Telecommunications and media company Comcast (NASDAQ:CMCSA) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 1.2% year on year to $30.06 billion. It made a non-GAAP profit of $1.04 per share, improving from its profit of $0.92 per share in the same quarter last year.

Comcast (CMCSA) Q1 CY2024 Highlights:

- Revenue: $30.06 billion vs analyst estimates of $29.85 billion (small beat)

- Adjusted EBITDA: $9.36 billion vs analyst estimates of $9.39 billion (small miss)

- EPS (non-GAAP): $1.04 vs analyst estimates of $0.99 (5.3% beat)

- Gross Margin (GAAP): 70.6%, up from 69.7% in the same quarter last year

- Free Cash Flow of $4.54 billion, up 166% from the previous quarter (large beat)

- Total domestic broadband customers: 32.19 million (in line)

- Market Capitalization: $159.7 billion

Formerly known as American Cable Systems, Comcast (NASDAQ:CMCSA) is a multinational telecommunications company offering a wide range of services.

Founded in 1963, Comcast emerged with the aim of providing innovative and comprehensive telecommunications services. The company's inception was driven by a vision to bridge the gap in the market for reliable cable television and high-speed internet services. Comcast recognized the growing demand for advanced communication and entertainment options, setting out to offer cutting-edge solutions that catered to customers' evolving needs and preferences.

Comcast's diverse portfolio of services includes cable television, high-speed internet, digital phone, and home security solutions. The company addresses the challenge of delivering seamless and convenient connectivity and entertainment experiences to residential and business customers.

Comcast generates revenue through subscription-based services, advertising sales, and content licensing agreements. The company's business model is founded on technological innovation, customer-centricity, and strategic partnerships, creating value for its stakeholders. Comcast's unique appeal lies in its ability to provide a comprehensive suite of services, ensuring convenience and quality for its broad customer base.

Cable and Satellite

The massive physical footprints of fiber in the ground or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their traditional cable subscriptions in favor of streaming options. While that is a headwind, this affinity to streaming means more households need high-speed internet, and companies that successfully serve customers can enjoy high retention rates and pricing power since the options for internet connectivity in any geography is usually limited.

Competitors in the telecommunications and media services industry include Charter Communications (NASDAQ:CHTR), Altice USA (NYSE:ATUS), Dish Network (NASDAQ:DISH).Sales Growth

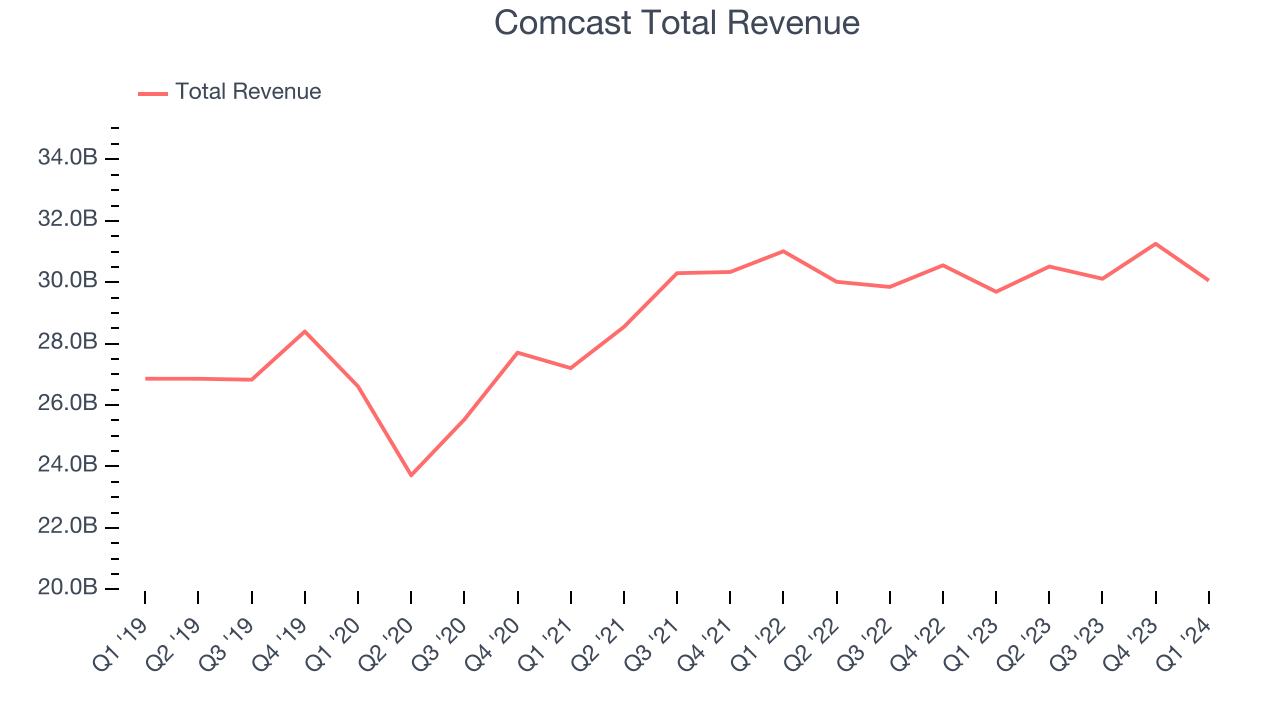

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Comcast's annualized revenue growth rate of 2.3% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Comcast's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Comcast's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

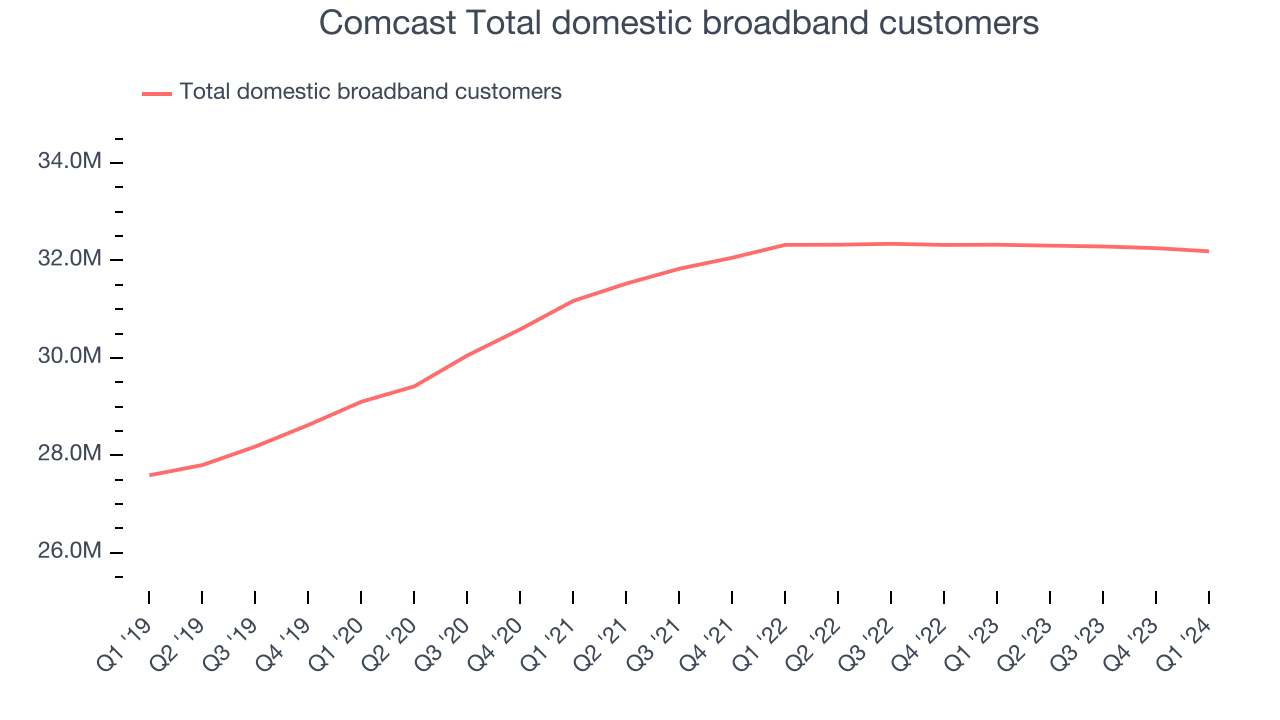

We can dig even further into the company's revenue dynamics by analyzing its number of total domestic broadband customers and total domestic video customers, which clocked in at 32.19 million and 13.62 million in the latest quarter. Over the last two years, Comcast's total domestic broadband customers were flat while its total domestic video customers averaged 11.7% year-on-year declines.

This quarter, Comcast grew its revenue by 1.2% year on year, and its $30.06 billion of revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 1.8% over the next 12 months, an acceleration from this quarter.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

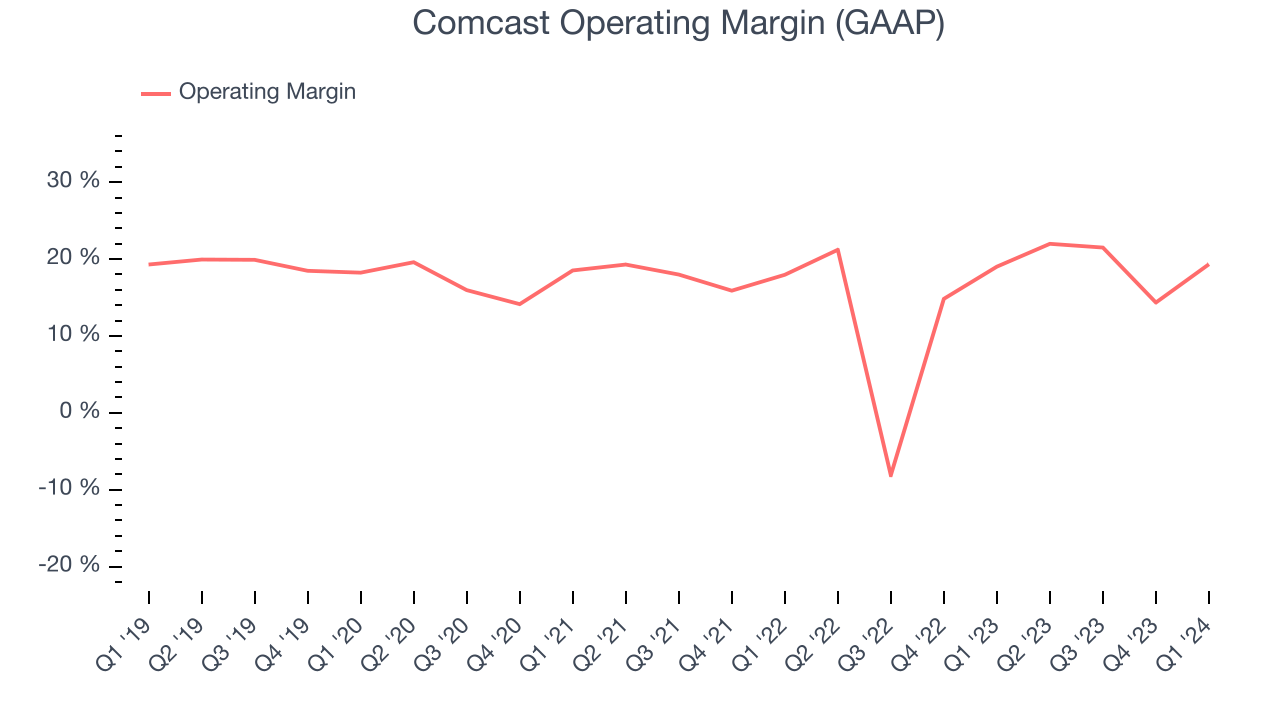

Comcast has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer discretionary business, producing an average operating margin of 15.5%.

In Q1, Comcast generated an operating profit margin of 19.3%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Comcast to maintain its LTM operating margin of 19.3%.EPS

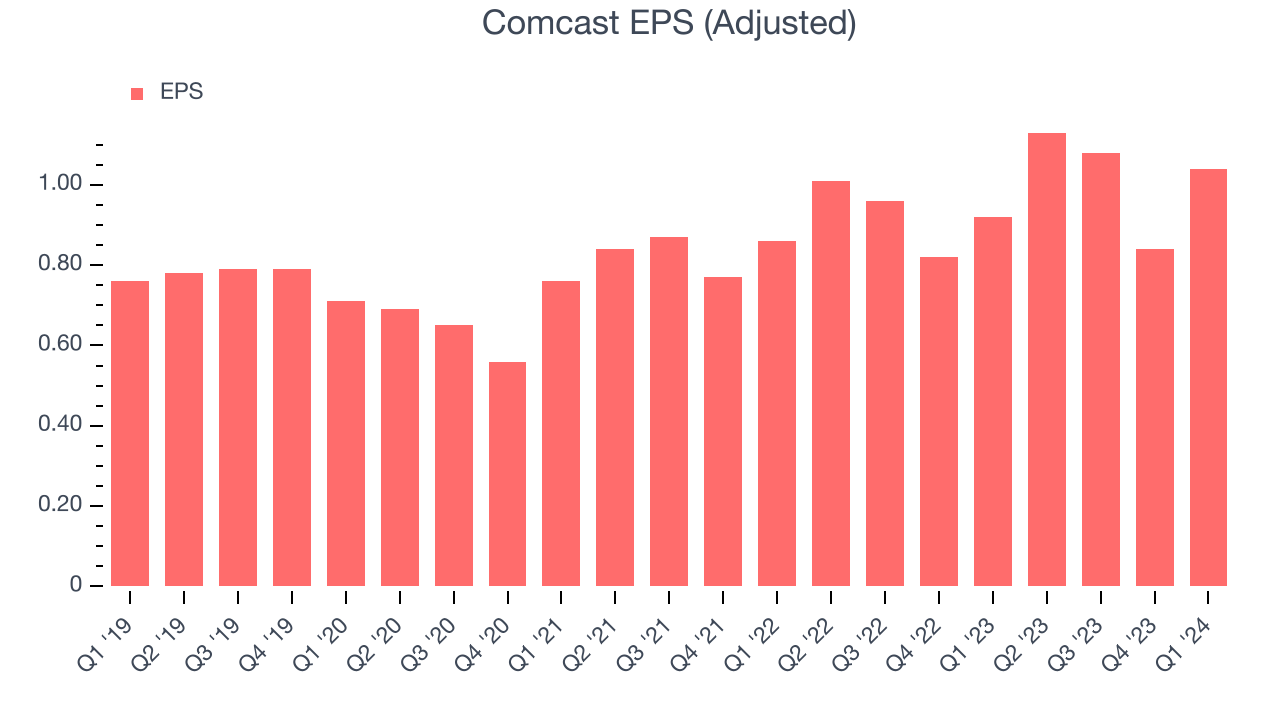

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Comcast's EPS grew 43.5%, translating into an unimpressive 7.5% compounded annual growth rate. This performance, however, is materially higher than its 2.3% annualized revenue growth over the same period. Let's dig into why.

A five-year view shows that Comcast has repurchased its stock, shrinking its share count by 13.1%. This has led to higher per share earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, Comcast reported EPS at $1.04, up from $0.92 in the same quarter last year. This print beat analysts' estimates by 5.3%. Over the next 12 months, Wall Street expects Comcast to grow its earnings. Analysts are projecting its LTM EPS of $4.09 to climb by 5.1% to $4.30.

Cash Is King

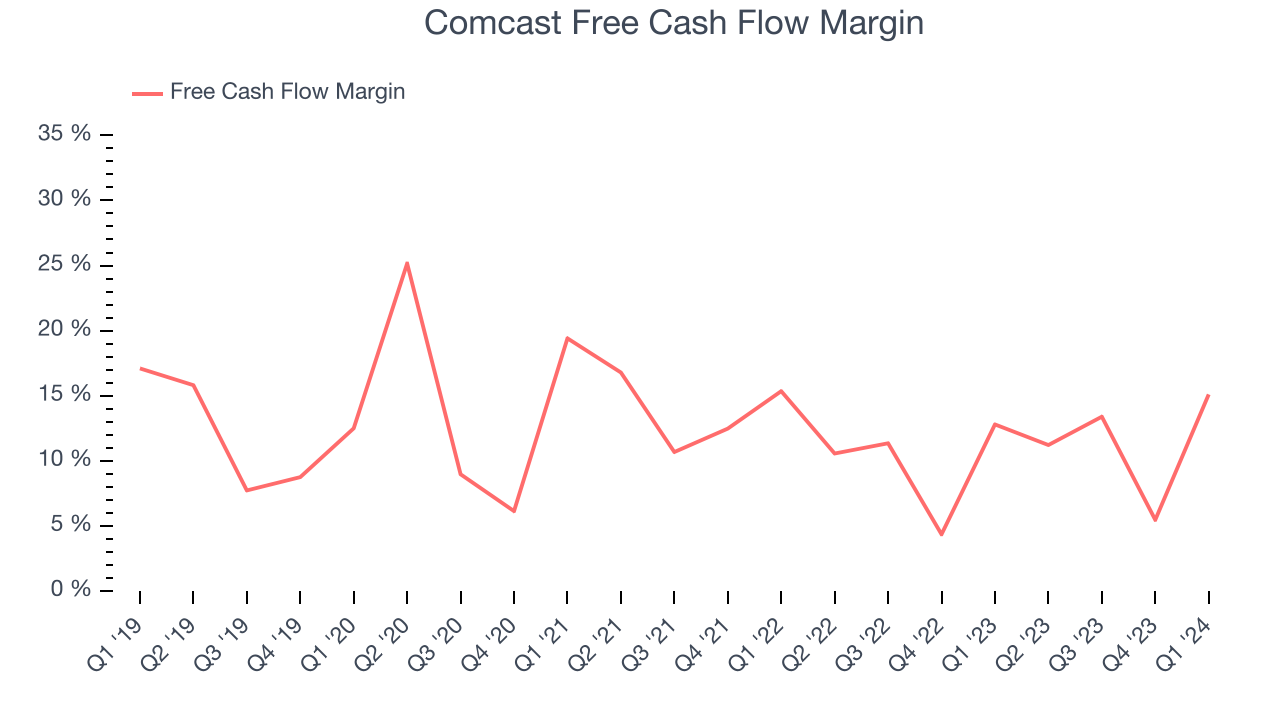

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Comcast has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 10.5%, slightly better than the broader consumer discretionary sector.

Comcast's free cash flow came in at $4.54 billion in Q1, equivalent to a 15.1% margin and up 19.5% year on year. Over the next year, analysts' consensus estimates show they're expecting Comcast's LTM free cash flow margin of 11.2% to remain the same.

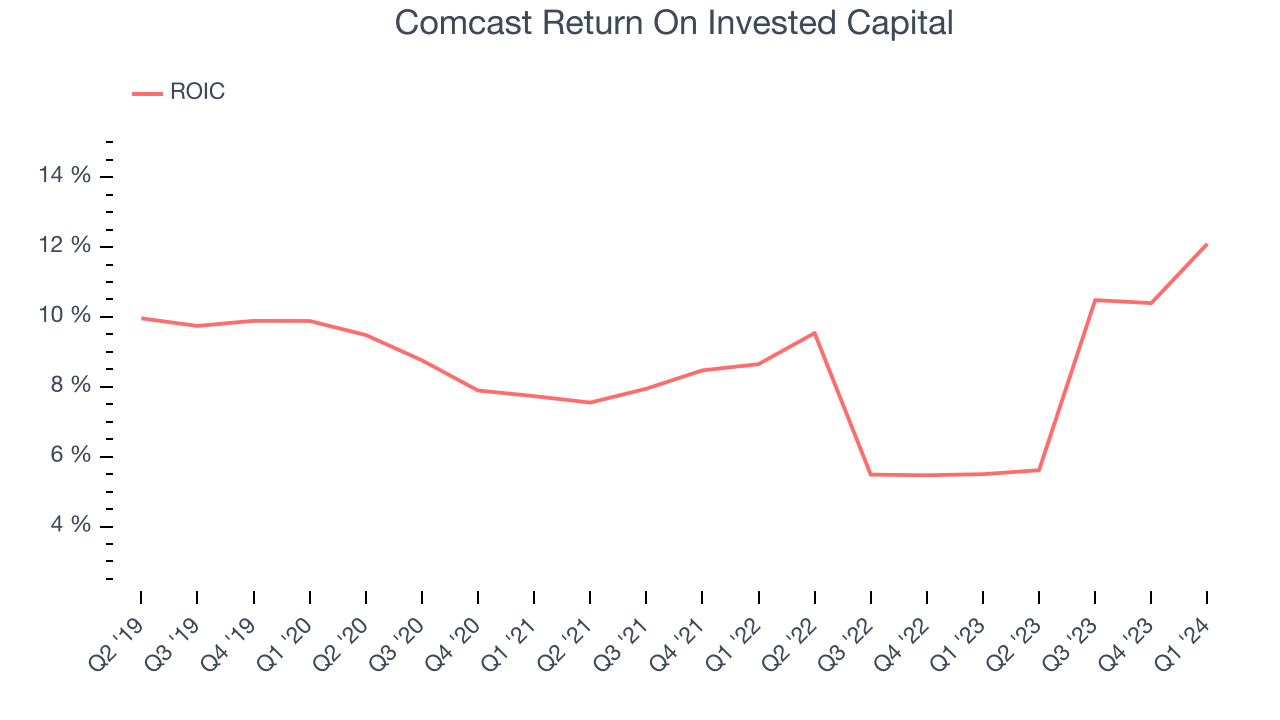

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Comcast's five-year average return on invested capital was 8.8%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Comcast's ROIC has stayed the same over the last few years. If the company wants to become an investable business, it will need to increase its returns.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Comcast reported $6.52 billion of cash and $96.57 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $37.57 billion of EBITDA over the last 12 months, we view Comcast's 2.4x net-debt-to-EBITDA ratio as safe. We also see its $2.08 billion of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Comcast's Q1 Results

It was an unexciting quarter, with revenue slightly ahead and adjusted EBITDA slightly below. The all-important volume metric of domestic broadband subscribers was in line with expectations. Zooming out, we think this was a mixed quarter. Investors were likely expecting more, and the stock is down 3.4% after reporting, trading at $38.8 per share.

Is Now The Time?

Comcast may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Comcast, we'll be cheering from the sidelines. Its revenue growth has been weak over the last five years. And while its sturdy operating margins show it has disciplined expense controls, the downside is its number of total domestic broadband customers has been disappointing. On top of that, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

Comcast's price-to-earnings ratio based on the next 12 months is 9.3x. While there are some things to like about Comcast and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $49.94 per share right before these results (compared to the current share price of $38.80).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.