Cybersecurity company CrowdStrike (NASDAQ:CRWD) reported Q4 FY2022 results that beat analyst expectations, with revenue up 62.6% year on year to $431 million. On top of that, guidance for next quarter's revenue was surprisingly good, being $462.1 million at the midpoint, 4.85% above what analysts were expecting. CrowdStrike made a GAAP loss of $41.7 million, down on its loss of $19 million, in the same quarter last year.

Is now the time to buy CrowdStrike? Access our full analysis of the earnings results here, it's free.

CrowdStrike (CRWD) Q4 FY2022 Highlights:

- Revenue: $431 million vs analyst estimates of $412.3 million (4.51% beat)

- EPS (non-GAAP): $0.30 vs analyst estimates of $0.20 (47.8% beat)

- Revenue guidance for Q1 2023 is $462.1 million at the midpoint, above analyst estimates of $440.7 million

- Management's revenue guidance for upcoming financial year 2023 is $2.14 billion at the midpoint, beating analyst estimates by 6.8% and predicting 47.9% growth (vs 66.4% in FY2022)

- Free cash flow of $127.3 million, roughly flat from previous quarter

- Customers: 16,325, up from 14,687 in previous quarter

- Gross Margin (GAAP): 73.8%, down from 74.8% same quarter last year

"CrowdStrike once again delivered an exceptional fourth quarter and capped off a record year, achieving new milestones across both the top and bottom line. ” said George Kurtz, CrowdStrike’s co-founder and chief executive officer.

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

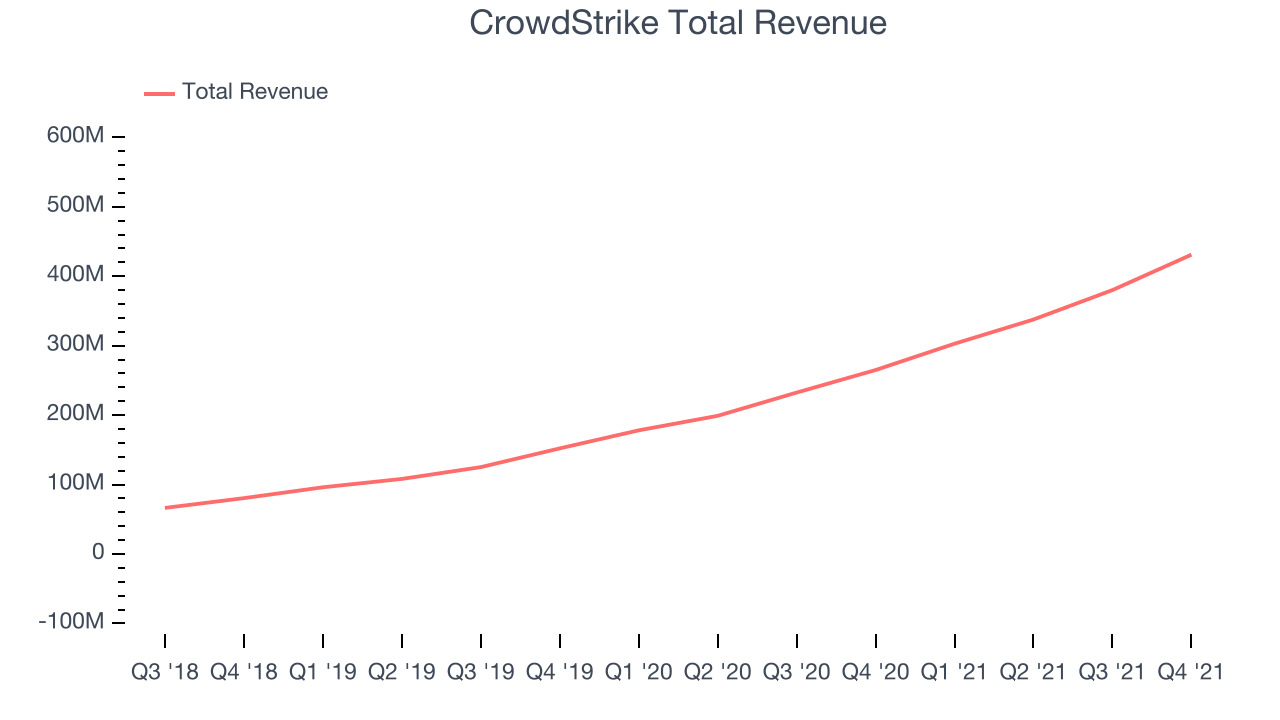

Sales Growth

As you can see below, CrowdStrike's revenue growth has been incredible over the last year, growing from quarterly revenue of $264.9 million, to $431 million.

This was another standout quarter with the revenue up a splendid 62.6% year on year. On top of that, revenue increased $50.9 million quarter on quarter, a very strong improvement on the $42.3 million increase in Q3 2022, and a sign of re-acceleration of growth, which is very nice to see indeed.

Guidance for the next quarter indicates CrowdStrike is expecting revenue to grow 52.6% year on year to $462.1 million, slowing down from the 70% year-over-year increase in revenue the company had recorded in the same quarter last year. For the upcoming financial year management expects revenue to be $2.14 billion at the midpoint, growing 47.9% compared to 66.4% increase in FY2022.

There are others doing even better than CrowdStrike. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

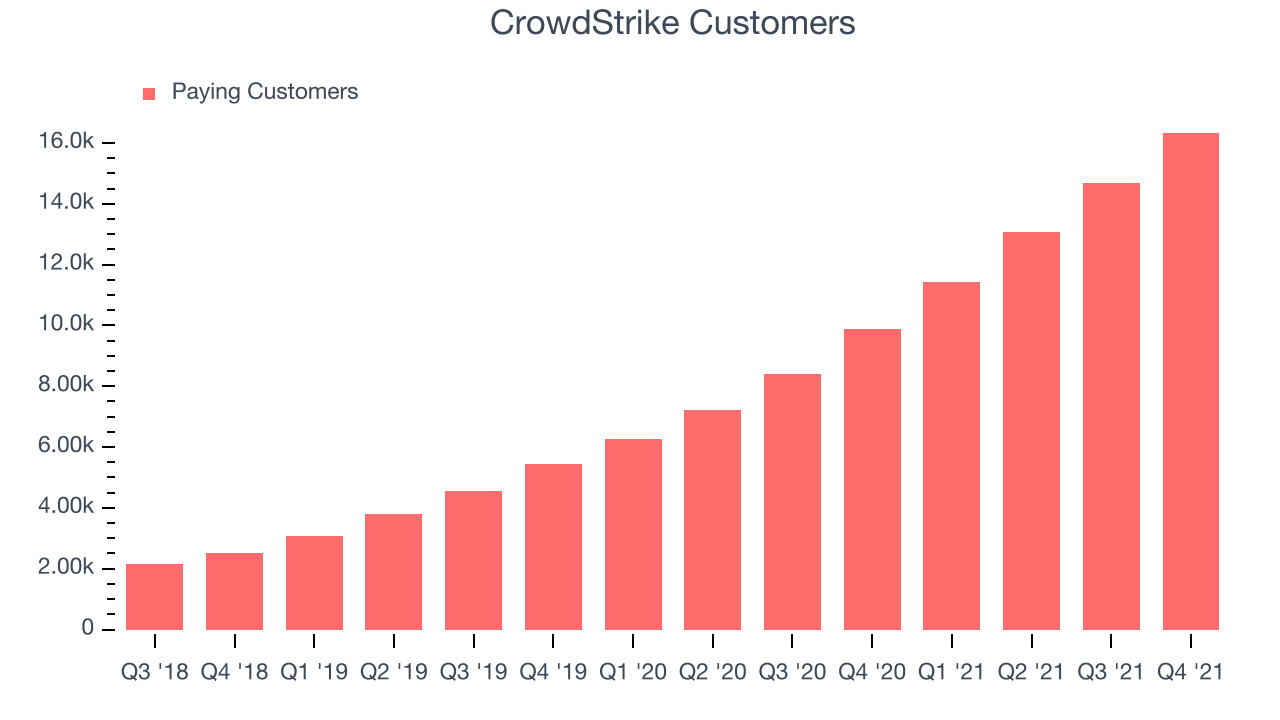

Customer Growth

You can see below that CrowdStrike reported 16,325 customers at the end of the quarter, an increase of 1,638 on last quarter. That's in line with the customer growth we have seen over the last couple of quarters, suggesting that the company can maintain its current sales momentum.

Key Takeaways from CrowdStrike's Q4 Results

Sporting a market capitalization of $35.9 billion, more than $1.99 billion in cash and with positive free cash flow over the last twelve months, we're confident that CrowdStrike has the resources it needs to pursue a high growth business strategy.

We were impressed by the exceptional revenue growth CrowdStrike delivered this quarter. And we were also glad that the revenue guidance for the rest of the year exceeded expectations. On the other hand, it was a little less exciting that the revenue guidance for next year indicated the growth will be slowing down. Overall, we think this was still a really good quarter, that should leave shareholders feeling very positive. The company is up 12.6% on the results and currently trades at $191.54 per share.

Should you invest in CrowdStrike right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.