Energy drink company Celsius (NASDAQ:CELH) fell short of analysts' expectations in Q1 CY2024, with revenue up 36.8% year on year to $355.7 million. It made a GAAP profit of $0.27 per share, down from its profit of $0.40 per share in the same quarter last year.

Celsius (CELH) Q1 CY2024 Highlights:

- Revenue: $355.7 million vs analyst estimates of $389.8 million (8.8% miss)

- Adjusted EBITDA: $88.0 million vs analyst estimates of $72.7 million (21.0% beat)

- EPS: $0.27 vs analyst estimates of $0.19 (38.9% beat)

- Gross Margin (GAAP): 51.2%, up from 43.8% in the same quarter last year

- Market Capitalization: $18.26 billion

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ:CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

The MetaPlus formulation includes natural ingredients such as green tea extract, ginger, and guarana seed. Backed by clinical studies, the company states that this combination can enhance thermogenesis, a process that boosts energy and your body's metabolic rate.

Combining the MetaPlus cocktail with athlete and fitness influencer partnerships as well as fun flavors like ‘Arctic Vibe’ and ‘Prickly Pear Lime’, Celsius targets younger, health-conscious individuals who have sworn off soda because of its sugar content and who may be skeptical of more established energy drinks. Fitness enthusiasts, athletes, and those seeking to maintain or lose weight are core customers.

Celsius products can be found in major grocery stores, convenience stores, fitness centers, and nutrition retailers. Popular online marketplaces such as Amazon (NASDAQ:AMZN) sell Celsius products, and the company has its own official e-commerce site, launched in 2015. Consumers can not only buy Celsius products on the site but can locate stores that sell products, learn about the science behind the drinks, or apply to be a brand ambassador (the more Instagram followers, the better!).

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors that offer energy drinks or alternatives to energy drinks include Monster Beverage (NASDAQ:MNST), Rockstar Energy from PepsiCo (NASDAQ:PEP), and Coca-Cola Energy and Full Throttle from Coca-Cola (NYSE:KO).Sales Growth

Celsius is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

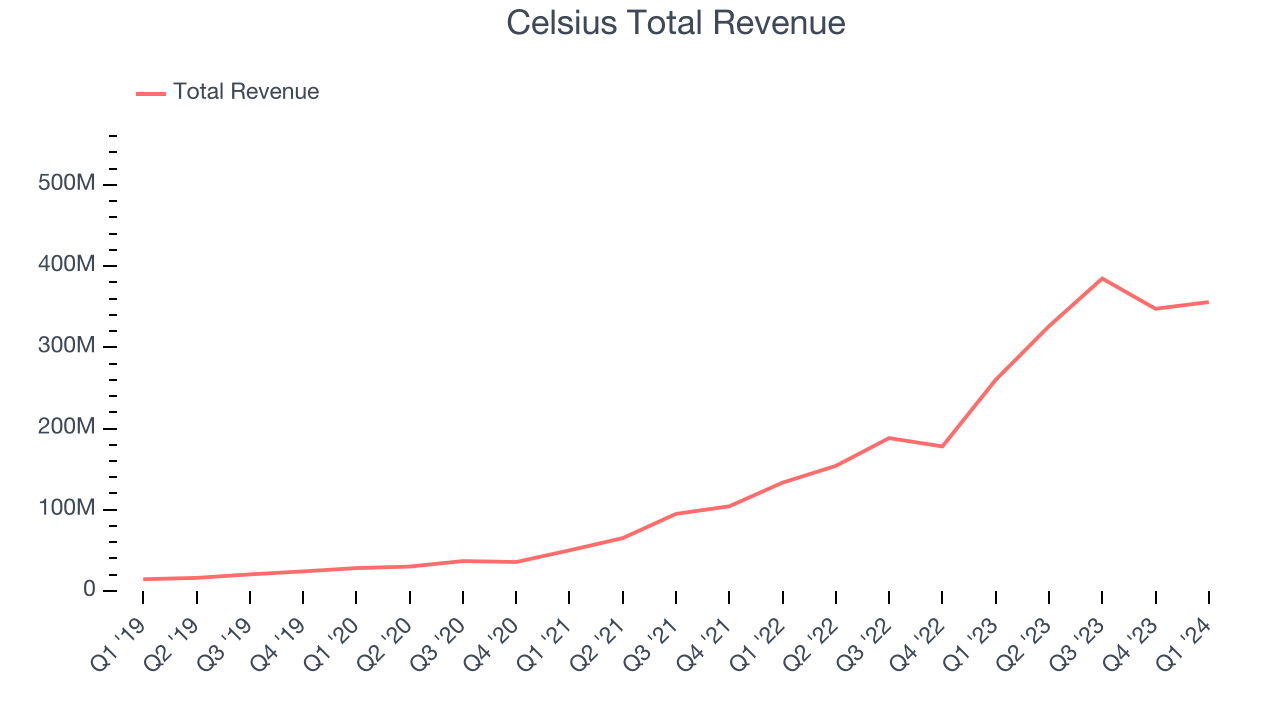

As you can see below, the company's annualized revenue growth rate of 110% over the last three years was incredible for a consumer staples business.

This quarter, Celsius pulled off a wonderful 36.8% year-on-year revenue growth rate, but its $355.7 million in revenue fell short of Wall Street's rosy estimates. Looking ahead, Wall Street expects sales to grow 42.5% over the next 12 months, an acceleration from this quarter.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

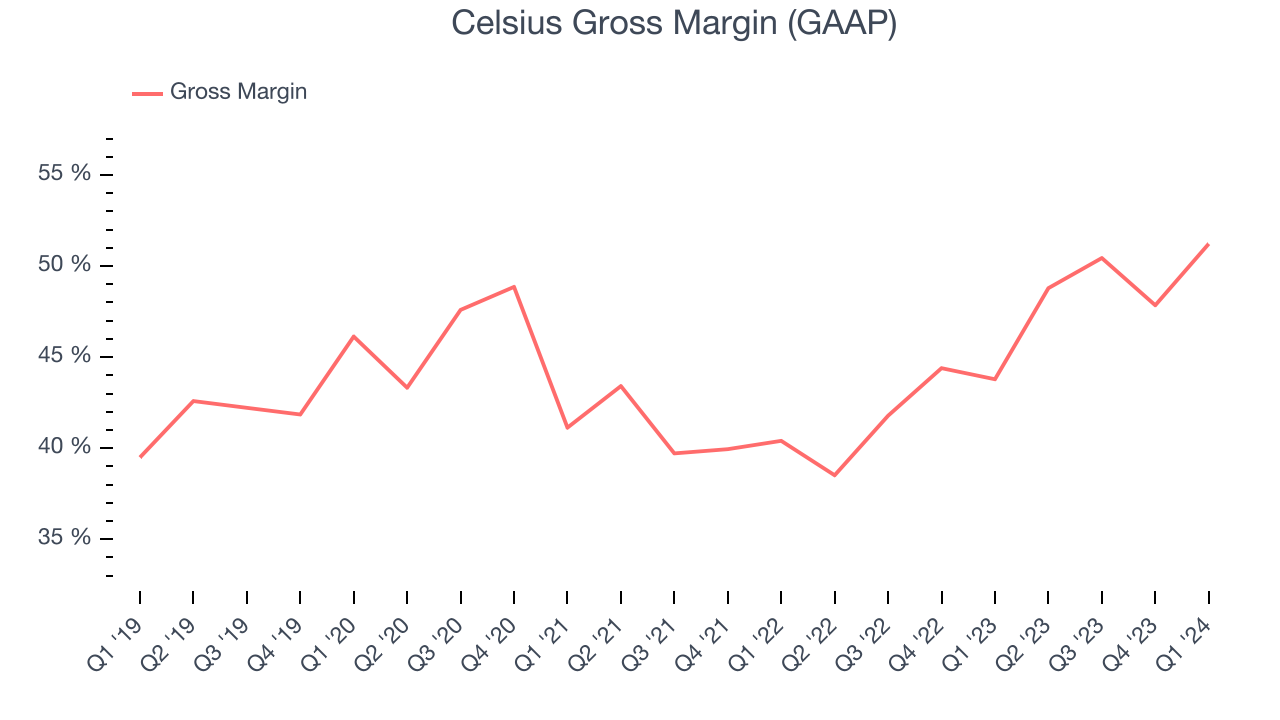

This quarter, Celsius's gross profit margin was 51.2%, up 7.4 percentage points year on year. That means for every $1 in revenue, $0.49 went towards paying for raw materials, production of goods, and distribution expenses.

Celsius has great unit economics for a consumer staples company, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged an impressive 47.1% gross margin over the last eight quarters. Its margin has also been trending up over the last 12 months, averaging 18% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

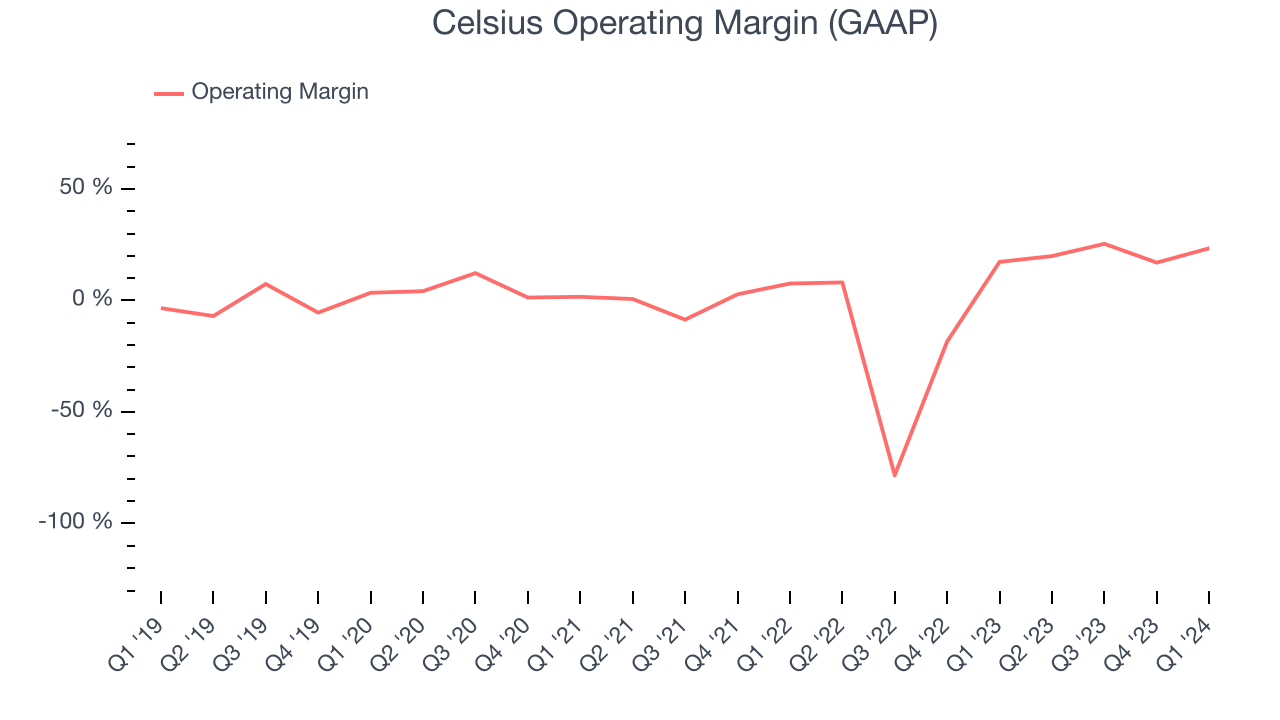

In Q1, Celsius generated an operating profit margin of 23.4%, up 6.1 percentage points year on year. This increase was encouraging, and we can infer Celsius had stronger pricing power and lower raw materials/transportation costs because its gross margin expanded more than its operating margin.

Zooming out, Celsius has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 8.3%, higher than the broader consumer staples sector. On top of that, its margin has improved by 37.3 percentage points on average over the last year, a great sign for shareholders.

Zooming out, Celsius has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 8.3%, higher than the broader consumer staples sector. On top of that, its margin has improved by 37.3 percentage points on average over the last year, a great sign for shareholders. EPS

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

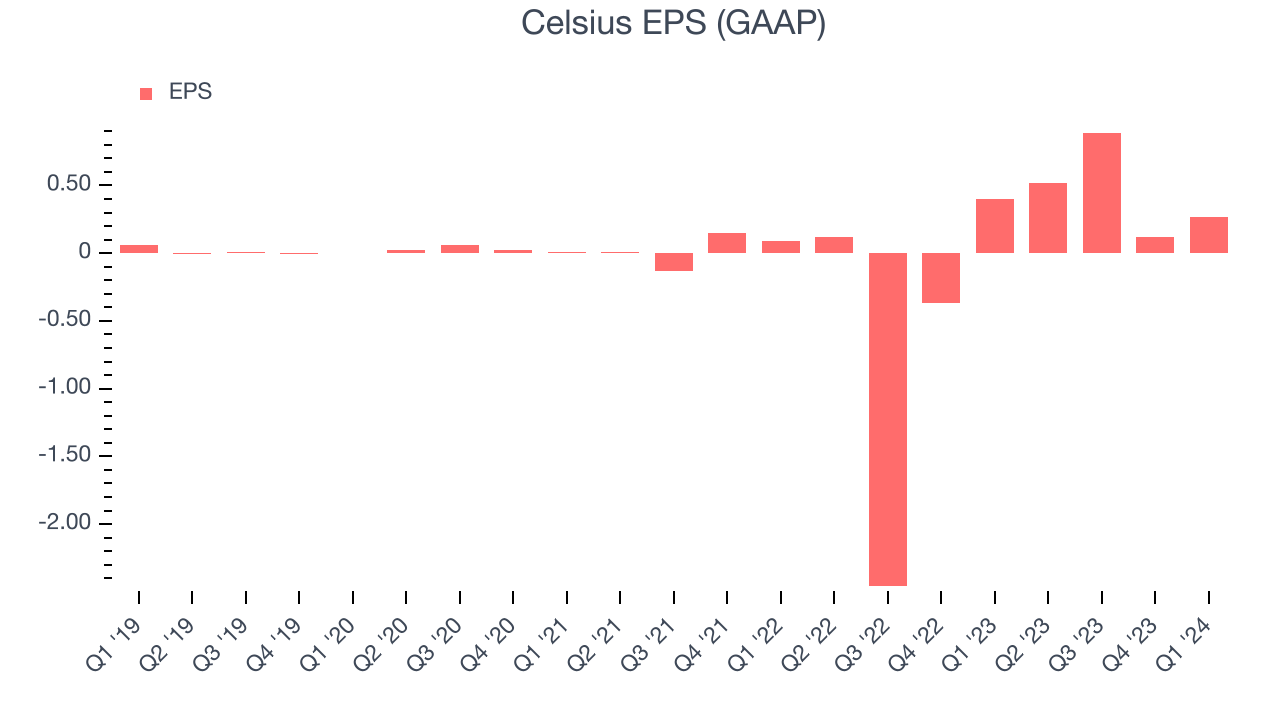

In Q1, Celsius reported EPS at $0.27, down from $0.40 in the same quarter a year ago. This print beat Wall Street's estimates by 38.9%.

Between FY2021 and FY2024, Celsius's EPS grew 1,535%, translating into an astounding 154% compounded annual growth rate. Thanks to the magic of compound interest, this means that Celsius will more than quintuple its EPS in five years if it can maintain this rate of growth.

Over the next 12 months, however, Wall Street is projecting an average 34.8% year-on-year decline in EPS.

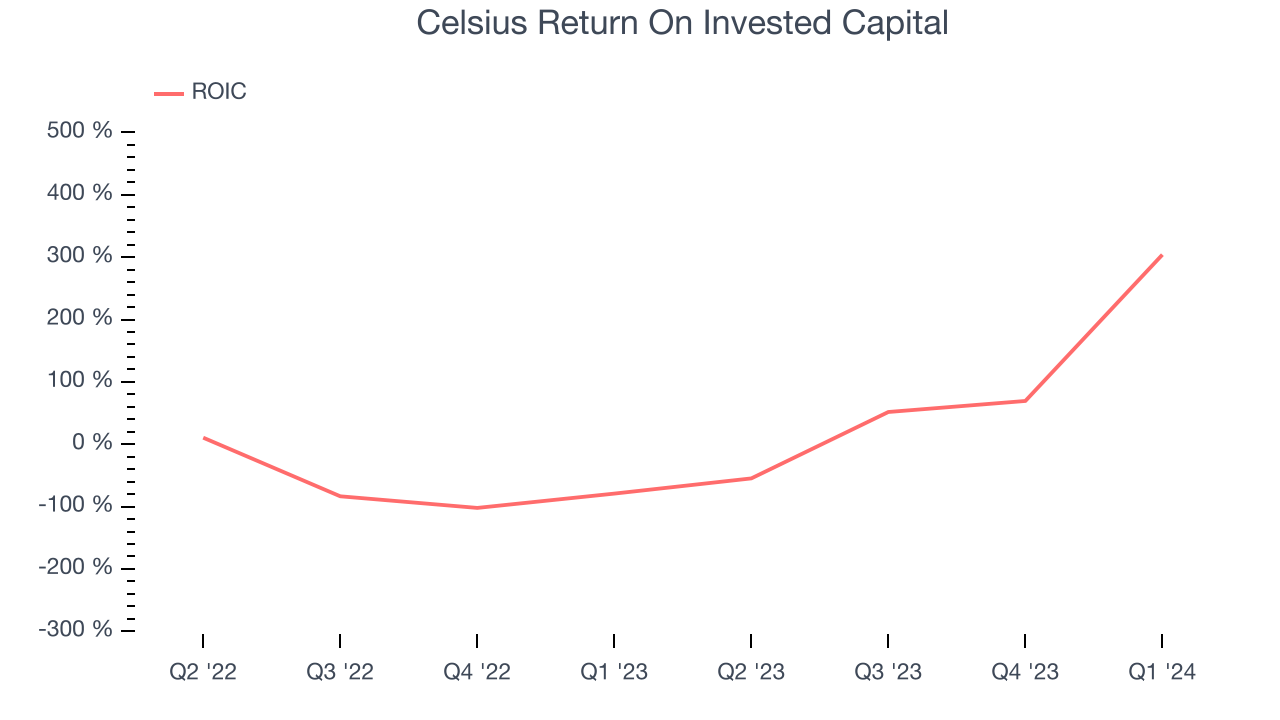

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Celsius's five-year average ROIC was negative 79.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Celsius is a well-capitalized company with $879.5 million of cash and no debt. This position gives Celsius the freedom to borrow money, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Celsius's Q1 Results

We were impressed by how significantly Celsius blew past analysts' adjusted EBITDA expectations this quarter. We were also excited its gross margin outperformed Wall Street's estimates. On the other hand, its revenue unfortunately missed analysts' expectations. Overall, we think there will be focus on the revenue miss since this is a stock where topline is a key part of the bull case. The stock is down 5.1% after reporting, trading at $74.32 per share.

Is Now The Time?

Celsius may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Celsius isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been exceptional over the last three years, its projected EPS for the next year is lacking. And while its EPS growth over the last three years has been fantastic, the downside is its relatively low ROIC suggests it has struggled to grow profits historically.

Celsius's price-to-earnings ratio based on the next 12 months is 64.6x. We can find things to like about Celsius and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $92.09 per share right before these results (compared to the current share price of $74.32).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.