Spend management software maker Coupa Software (COUP) announced better-than-expected results in the Q3 FY2023 quarter, with revenue up 16.9% year on year to $217.3 million. Coupa made a GAAP loss of $84.1 million, improving on its loss of $88 million, in the same quarter last year.

Is now the time to buy Coupa? Access our full analysis of the earnings results here, it's free.

Coupa (COUP) Q3 FY2023 Highlights:

- Revenue: $217.3 million vs analyst estimates of $213.3 million (1.88% beat)

- EPS (non-GAAP): $0.43 vs analyst estimates of $0.10 ($0.33 beat)

- Free cash flow of $196.7 million, up from $24.9 million in previous quarter

- Gross Margin (GAAP): 59.6%, up from 58.2% same quarter last year

- Coupa announced it has entered into a definitive agreement to be acquired by Thoma Bravo

Founded in 2006 by former Oracle executives, Coupa Software (COUP) is a software as a service platform that helps enterprises manage their spending across procurement, billing and business expenses and get a better visibility into how the money is spent.

The adoption of financial technology software is propelled by an ongoing drive to reduce costs. The combination of rising transactions volumes and global supply chain complexity is driving demand for cloud based spend management platforms able to integrate the two.

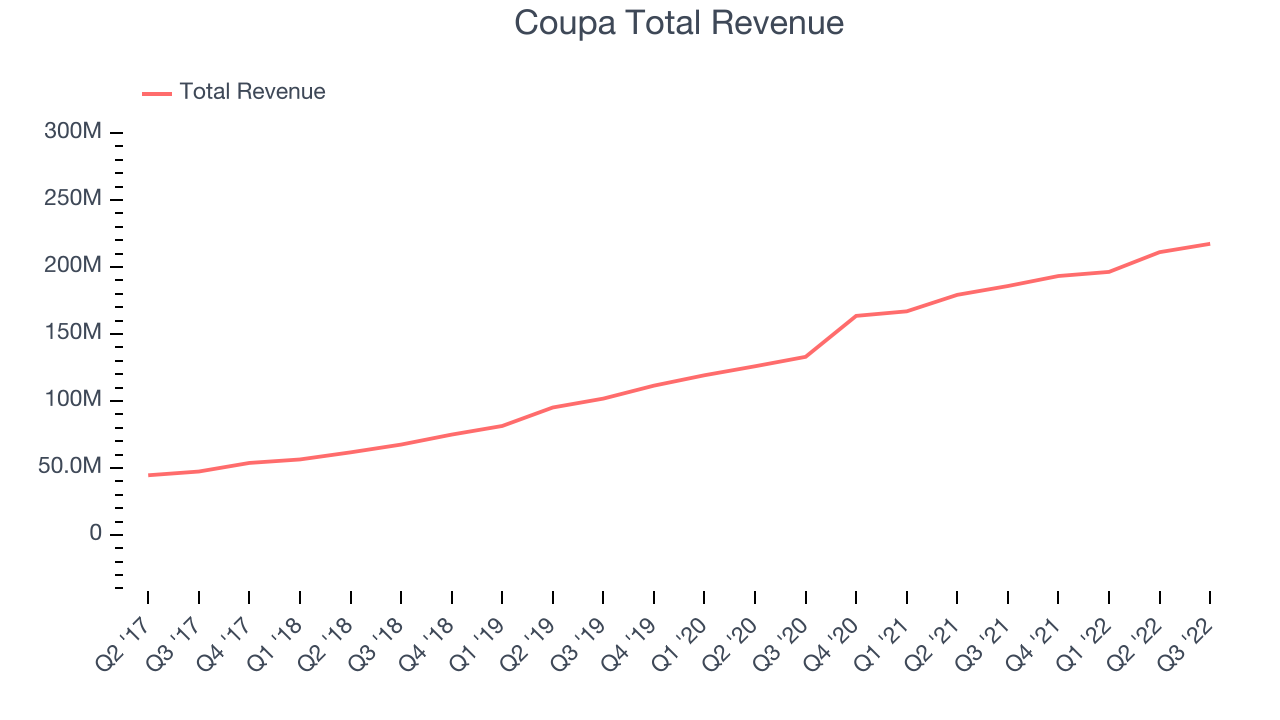

Sales Growth

As you can see below, Coupa's revenue growth has been strong over the last two years, growing from quarterly revenue of $132.9 million in Q3 FY2021, to $217.3 million.

This quarter, Coupa's quarterly revenue was once again up 16.9% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $6.23 million in Q3, compared to $14.7 million in Q2 2023. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Ahead of the earnings results the analysts covering the company were estimating sales to grow 15.8% over the next twelve months.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

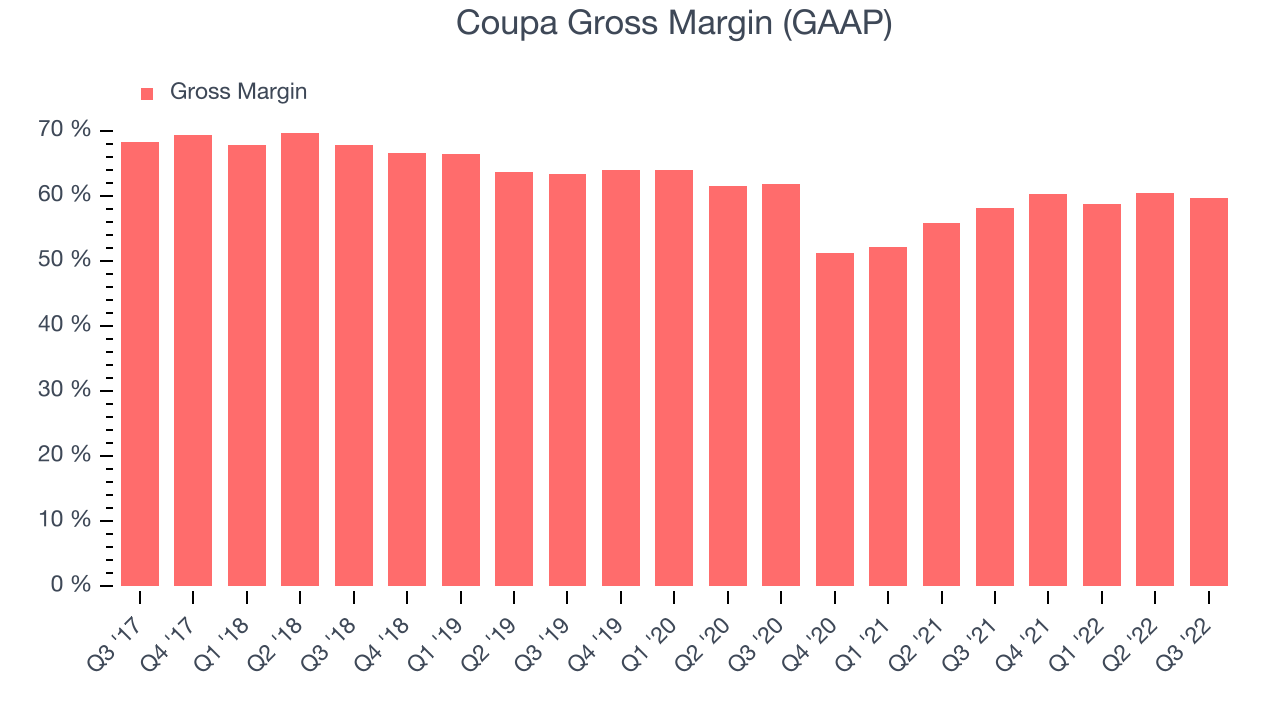

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Coupa's gross profit margin, an important metric measuring how much money there is left after paying for servers, licenses, technical support and other necessary running expenses was at 59.6% in Q3.

That means that for every $1 in revenue the company had $0.59 left to spend on developing new products, marketing & sales and the general administrative overhead. This would be considered a low gross margin for a SaaS company and it has dropped significantly from the previous quarter, which is probably the opposite of what shareholders would like it to do.

Key Takeaways from Coupa's Q3 Results

With a market capitalization of $4.71 billion Coupa is among smaller companies, but its more than $860.1 million in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

Coupa topped analysts’ revenue expectations this quarter, even if just narrowly. That feature of these results really stood out as a positive. On the other hand, there was a deterioration in gross margin and revenue growth is slower these days. Overall, this quarter's results could have been better. The company is up 27.1% on the Thoma Bravo acquisition news and currently trades at $78.95 per share.

Should you invest in Coupa right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.