Coconut water company The Vita Coco Company (NASDAQ:COCO) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 1.8% year on year to $111.7 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $505 million at the midpoint. It made a GAAP profit of $0.24 per share, improving from its profit of $0.12 per share in the same quarter last year.

Vita Coco (COCO) Q1 CY2024 Highlights:

- Revenue: $111.7 million vs analyst estimates of $111.7 million (small beat)

- EPS: $0.24 vs analyst estimates of $0.18 ($0.06 beat)

- The company lifted its revenue guidance for the full year from $500 million to $505 million at the midpoint, a 1% increase

- Full year adjusted EBITDA guidance of $79 million at the midpoint is above estimates of $75 million

- Gross Margin (GAAP): 42.2%, up from 30.7% in the same quarter last year

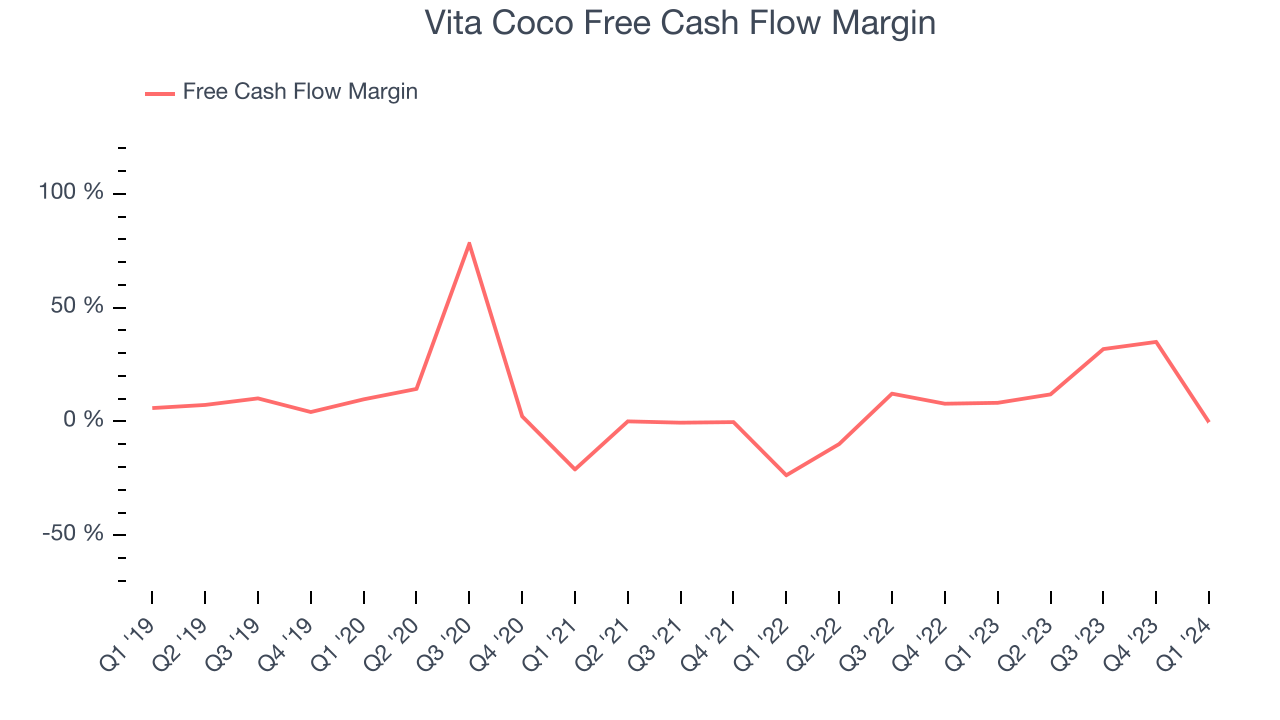

- Free Cash Flow was -$391,000, down from $37.09 million in the previous quarter

- Sales Volumes were down 0.5% year on year

- Market Capitalization: $1.37 billion

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ:COCO) offers coconut water products that are a natural way to quench thirst.

The company’s flagship product is made from young green coconuts, and Vita Coco emphasizes their hydrating properties, natural electrolytes, and delicious taste. For those leading an active lifestyle, the company markets its products as an alternative to sports drinks plain water. Vita Coco also has a commitment to sourcing coconuts from sustainable and ethical suppliers, allowing its customers to not only enjoy something that tastes good but also feel good about how they’re spending their money.

While Vita Coco aims for broad appeal, its core customer is more health-conscious like a fitness buff or nutrition enthusiast. By promoting its products as a healthier alternative to artificially flavored sports drinks or sugary sodas, the company caters to the growing demand for functional beverages featuring natural and clean ingredients.

Vita Coco's products can be found in a wide range of locations, and the list is growing. Grocery stores, convenience stores, health food stores, and fitness centers are the most common sellers today. As the company adds flavored variations such as pineapple, mango, and peach as well as caffeinated versions, its presence on shelves could continue to grow.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors that offer coconut or other hydrating drinks include ZICO from Coca-Cola (NYSE:KO), ONE Coconut Water from PepsiCo (NASDAQ:PEP), and private companies Harmless Harvest and Naked Juice.Sales Growth

Vita Coco is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

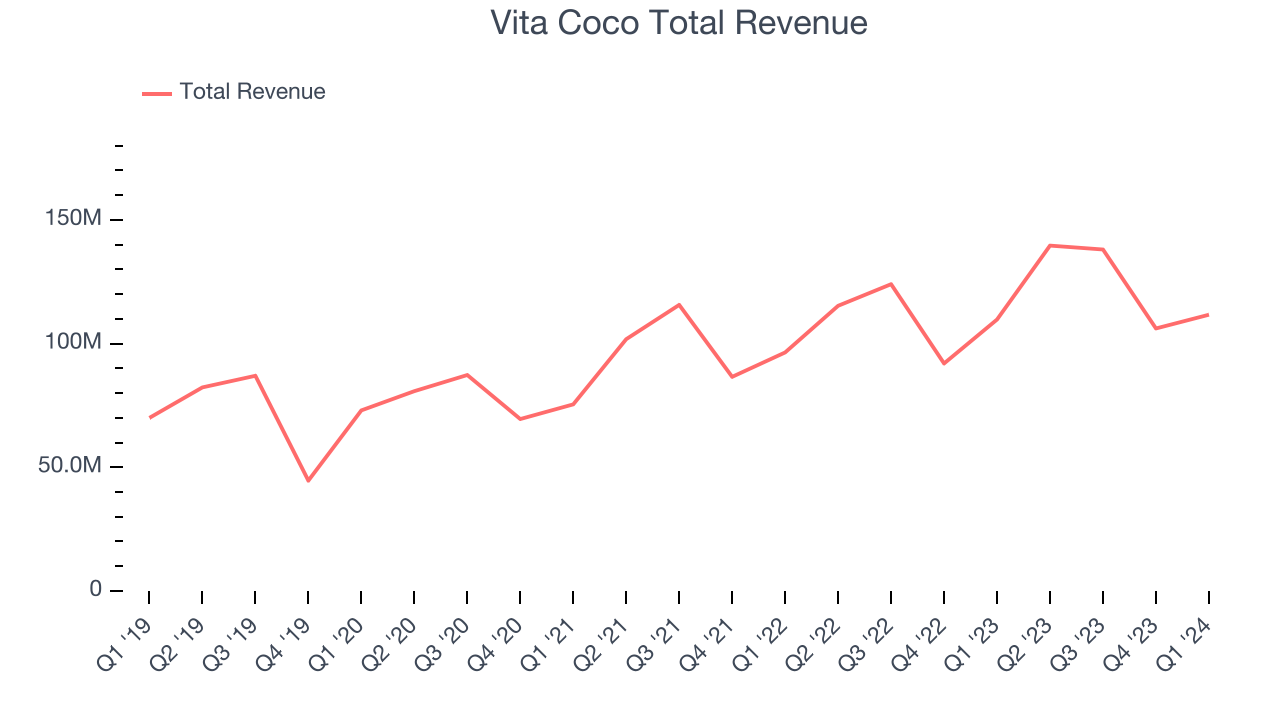

As you can see below, the company's annualized revenue growth rate of 16.5% over the last three years was impressive for a consumer staples business.

This quarter, Vita Coco grew its revenue by 1.8% year on year, and its $111.7 million in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.5% over the next 12 months, an acceleration from this quarter.

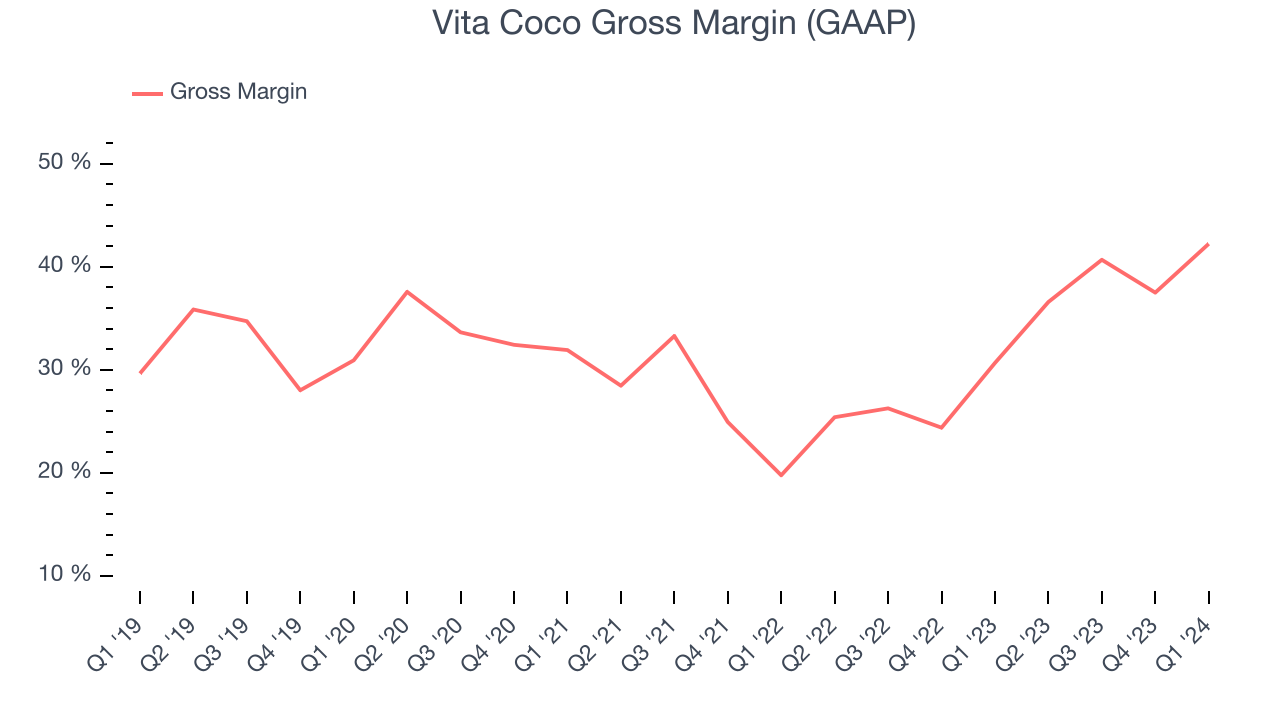

Gross Margin & Pricing Power

Vita Coco's gross profit margin came in at 42.2% this quarter, up 11.6 percentage points year on year. That means for every $1 in revenue, $0.58 went towards paying for raw materials, production of goods, and distribution expenses.

Vita Coco's unit economics are higher than the typical consumer staples company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see above, it's averaged a decent 33.3% gross margin over the last eight quarters. Its margin has also been trending up over the last 12 months, averaging 47.6% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

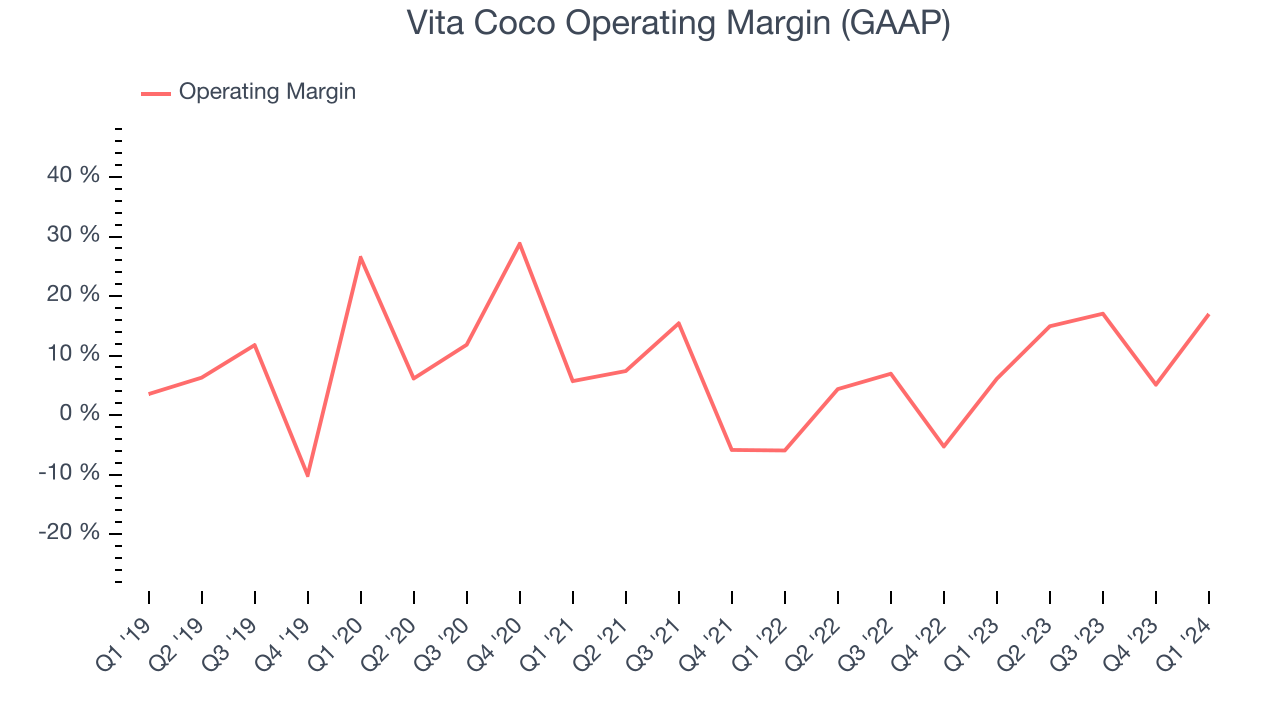

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

In Q1, Vita Coco generated an operating profit margin of 17%, up 10.9 percentage points year on year. This increase was encouraging, and we can infer Vita Coco had stronger pricing power and lower raw materials/transportation costs because its gross margin expanded more than its operating margin.

Zooming out, Vita Coco has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 9%, higher than the broader consumer staples sector. On top of that, its margin has improved by 10.4 percentage points on average over the last year, a great sign for shareholders.

Zooming out, Vita Coco has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 9%, higher than the broader consumer staples sector. On top of that, its margin has improved by 10.4 percentage points on average over the last year, a great sign for shareholders. EPS

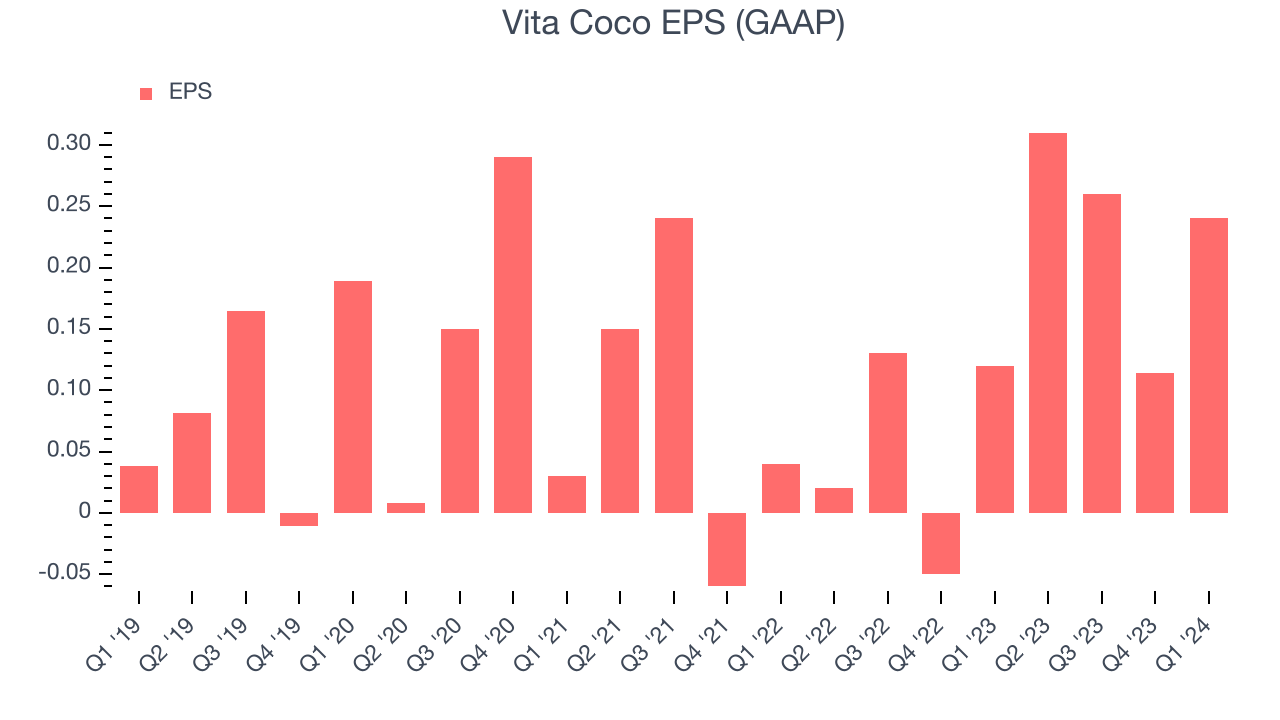

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Vita Coco reported EPS at $0.24, up from $0.12 in the same quarter a year ago. This print beat Wall Street's estimates by 34.4%.

Between FY2021 and FY2024, Vita Coco's EPS grew 93.4%, translating into an astounding 24.6% compounded annual growth rate. If it can maintain this rate of growth, Vita Coco will more than double its EPS in the next five years.

Over the next 12 months, however, Wall Street is projecting an average 1.9% year-on-year decline in EPS.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Vita Coco broke even from a free cash flow perspective in Q1. The company's margin regressed this quarter as it was 8.5 percentage points lower than in the same period last year.

Over the last two years, Vita Coco has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 12.5%, quite impressive for a consumer staples business. Furthermore, its margin has averaged year-on-year increases of 15.1 percentage points over the last 12 months. Shareholders should be excited as this will certainly help Vita Coco achieve its strategic long-term plans.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Vita Coco's five-year average ROIC was 28.4%, placing it among the best consumer staples companies. Just as you’d like your investment dollars to generate returns, Vita Coco's invested capital has produced excellent profits.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Vita Coco is a profitable, well-capitalized company with $123 million of cash and $21,000 of debt, meaning it could pay back all its debt tomorrow and still have $123 million of cash on its balance sheet. This net cash position gives Vita Coco the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Vita Coco's Q1 Results

We liked how Vita Coco beat revenue, gross margin, and EPS expectations this quarter. It's also nice to see that full year guidance for revenue and adjusted EBITDA both came in slightly above Wall Street analysts' estimates. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 6.4% after reporting and currently trades at $25.79 per share.

Is Now The Time?

Vita Coco may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Vita Coco is a good business. First off, its revenue growth has been good over the last three years. And while its brand caters to a niche market, its EPS growth over the last three years has been fantastic. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Vita Coco's price-to-earnings ratio based on the next 12 months is 25.3x. There are definitely a lot of things to like about Vita Coco, and looking at the consumer staples landscape right now, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $29.89 per share right before these results (compared to the current share price of $25.79), implying they saw upside in buying Vita Coco in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.