Membership-only discount retailer Costco (NASDAQ:COST) beat analysts' expectations in Q2 CY2024, with revenue up 9.1% year on year to $58.52 billion. It made a GAAP profit of $3.78 per share, improving from its profit of $2.93 per share in the same quarter last year.

Is now the time to buy Costco? Find out by accessing our full research report, it's free.

Costco (COST) Q2 CY2024 Highlights:

- Revenue: $58.52 billion vs analyst estimates of $58 billion (small beat)

- EPS: $3.78, up from $2.93 in the same quarter last year (2.7% beat)

- Gross Margin (GAAP): 12.5%, in line with the same quarter last year

- Free Cash Flow of $5.25 billion, up from $721 million in the same quarter last year

- Locations: 878 at quarter end, up from 853 in the same quarter last year

- Same-Store Sales rose 6.5% year on year rose 6.5% year on year (beat vs. Consensus estimates and vs. 0.3% in the same quarter last year)

- Market Capitalization: $357.7 billion

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ:COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Large-format Grocery & General Merchandise Retailer

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

Sales Growth

Costco is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

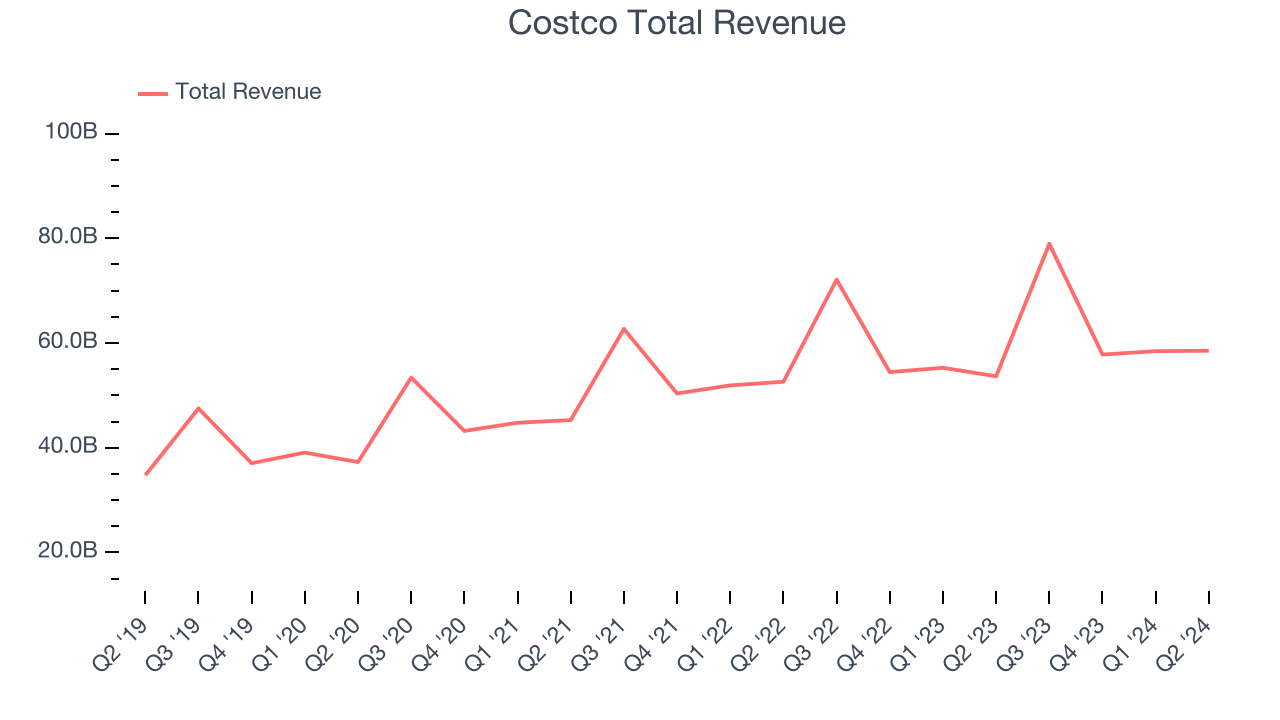

As you can see below, the company's annualized revenue growth rate of 11.1% over the last five years was decent as it opened new stores and grew sales at existing, established stores.

This quarter, Costco grew its revenue by 9.1% year on year, and its $58.52 billion in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 5.3% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

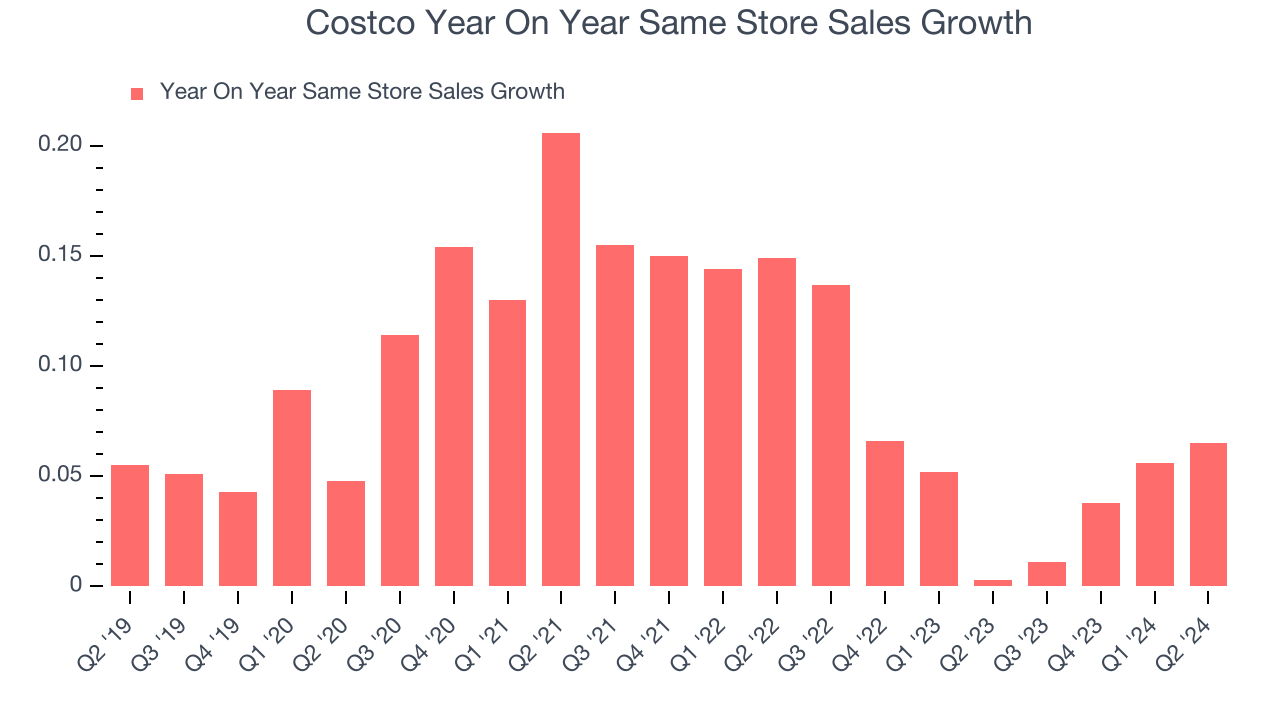

Costco's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 5.4% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Costco is reaching more customers and growing sales.

In the latest quarter, Costco's same-store sales rose 6.5% year on year. This growth was an acceleration from the 0.3% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Key Takeaways from Costco's Q2 Results

Costco beat on the key line items including same-store sales, revenue, gross margin, and EPS. Overall, we think this was a good quarter. The market was likely expecting more, however, and the stock is down 1.9% after reporting, trading at $799 per share.

So should you invest in Costco right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.