Data infrastructure software company, Confluent (NASDAQ:CFLT) announced better-than-expected results in Q1 CY2024, with revenue up 24.6% year on year to $217.2 million. The company expects next quarter's revenue to be around $229.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.05 per share, improving from its loss of $0.09 per share in the same quarter last year.

Confluent (CFLT) Q1 CY2024 Highlights:

- Revenue: $217.2 million vs analyst estimates of $211.8 million (2.5% beat)

- EPS (non-GAAP): $0.05 vs analyst estimates of $0.02 ($0.03 beat)

- Revenue Guidance for Q2 CY2024 is $229.5 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $957 million at the midpoint

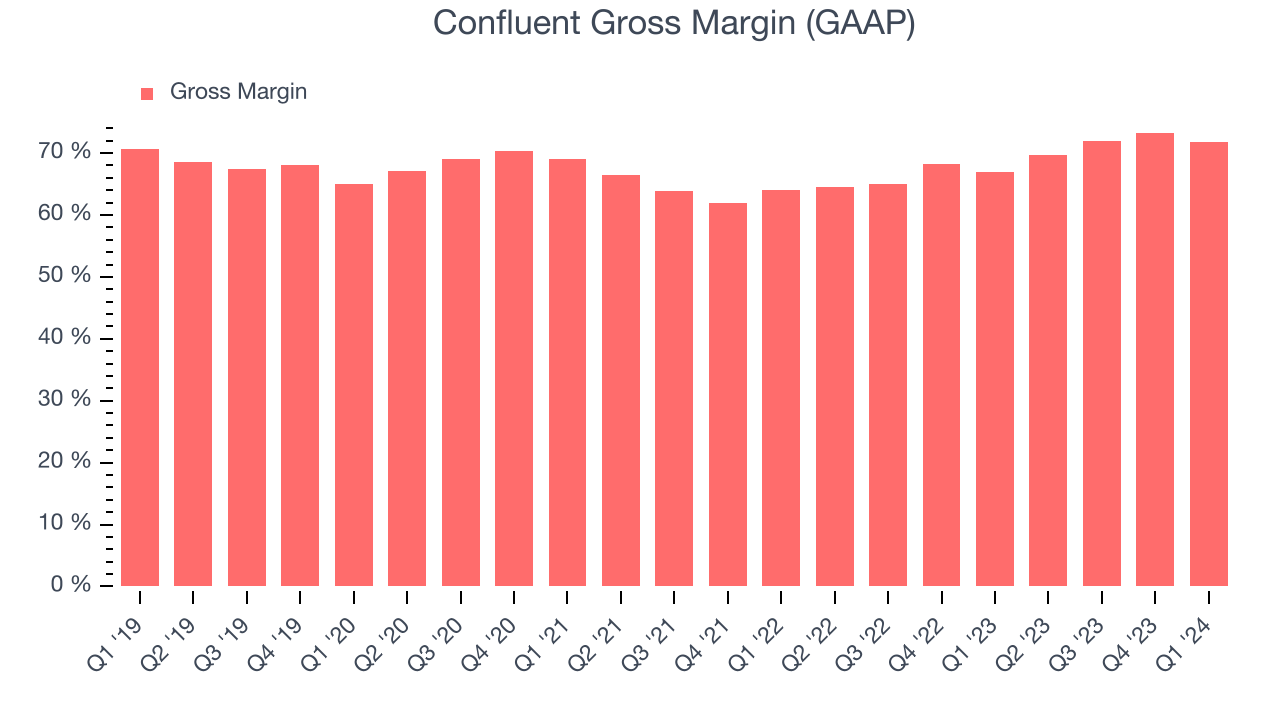

- Gross Margin (GAAP): 71.8%, up from 66.9% in the same quarter last year

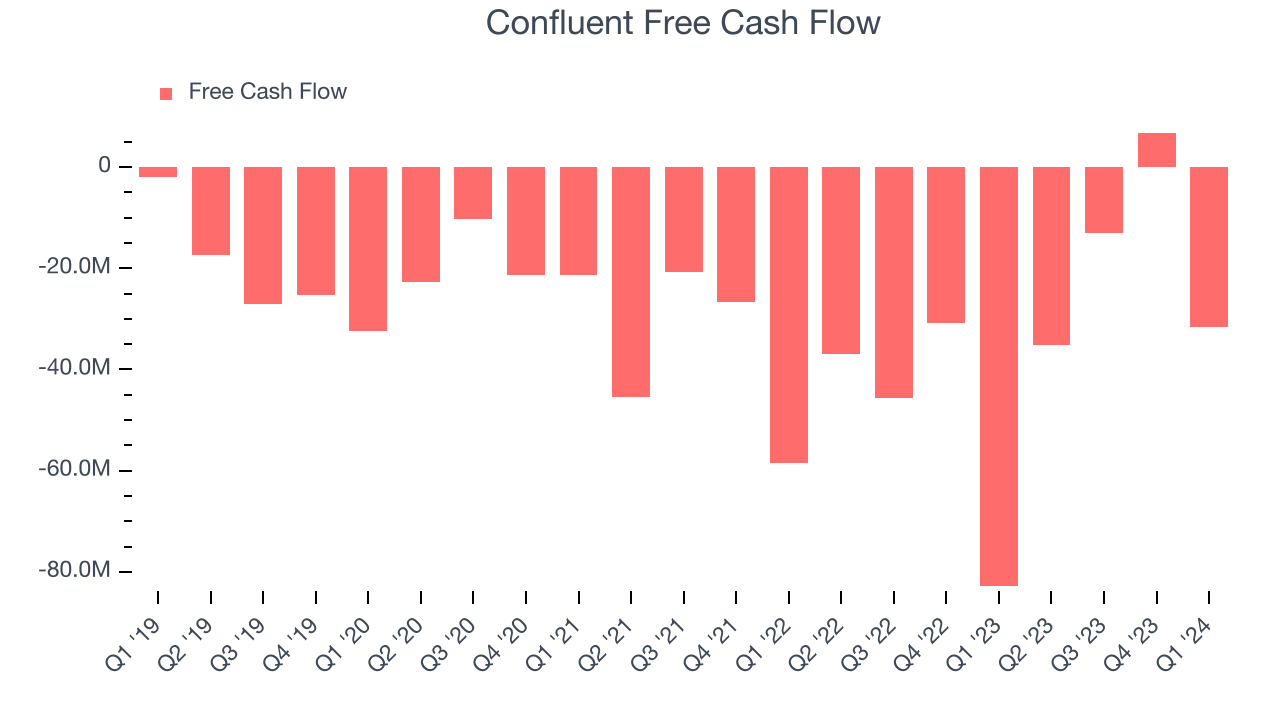

- Free Cash Flow was -$31.68 million, down from $6.82 million in the previous quarter

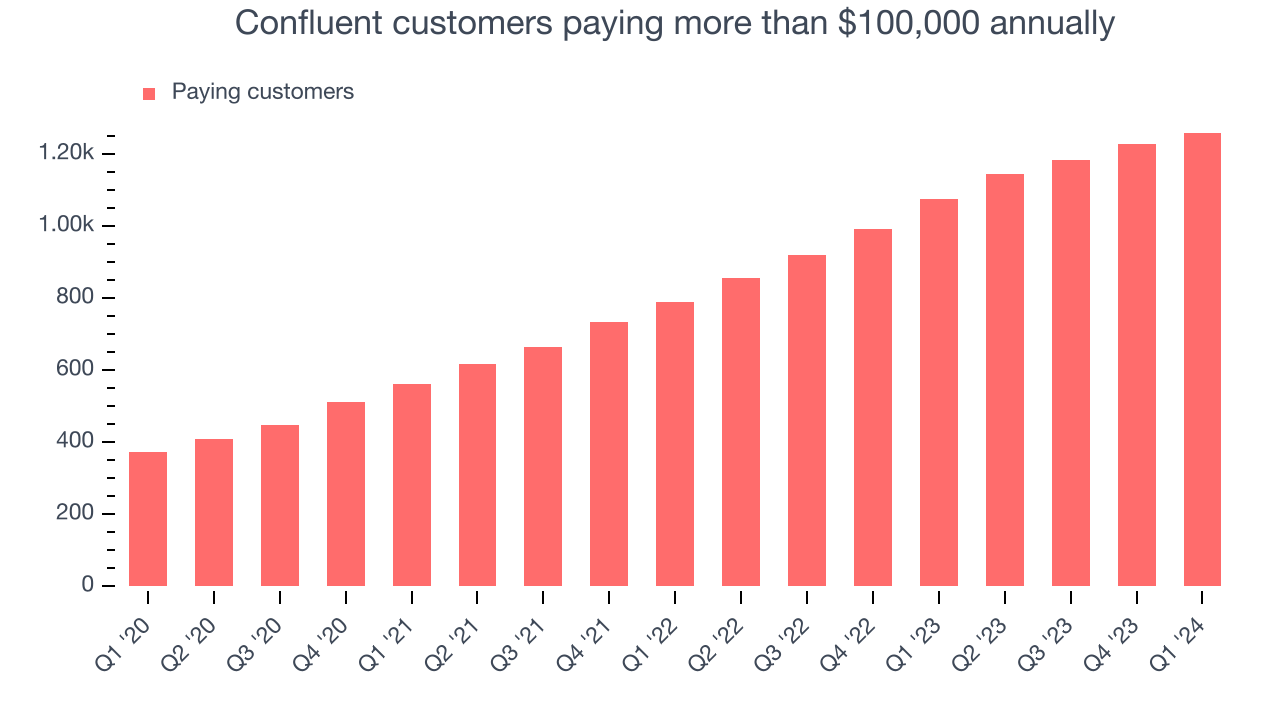

- Customers: 1,260 customers paying more than $100,000 annually

- Market Capitalization: $9.09 billion

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ:CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

More and more data is being collected, a trend driven by both cheaper storage and more users, applications and systems being online. Most companies are capturing data about every single visit, click, input or a transaction made in their app or on their website, and some go even deeper. But as they accumulate more and more data, companies are confronted with the reality that gathering the data on its own isn’t really creating any value, and that it needs to be moved, processed and analyzed to be useful.

Confluent takes a massively popular open source data infrastructure software called Kafka, and provides it as a paid managed service. Kafka acts as a central transportation hub for the data, ingesting it from different sources (websites, mobile apps) and distributing it to all of the destinations it needs to get to (like analytical tools, databases, billing systems). The advantage of Kafka is that it moves the data in real time, which is becoming increasingly important, but is complex to implement and maintain which is where Confluent sees their opportunity.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Competitors in the data management space include Snowflake (NYSE:SNOW) as well as the services provided by cloud vendors such as Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google Cloud (owned by Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG)). Confluent also competes with the self-managed, free version of Apache Kafka, the open-source software from which it was derived.

Sales Growth

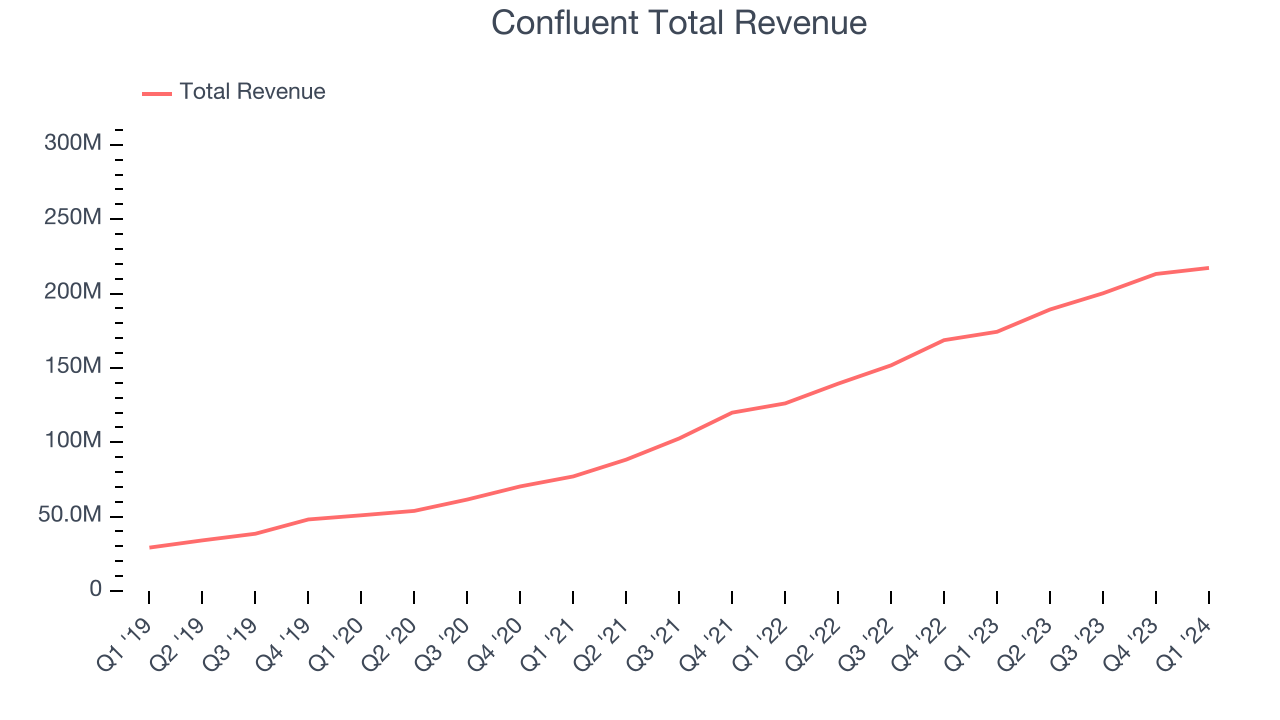

As you can see below, Confluent's revenue growth has been impressive over the last three years, growing from $77.03 million in Q1 2021 to $217.2 million this quarter.

This quarter, Confluent's quarterly revenue was once again up a very solid 24.6% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $4.05 million in Q1 compared to $13 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Confluent is expecting revenue to grow 21.2% year on year to $229.5 million, slowing down from the 35.8% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 22.6% over the next 12 months before the earnings results announcement.

Large Customers Growth

This quarter, Confluent reported 1,260 enterprise customers paying more than $100,000 annually, an increase of 31 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Confluent's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 71.8% in Q1.

That means that for every $1 in revenue the company had $0.72 left to spend on developing new products, sales and marketing, and general administrative overhead. Confluent's gross margin is lower than that of a typical SaaS businesses and its decline over the last year is putting it in an even deeper hole. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Confluent burned through $31.68 million of cash in Q1 , increasing its cash burn by 61.8% year on year.

Confluent has burned through $73.14 million of cash over the last 12 months, resulting in a negative 8.9% free cash flow margin. This low FCF margin stems from Confluent's constant need to reinvest in its business to stay competitive.

Key Takeaways from Confluent's Q1 Results

It was good to see Confluent beat analysts' revenue and EPS expectations this quarter. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. Overall, this was a solid quarter for Confluent. The stock is up 8.1% after reporting and currently trades at $30.1 per share.

Is Now The Time?

When considering an investment in Confluent, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We think Confluent is a good business. We'd expect growth rates to moderate from here, but its revenue growth has been exceptional over the last three years. And while its growth is coming at the cost of significant cash burn, the good news is its customers are increasing their spending quite quickly, suggesting they love the product. On top of that, its strong gross margins suggest it can operate profitably and sustainably.

Given its price-to-sales ratio of 8.7x based on the next 12 months, the market is certainly expecting long-term growth from Confluent. There are definitely a lot of things to like about Confluent, and looking at the tech landscape right now, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $34.01 right before these results (compared to the current share price of $30.10), implying they see short-term upside potential in Confluent.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.