Spend management software maker Coupa Software (COUP) reported strong growth in the Q4 FY2021 earnings announcement, with revenue up 46.74% year on year to $163.5 million. Coupa Software made a GAAP loss of $61.39 million, down on its loss of $24.05 million, in the same quarter last year.

Coupa Software (COUP) Q4 FY2021 Highlights:

- Revenue: $163.5 million vs analyst estimates of $145.9 million (12.10% beat)

- EPS (non-GAAP): $0.17 vs analyst estimates of -$0.11 ($0.28 beat)

- Revenue guidance for Q1 2022 is $152.0 million at the midpoint, above analyst estimates of $148.9 million

- Management's revenue guidance for FY2022 of $676.5 million at the midpoint, predicting 24.90% growth (vs 43.78% in FY2021)

- Free cash flow of $38.10 million, up 120% from previous quarter

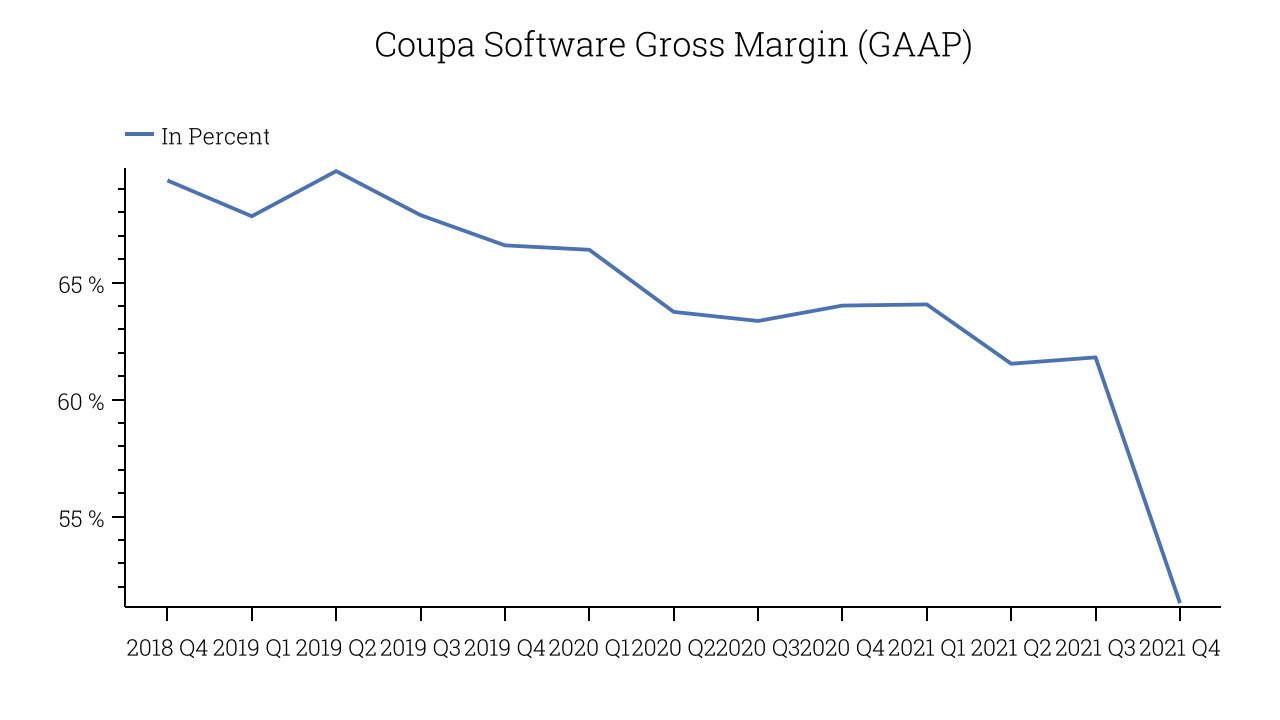

- Gross Margin (GAAP): 51.31%, down from 61.80% previous quarter

"This year, we delivered record financial results across all key measures amid a difficult macroeconomic environment," said Rob Bernshteyn, chairman and chief executive officer at Coupa. "As part of our strategy to develop and own the Business Spend Management market, we continued to invest meaningfully into all areas of our business. We also made strategic acquisitions in supply chain design and planning, treasury, and the enhancement of our supplier diversity and travel and expense offerings. We believe that we are now more optimally positioned than ever to deliver broad based global customer success."

Savings As A Service

Founded in 2006, Coupa Software (COUP) is a software as a service platform that helps enterprises manage their spendings across procurement, billing and business expenses and get a better visibility into how the money is spent. The software allows a company to setup an internal e-shop through which employees procure all goods and services they need, giving the management control over who they order from. It also offers a central cloud repository for invoices and expense claims and provides an easy to use interface through which employees can manage and resolve both. Coupa then ties all this financial data together and provides reports to help companies find potential inefficiencies and rooms for improvement.

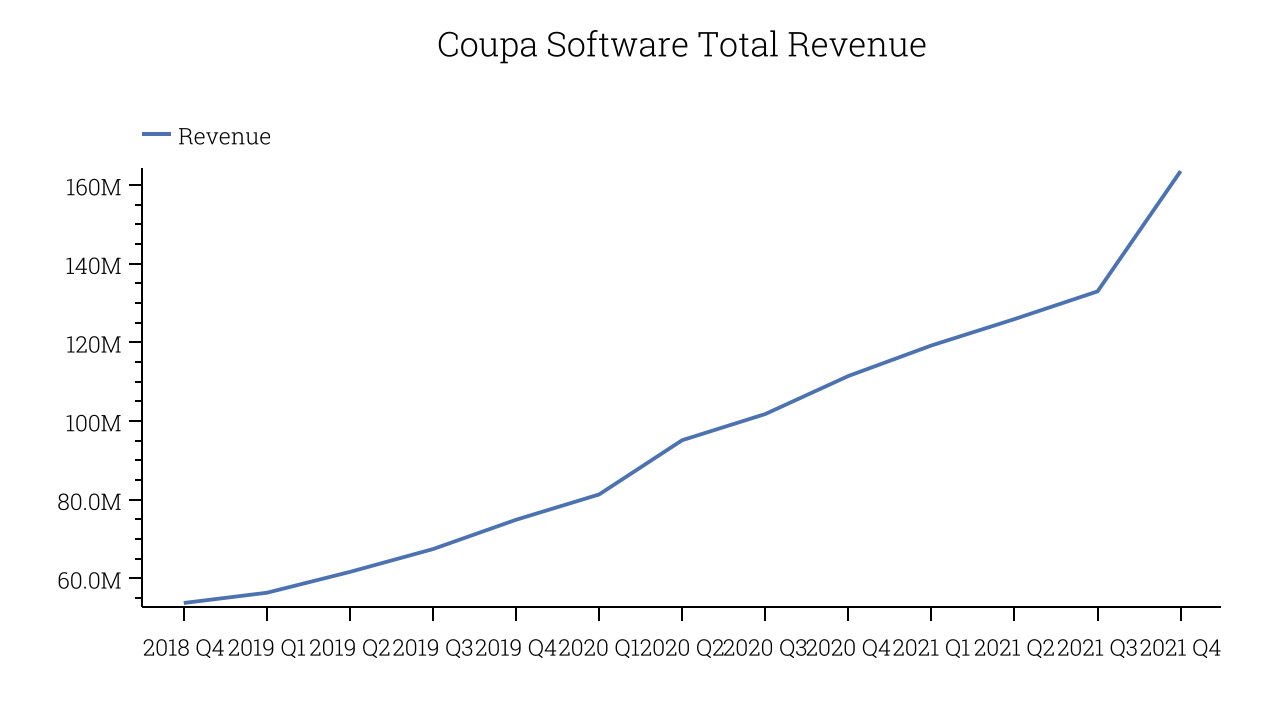

As you can see below, Coupa Software's revenue growth has been impressive over the last twelve months, growing from $111.5 million to $163.5 million.

And unsurprisingly, this was another great quarter for Coupa Software with revenue up an absolutely stunning 46.74% year on year. On top of that, revenue increased $30.58 million quarter on quarter, a very strong improvement on the $7.043 million increase in Q3 2021, and a sign of re-acceleration of growth.

Coupa Software's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 51.31% in Q4. That means that from every $1 in revenue the company had $0.51 left to spend on developing new products, marketing & sales and the general administrative overhead. This is a low gross margin for a SaaS company and it has been going down over the last year suggesting that the company might be facing some business pressure.

Key Takeaways from Coupa Software's Q4 Results

Sporting a market capitalisation of $20.34 billion, more than $606.3 million in cash and operating free cash flow positive over the last twelve months, we're confident that Coupa Software has the resources it needs to pursue a high growth business strategy.

We were impressed by how strongly Coupa Software outperformed analysts’ revenue expectations this quarter. And we were also excited to see the really strong revenue growth. On the other hand, it was disappointing to see the deterioration in gross margin and that the revenue guidance for next year was quite weak. Zooming out, we think this was still a decent, albeit mixed, quarter. Coupa Software was already worth watching for its growth, and nothing we've seen today has changed that.

The author has no position in any of the stocks mentioned.