Pet company Central Garden & Pet (NASDAQGS:CENT) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue flat year on year at $900.1 million. It made a non-GAAP profit of $0.99 per share, improving from its profit of $0.90 per share in the same quarter last year.

Central Garden & Pet (CENT) Q1 CY2024 Highlights:

- Revenue: $900.1 million vs analyst estimates of $887.5 million (1.4% beat)

- EPS (non-GAAP): $0.99 vs analyst estimates of $0.76 (29.4% beat)

- Gross Margin (GAAP): 31%, up from 28.6% in the same quarter last year

- Free Cash Flow was -$33.87 million compared to -$79.91 million in the previous quarter

- Organic Revenue was up 1% year on year

- Market Capitalization: $2.37 billion

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQGS:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

The company was founded in 1980 and has a plethora of brands under its belt. In its pet care division, it serves pets of all kinds through its comprehensive range of products, including pet food, treats, toys, accessories, and healthcare solutions.

Central Garden & Pet is also equally recognized for its pest control and lawn and garden care expertise, providing a wide array of products such as fertilizers, pesticides, grass seed, and gardening tools. These products empower homeowners and gardeners to maintain lush lawns, vibrant gardens, and pest-free outdoor spaces.

Each brand, whether it be Kaytee for pet care products or Amdro for pest control solutions, caters to a specific niche within the pet care and lawn and garden markets. Many brands often hold market-leading positions and are recognized for their quality.

While headquartered in the United States, Central Garden & Pet’s products are distributed internationally, serving customers around the world. To reach its customer base, the company utilizes an extensive distribution network. Products are available through a wide range of channels, including major retail chains, independent pet stores, garden centers, and online platforms.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Competitors in the pet care space include Hill's Science Diet (owned by Colgate-Palmolive, NYSE:CL) and private companies Mars Petcare, Nestlé Purina while pest control and lawn and garden competitors include Scotts Miracle-Gro (NYSE:SMG) and Spectrum Brands (NYSE:SPB) along with private company Terminix.Sales Growth

Central Garden & Pet is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

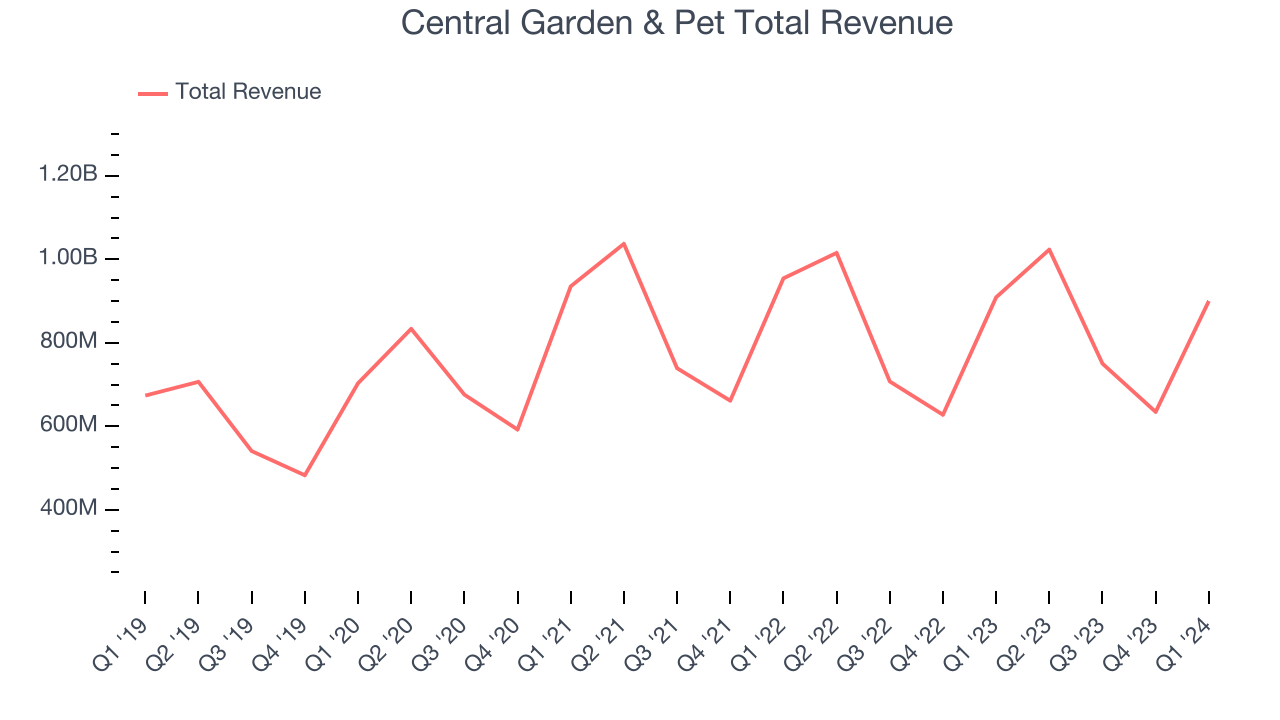

As you can see below, the company's annualized revenue growth rate of 2.9% over the last three years was weak for a consumer staples business.

This quarter, Central Garden & Pet's revenue fell 1% year on year to $900.1 million but beat Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Gross Margin & Pricing Power

All else equal, we prefer higher gross margins. They make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

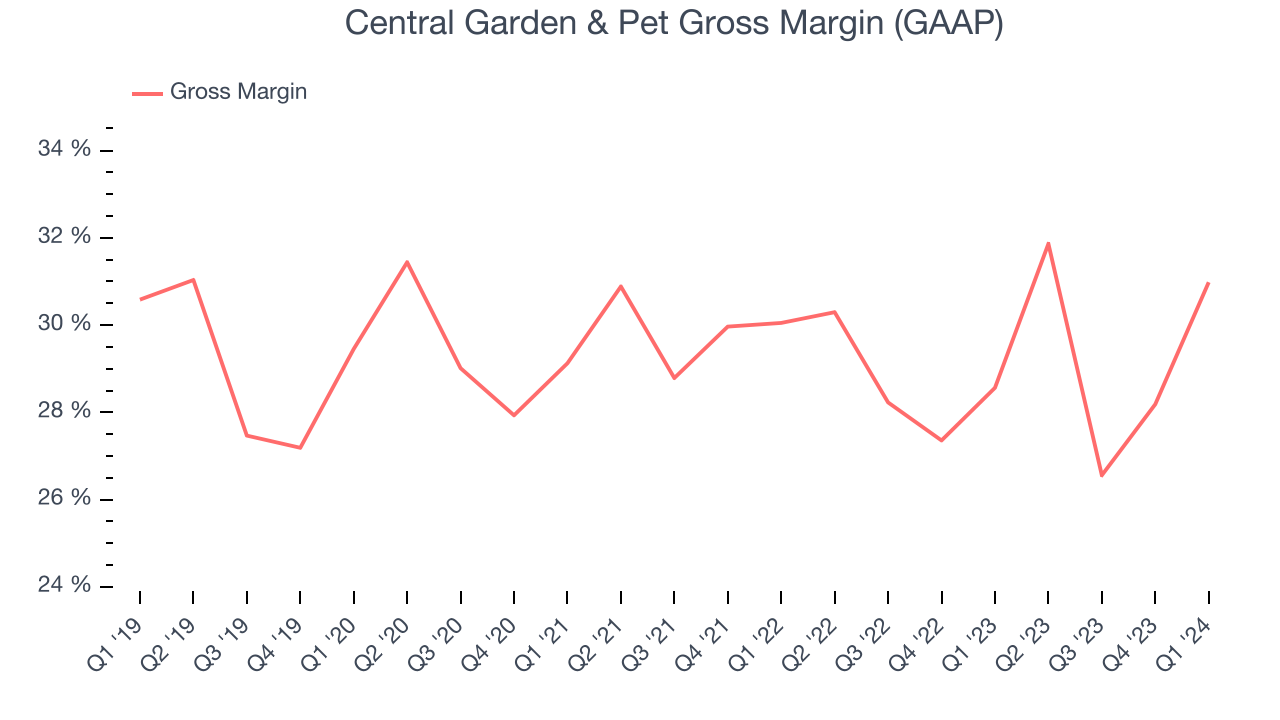

This quarter, Central Garden & Pet's gross profit margin was 31%, up 2.4 percentage points year on year. That means for every $1 in revenue, a chunky $0.69 went towards paying for raw materials, production of goods, and distribution expenses.

Central Garden & Pet has subpar unit economics for a consumer staples company, making it difficult to invest in areas such as marketing and talent to grow its brand. As you can see above, it's averaged a 29.3% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 2.7% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

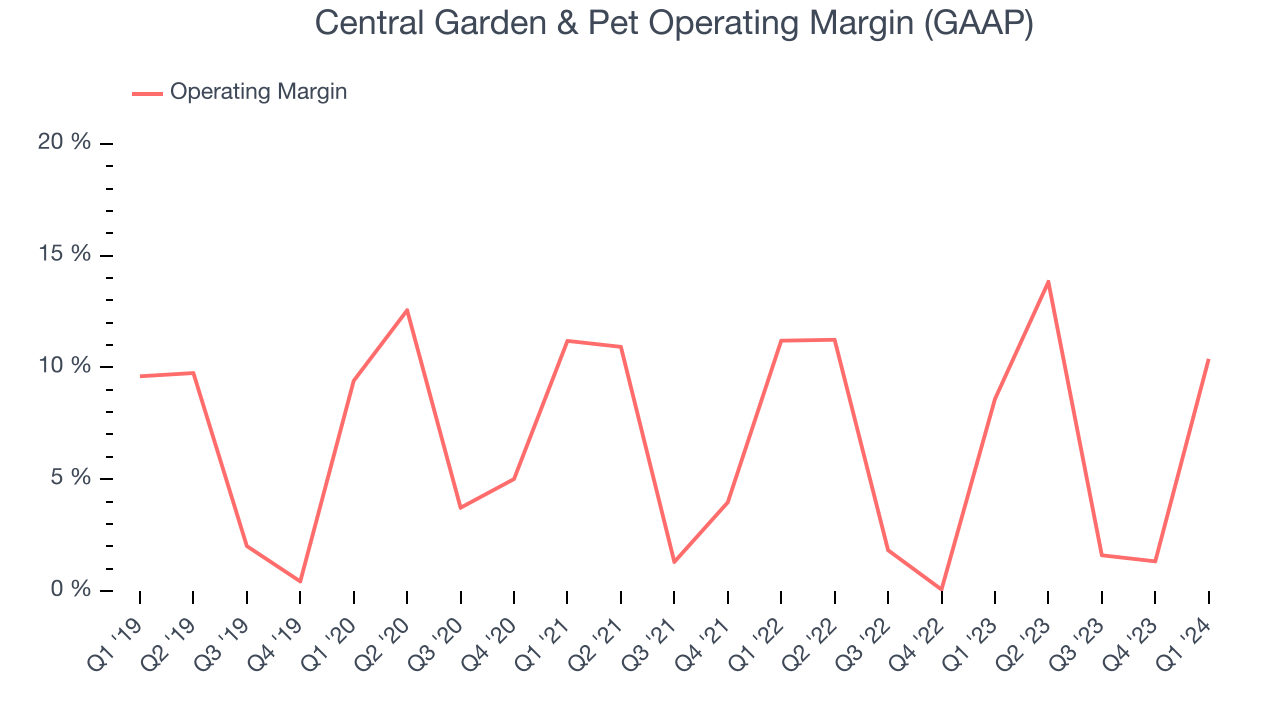

This quarter, Central Garden & Pet generated an operating profit margin of 10.4%, up 1.8 percentage points year on year. This increase was encouraging, and we can infer Central Garden & Pet had stronger pricing power and lower raw materials/transportation costs because its gross margin expanded more than its operating margin.

Zooming out, Central Garden & Pet was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer staples business, producing an average operating margin of 7%. However, Central Garden & Pet's margin has improved by 1.4 percentage points on average over the last year, showing the company is heading in the right direction.

Zooming out, Central Garden & Pet was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer staples business, producing an average operating margin of 7%. However, Central Garden & Pet's margin has improved by 1.4 percentage points on average over the last year, showing the company is heading in the right direction.EPS

Analyzing revenue trends tells us about a company's historical growth, but earnings per share (EPS) growth points to the profitability of that growth–for example, a company could inflate sales through excessive spending on advertising and promotions.

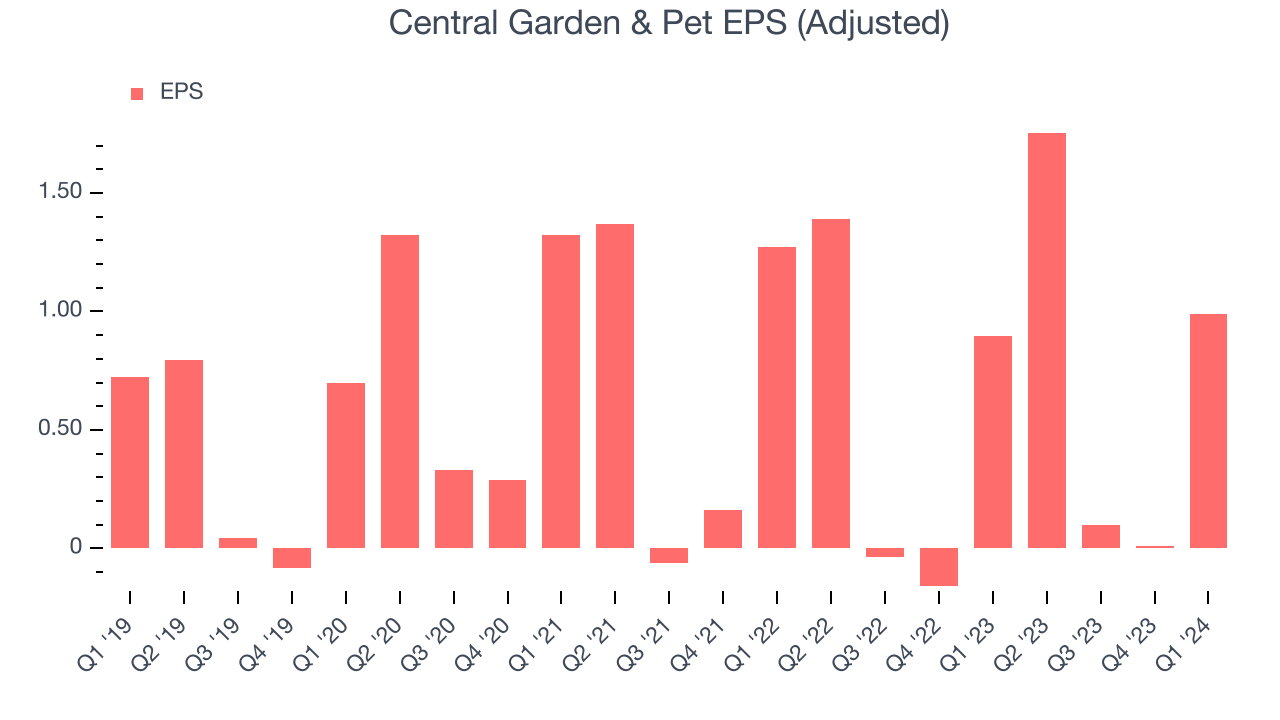

Sadly for Central Garden & Pet, its EPS declined by 4.4% annually over the last three years while its revenue grew by 2.9%.

We can take an even deeper look into Central Garden & Pet's earnings performance. A three-year view shows Central Garden & Pet has diluted its shareholders, growing its share count by 21.2%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

In Q1, Central Garden & Pet reported EPS at $0.99, up from $0.90 in the same quarter last year. This print beat analysts' estimates by 29.4%. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but there is insufficient data.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

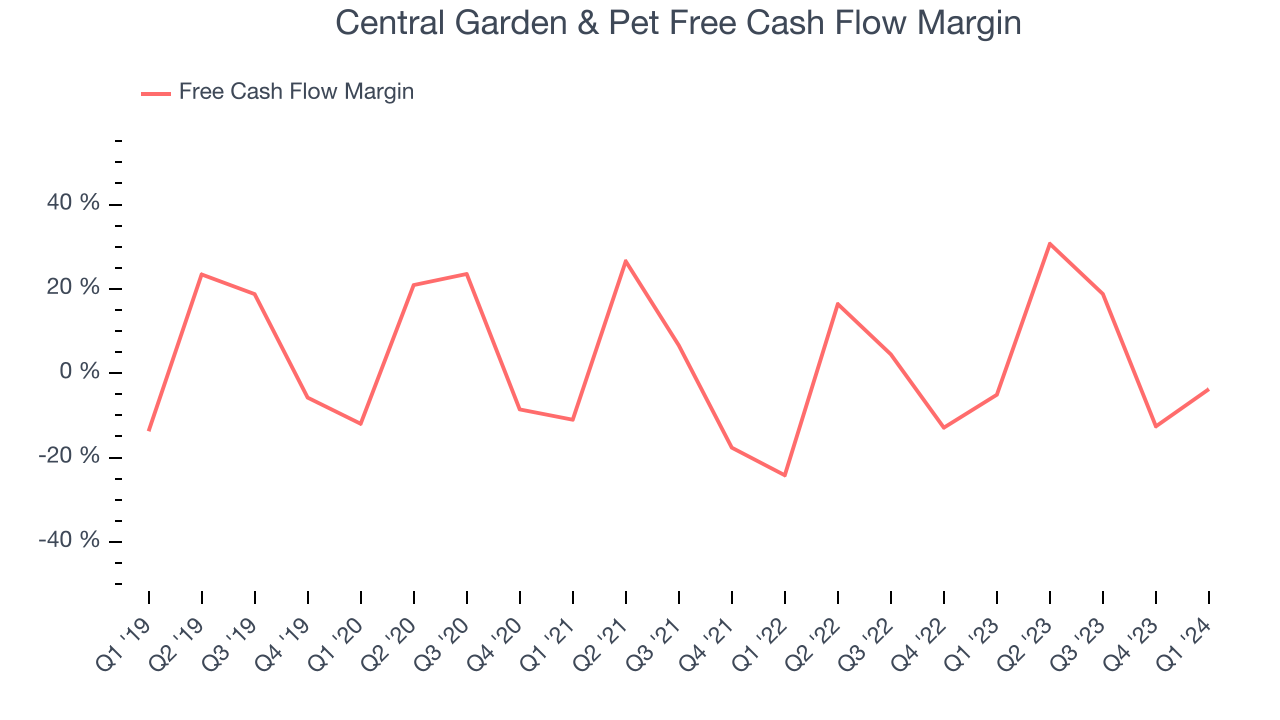

Central Garden & Pet burned through $33.87 million of cash in Q1, representing a negative 3.8% free cash flow margin. The company increased its cash burn by 26.8% year on year.

Over the last two years, Central Garden & Pet has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 6.3%, slightly better than the broader consumer staples sector. Furthermore, its margin has averaged year-on-year increases of 8.1 percentage points over the last 12 months. This likely pleases the company's investors.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money it has raised (debt and equity).

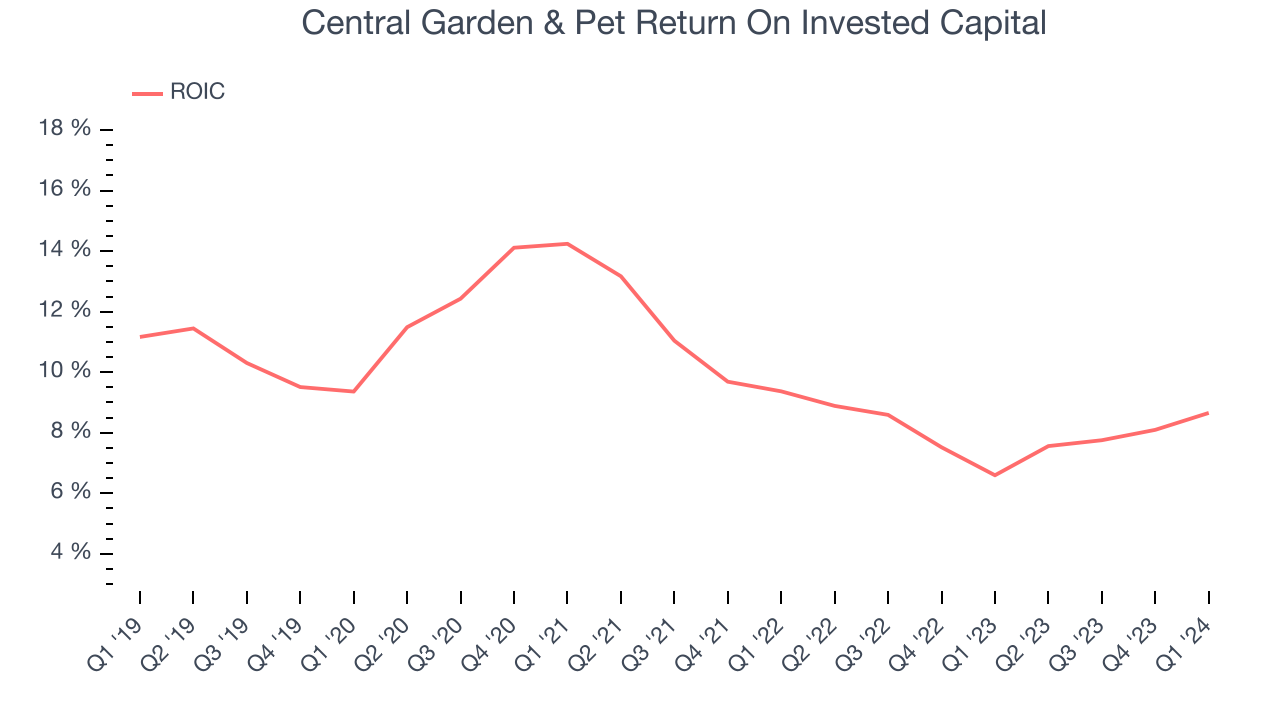

Central Garden & Pet's five-year average ROIC was 9.6%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it was mediocre at investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Central Garden & Pet's ROIC averaged 4.2 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Central Garden & Pet reported $301.3 million of cash and $1.38 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $367.9 million of EBITDA over the last 12 months, we view Central Garden & Pet's 2.9x net-debt-to-EBITDA ratio as safe. We also see its $14.7 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Central Garden & Pet's Q1 Results

We were impressed by how significantly Central Garden & Pet blew past analysts' organic revenue growth and EPS expectations this quarter. On the other hand, its full-year earnings forecast was underwhelming. Overall, we think this was decent quarter. The stock is up 1.1% after reporting and currently trades at $42.19 per share.

Is Now The Time?

Central Garden & Pet may have had a decent quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Central Garden & Pet, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last three years, and analysts expect growth to deteriorate from here. And while its solid free cash flow generation gives it re-investment options, the downside is its projected EPS for the next year is lacking. On top of that, its declining EPS over the last three years makes it hard to trust over the long term.

While we've no doubt one can find things to like about Central Garden & Pet, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $46.67 per share right before these results (compared to the current share price of $42.19).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.