Spend management software maker Coupa Software (NASDAQ:COUP) reported Q1 FY2022 results that beat analyst expectations, with revenue up 40% year on year to $166.9 million. Coupa Software made a GAAP loss of $100.3 million, down on its loss of $14.8 million, in the same quarter last year.

Is now the time to buy Coupa Software? Get early access to our full analysis of the earnings results here

Coupa Software (NASDAQ:COUP) Q1 FY2022 Highlights:

- Revenue: $166.9 million vs analyst estimates of $152.4 million (9.46% beat)

- EPS (non-GAAP): $0.07 vs analyst estimates of -$0.19 ($0.26 beat)

- Revenue guidance for Q2 2022 is $162.5 million at the midpoint, above analyst estimates of $161.6 million

- The company reconfirmed revenue guidance for the full year, at $682.5 million at the midpoint

- Free cash flow of $29.8 million, down 21.6% from previous quarter

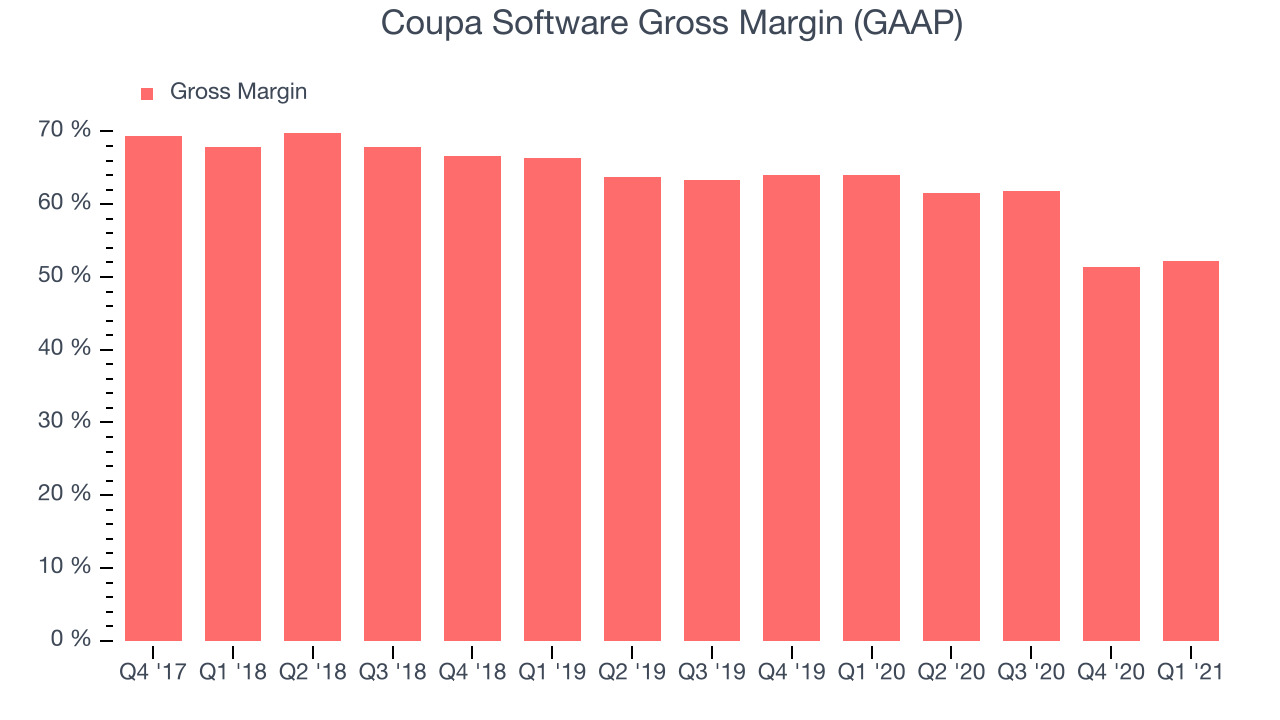

- Gross Margin (GAAP): 52.2%, up from 51.3% previous quarter

- Updated valuation: Coupa Software is down at $229 and accounting for the revenue added in Q1 it now trades at 29.2x price-to-sales (LTM), compared to 31.5x just before the results.

"During the first quarter, we delivered record revenue, generated meaningful free cash flows, and added dozens of new customers to the Coupa Community," said Rob Bernshteyn, chairman and chief executive officer at Coupa.

Savings As A Service

Founded in 2006, Coupa Software (NASDAQ:COUP) is a software as a service platform that helps enterprises manage their spendings across procurement, billing and business expenses and get a better visibility into how the money is spent. The software allows a company to setup an internal e-shop through which employees procure all goods and services they need, giving the management control over who they order from. It also offers a central cloud repository for invoices and expense claims and provides an easy to use interface through which employees can manage and resolve both. Coupa then ties all this financial data together and provides reports to help companies find potential inefficiencies and rooms for improvement.

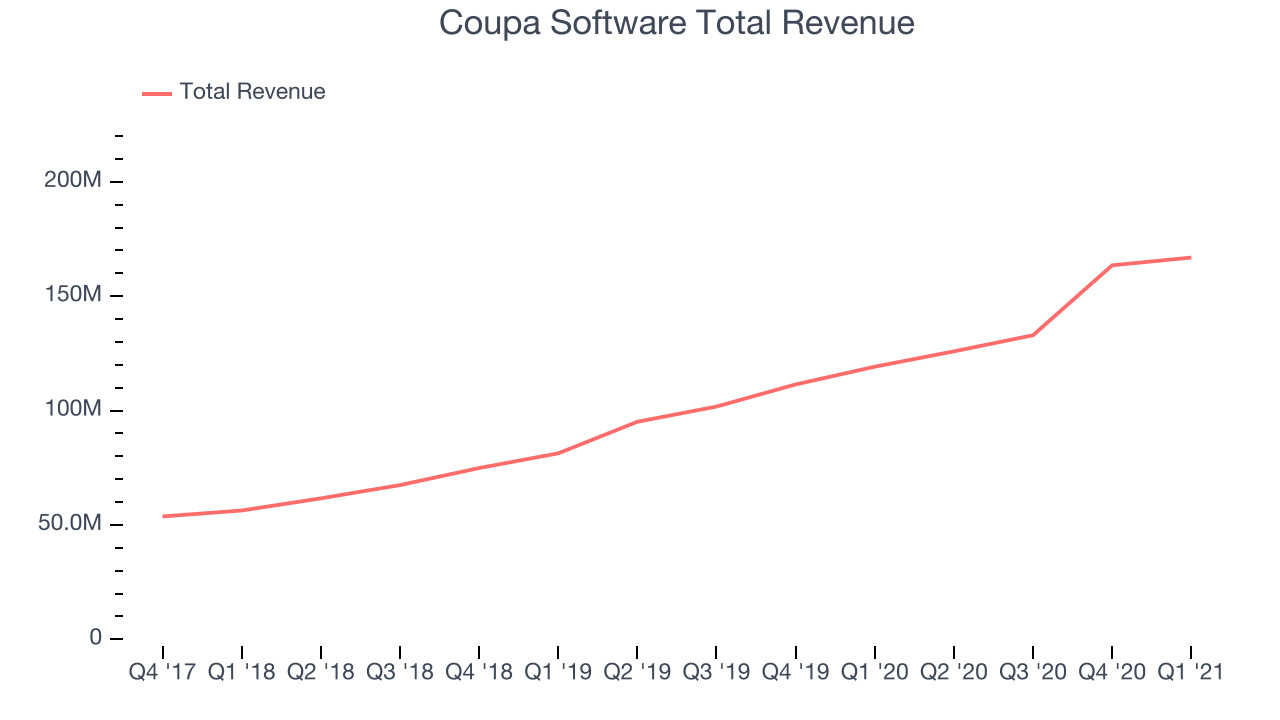

As you can see below, Coupa Software's revenue growth has been impressive over the last twelve months, growing from $119.2 million to $166.9 million.

And unsurprisingly, this was another great quarter for Coupa Software with revenue up an absolutely stunning 40% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $3.38 million in Q1, compared to $30.5 million in Q4 2021. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 80% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Coupa Software's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 52.2% in Q1. That means that for every $1 in revenue the company had $0.52 left to spend on developing new products, marketing & sales and the general administrative overhead. While it improved significantly from previous quarter this would still be considered a low gross margin for a SaaS company and we would like to see the improvements to continue.

Key Takeaways from Coupa Software's Q1 Results

Sporting a market capitalisation of $16.8 billion, more than $600.3 million in cash and operating free cash flow positive over the last twelve months, we're confident that Coupa Software has the resources it needs to pursue a high growth business strategy.

We were impressed by how strongly Coupa Software outperformed analysts’ revenue expectations this quarter. And we were also excited to see the strong revenue growth year on year, although as we mentioned it did slow down compared to Q4. Overall, we think this was a good quarter, that should leave shareholders feeling very positive. Therefore, we think Coupa Software will look more attractive to growth investors after these results.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.