Egg company Cal-Maine Foods (NASDAQ:CALM) reported Q1 CY2024 results topping analysts' expectations, with revenue down 29.5% year on year to $703.1 million. It made a GAAP profit of $3 per share, down from its profit of $6.62 per share in the same quarter last year.

Cal-Maine (CALM) Q1 CY2024 Highlights:

- Revenue: $703.1 million vs analyst estimates of $692.4 million (1.5% beat)

- EPS: $3 vs analyst estimates of $2.45 (22.3% beat)

- Guidance: no specific figures given in the earnings release, but commentary on headwinds from highly pathogenic avian influenza (“HPAI”) and broader demand for eggs was encouraging

- Gross Margin (GAAP): 31.1%, down from 46.4% in the same quarter last year

- Market Capitalization: $2.87 billion

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

The company was founded in 1957 by Fred R. Adams. Over time, Cal-Maine grew organically and also capitalized on strategic acquisitions. One of the largest was its 2012 purchase of Pilgrim Pride’s (NASDAQ:PPC) egg production assets. Today, it is one of the largest producers and distributors of eggs in the United States.

The product is self-explanatory, but Cal-Maine’s operations are vertically integrated and complex. The company starts by hatching chicks and growing flocks. These flocks produce eggs, which are then processed, packaged, and distributed. The company specifically offers eggs in six categories:cage-free, organic, brown, free-range, pasture-raised, and nutritionally enhanced as specialty eggs.

Cal-Maine distributes its eggs to large retailers and supermarkets. The end customer tends to be the buyer of groceries for a household, and most households will have a carton of eggs in the refrigerator at all times. These customers may buy eggs for family breakfasts, baking purposes, or some combination.

Vital Farms (NASDAQ:VITL) is a publicly-traded competitor. Private competitors include Rose Acre Farms Hillandale Farms, but Cal-Maine’s scale and market share are unique.Sales Growth

Cal-Maine carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Cal-Maine can still achieve high growth rates because its revenue base is not yet monstrous.

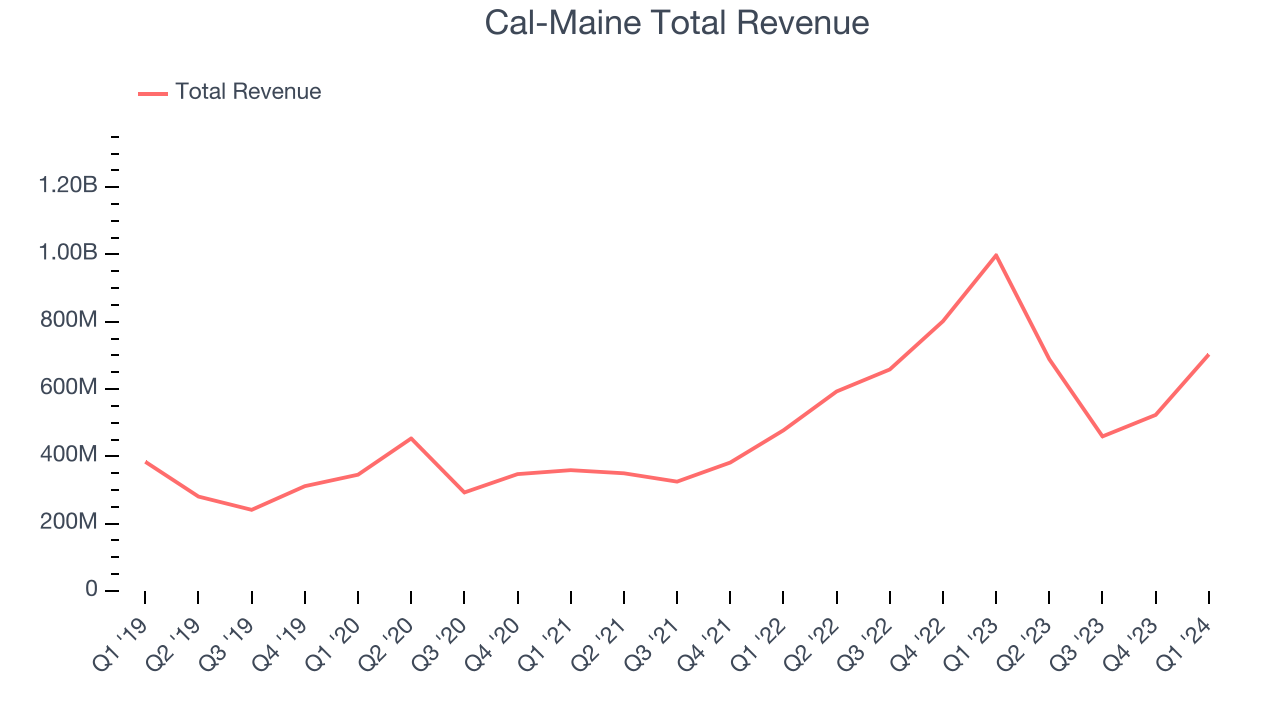

As you can see below, the company's annualized revenue growth rate of 17.8% over the last three years was impressive for a consumer staples business.

This quarter, Cal-Maine's revenue fell 29.5% year on year to $703.1 million but beat Wall Street's estimates by 1.5%. Looking ahead, Wall Street expects revenue to decline 12.5% over the next 12 months.

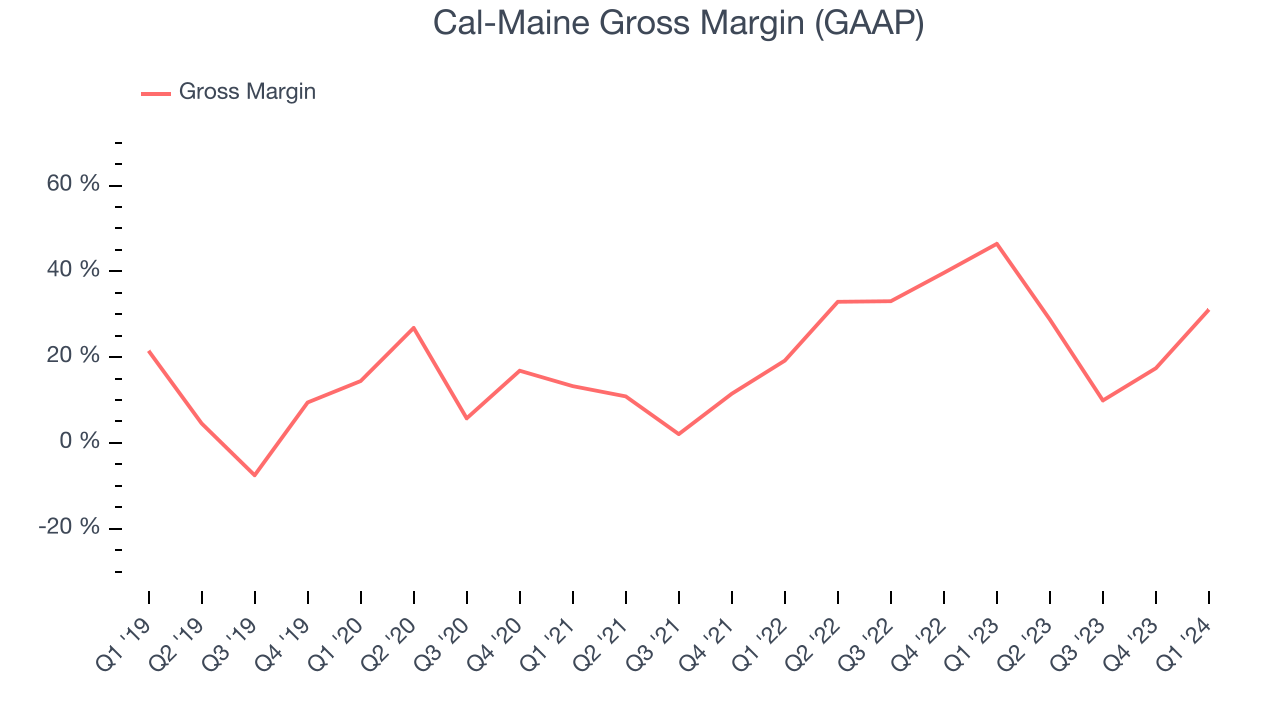

Gross Margin & Pricing Power

All else equal, we prefer higher gross margins. They make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Cal-Maine's gross profit margin came in at 31.1% this quarter, down 15.3 percentage points year on year. That means for every $1 in revenue, $0.69 went towards paying for raw materials, production of goods, and distribution expenses.

Cal-Maine's unit economics are higher than the typical consumer staples company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see above, it's averaged a decent 32.2% gross margin over the last eight quarters. Its margin, however, has been trending down over the last year, averaging 42.9% year-on-year decreases each quarter. If this trend continues, it could suggest a more competitive environment.

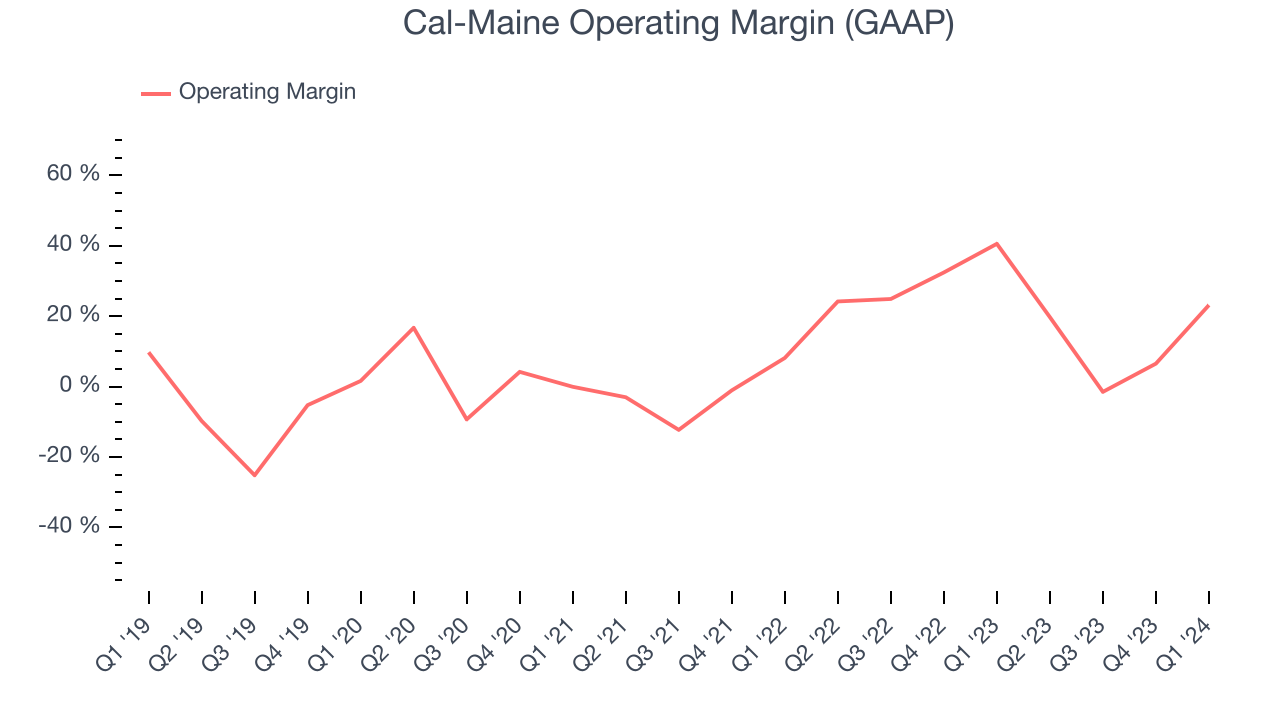

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, Cal-Maine generated an operating profit margin of 23.2%, down 17.4 percentage points year on year. Because Cal-Maine's operating margin decreased more than its gross margin, we can infer the company was less efficient and increased spending in discretionary areas like corporate overhead and advertising.

Zooming out, Cal-Maine has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 23.9%. However, Cal-Maine's margin has declined by 18.1 percentage points on average over the last year. Although this isn't the end of the world, investors are likely hoping for better results in the future.

Zooming out, Cal-Maine has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 23.9%. However, Cal-Maine's margin has declined by 18.1 percentage points on average over the last year. Although this isn't the end of the world, investors are likely hoping for better results in the future. EPS

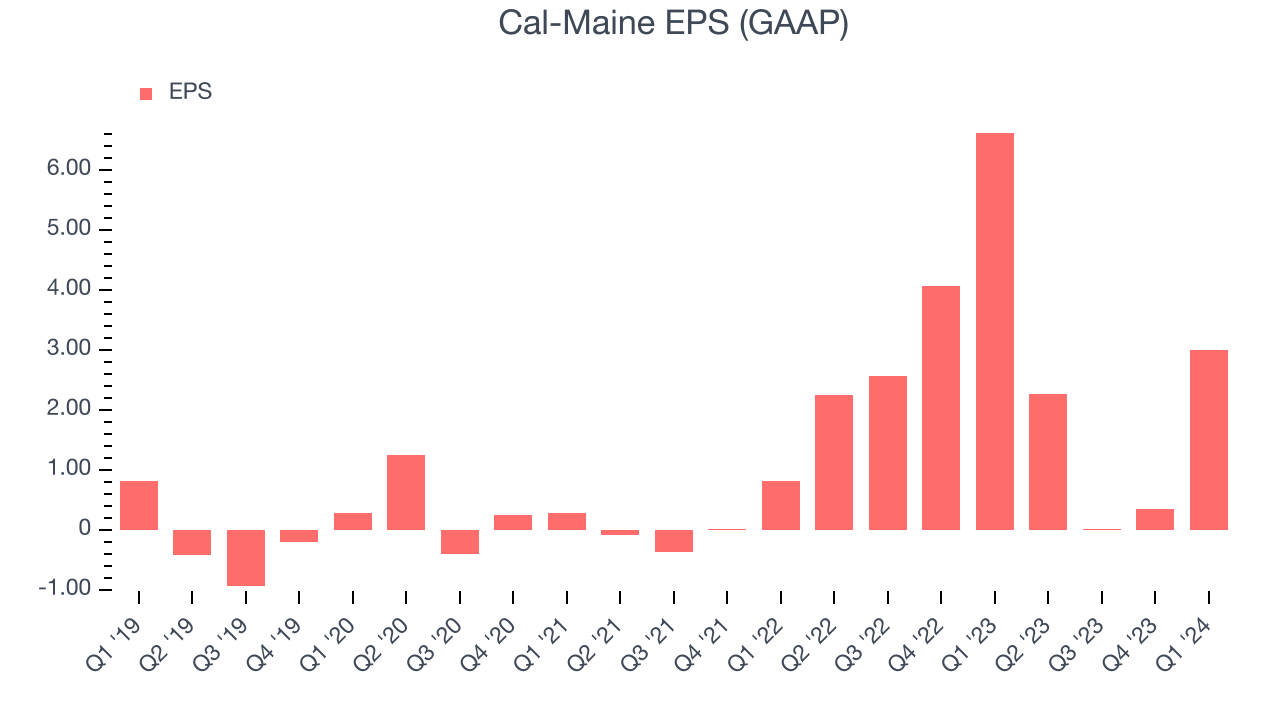

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Cal-Maine reported EPS at $3, down from $6.62 in the same quarter a year ago. This print beat Wall Street's estimates by 22.3%.

Between FY2021 and FY2024, Cal-Maine's EPS grew 311%, translating into an astounding 60.2% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period, showing that Cal-Maine has excelled in managing its expenses.

Over the next 12 months, however, Wall Street is projecting an average 41.4% year-on-year decline in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Cal-Maine hasn't been the highest-quality company lately, it historically did a solid job investing in profitable business initiatives. Its five-year average ROIC was 19.9%, higher than most consumer staples companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last five years, Cal-Maine's ROIC averaged large increases each year. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Key Takeaways from Cal-Maine's Q1 Results

We enjoyed seeing Cal-Maine exceed analysts' EPS expectations this quarter by a large magnitude. We were also glad its revenue outperformed Wall Street's estimates. While no specific numerical guidance was given, commentary was positive. There have been fears of highly pathogenic avian influenza's impact on the industry, and the company stated that "While the more recent outbreaks of HPAI have also affected supply and caused market prices to move higher, the overall market impact has not been as severe." Additionally, it seems like the backdrop for eggs is strong, with Cal-Maine stating that "Demand for shell eggs has remained strong as consumers look for an affordable and nutritious protein option." Overall, this was a good quarter for Cal-Maine. The stock is up 8.2% after reporting and currently trades at $63.77 per share.

Is Now The Time?

Cal-Maine may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Cal-Maine isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been good over the last three years, its projected EPS for the next year is lacking. And while its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its brand caters to a niche market.

Cal-Maine's price-to-earnings ratio based on the next 12 months is 17.9x. In the end, beauty is in the eye of the beholder. While Cal-Maine wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $57.33 per share right before these results (compared to the current share price of $63.77).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.