Wrapping up Q1 earnings, we look at the numbers and key takeaways for the design software stocks, including Cadence (NASDAQ:CDNS) and its peers.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 8 design software stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 3.01%, while on average next quarter revenue guidance was 1.12% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows, but design software stocks held their ground better than others, with the share prices up 14.8% since the previous earnings results, on average.

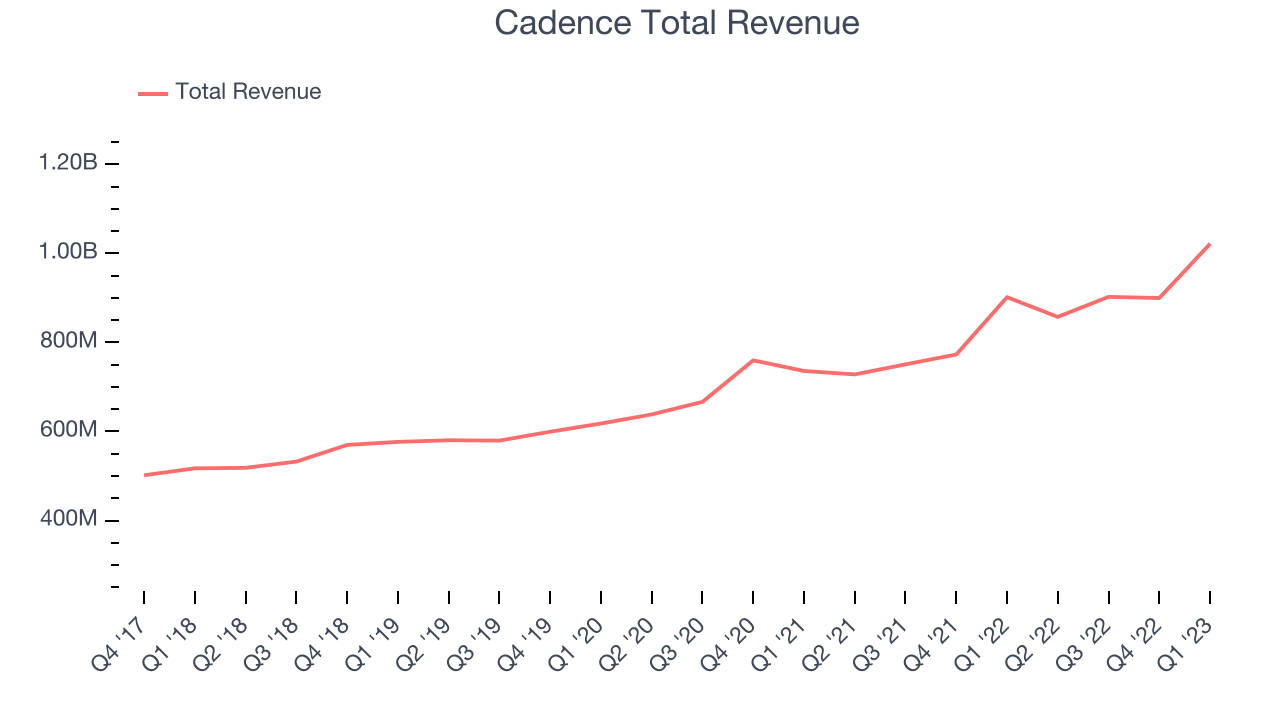

Cadence (NASDAQ:CDNS)

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ:CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Cadence reported revenues of $1.02 billion, up 13.3% year on year, beating analyst expectations by 1.51%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in gross margin.

“Cadence delivered strong results for the first quarter driven by our consistent execution and continued momentum in the core EDA and System Design & Analysis businesses,” said Anirudh Devgan, president and chief executive officer.

The stock is up 10% since the results and currently trades at $234.42.

Read our full report on Cadence here, it's free.

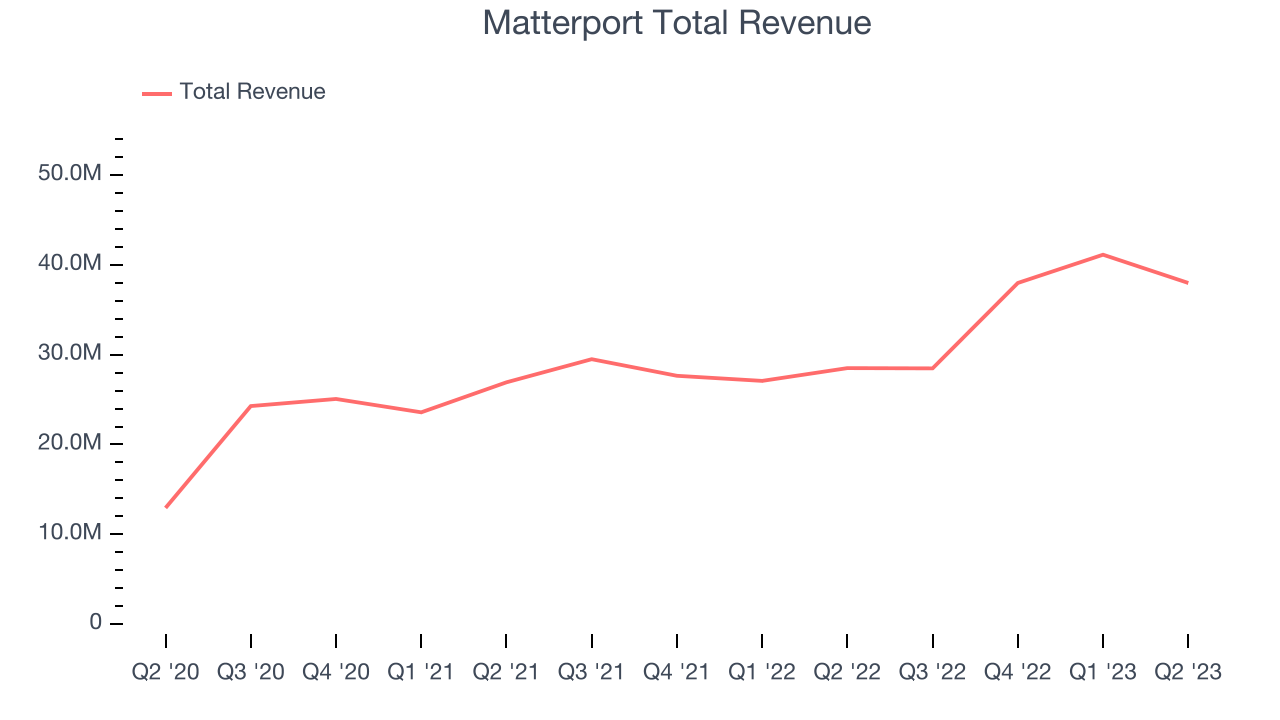

Best Q1: Matterport (NASDAQ:MTTR)

Founded in 2011 before any mass market VR headset was released, Matterport (NASDAQ:MTTR) provides the hardware and software necessary to turn real world spaces into 3D visualization.

Matterport reported revenues of $38 million, up 33.3% year on year, beating analyst expectations by 8.13%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and a full year guidance beating analysts' expectations.

Matterport pulled off the strongest analyst estimates beat and highest full year guidance raise among its peers. The company added 70,000 customers to a total of 771,000. The stock is up 19% since the results and currently trades at $3.2.

Is now the time to buy Matterport? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk reported revenues of $1.27 billion, up 8.46% year on year, in line with analyst expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in gross margin.

Autodesk had the weakest performance against analyst estimates in the group. The stock is up 5.42% since the results and currently trades at $208.33.

Read our full analysis of Autodesk's results here.

Procore Technologies (NYSE:PCOR)

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore Technologies (NYSE:PCOR) offers a software-as-service project, finance and quality management platform for the construction industry.

Procore Technologies reported revenues of $213.5 million, up 33.9% year on year, beating analyst expectations by 5.07%. It was a strong quarter for the company, with accelerating customer growth.

The company added 601 customers to a total of 15,089. The stock is up 22.8% since the results and currently trades at $65.3.

Read our full, actionable report on Procore Technologies here, it's free.

Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $500.4 million, up 56.3% year on year, beating analyst expectations by 4.28%. It was a solid quarter for the company, with a decent beat of analyst estimates and very optimistic guidance for the next quarter.

Unity pulled off the fastest revenue growth among the peers. The stock is up 39.9% since the results and currently trades at $40.18.

Read our full, actionable report on Unity here, it's free.

The author has no position in any of the stocks mentioned