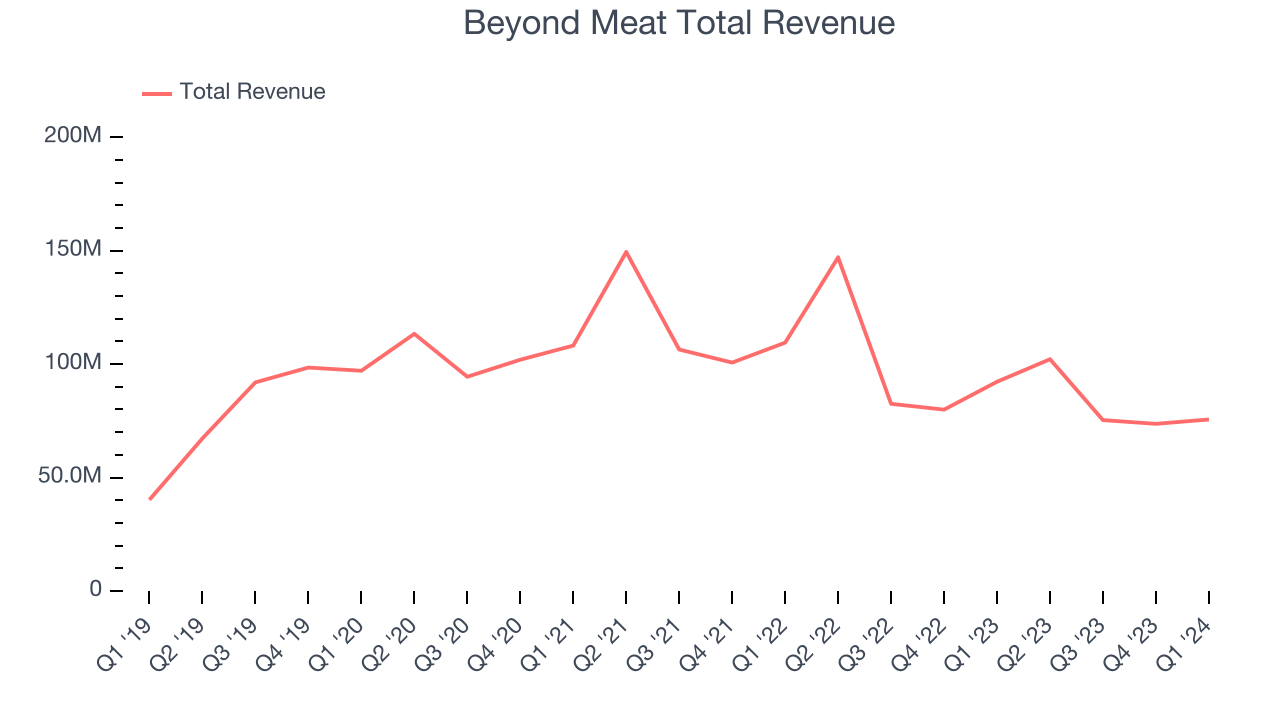

As you can see below, the company's revenue has declined over the last three years, dropping 7.9% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Beyond Meat missed Wall Street's estimates and reported a rather uninspiring 18% year-on-year revenue decline, generating $75.6 million in revenue. Looking ahead, Wall Street expects sales to grow 4% over the next 12 months, an acceleration from this quarter.

Gross Margin & Pricing Power

All else equal, we prefer higher gross margins. They make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

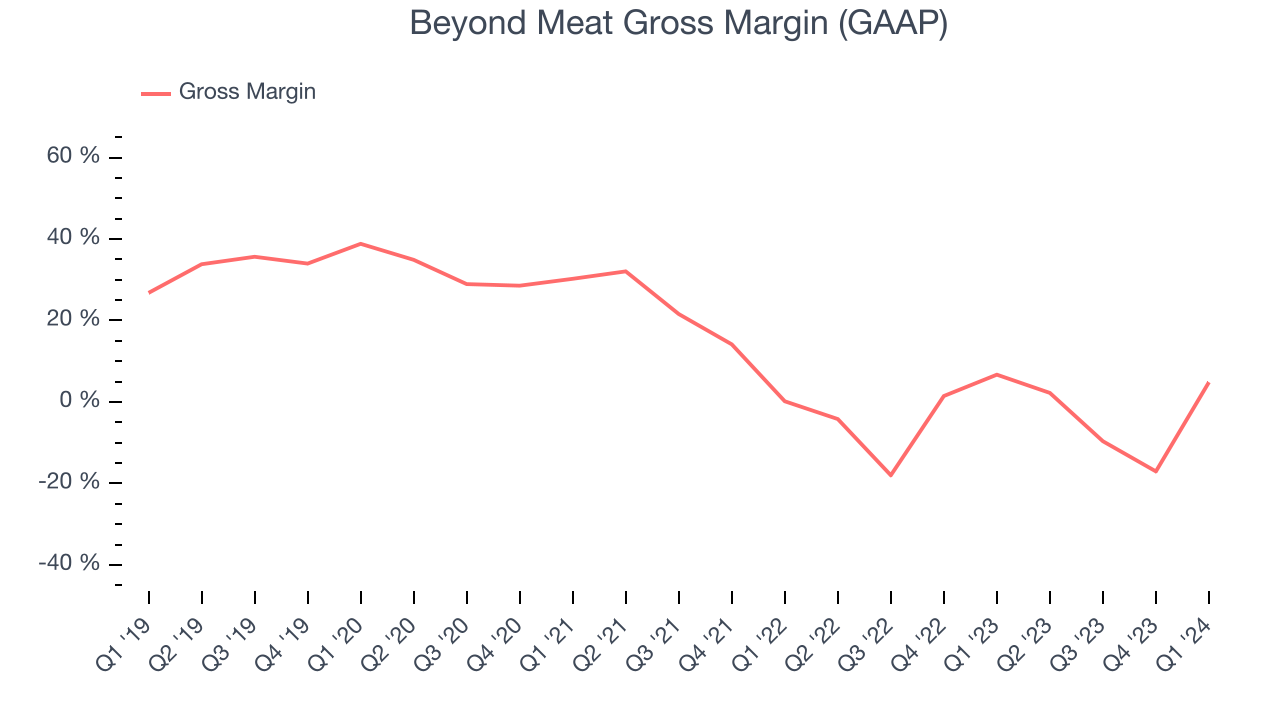

This quarter, Beyond Meat's gross profit margin was 4.9%, down 1.9 percentage points year on year. That means for every $1 in revenue, a chunky $0.95 went towards paying for raw materials, production of goods, and distribution expenses.

Beyond Meat has bad unit economics for a consumer staples company. As you can see above, it's averaged a negative 3.8% gross margin over the last two years. Its margin has also been trending down over the last year, averaging 273% year-on-year decreases each quarter. If this trend continues, it could suggest a more competitive environment where Beyond Meat has diminishing pricing power and less favorable input costs (such as raw materials).

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

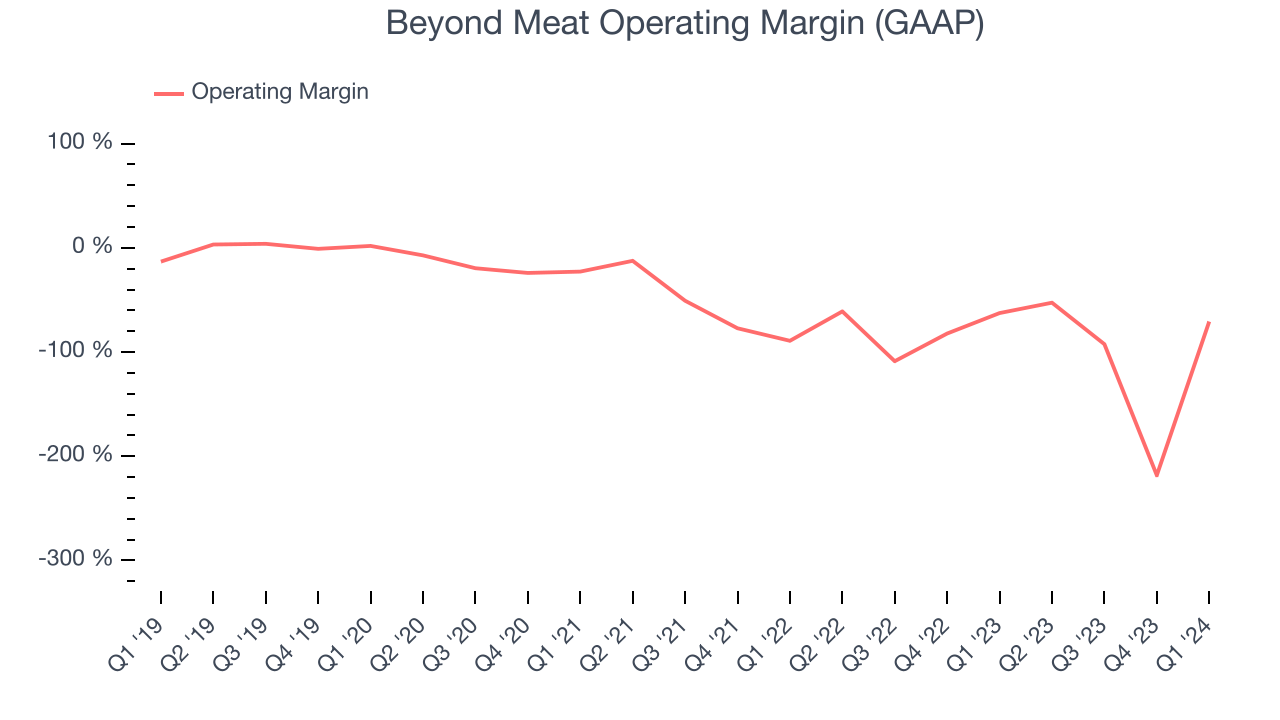

In Q1, Beyond Meat generated an operating profit margin of negative 70.7%, down 8.2 percentage points year on year. Because Beyond Meat's operating margin decreased more than its gross margin, we can infer the company was less efficient and increased spending in discretionary areas like corporate overhead and advertising.

There are few unprofitable publicly traded consumer staples companies, and over the last two years, Beyond Meat has been one of them. Its high expenses have contributed to an average operating margin of negative 87.9%. On top of that, Beyond Meat's margin has declined by 27.9 percentage points on average over the last year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.

There are few unprofitable publicly traded consumer staples companies, and over the last two years, Beyond Meat has been one of them. Its high expenses have contributed to an average operating margin of negative 87.9%. On top of that, Beyond Meat's margin has declined by 27.9 percentage points on average over the last year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.EPS

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

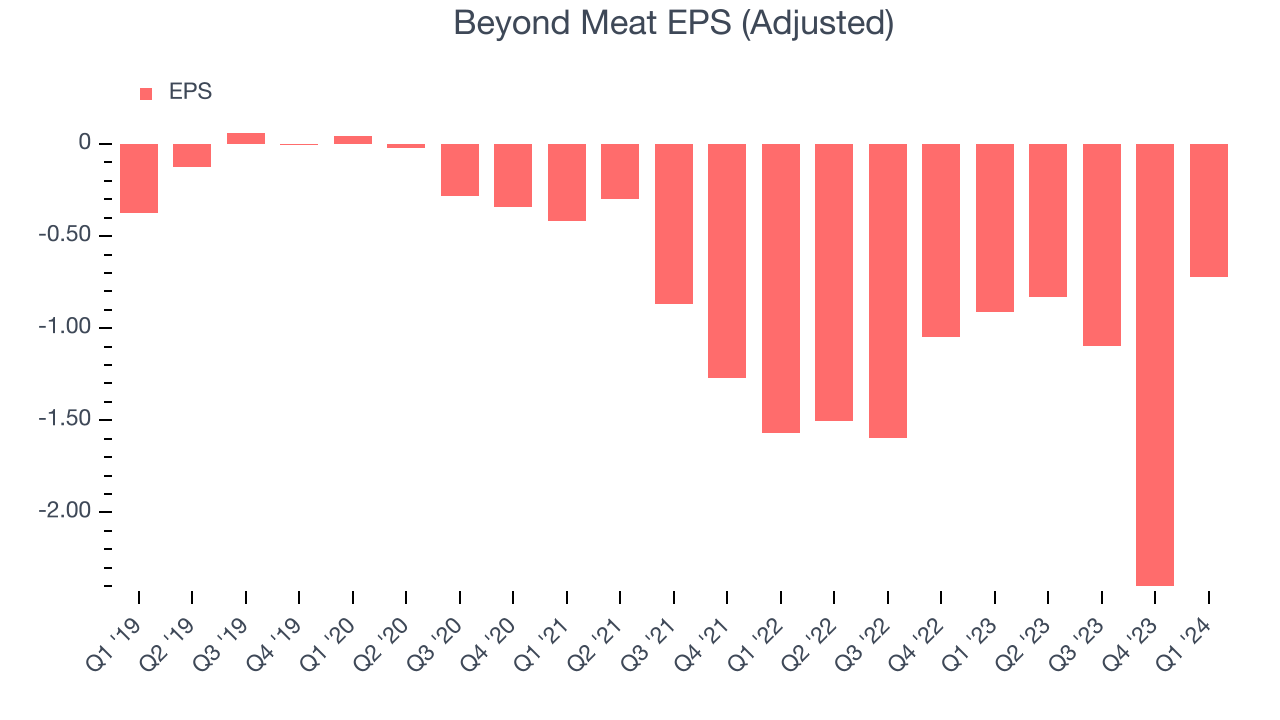

In Q1, Beyond Meat reported EPS at negative $0.72, up from negative $0.91 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2021 and FY2024, Beyond Meat's EPS dropped 96.8%, translating into 68.4% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 58.2% year-on-year increase in EPS.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

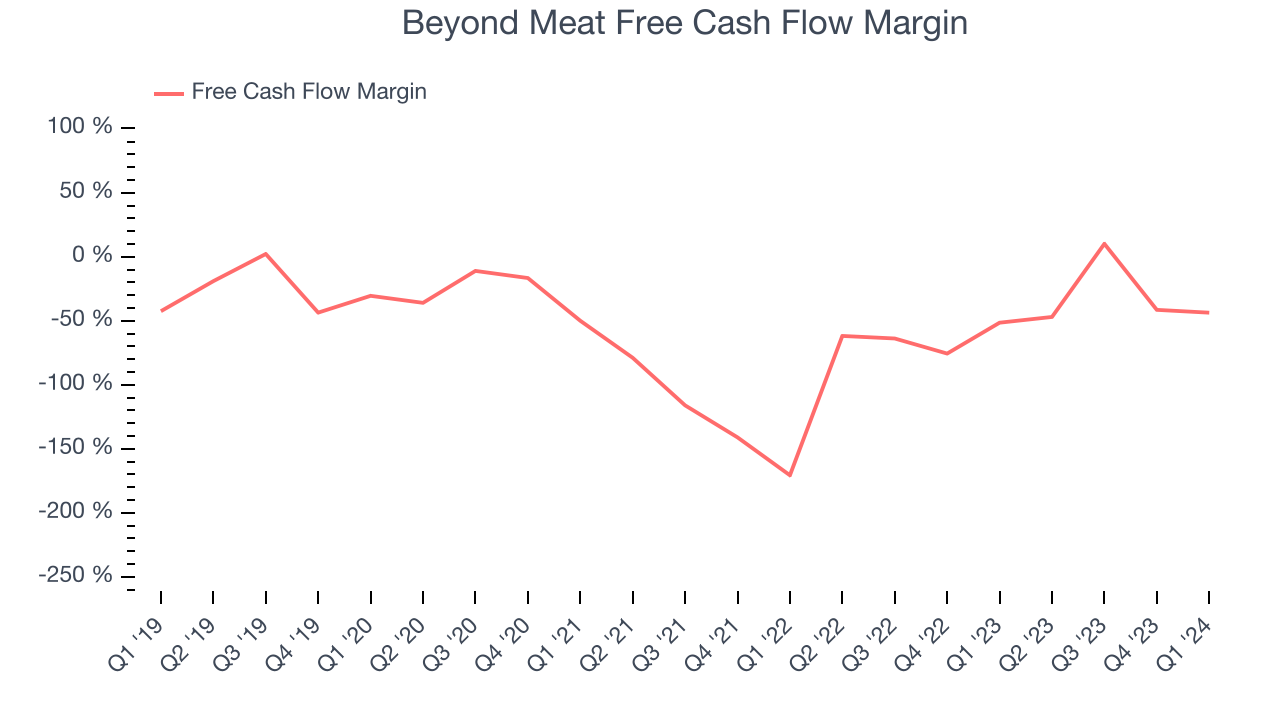

Beyond Meat burned through $33 million of cash in Q1, representing a negative 43.7% free cash flow margin. The company increased its cash burn by 30.5% year on year.

Over the last two years, Beyond Meat's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer staples sector, averaging negative 48.8%. However, its margin has averaged year-on-year increases of 30.8 percentage points over the last 12 months, showing the company is taking action to improve its situation.

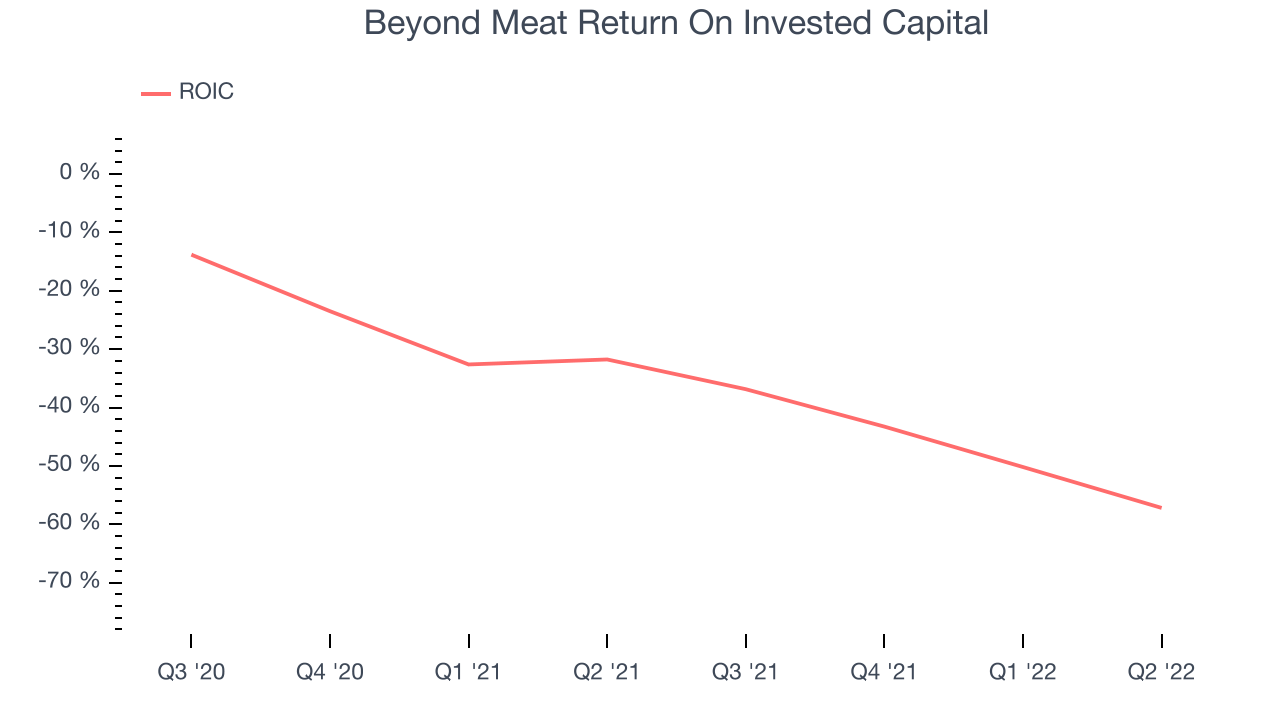

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Beyond Meat's five-year average ROIC was negative 41.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Beyond Meat is a well-capitalized company with $157.9 million of cash and no debt. This position gives Beyond Meat the freedom to borrow money, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Beyond Meat's Q1 Results

We struggled to find many strong positives in these results. The company missed on revenue and adjusted EBITDA. Beyond Meat still seems to believe that its previously-provided full-year guidance can be achieved as the company reiterated that full year guidance for revenue and implied operating profit. Overall, this was a mediocre quarter for Beyond Meat. The stock is flat after reporting and currently trades at $8.2 per share.

Is Now The Time?

Beyond Meat may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Beyond Meat, we'll be cheering from the sidelines. Its revenue has declined over the last three years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its brand caters to a niche market. On top of that, its declining EPS over the last three years makes it hard to trust.

While we've no doubt one can find things to like about Beyond Meat, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $6.50 per share right before these results (compared to the current share price of $8.20), implying they didn't see much short-term potential in Beyond Meat.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.