Casual restaurant chain Chuy’s (NASDAQ:CHUY) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 11.8% year on year to $116.3 million. It made a non-GAAP profit of $0.45 per share, improving from its profit of $0.27 per share in the same quarter last year.

Chuy's (CHUY) Q4 FY2023 Highlights:

- Revenue: $116.3 million vs analyst estimates of $116.6 million (small miss)

- EPS (non-GAAP): $0.45 vs analyst estimates of $0.38 (18.1% beat)

- EPS (non-GAAP) guidance for 2024: $1.85 at the midpoint vs analyst estimates of $1.93 (4.4% miss)

- Gross Margin (GAAP): 21.4%, up from 18.4% in the same quarter last year

- Same-Store Sales were up 0.3% year on year (miss vs. expectations of up 0.7% year on year)

- Store Locations: 101 at quarter end, increasing by 3 over the last 12 months

- Market Capitalization: $580.3 million

Known for its ‘Big As Yo' Face’ burritos, Chuy’s (NASDAQ:CHUY) is a casual restaurant chain that specializes in Tex-Mex fare, which combines elements of traditional Mexican cuisine with Southern American cooking.

Chuy’s opened on April 16, 1982 in an old, abandoned Texas Barbeque joint in Austin, Texas. Founders Mike Young and John Zapp had a vision of a fun and funky Tex-Mex restaurant that served authentic and fresh food in a fun atmosphere.

In addition to the signature burritos, Chuy’s offers other Tex-Mex favorites such as nachos, tacos, and fajitas. While the dishes may vary, a unifying theme at every Chuy’s is the commitment to freshness. This is evidenced by the fact that no location has a microwave or freezer. This means everything you order on has been made that very day.

The core Chuy’s customer is diverse: families, professionals, and students. What unifies these customers is their affinity for hearty Tex-Mex in a vibrant atmosphere and at reasonable prices. A typical Chuy's location is eclectic, with vibrant colors, vintage photographs, and quirky Tex-Mex art. It is sometimes loud and celebratory when it’s a full house, so this is no stuffy high end restaurant.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Competitors offering Mexican or Southern-inspired fare include Chipotle (NYSE:CMG), El Pollo Loco (NASDAQ:LOCO),Texas Roadhouse (NASDAQ:TXRH), and private company Qdoba.Sales Growth

Chuy's is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

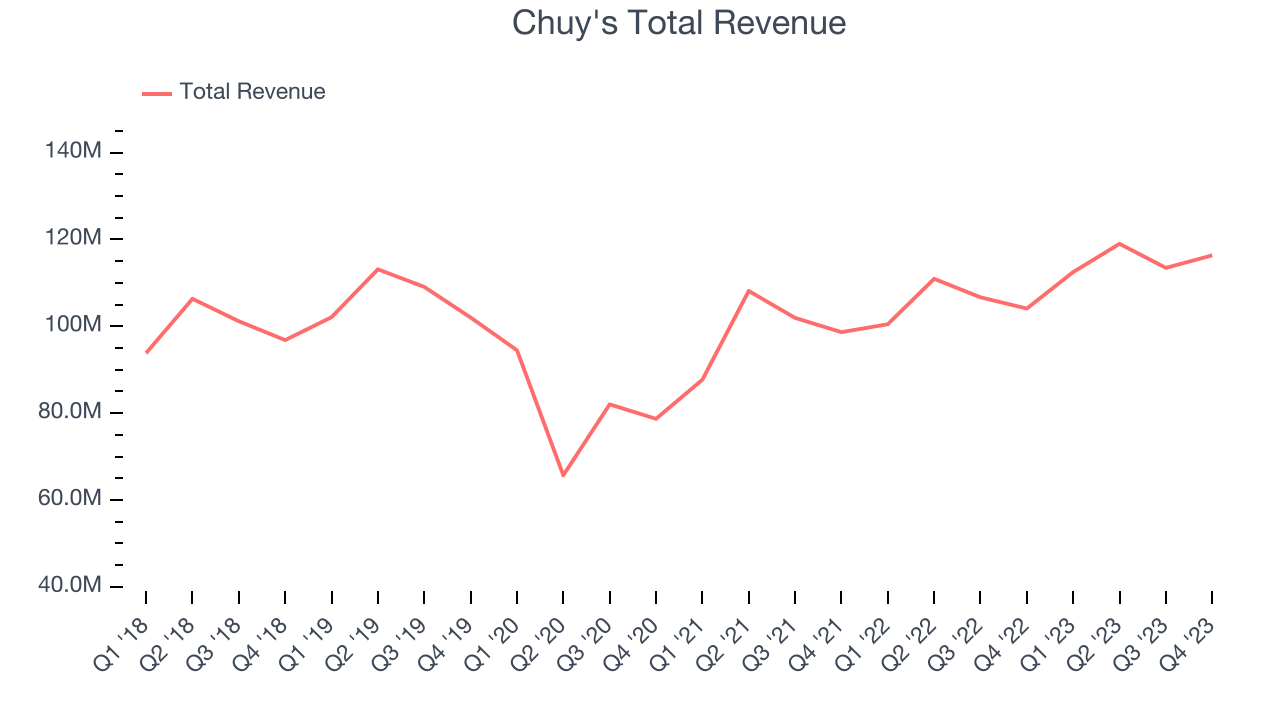

As you can see below, the company's annualized revenue growth rate of 2% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Chuy's revenue grew 11.8% year on year to $116.3 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 4.3% over the next 12 months, a deceleration from this quarter.

Number of Stores

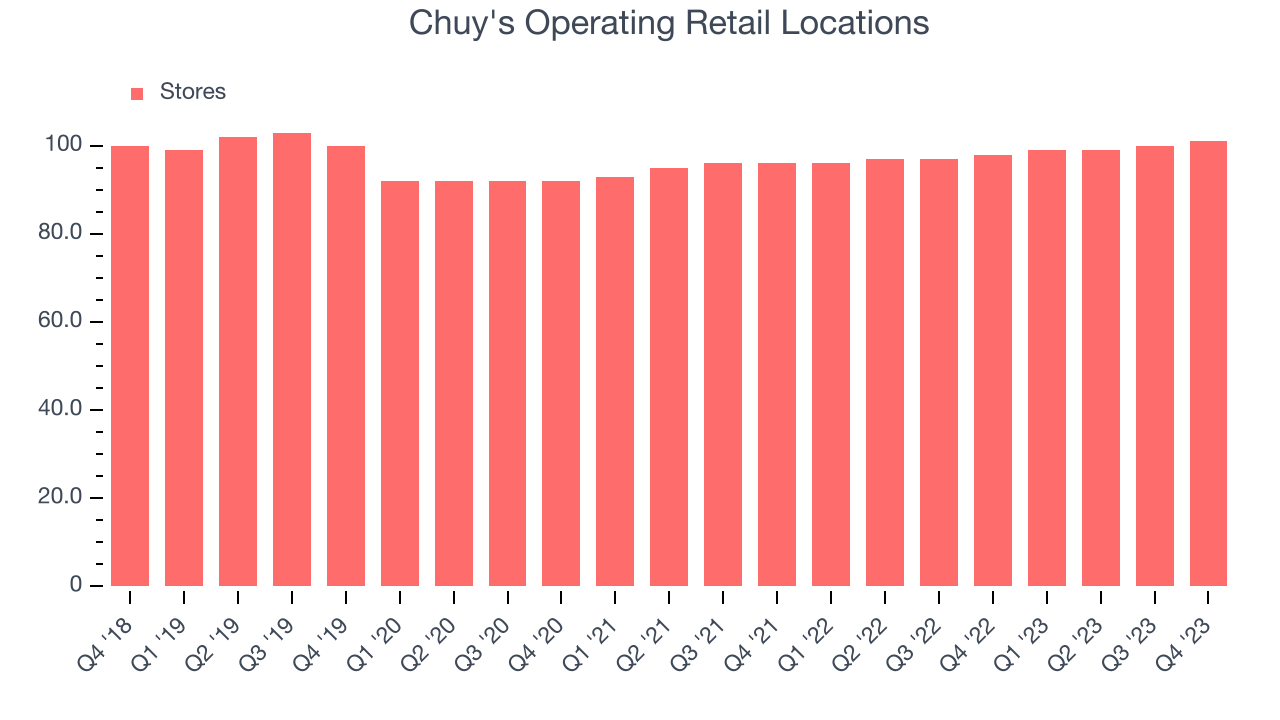

When a chain like Chuy's is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Since last year, Chuy's restaurant count increased by 3, or 3.1%, to 101 locations in the most recently reported quarter.

Over the last two years, Chuy's has opened new restaurants and averaged 2.5% annual growth in new locations, higher than other restaurant businesses. Comparisons, however, should be taken with a grain of salt as the industry is quite mature. Analyzing a restaurant's location growth is important because expansion means Chuy's has more opportunities to feed customers and generate sales.

Same-Store Sales

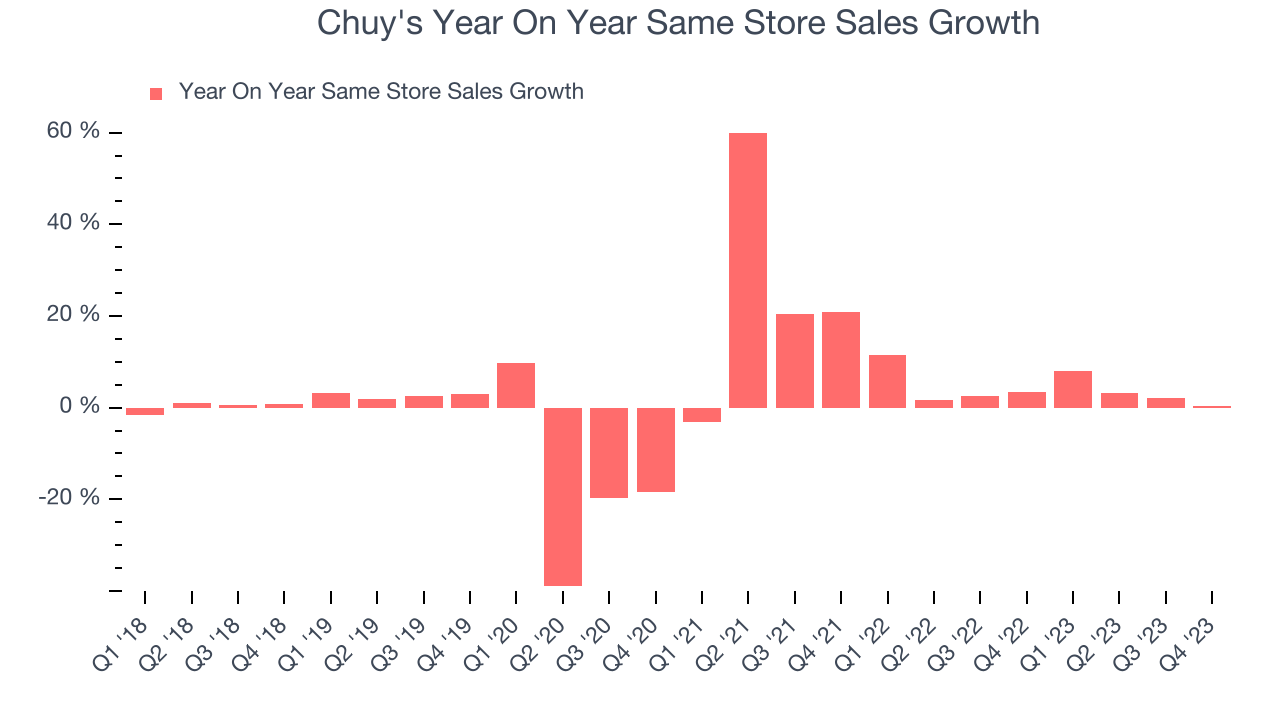

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

Chuy's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 4.1% year on year. With positive same-store sales growth amid an increasing number of restaurants, Chuy's is reaching more diners and growing sales.

In the latest quarter, Chuy's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 3.4% year-on-year increase it posted 12 months ago. We'll be watching Chuy's closely to see if it can reaccelerate growth.

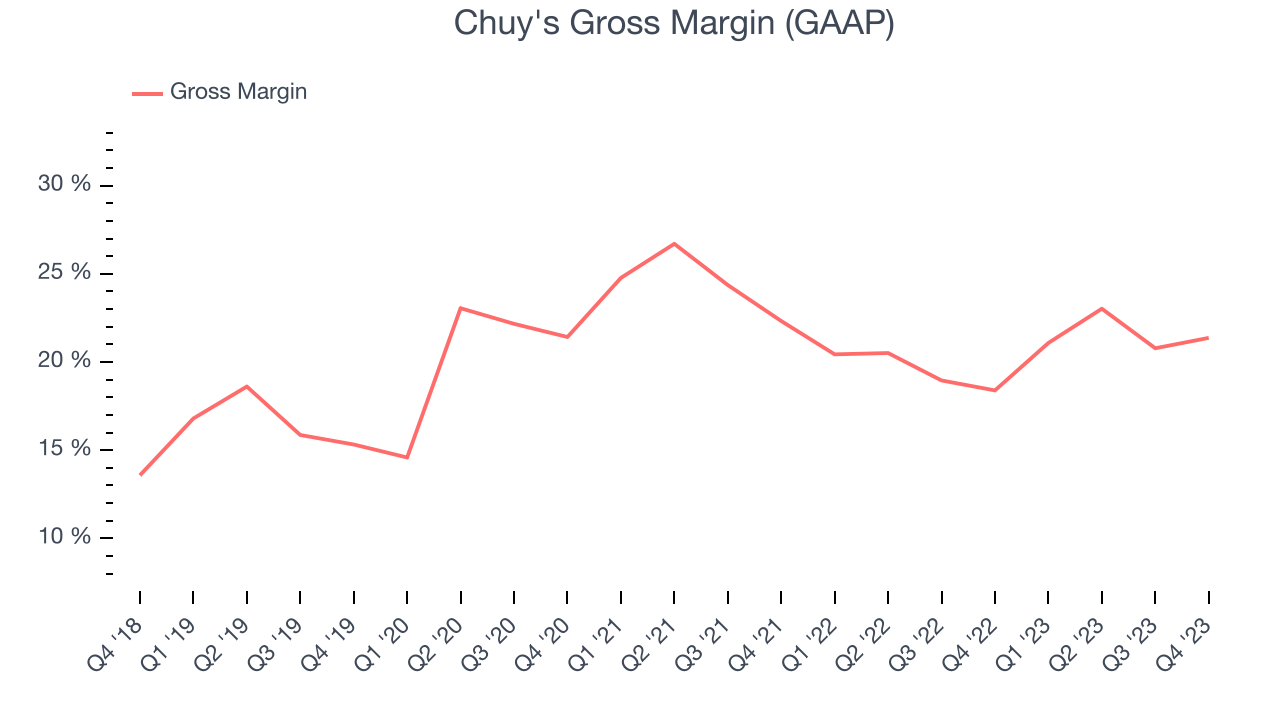

Gross Margin & Pricing Power

Gross profit margins tell us how much money a restaurant gets to keep after paying for the direct costs of the meals it sells.

In Q4, Chuy's gross profit margin was 21.4%. up 3 percentage points year on year. This means the company makes $0.21 for every $1 in revenue before accounting for its operating expenses.

Chuy's has weak unit economics for a restaurant company, making it difficult to reinvest in the business. As you can see above, it's averaged a 20.6% gross margin over the last eight quarters. Its margin, however, has been trending up over the last 12 months, averaging 10.3% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

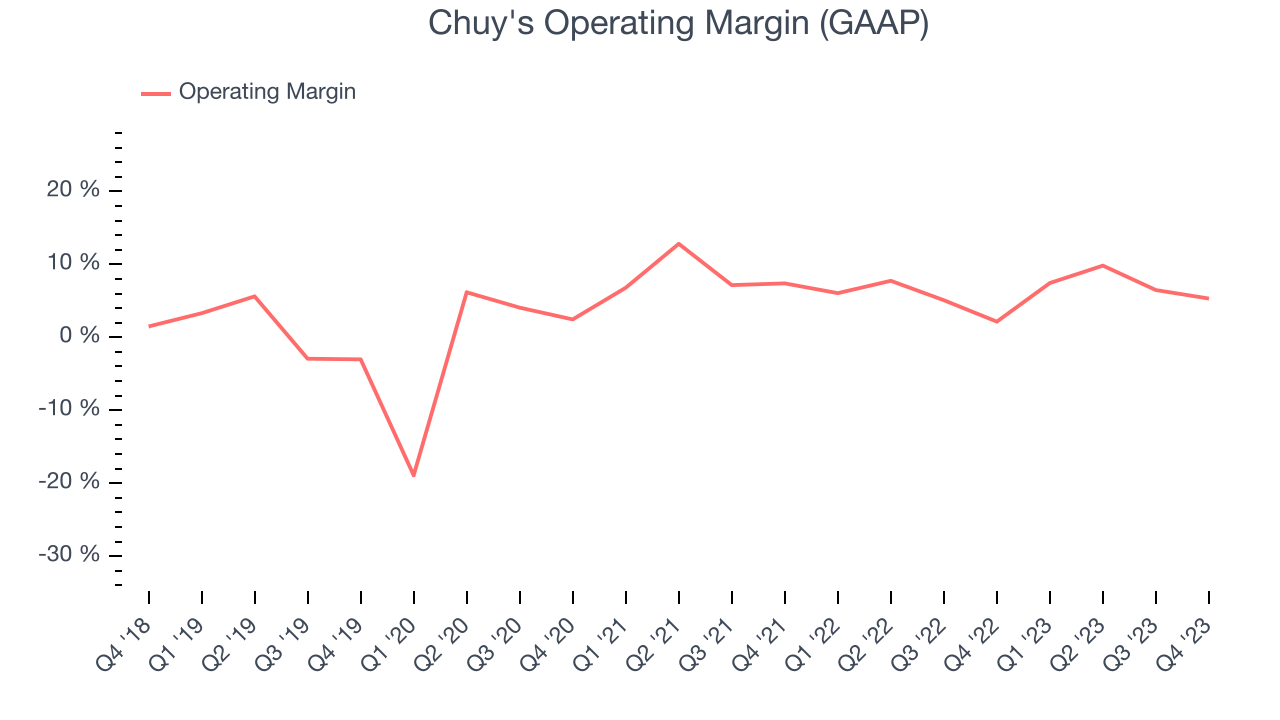

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Chuy's generated an operating profit margin of 5.3%, up 3.2 percentage points year on year. This increase was encouraging, and we can infer Chuy's was more disciplined with its expenses or gained leverage on its fixed costs because its operating margin expanded more than its gross margin.

Zooming out, Chuy's was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a restaurant business, producing an average operating margin of 6.3%. However, Chuy's margin has improved, on average, by 2 percentage points each year, an encouraging sign for shareholders. The tide could be turning.

Zooming out, Chuy's was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a restaurant business, producing an average operating margin of 6.3%. However, Chuy's margin has improved, on average, by 2 percentage points each year, an encouraging sign for shareholders. The tide could be turning.EPS

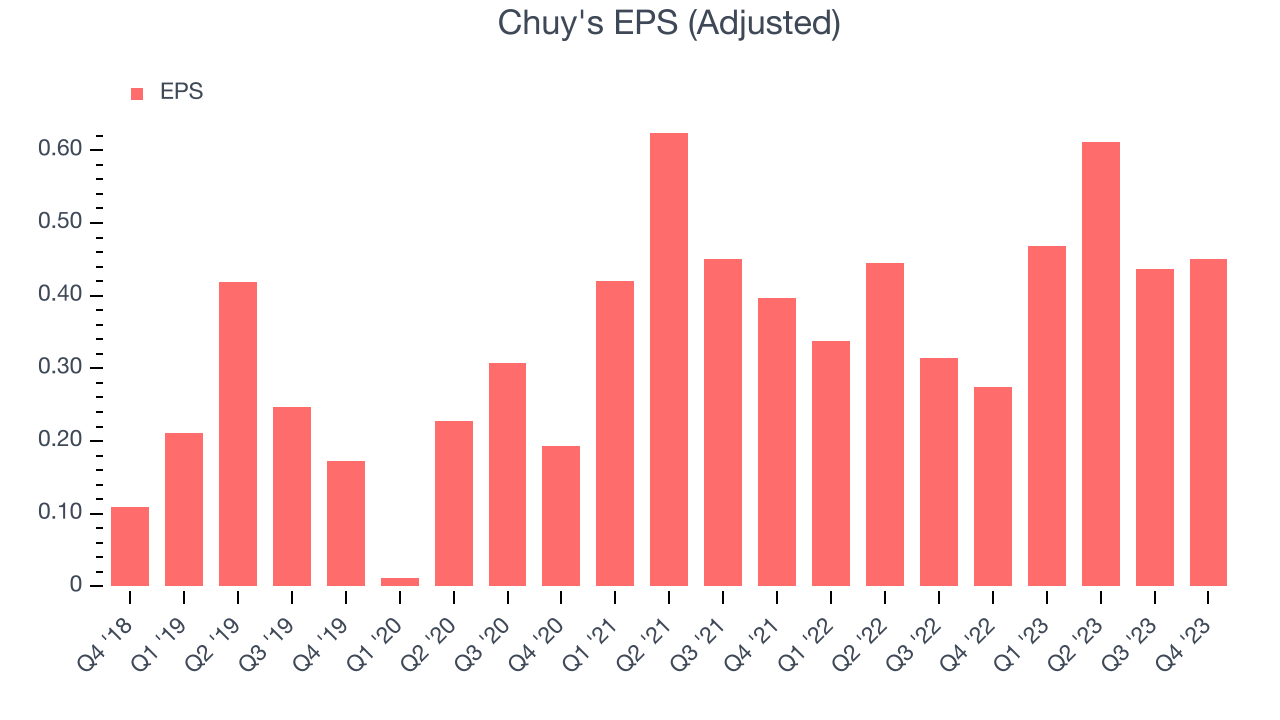

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, Chuy's reported EPS at $0.45, up from $0.27 in the same quarter a year ago. This print beat Wall Street's estimates by 18.1%.

Between FY2019 and FY2023, Chuy's adjusted diluted EPS grew 87.5%, translating into a decent 17% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period, showing that Chuy's has excelled in managing its expenses.

Over the next 12 months, however, Wall Street is projecting an average 2.7% year-on-year decline in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Chuy's five-year average ROIC was 9.6%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, Chuy's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Chuy's ROIC averaged 12.8 percentage point increases each year. This is a good sign and we hope the company can continue improving.

Key Takeaways from Chuy's Q4 Results

We were impressed by how significantly Chuy's blew past analysts' gross margin expectations this quarter. We were also glad its EPS outperformed Wall Street's estimates. On the other hand, its full-year earnings forecast missed analysts' expectations, and this seems to be dragging down shares. As such, the stock is down 5.9% after reporting, trading at $31.25 per share.

Is Now The Time?

Chuy's may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Chuy's, we'll be cheering from the sidelines. Its revenue growth has been weak over the last four years, but at least growth is expected to increase in the short term. And while its new restaurant openings show it's growing its brand, the downside is its brand caters to a niche market. On top of that, its projected EPS for the next year is lacking.

Chuy's price-to-earnings ratio based on the next 12 months is 17.4x. While we've no doubt one can find things to like about Chuy's, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $40.14 per share right before these results (compared to the current share price of $31.25).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.