Cable, internet, and telephone services provider Charter (NASDAQ:CHTR) reported results in line with analysts' expectations in Q1 CY2024, with revenue flat year on year at $13.68 billion. It made a GAAP profit of $7.55 per share, improving from its profit of $6.65 per share in the same quarter last year.

Is now the time to buy Charter? Find out by accessing our full research report, it's free.

Charter (CHTR) Q1 CY2024 Highlights:

- Revenue: $13.68 billion vs analyst estimates of $13.74 billion (small miss)

- Adjusted EBITDA: $5.50 billion vs analyst estimates of $5.46 billion (small beat)

- EPS: $7.55 vs analyst expectations of $7.74 (2.5% miss)

- Gross Margin (GAAP): 38.6%, up from 37.7% in the same quarter last year

- Free Cash Flow of $358 million, down 66.3% from the previous quarter (big miss vs. expectations of $609 million)

- Internet Subscribers: 28,472

- Market Capitalization: $37.41 billion

"Our differentiated converged connectivity products provide us with significant competitive advantages that position Charter for sustainable customer and financial growth," said Chris Winfrey, President and CEO of Charter.

Operating as Spectrum, Charter (NASDAQ:CHTR) is a leading telecommunications company offering cable television, high-speed internet, and voice services across the United States.

Cable and Satellite

The massive physical footprints of fiber in the ground or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their traditional cable subscriptions in favor of streaming options. While that is a headwind, this affinity to streaming means more households need high-speed internet, and companies that successfully serve customers can enjoy high retention rates and pricing power since the options for internet connectivity in any geography is usually limited.

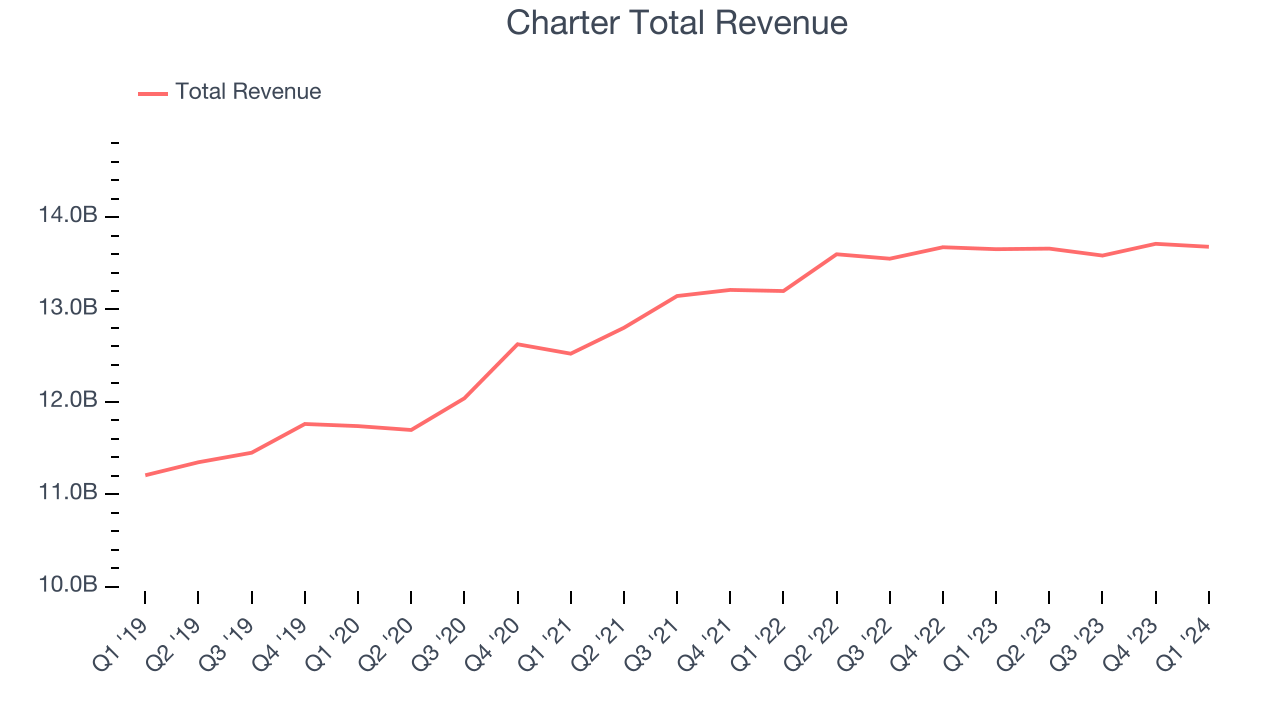

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Charter's annualized revenue growth rate of 4.3% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Charter's recent history shows the business has slowed as its annualized revenue growth of 2.1% over the last two years is below its five-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Charter's recent history shows the business has slowed as its annualized revenue growth of 2.1% over the last two years is below its five-year trend.

This quarter, Charter's $13.68 billion of revenue was flat year on year and in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

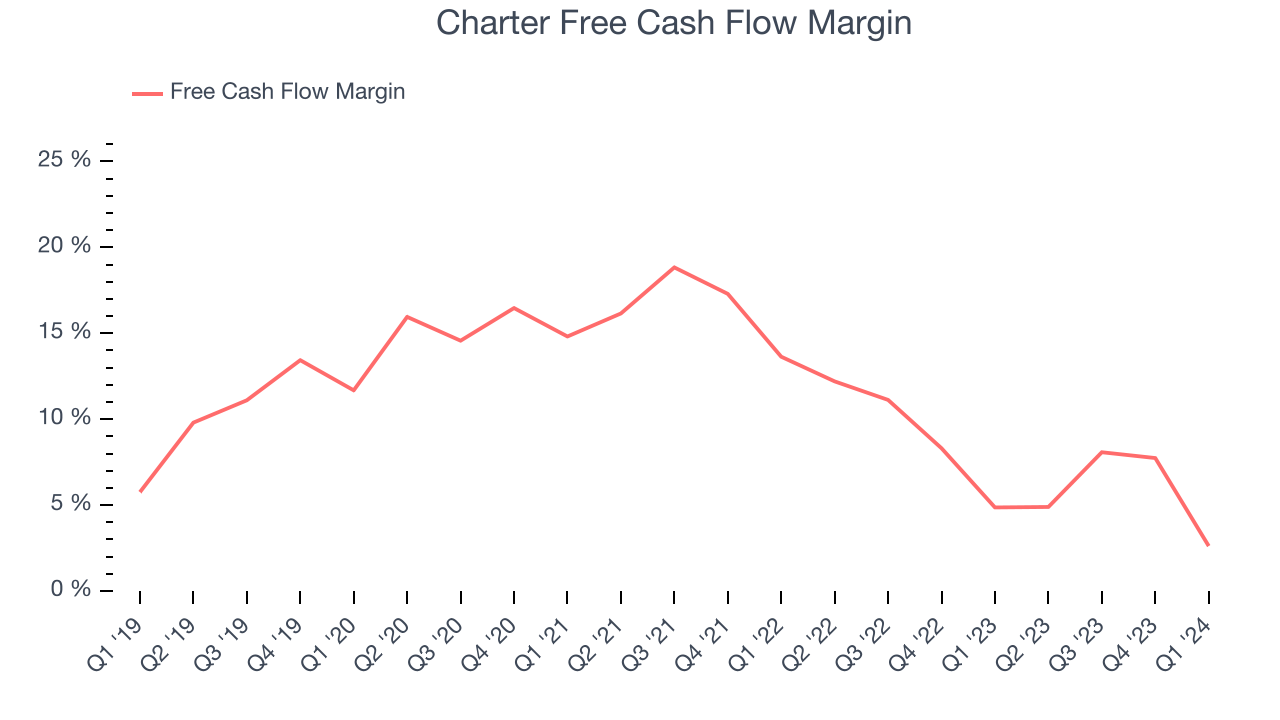

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Charter has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 7.5%, subpar for a consumer discretionary business.

Charter's free cash flow came in at $358 million in Q1, equivalent to a 2.6% margin and down 46.1% year on year.

Key Takeaways from Charter's Q1 Results

It wasn't a great quarter. Charter's revenue, EPS, and free cash flow all fell short of Wall Street's estimates. Internet subscribers were roughly in line, video subscribers missed, and adjusted EBITDA was in line. Overall, the results could have been better. The company is down 2.6% on the results and currently trades at $252.65 per share.

So should you invest in Charter right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.