Semiconductor design software provider Cadence Design Systems (NASDAQ:CDNS) fell short of analysts' expectations in Q1 CY2024, with revenue down 1.2% year on year to $1.01 billion. Next quarter's revenue guidance of $1.04 billion also underwhelmed, coming in 6.3% below analysts' estimates. It made a non-GAAP profit of $1.17 per share, down from its profit of $1.29 per share in the same quarter last year.

Cadence (CDNS) Q1 CY2024 Highlights:

- Revenue: $1.01 billion vs analyst estimates of $1.02 billion (0.9% miss)

- EPS (non-GAAP): $1.17 vs analyst estimates of $1.13 (3.5% beat)

- Revenue Guidance for Q2 CY2024 is $1.04 billion at the midpoint, below analyst estimates of $1.11 billion

- The company reconfirmed its revenue guidance for the full year of $4.59 billion at the midpoint

- Gross Margin (GAAP): 87.6%, in line with the same quarter last year

- Free Cash Flow of $203.6 million, down 14.6% from the previous quarter

- Backlog: $6.0 billion

- cRPO: $3.1 billion

- Market Capitalization: $76.4 billion

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ:CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Known as an electronic design automation (EDA) software platform, Cadence helps engineers design semiconductors and test them through simulation. The company's flagship product is the Cadence Encounter digital implementation system, which provides a complete set of tools such as logic synthesis, placement and routing, and timing optimization. Logic synthesis converts electronic designs into detailed digital circuit implementations. Placement and timing tools determine the physical locations of components to meet design constraints. Timing optimization ensures the digital circuit meets the required performance metrics.

As chips become smaller and more densely packed with transistors, it becomes harder to design and optimize them. Cadence's tools address these challenges by automating many of the design and optimization tasks, which lets engineers to focus on higher-level decisions. Simulation capabilities means testing can be done before final production to identify and correct defects or inefficiencies, which saves time/resources and improves time to market.

Cadence principally generates revenue by selling software seat licenses, usually based on number of users in a customer’s organization. In addition, the company generates a smaller portion of revenue from consulting and support services to ensure that customers succeed with the company’s software suite.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Competitors in engineering and design software include Ansys (NASDAQ:ANSS), Synopsys (NASDAQ:SNPS), and Siemens EDA (subsidiary of XTRA:SIE).Sales Growth

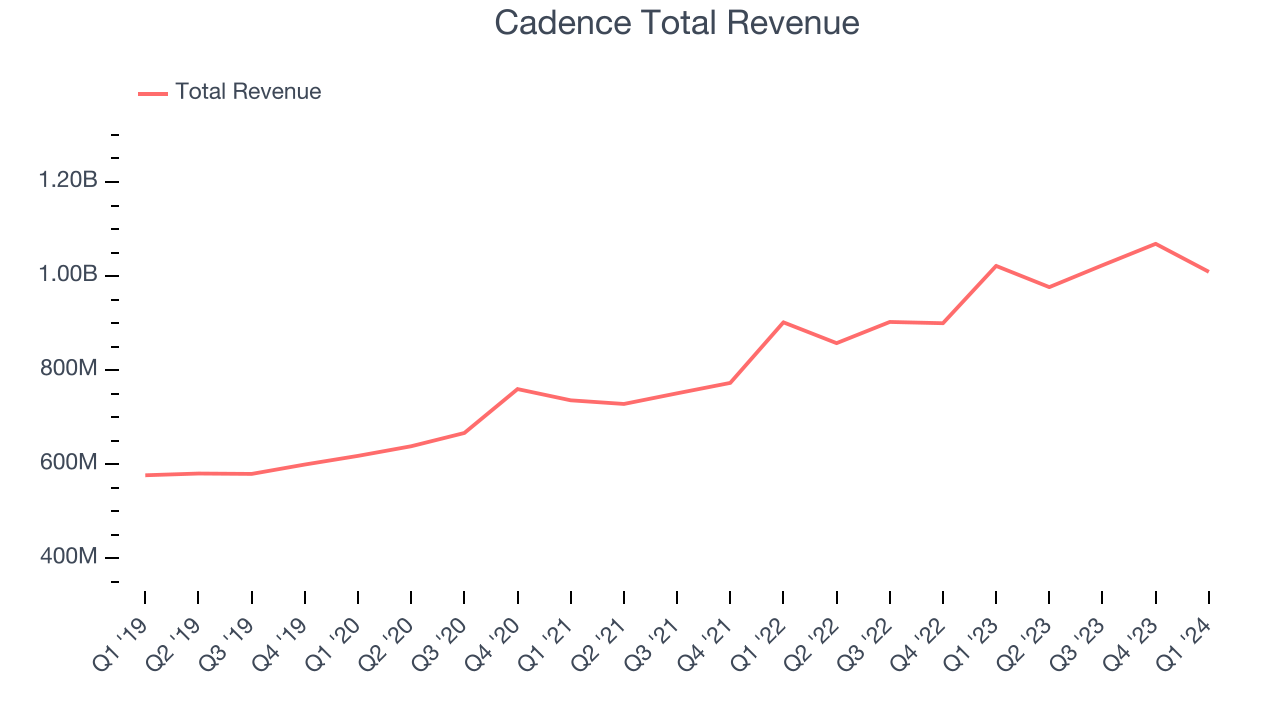

As you can see below, Cadence's revenue growth has been mediocre over the last three years, growing from $736 million in Q1 2021 to $1.01 billion this quarter.

This quarter, Cadence's revenue was down 1.2% year on year, which might disappointment some shareholders.

Next quarter's guidance suggests that Cadence is expecting revenue to grow 6.5% year on year to $1.04 billion, slowing down from the 13.9% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 17.3% over the next 12 months before the earnings results announcement.

Profitability

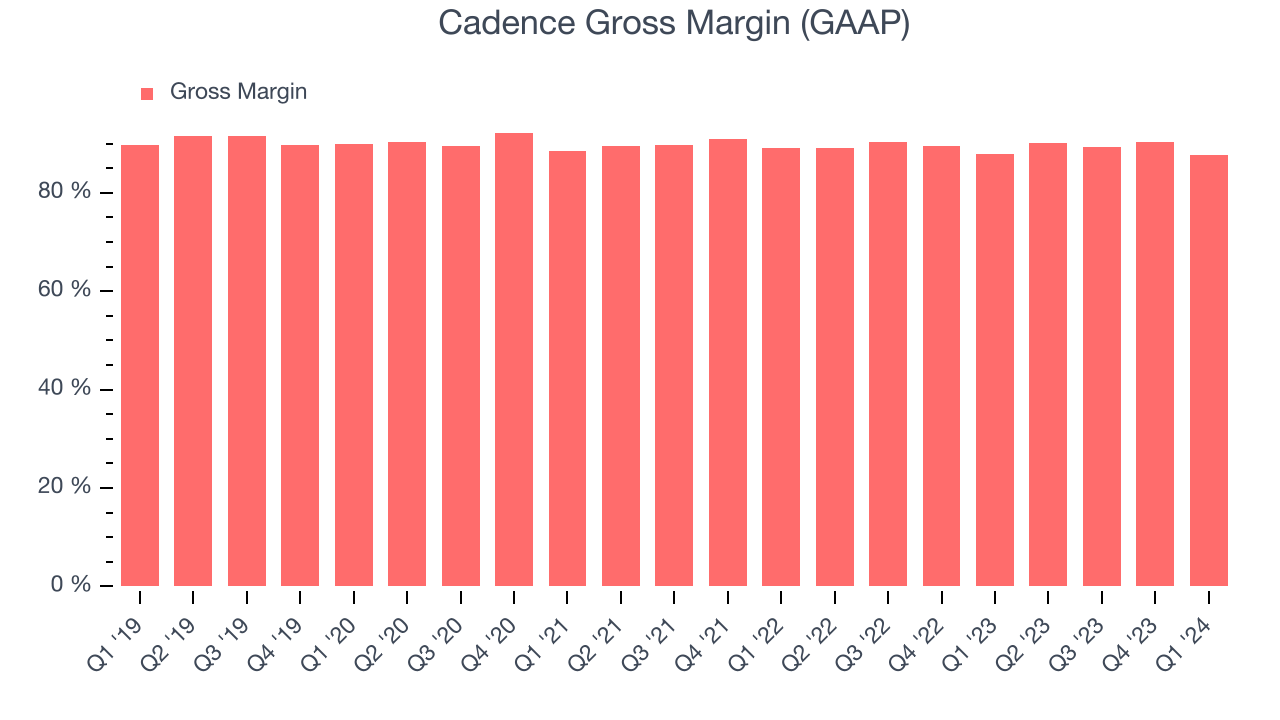

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Cadence's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 87.6% in Q1.

That means that for every $1 in revenue the company had $0.88 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite its recent drop, Cadence still has an excellent gross margin that allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

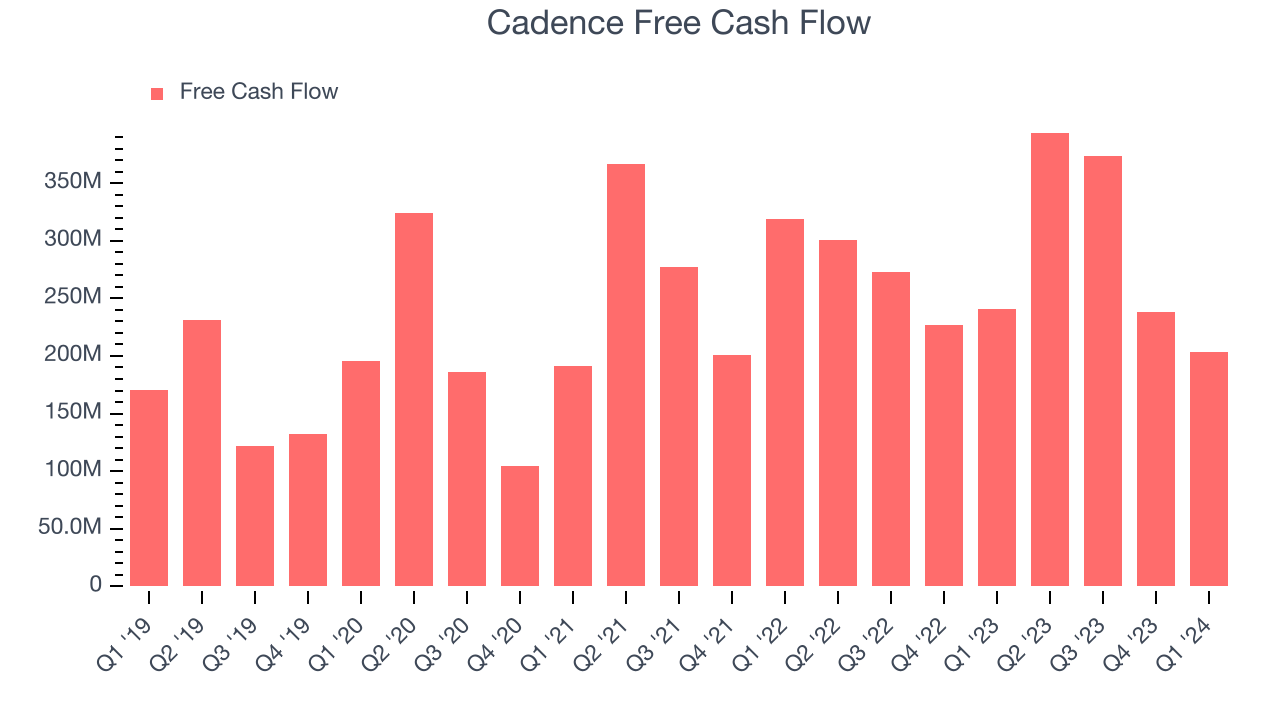

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Cadence's free cash flow came in at $203.6 million in Q1, down 15.4% year on year.

Cadence has generated $1.21 billion in free cash flow over the last 12 months, an eye-popping 29.7% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Cadence is a well-capitalized company with $1.01 billion of cash and $649.3 million of debt, meaning it could pay back all its debt tomorrow and still have $363.1 million of cash on its balance sheet. This net cash position gives Cadence the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Cadence's Q1 Results

We struggled to find many strong positives in these results. Although its EPS beat Wall Street's estimates, its revenue and billings missed while its revenue guidance for next quarter fell short. The company raised its full-year 2024 revenue outlook, but the new forecast aligned with analysts' expectations, meaning it was already priced into the stock. Overall, the results could have been better. The company is down 7.3% on the results and currently trades at $264.5 per share.

Is Now The Time?

Cadence may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Cadence is a great business. Although its revenue growth has been uninspiring over the last three years, its impressive gross margins indicate excellent business economics. On top of that, its efficient customer acquisition hints at the potential for strong profitability.

Cadence's price-to-sales ratio of 16.3x based on the next 12 months indicates the market is optimistic about its growth prospects. But looking at the tech landscape today, Cadence's qualities stand out, and we think that the multiple is justified. We still like the stock at this price.

Wall Street analysts covering the company had a one-year price target of $323.79 right before these results (compared to the current share price of $264.50), implying they see short-term upside potential in Cadence.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.