Cybersecurity company Crowdstrike (NASDAQ:CRWD) reported Q1 FY2022 results beating Wall St's expectations, with revenue up 70% year on year to $302.8 million. Crowdstrike made a GAAP loss of $82.8 million, down on its loss of $19.2 million, in the same quarter last year.

Is now the time to buy Crowdstrike? Get early access to our full analysis of the earnings results here

Crowdstrike (NASDAQ:CRWD) Q1 FY2022 Highlights:

- Revenue: $302.8 million vs analyst estimates of $291.7 million (3.79% beat)

- EPS (non-GAAP): $0.10 vs analyst estimates of $0.06 ($0.04 beat)

- Revenue guidance for Q2 2022 is $321.3 million at the midpoint, above analyst estimates of $311.5 million

- The company lifted revenue guidance for the full year, from $1.31 billion to $1.35 billion at the midpoint, a 3.1% increase

- Free cash flow of $117.3 million, up 20.4% from previous quarter

- Customers: 11,420, up from 9,896 in previous quarter

- Gross Margin (GAAP): 74%, in line with previous quarter

- Updated valuation: Crowdstrike is up slightly at $220.05 and accounting for the revenue added in Q1 it now trades at 48.5x price-to-sales (LTM), compared to 54.8x just before the results.

“CrowdStrike kicked off the new fiscal year with strong momentum and delivered outstanding first quarter results that exceeded our expectations. We saw strength in multiple areas of the business, added $144 million in net new ARR in the quarter and grew ending ARR 74% year-over-year to exceed $1.19 billion. The CrowdStrike name has become synonymous with best-in-class cybersecurity protection and a platform that just works. Customers of all sizes are increasingly choosing CrowdStrike as their security platform of record with 1,524 net new subscription customers added in the quarter and half of total subscription customers now adopting at least five cloud modules. We believe the robust demand environment driven by secular trends, such as digital and security transformation, cloud adoption and a heightened threat environment, provides a runway for long-term sustainable growth,” said George Kurtz, CrowdStrike’s co-founder and chief executive officer.

Modern Cybersecurity

The story of Crowdstrike starts in 2011 when the founder George Kurtz watched a fellow plane passenger turn his laptop on and wait 15 minutes for the antivirus software to stop scanning before he could use the computer.

Crowdstrike (NASDAQ:CRWD) is a cybersecurity software as a service that protects companies from breaches and detects and responds to attacks. Unlike the legacy antivirus products which are typically rules based and on-premise, Crowdstrike's Falcon platform is cloud-based and uses prevention-and-detection technology based on machine-learning and artificial intelligence that looks for behavioral attack patterns and indicators of attack to identify bad actors. As a result it is easier and cheaper to deploy, it works on any device and it has superior efficacy rates in detecting threats compared to the legacy competitors.

The overall demand for cybersecurity has been increasing as companies move their systems and data into cloud and work is becoming more distributed.

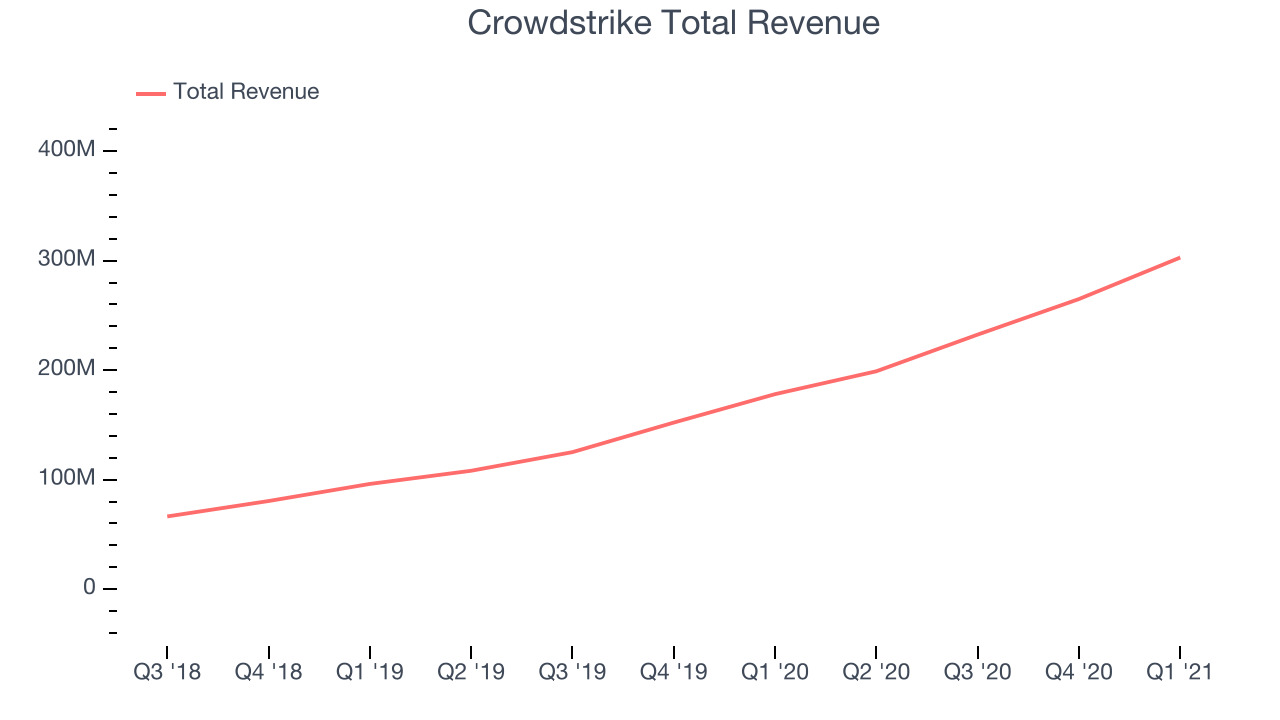

As you can see below, Crowdstrike's revenue growth has been incredible over the last twelve months, growing from $178 million to $302.8 million.

This was another standout quarter with the revenue up a splendid 70% year on year. On top of that, revenue increased $37.9 million quarter on quarter, a solid improvement on the $32.4 million increase in Q4 2021, and happily, a slight acceleration of growth.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 80% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Crowdstrike Grows With Its Customers

For any software-as-a-service company new customers typically mean new predictable revenue streams. But for Crowdstrike they also mean a better product, because Falcon’s machine learning algorithms get better at predicting and identifying breaches as more customers use it.

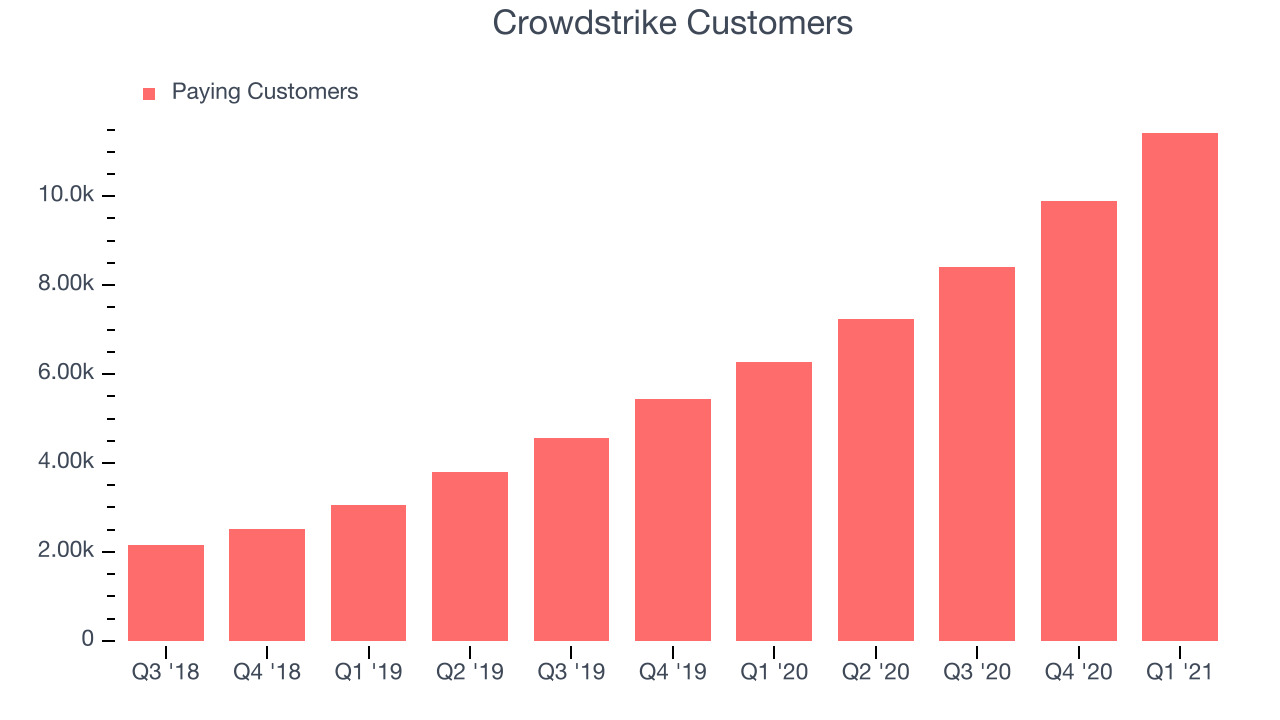

You can see below that Crowdstrike reported 11,420 customers at the end of the quarter, an increase of 1,524 on last quarter. That's about the same customer growth as what we seen last quarter and quite a bit again above what we have typically seen over the last year, confirming the company is sustaining a good pace of sales.

Key Takeaways from Crowdstrike's Q1 Results

With market capitalisation of $49.7 billion, more than $1.68 billion in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

We were impressed by the exceptional revenue growth Crowdstrike delivered this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Overall, we think this was a really good quarter, that should leave shareholders feeling very positive. While the market has high expectations of Crowdstrike we think it will continue to stand out as a very compelling growth stock, arguably even more so than before.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.