Used-car retailer America’s Car-Mart (NASDAQ:CRMT) fell short of analysts' expectations in Q3 FY2024, with revenue down 8.2% year on year to $299.6 million. It made a GAAP loss of $1.34 per share, down from its profit of $0.23 per share in the same quarter last year.

America's Car-Mart (CRMT) Q3 FY2024 Highlights:

- Revenue: $299.6 million vs analyst estimates of $351 million (14.6% miss)

- EPS: -$1.34 vs analyst estimates of -$0.65 (-$0.69 miss)

- Free Cash Flow of $9.73 million is up from -$36.28 million in the same quarter last year

- Gross Margin (GAAP): 17.3%, down from 17.7% in the same quarter last year

- Same-Store Sales were down 9.3% year on year

- Store Locations: 154 at quarter end, decreasing by 1 over the last 12 months

- Interest Income: 9.8% of revenue, up from 15.7% in the same quarter last year

- Market Capitalization: $398.3 million

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

This core customer is usually a credit-constrained consumer who may have difficulty securing financing from traditional lenders such as banks. These customers may have poor or limited credit histories, which traditional lenders rely on to underwrite auto loans. America’s Car-Mart’s ‘buy here, pay here’ model addresses these difficulties. In this model, the dealership acts as both the seller of the vehicle and the financier, allowing a customer to purchase a car directly from America’s Car-Mart and make their payments directly to the company rather than a bank or other finance provider.

America’s Car-Mart locations are 8,000 to 10,000 square feet with ample outdoor space to display used cars for sale. These locations are primarily located in smaller cities and towns, especially ones with credit-challenged and likely lower-income populations. While the company does have an e-commerce presence, it was only established in 2020 and physical locations remain the primary avenue for doing business.

Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Competitors in the auto retail space include AutoNation (NYSE:AN), CarMax (NYSE:KMX), and Group 1 Automotive (NYSE:GPI).Sales Growth

America's Car-Mart is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

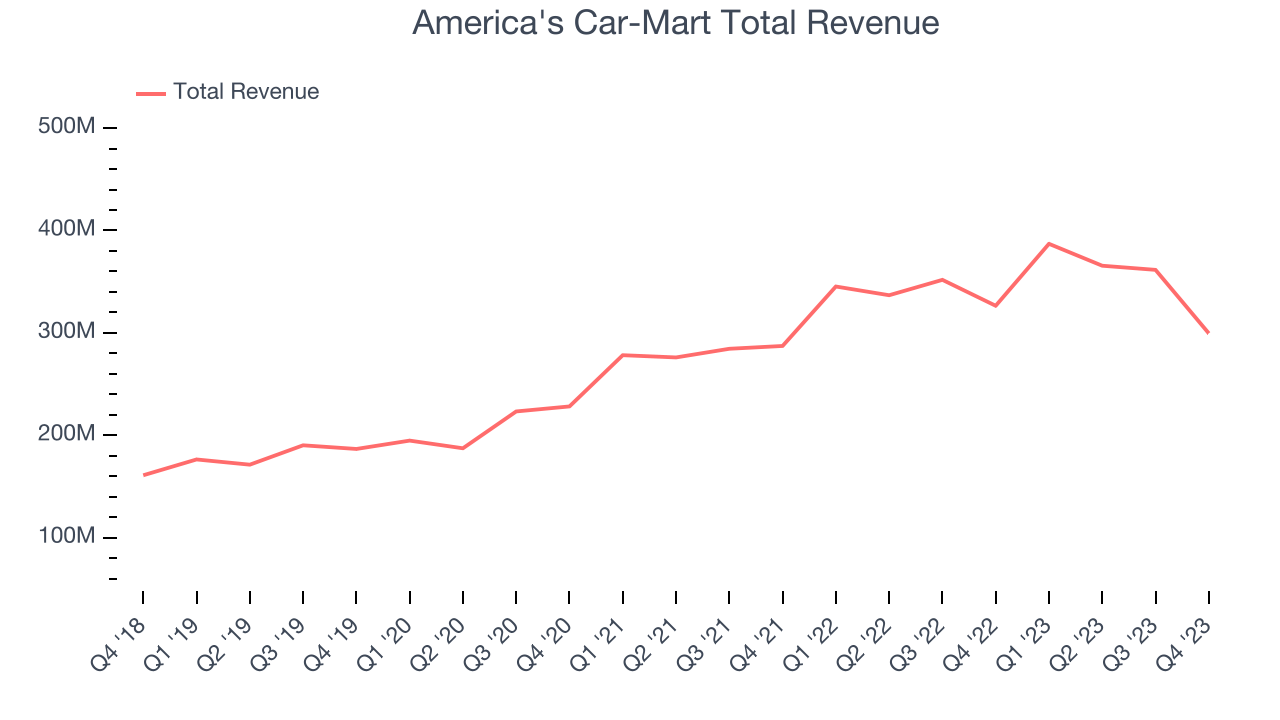

As you can see below, the company's annualized revenue growth rate of 18.2% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was excellent despite not opening many new stores, implying that growth was driven by increased sales at existing, established stores.

This quarter, America's Car-Mart missed Wall Street's estimates and reported a rather uninspiring 8.2% year-on-year revenue decline, generating $299.6 million in revenue. Looking ahead, Wall Street expects sales to grow 5.7% over the next 12 months, an acceleration from this quarter.

Number of Stores

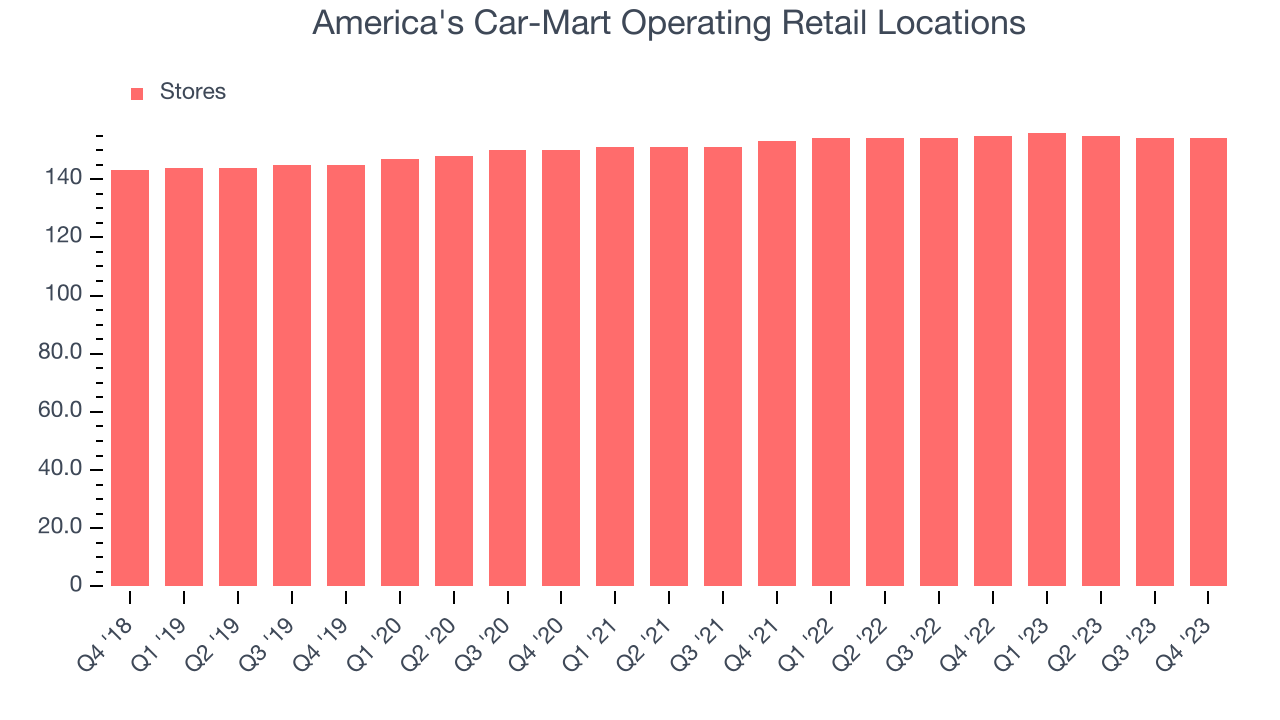

A retailer's store count is a crucial factor influencing how much it can sell, and store growth is a critical driver of how quickly its sales can grow.

When a retailer like America's Car-Mart keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. As of the most recently reported quarter, America's Car-Mart operated 154 total retail locations, in line with its store count a year ago.

Taking a step back, the company has kept its physical footprint more or less flat over the last two years while other consumer retail businesses have opted for growth. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

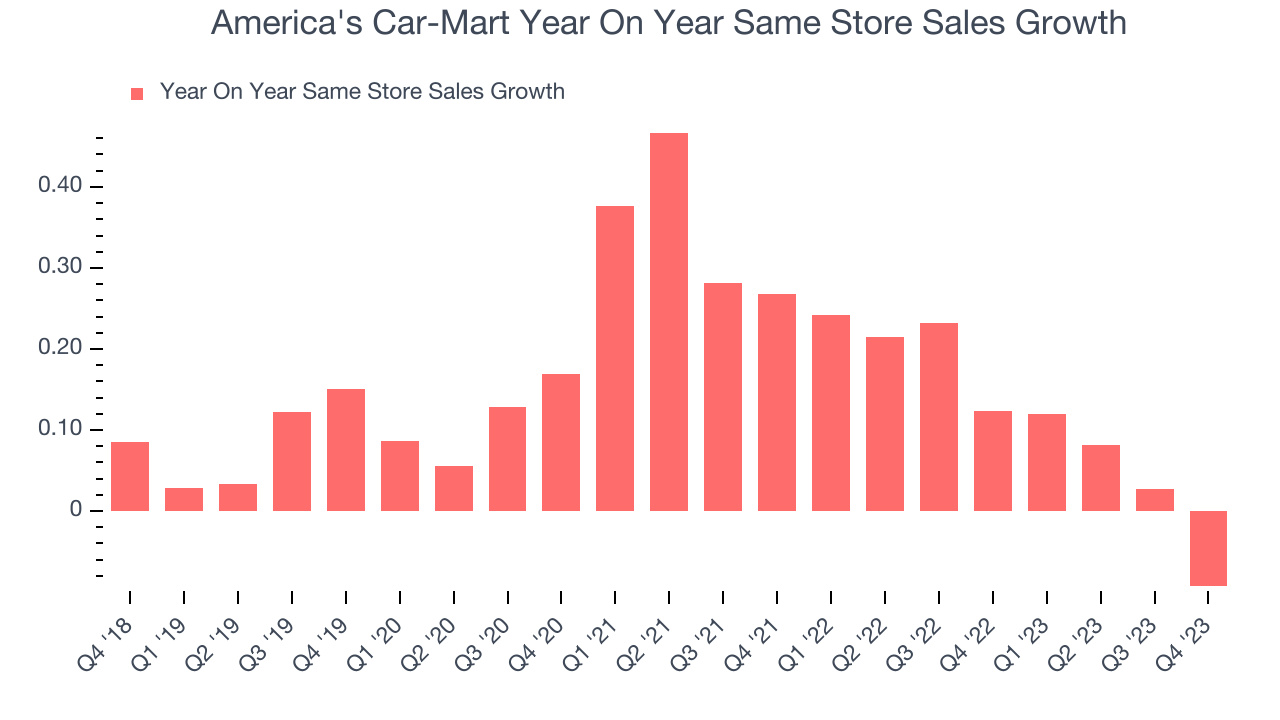

Same-Store Sales

America's Car-Mart has generated solid demand for its products over the last two years. On average, the company's same-store sales have grown by a healthy 11.9% year on year. Given its flat store count over the same period, this performance stems from increased foot traffic at existing stores or higher e-commerce sales as the company shifts demand from in-store to online.

In the latest quarter, America's Car-Mart's same-store sales fell 9.3% year on year. This decline was a reversal from the 12.3% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

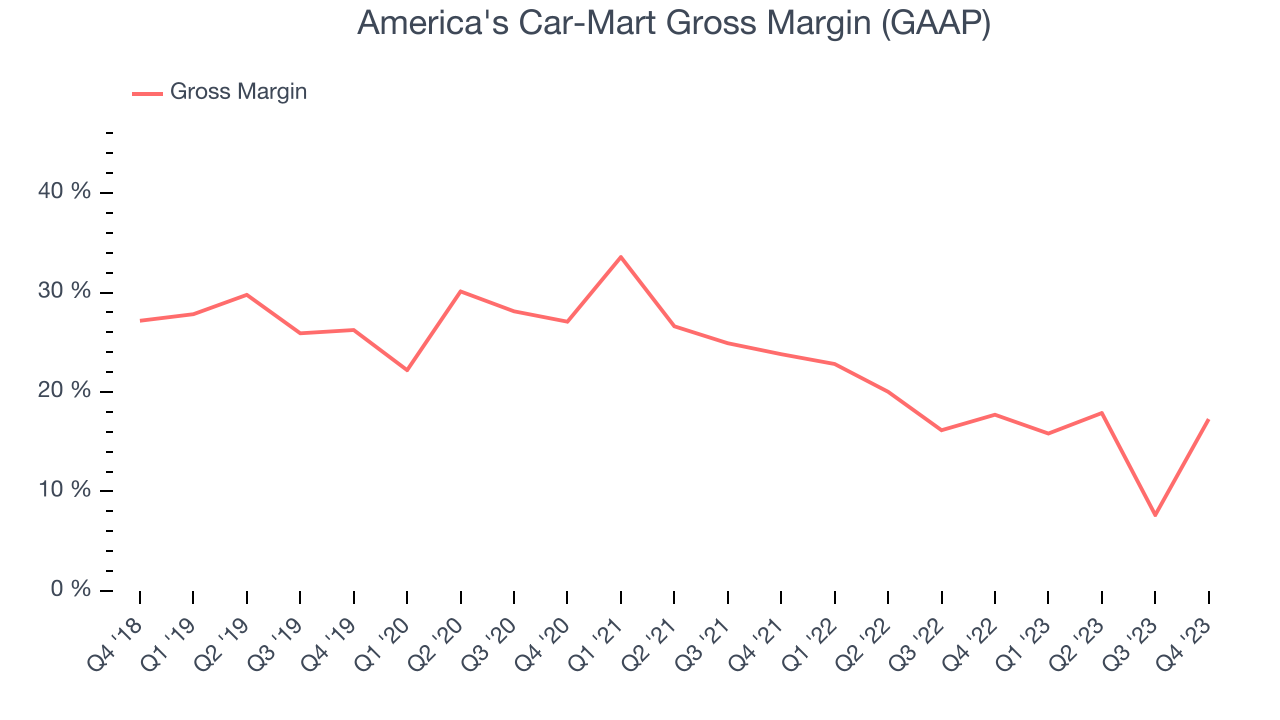

Gross Margin & Pricing Power

America's Car-Mart has poor unit economics for a retailer, leaving it with little room for error if things go awry. As you can see below, it's averaged a 16.8% gross margin over the last two years. This means the company makes $0.17 for every $1 in revenue before accounting for its operating expenses.

America's Car-Mart's gross profit margin came in at 17.3% this quarter, flat with the same quarter last year. This steady margin stems from its efforts to keep prices low for consumers and signals that it has stable input costs (such as freight expenses to transport goods).

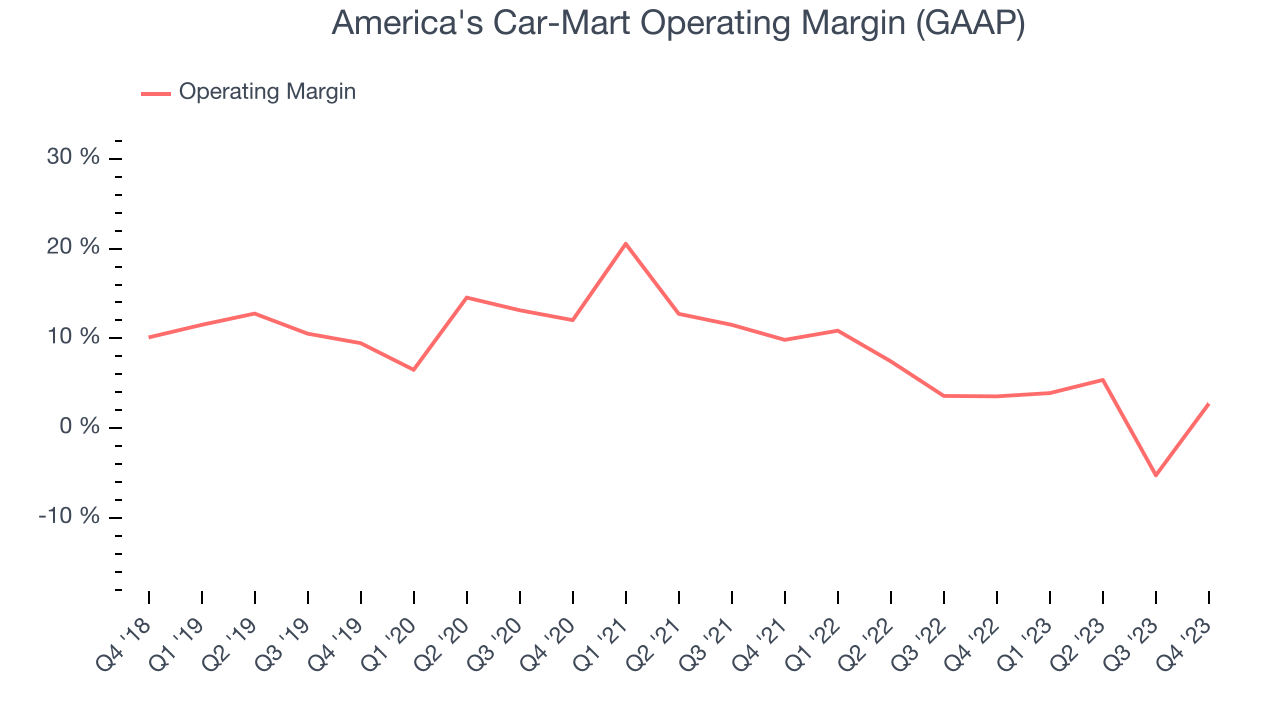

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q3, America's Car-Mart generated an operating profit margin of 2.7%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, America's Car-Mart was profitable over the last two years but held back by its large expense base. Its average operating margin of 4% has been paltry for a consumer retail business. On top of that, America's Car-Mart's margin has declined, on average, by 4.7 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Zooming out, America's Car-Mart was profitable over the last two years but held back by its large expense base. Its average operating margin of 4% has been paltry for a consumer retail business. On top of that, America's Car-Mart's margin has declined, on average, by 4.7 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

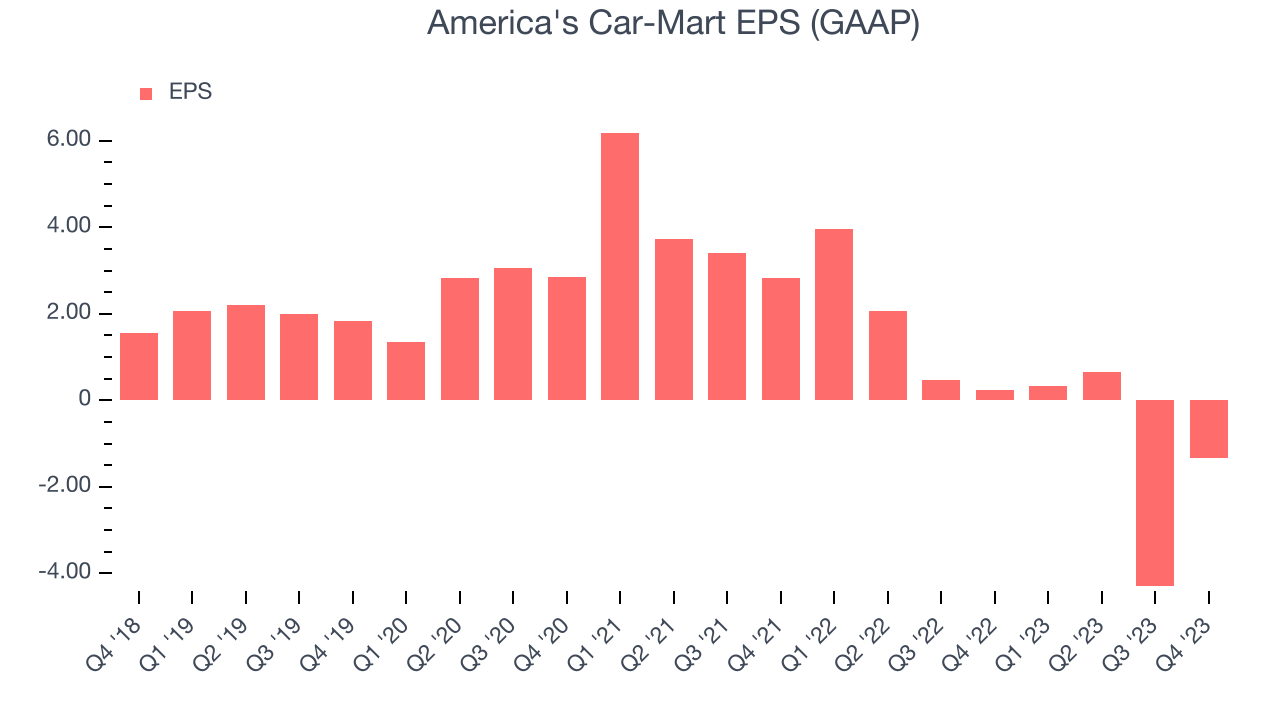

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q3, America's Car-Mart reported EPS at negative $1.34, down from $0.23 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2020 and FY2024, America's Car-Mart's adjusted diluted EPS dropped 71.1%, translating into 26.7% annualized declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 189% year-on-year increase in EPS.

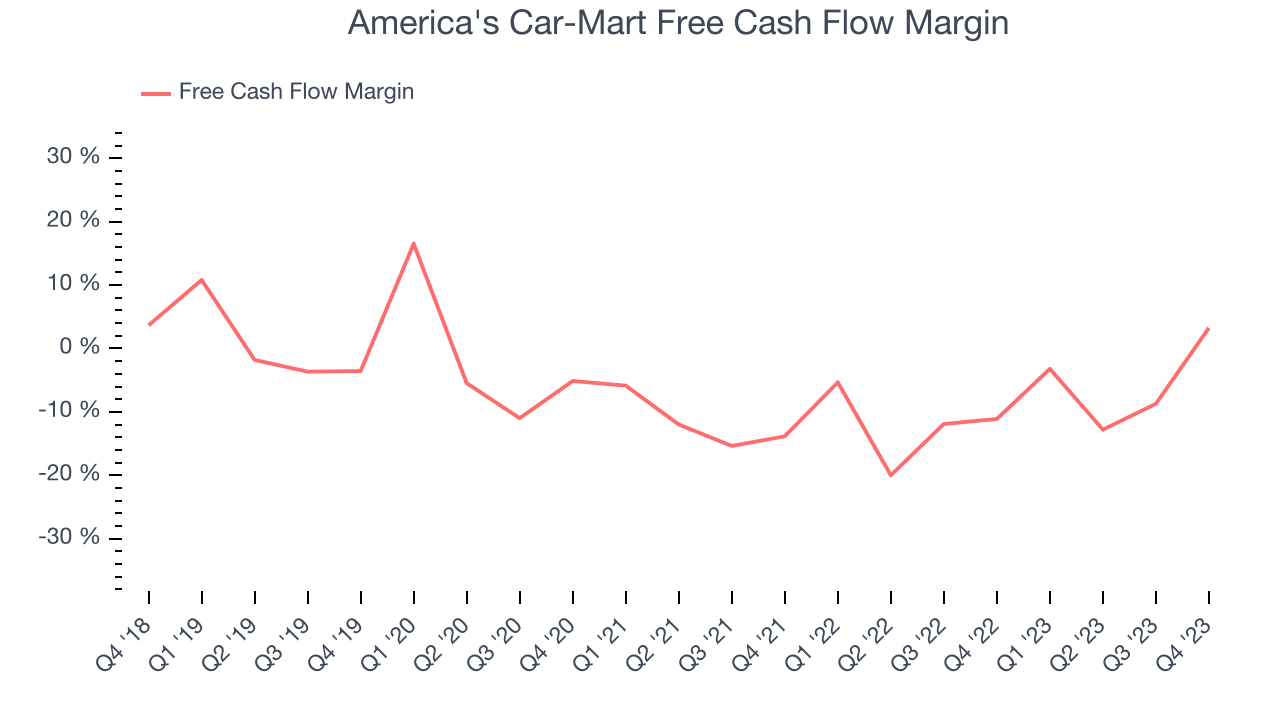

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

America's Car-Mart's free cash flow came in at $9.73 million in Q3, representing a 3.2% margin and flipping from negative in the same quarter last year to positive this quarter. Seasonal factors aside, this was great for the business.

While America's Car-Mart posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, America's Car-Mart's capital-intensive business model and demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer retail sector, averaging negative 8.8%. However, its margin has averaged year-on-year increases of 6.3 percentage points, showing the company is at least improving.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

America's Car-Mart's five-year average ROIC was 10.8%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, America's Car-Mart's ROIC over the last two years averaged 9.3 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from America's Car-Mart's Q3 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed analysts' expectations as its sales volumes fell short (11,664 retail units sold vs Wall Street estimates of 14,523). Its gross margin also missed estimates. On the bright side, the management team noted its financing division is doing well thanks to higher interest rates. Interest income was up 16% year on year and clocked in at 19.8% of revenue, up from 15.7% in the same quarter last year. Overall, the results could have been better. The company is down 5.3% on the results and currently trades at $59 per share.

Is Now The Time?

America's Car-Mart may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of America's Car-Mart, we'll be cheering from the sidelines. Although its revenue growth has been impressive over the last four years, its declining EPS over the last four years makes it hard to trust. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

America's Car-Mart's price-to-earnings ratio based on the next 12 months is 14.9x. While we've no doubt one can find things to like about America's Car-Mart, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $62 per share right before these results (compared to the current share price of $59).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.