Data infrastructure software company, Confluent (NASDAQ:CFLT) reported Q4 FY2023 results beating Wall Street analysts' expectations, with revenue up 26.4% year on year to $213.2 million. The company expects next quarter's revenue to be around $211.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.09 per share, improving from its loss of $0.09 per share in the same quarter last year.

Confluent (CFLT) Q4 FY2023 Highlights:

- Revenue: $213.2 million vs analyst estimates of $205.3 million (3.8% beat)

- EPS (non-GAAP): $0.09 vs analyst estimates of $0.05 ($0.04 beat)

- Revenue Guidance for Q1 2024 is $211.5 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2024 is $950 million at the midpoint, beating analyst estimates by 1.6% and implying 22.3% growth (vs 33.1% in FY2023)

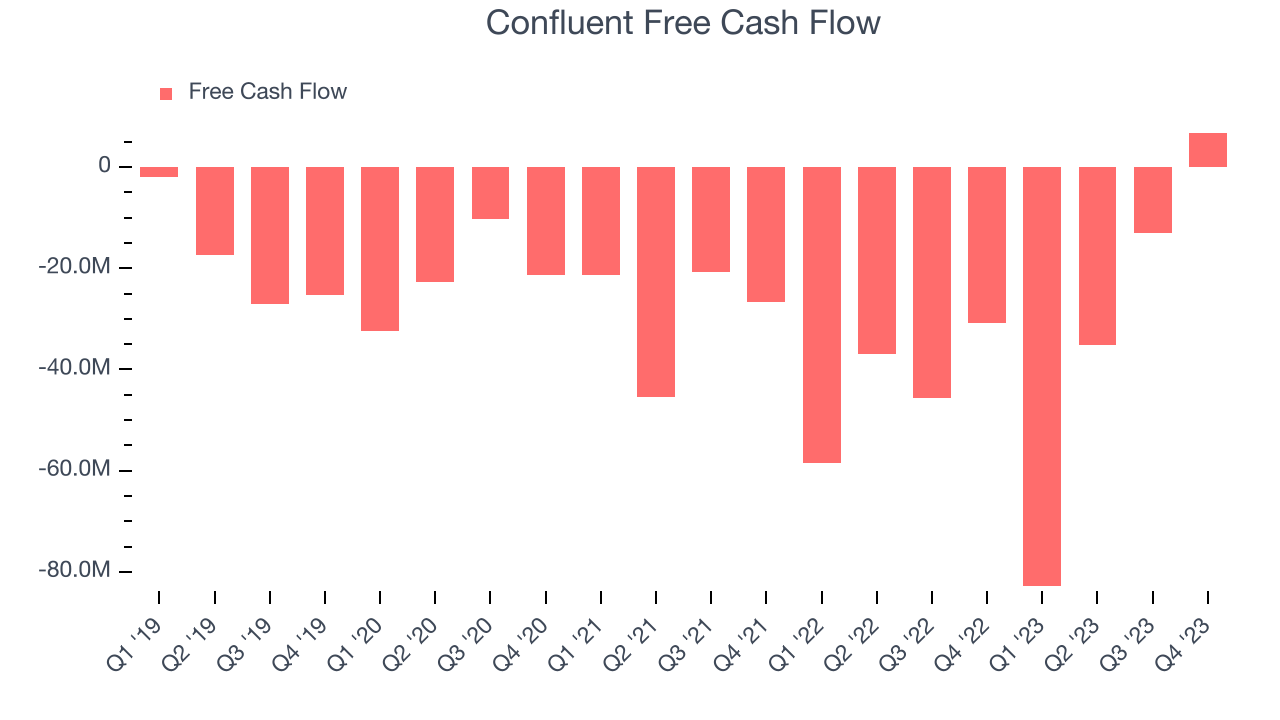

- Free Cash Flow of $6.82 million is up from -$13.08 million in the previous quarter

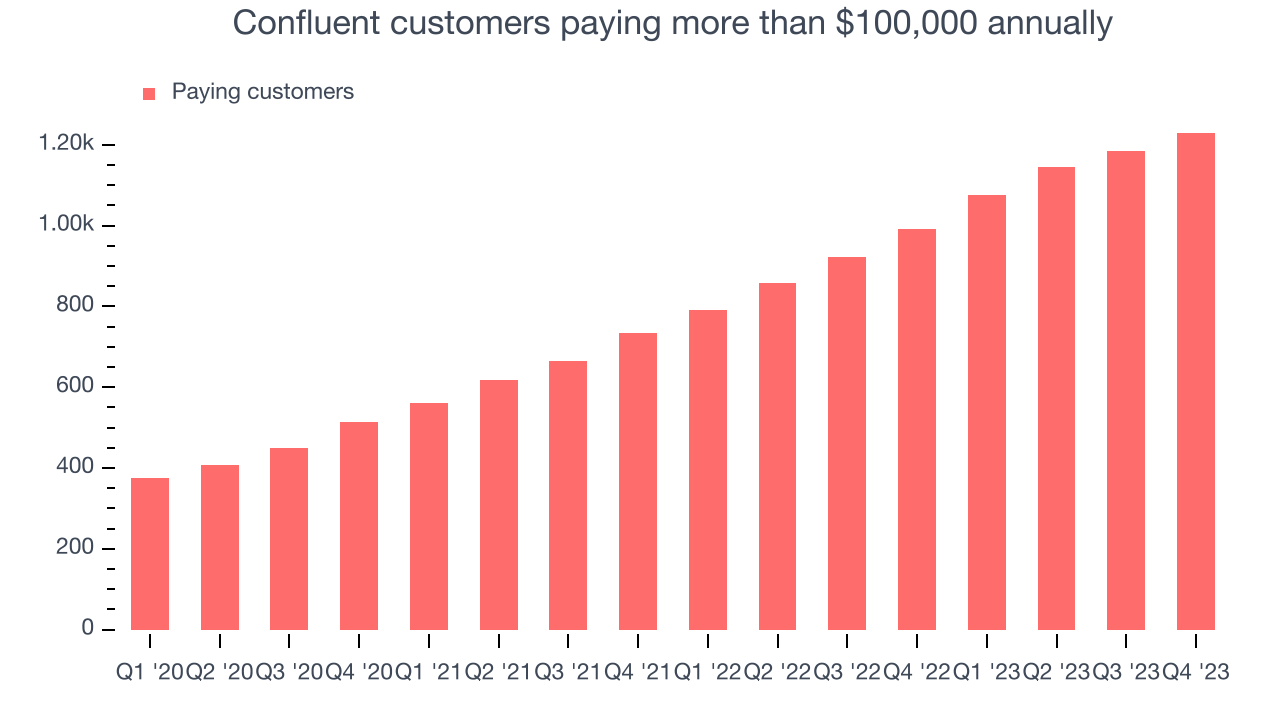

- Customers: 1,229 customers paying more than $100,000 annually

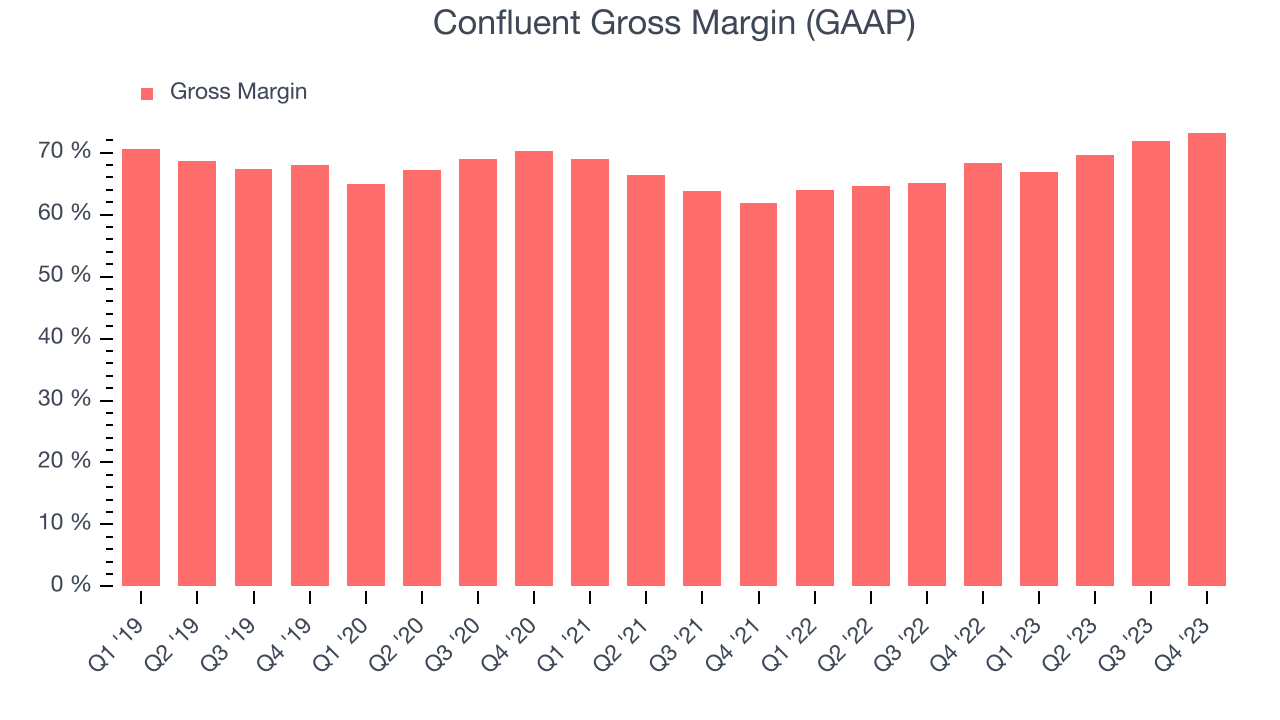

- Gross Margin (GAAP): 73.2%, up from 68.3% in the same quarter last year

- Market Capitalization: $7.23 billion

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ:CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

More and more data is being collected, a trend driven by both cheaper storage and more users, applications and systems being online. Most companies are capturing data about every single visit, click, input or a transaction made in their app or on their website, and some go even deeper. But as they accumulate more and more data, companies are confronted with the reality that gathering the data on its own isn’t really creating any value, and that it needs to be moved, processed and analyzed to be useful.

Confluent takes a massively popular open source data infrastructure software called Kafka, and provides it as a paid managed service. Kafka acts as a central transportation hub for the data, ingesting it from different sources (websites, mobile apps) and distributing it to all of the destinations it needs to get to (like analytical tools, databases, billing systems). The advantage of Kafka is that it moves the data in real time, which is becoming increasingly important, but is complex to implement and maintain which is where Confluent sees their opportunity.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Competitors in the data management space include Snowflake (NYSE:SNOW) as well as the services provided by cloud vendors such as Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google Cloud (owned by Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG)). Confluent also competes with the self-managed, free version of Apache Kafka, the open-source software from which it was derived.

Sales Growth

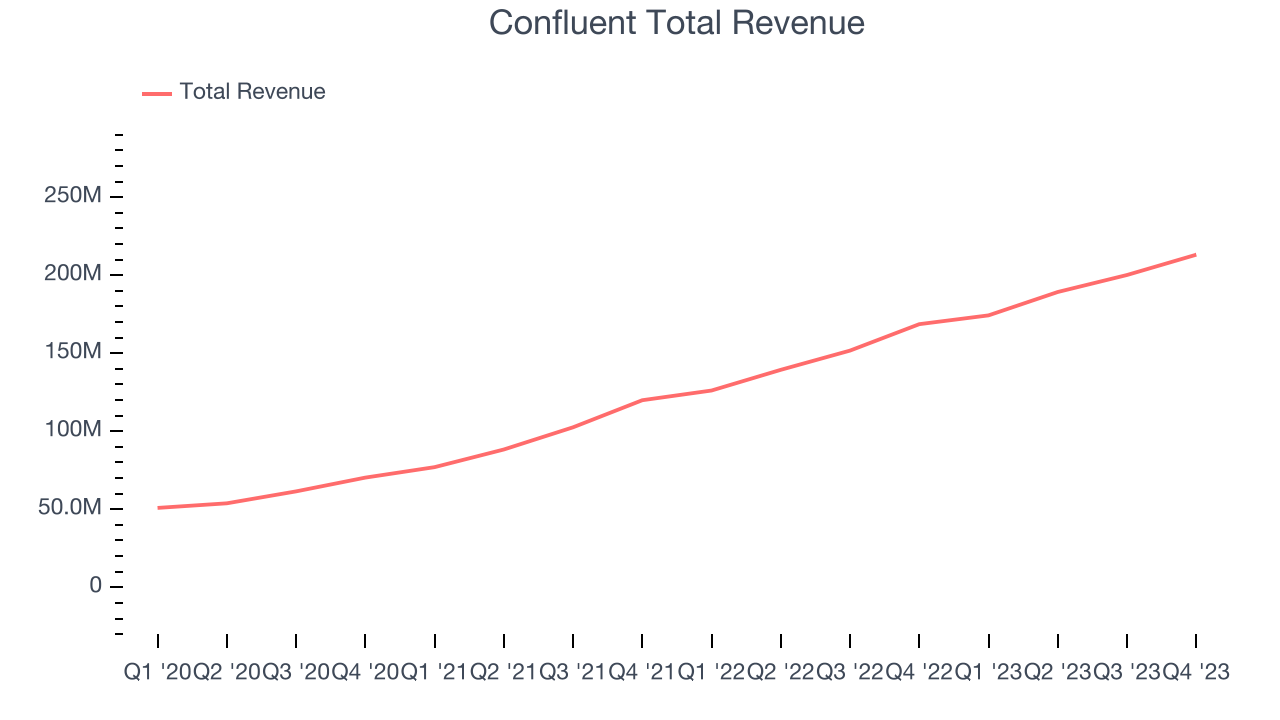

As you can see below, Confluent's revenue growth has been impressive over the last two years, growing from $119.9 million in Q4 FY2021 to $213.2 million this quarter.

This quarter, Confluent's quarterly revenue was once again up a very solid 26.4% year on year. On top of that, its revenue increased $13 million quarter on quarter, a solid improvement from the $10.9 million increase in Q3 2023. Thankfully, that's a slight acceleration of growth.

Next quarter's guidance suggests that Confluent is expecting revenue to grow 21.3% year on year to $211.5 million, slowing down from the 38.2% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $950 million at the midpoint, growing 22.3% year on year compared to the 32.6% increase in FY2023.

Large Customers Growth

This quarter, Confluent reported 1,229 enterprise customers paying more than $100,000 annually, an increase of 44 from the previous quarter. That's in line with the number of contracts wins in the last quarter but quite a bit below what we've typically observed over the last year, suggesting that the sales slowdown we observed in the last quarter could continue.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Confluent's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 73.2% in Q4.

That means that for every $1 in revenue the company had $0.73 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Confluent's gross margin is around the average of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Confluent's free cash flow came in at $6.82 million in Q4, turning positive for the first time.

Confluent has burned through $124.3 million of cash over the last 12 months, resulting in a negative 17.4% free cash flow margin. This low FCF margin stems from Confluent's poor unit economics or a constant need to reinvest in its business to stay competitive.

Key Takeaways from Confluent's Q4 Results

It was good to see Confluent beat analysts' revenue expectations this quarter and turn free cash flow positive for the first time. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. Revenue guidance for next year suggests a slowdown in growth but that was mostly expected. Zooming out, we think this was still a very good quarter, showing that the company is staying on track. The stock is up 13.7% after reporting and currently trades at $27.65 per share.

Is Now The Time?

When considering an investment in Confluent, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Confluent, we'll be cheering from the sidelines. Although its revenue growth has been impressive over the last two years, Wall Street expects growth to deteriorate from here. On top of that, its customer acquisition is less efficient than many comparable companies and its growth is coming at a cost of significant cash burn.

Given its price-to-sales ratio based on the next 12 months is 8.0x, Confluent is priced with expectations of a long-term growth, and there's no doubt it's a bit of a market darling, at least for some. While we have no doubt one can find things to like about the company, we think there might be better opportunities in the market and at the moment don't see many reasons to get involved.

Wall Street analysts covering the company had a one-year price target of $26.65 per share right before these results (compared to the current share price of $27.65), implying they didn't see much short-term potential in the Confluent.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.