Outerwear manufacturer Columbia Sportswear (NASDAQ:COLM) reported Q1 CY2024 results exceeding Wall Street analysts' expectations, with revenue down 6.2% year on year to $770 million. On the other hand, next quarter's revenue guidance of $566.5 million was less impressive, coming in 3.2% below analysts' estimates. It made a GAAP profit of $0.71 per share, down from its profit of $0.74 per share in the same quarter last year.

Columbia Sportswear (COLM) Q1 CY2024 Highlights:

- Revenue: $770 million vs analyst estimates of $743.3 million (3.6% beat)

- EPS: $0.71 vs analyst estimates of $0.34 (111% beat)

- EPS Guidance for full year 2024 raised from previous ($3.85 million at the midpoint, analyst estimates of $3.69)

- Gross Margin (GAAP): 50.6%, up from 48.7% in the same quarter last year

- Free Cash Flow of $91.98 million, down 84.7% from the previous quarter

- Market Capitalization: $4.74 billion

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ:COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Columbia Sportswear’s 80-year-old brand represents the outdoors, and it has developed clothing technologies such as Omni-Heat Reflective, which reflects body heat while maintaining breathability, to stand out.

The company markets its products under several brands, including the flagship Columbia brand, Mountain Hardwear, Sorel, and prAna. Its products range from winter jackets, trail shoes, and waterproof boots to tents and sleeping bags, catering to a broad spectrum of outdoor activities including hiking, skiing, fishing, and trail running. This breadth appeals to a wide demographic, from casual hikers and families enjoying the outdoors to serious mountaineers and adventure sports enthusiasts.

Columbia Sportswear sells its products in over 90 countries through department stores, specialty stores, branded franchise stores, and corporate-owned online and brick-and-mortar stores.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Columbia Sportswear's primary competitors include The North Face (owned by VF Corporation NYSE:VFC), Jack Wolfskin (owned by Callaway Golf Company NYSE:ELY), Arc'teryx (owned by Amer Sports OTC:AGPDY), and private companies REI Co-op and Patagonia.Sales Growth

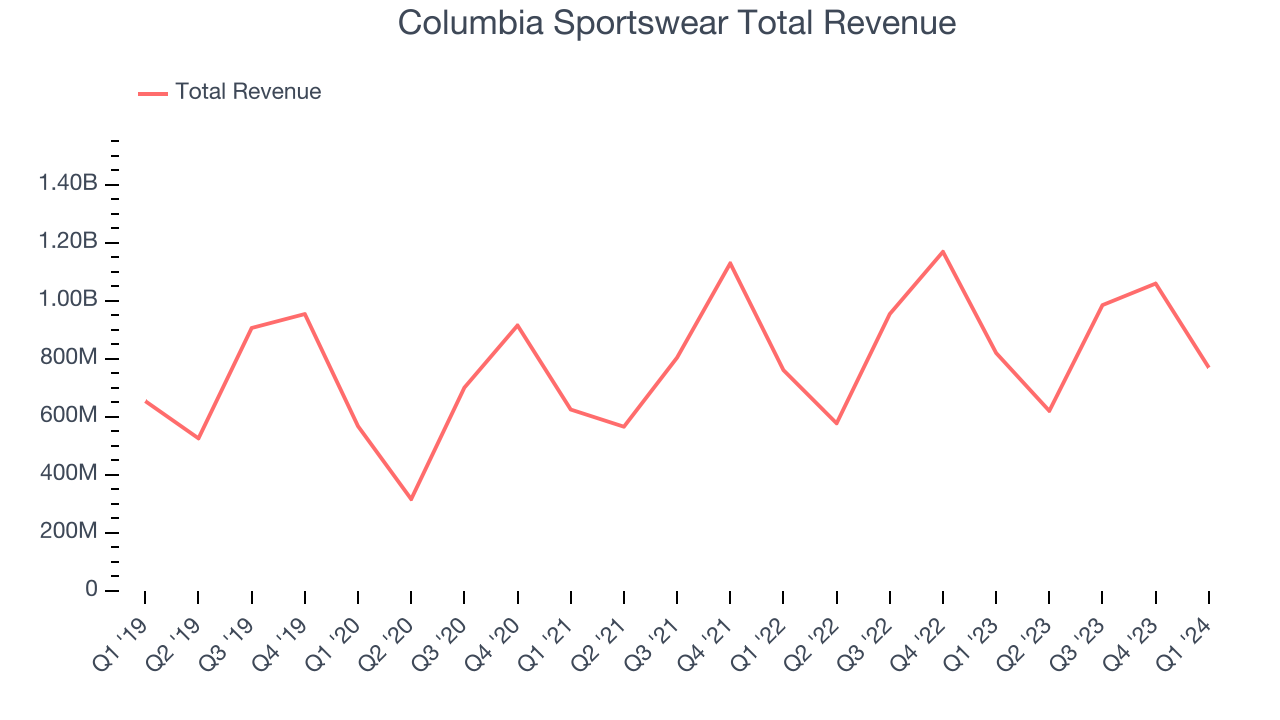

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Columbia Sportswear's annualized revenue growth rate of 3.8% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Columbia Sportswear's recent history shows the business has slowed as its annualized revenue growth of 2.6% over the last two years is below its five-year trend.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Columbia Sportswear's recent history shows the business has slowed as its annualized revenue growth of 2.6% over the last two years is below its five-year trend.

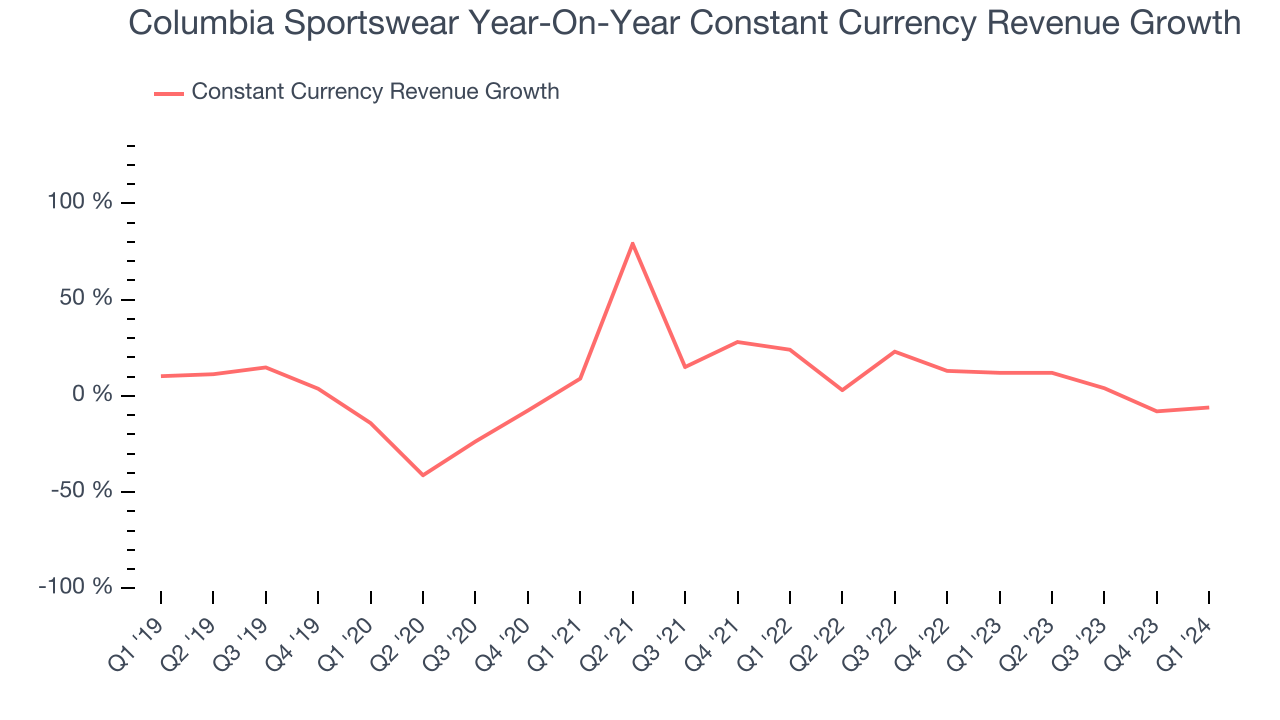

Columbia Sportswear also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 6.6% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see that foreign exchange rates have been a headwind for Columbia Sportswear.

This quarter, Columbia Sportswear's revenue fell 6.2% year on year to $770 million but beat Wall Street's estimates by 3.6%. The company is guiding for a 8.8% year-on-year revenue decline next quarter to $566.5 million, a reversal from the 7.4% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

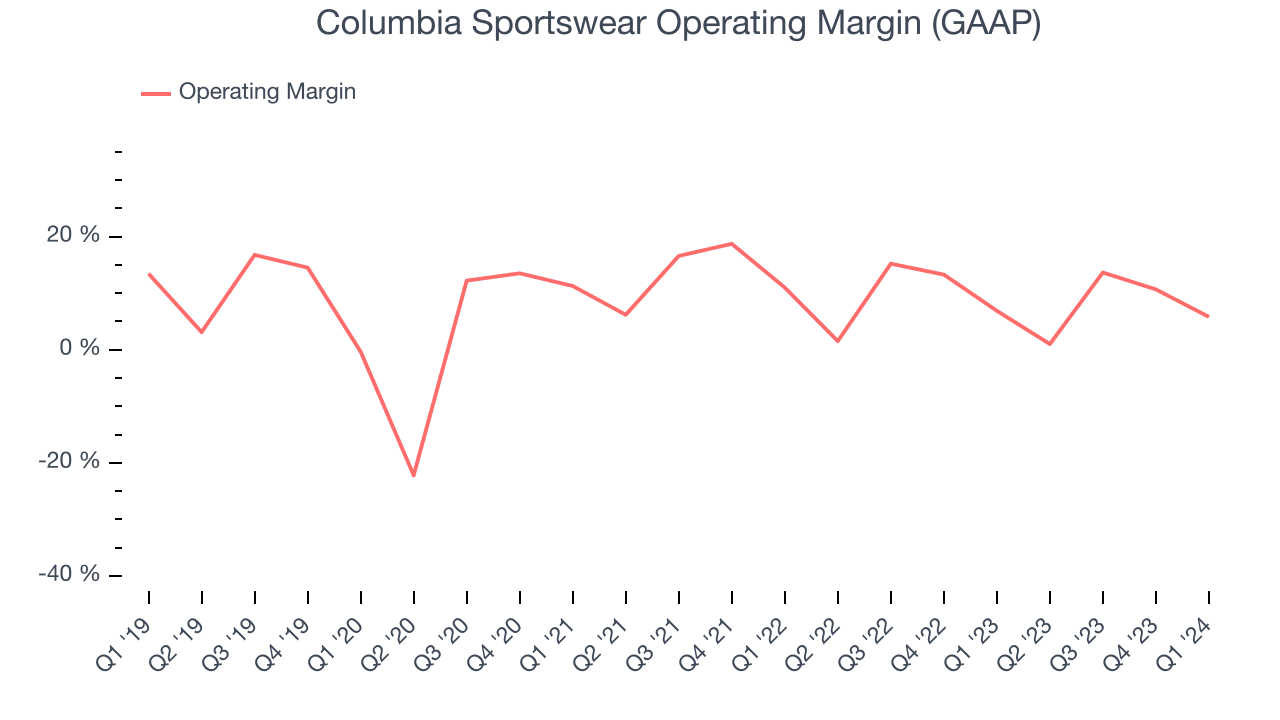

Columbia Sportswear was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 9.5%.

This quarter, Columbia Sportswear generated an operating profit margin of 5.8%, down 1.1 percentage points year on year.

Over the next 12 months, Wall Street expects Columbia Sportswear to maintain its LTM operating margin of 8.7%.EPS

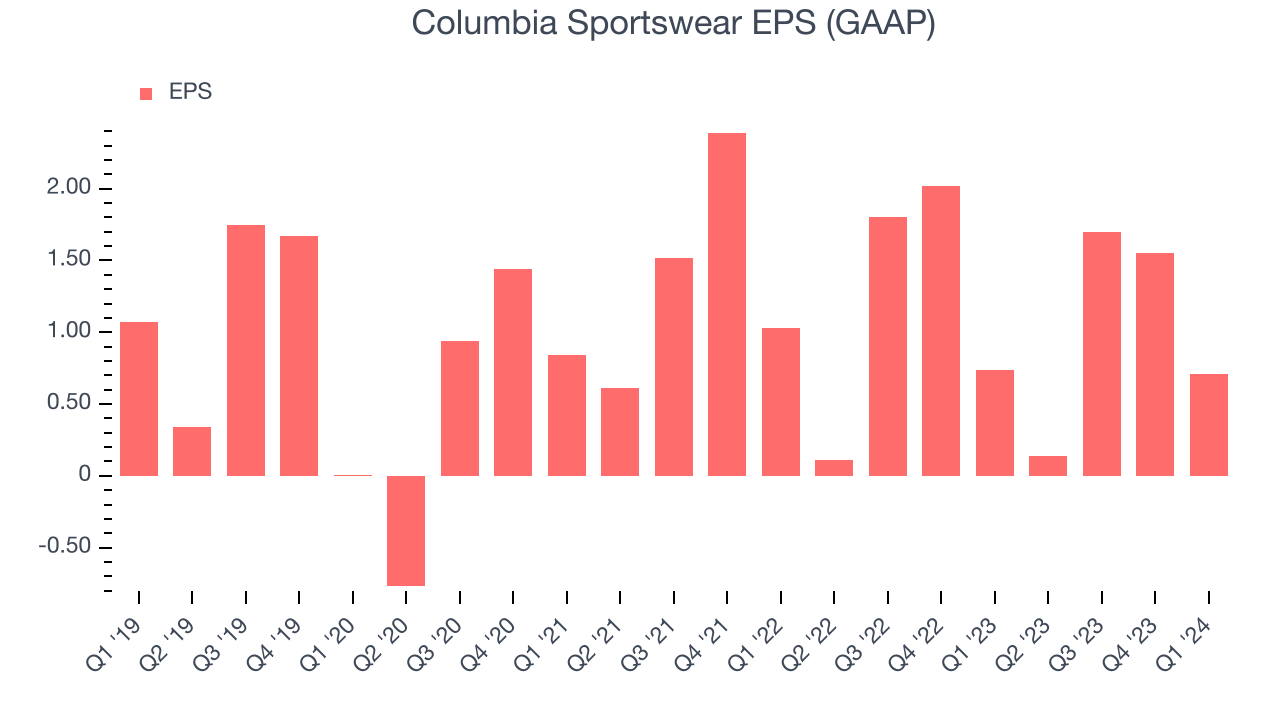

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Columbia Sportswear's EPS was roughly flat, which isn't ideal. Thankfully, Columbia Sportswear has bucked its trend as of late, growing its EPS over the last three years. We'll see if the company's growth is sustainable.

In Q1, Columbia Sportswear reported EPS at $0.71, down from $0.74 in the same quarter last year. Despite falling year on year, this print easily cleared analysts' estimates. Over the next 12 months, Wall Street expects Columbia Sportswear to perform poorly. Analysts are projecting its LTM EPS of $4.10 to shrink by 7.1% to $3.81.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

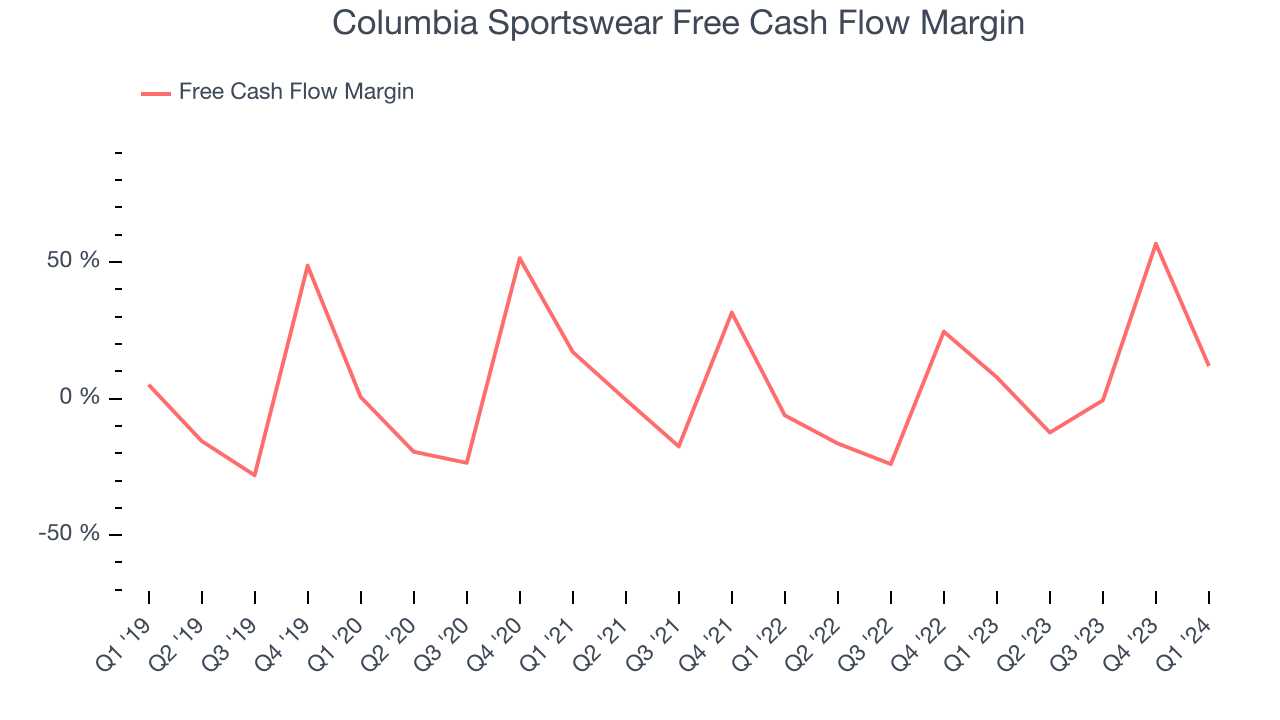

Over the last two years, Columbia Sportswear has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 9.1%, subpar for a consumer discretionary business.

Columbia Sportswear's free cash flow came in at $91.98 million in Q1, equivalent to a 11.9% margin and up 43.8% year on year. Over the next year, analysts predict Columbia Sportswear's cash profitability will fall to break even. Their consensus estimates imply its LTM free cash flow margin of 17.7% will decrease by 17 percentage points.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

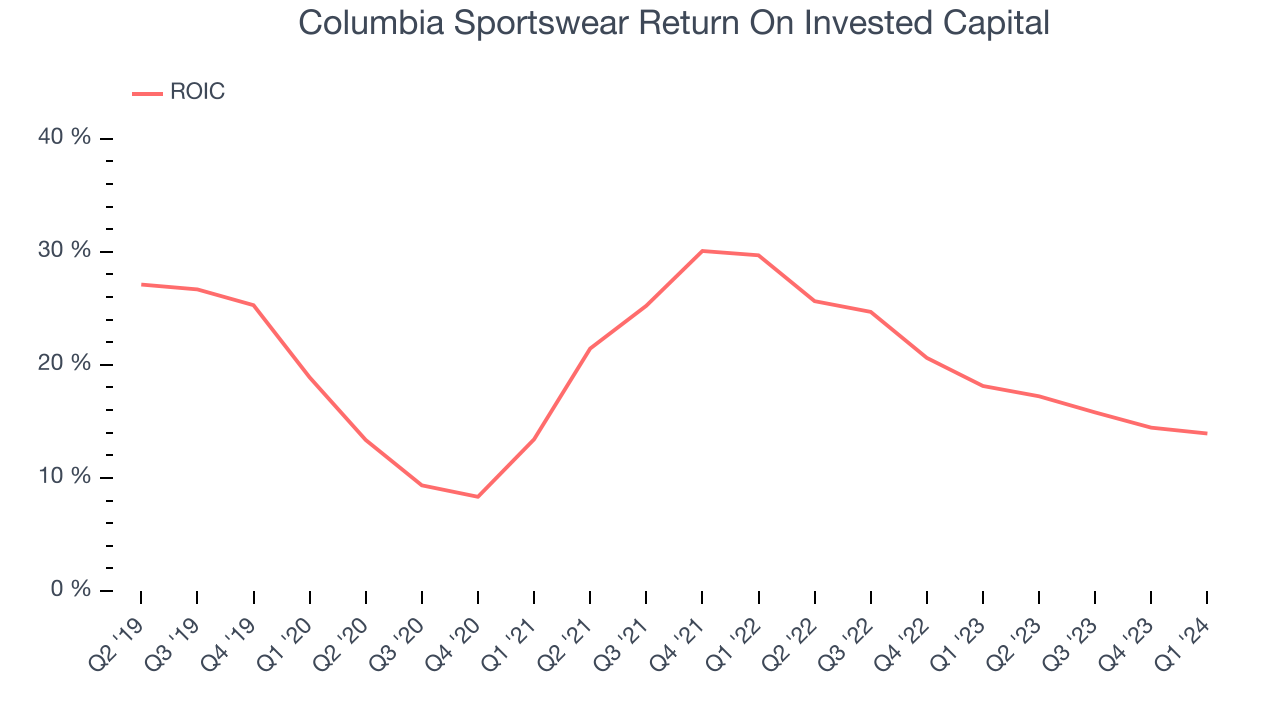

Although Columbia Sportswear hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a solid job investing in profitable business initiatives. Its five-year average return on invested capital was 18.8%, higher than most consumer discretionary companies.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Uneventfully, Columbia Sportswear's ROIC has stayed the same over the last few years. This is fine because its returns are solid, but if the company wants to become an investable business, it will need to increase its ROIC even more.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Columbia Sportswear is a profitable, well-capitalized company with $787.7 million of cash and $411.9 million of debt, meaning it could pay back all its debt tomorrow and still have $375.9 million of cash on its balance sheet. This net cash position gives Columbia Sportswear the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Columbia Sportswear's Q1 Results

We were impressed by how significantly Columbia Sportswear blew past analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. Full year EPS guidance was also raised and is above Wall Street's estimates, adding to the positivity of the print. Overall, this quarter's results still seemed fairly positive and shareholders should feel optimistic. The stock is up 7.6% after reporting and currently trades at $85 per share.

Is Now The Time?

Columbia Sportswear may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Columbia Sportswear, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last five years, and analysts expect growth to deteriorate from here. And while its solid ROIC suggests it has grown profitably in the past, the downside is its projected EPS for the next year is lacking. On top of that, its declining EPS over the last five years makes it hard to trust.

Columbia Sportswear's price-to-earnings ratio based on the next 12 months is 20.8x. While we've no doubt one can find things to like about Columbia Sportswear, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $73.40 per share right before these results (compared to the current share price of $85), implying they didn't see much short-term potential in Columbia Sportswear.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.