Spend management software maker Coupa Software (COUP) reported Q3 FY2023 results topping analyst expectations, with revenue up 16.9% year on year to $217.3 million. Coupa made a GAAP loss of $84.1 million, improving on its loss of $88 million, in the same quarter last year.

Coupa (COUP) Q3 FY2023 Highlights:

- Revenue: $217.3 million vs analyst estimates of $213.3 million (1.88% beat)

- EPS (non-GAAP): $0.43 vs analyst estimates of $0.10 ($0.33 beat)

- Free cash flow of $196.7 million, up from $24.9 million in previous quarter

- Gross Margin (GAAP): 59.6%, up from 58.2% same quarter last year

- Coupa announced it has entered into a definitive agreement to be acquired by Thoma Bravo

Founded in 2006 by former Oracle executives, Coupa Software (COUP) is a software as a service platform that helps enterprises manage their spending across procurement, billing and business expenses and get a better visibility into how the money is spent.

The software allows a company to set up an internal e-shop through which employees procure all goods and services they need, giving the management control over who they order from. It also offers a central cloud repository for invoices and expense claims and provides an easy to use interface through which employees can manage and resolve both. Coupa then ties all this financial data together and provides reports to help companies find potential inefficiencies and rooms for improvement.

The company continues to expand its capabilities via its robust integration with third-party sales and finance platforms.

The adoption of financial technology software is propelled by an ongoing drive to reduce costs. The combination of rising transactions volumes and global supply chain complexity is driving demand for cloud based spend management platforms able to integrate the two.

Competitors in the spend management space include Workday (NASDAQ:WDAY), SAP (NYSE:SAP), Oracle (NYSE:ORCL) and Basware.

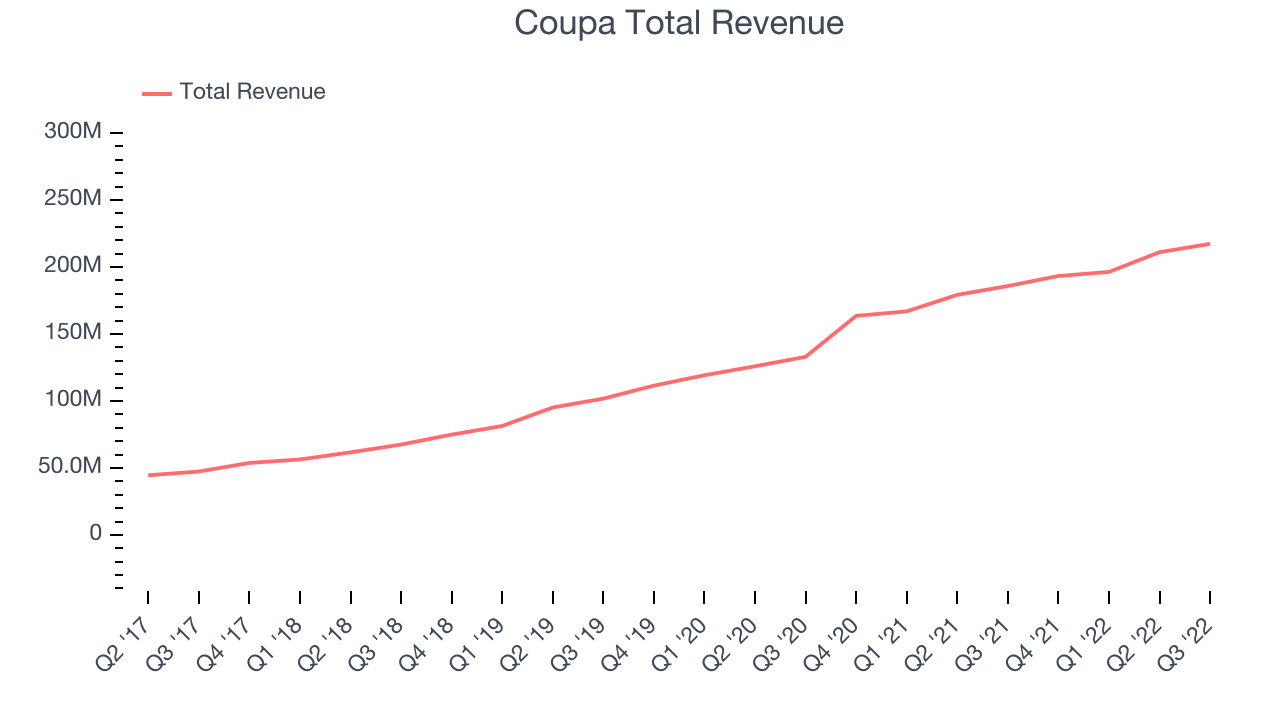

Sales Growth

As you can see below, Coupa's revenue growth has been strong over the last two years, growing from quarterly revenue of $132.9 million in Q3 FY2021, to $217.3 million.

This quarter, Coupa's quarterly revenue was once again up 16.9% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $6.23 million in Q3, compared to $14.7 million in Q2 2023. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

Ahead of the earnings results the analysts covering the company were estimating sales to grow 15.8% over the next twelve months.

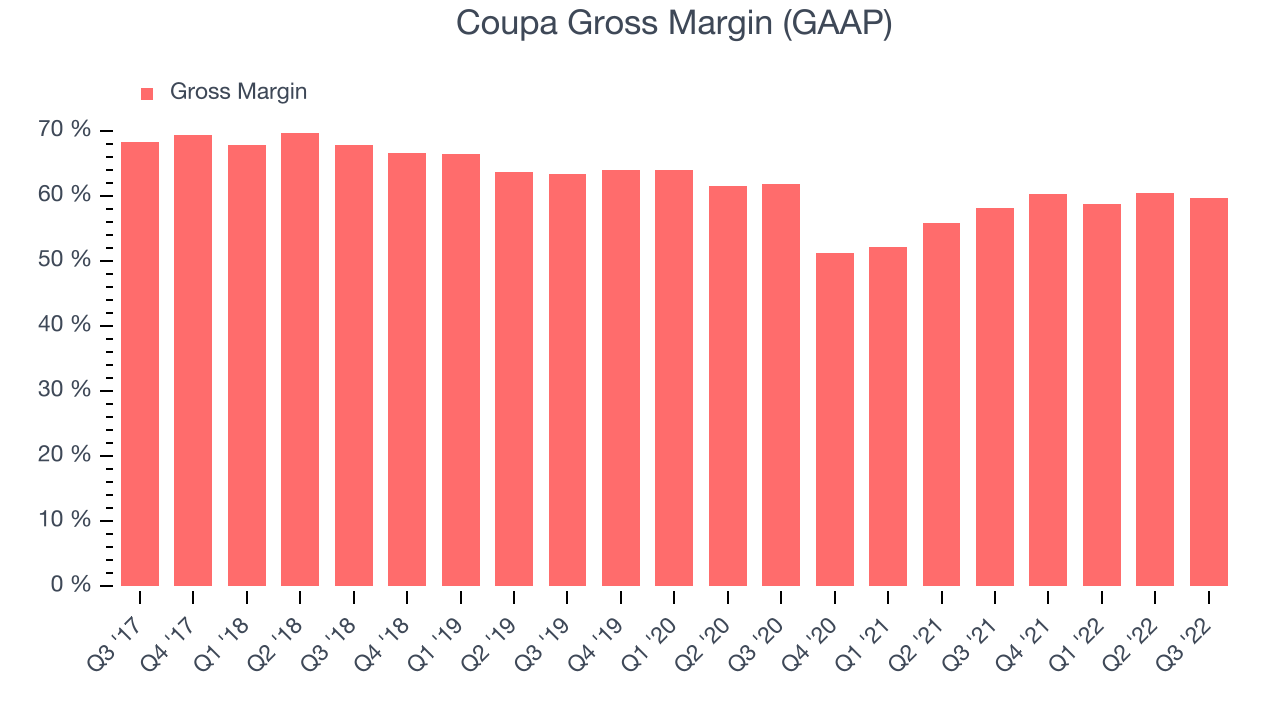

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Coupa's gross profit margin, an important metric measuring how much money there is left after paying for servers, licenses, technical support and other necessary running expenses was at 59.6% in Q3.

That means that for every $1 in revenue the company had $0.59 left to spend on developing new products, marketing & sales and the general administrative overhead. This would be considered a low gross margin for a SaaS company and it has dropped significantly from the previous quarter, which is probably the opposite of what shareholders would like it to do.

Cash Is King

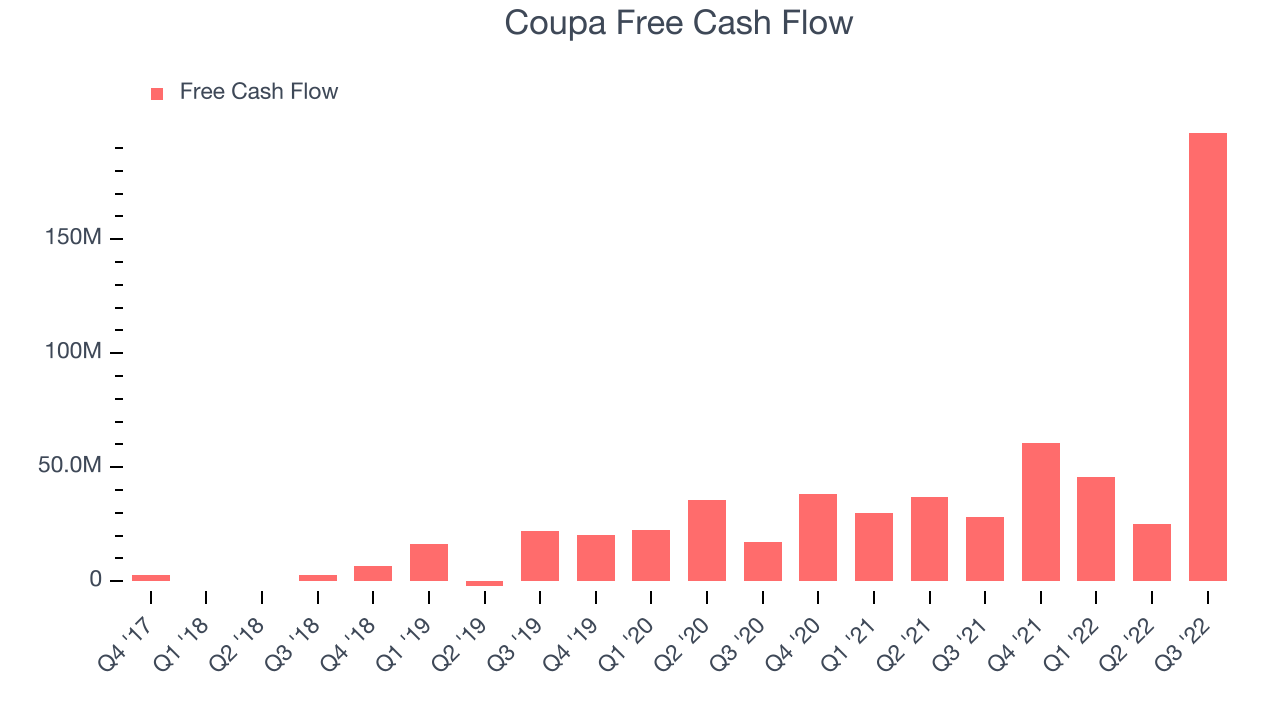

If you have followed StockStory for a while, you know that we put an emphasis on cash flow. Why, you ask? We believe that in the end cash is king, as you can't use accounting profits to pay the bills. Coupa's free cash flow came in at $196.7 million in Q3, up 596% year on year.

Coupa has generated $327.8 million in free cash flow over the last twelve months, an impressive 40% of revenues. This robust FCF margin is a result of Coupa asset lite business model, scale advantages, and strong competitive positioning, and provides it the option to return capital to shareholders while still having plenty of cash to invest in the business.

Key Takeaways from Coupa's Q3 Results

With a market capitalization of $4.71 billion Coupa is among smaller companies, but its more than $860.1 million in cash and positive free cash flow over the last twelve months give us confidence that Coupa has the resources it needs to pursue a high growth business strategy.

Coupa topped analysts’ revenue expectations this quarter, even if just narrowly. That feature of these results really stood out as a positive. On the other hand, there was a deterioration in gross margin and revenue growth is slower these days. Overall, this quarter's results could have been better. The company is up 27.1% on the Thoma Bravo acquisition news and currently trades at $78.95 per share.

Is Now The Time?

When considering Coupa, investors should take into account its valuation and business qualities, as well as what happened in the latest quarter. Although Coupa is not a bad business, it probably wouldn't be one of our picks. Its revenue growth has been strong, though we don't expect it to maintain historical growth rates. But while its bountiful generation of free cash flow empowers it to invest in growth initiatives, unfortunately its gross margins show its business model is much less lucrative than the best software businesses.

Coupa's price to sales ratio based on the next twelve months is 5.0x, suggesting that the market has lower expectations of the business, relative to the high growth tech stocks. We don't really see a big opportunity in the stock at the moment, but in the end beauty is in the eye of the beholder. And if you like the company, it seems that Coupa doesn't trade at a completely unreasonable price point.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds from the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.