Cybersecurity company CrowdStrike (NASDAQ:CRWD) reported results in line with analysts' expectations in Q2 FY2024, with revenue up 36.7% year on year to $731.6 million. The company also expects next quarter's revenue to be around $776.7 million, in line with analysts' estimates. Turning to EPS, CrowdStrike made a non-GAAP profit of $0.74 per share, improving from its profit of $0.36 per share in the same quarter last year.

Is now the time to buy CrowdStrike? Find out by accessing our full research report, it's free.

CrowdStrike (CRWD) Q2 FY2024 Highlights:

- Revenue: $731.6 million vs analyst estimates of $724.4 million (1% beat)

- EPS (non-GAAP): $0.74 vs analyst estimates of $0.56 (32.7% beat)

- Revenue Guidance for Q3 2024 is $776.7 million at the midpoint, roughly in line with what analysts were expecting

- The company slightly raised its revenue guidance for the full year, and it now stands at $3.04 billion at the midpoint

- Free Cash Flow of $188.7 million, down 17% from the previous quarter

- Gross Margin (GAAP): 75%, up from 73.7% in the same quarter last year

“CrowdStrike delivered strong growth at scale, exceeding our guidance across both top and bottom line metrics in the second quarter,” said George Kurtz, CrowdStrike's president, chief executive officer and co-founder.

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

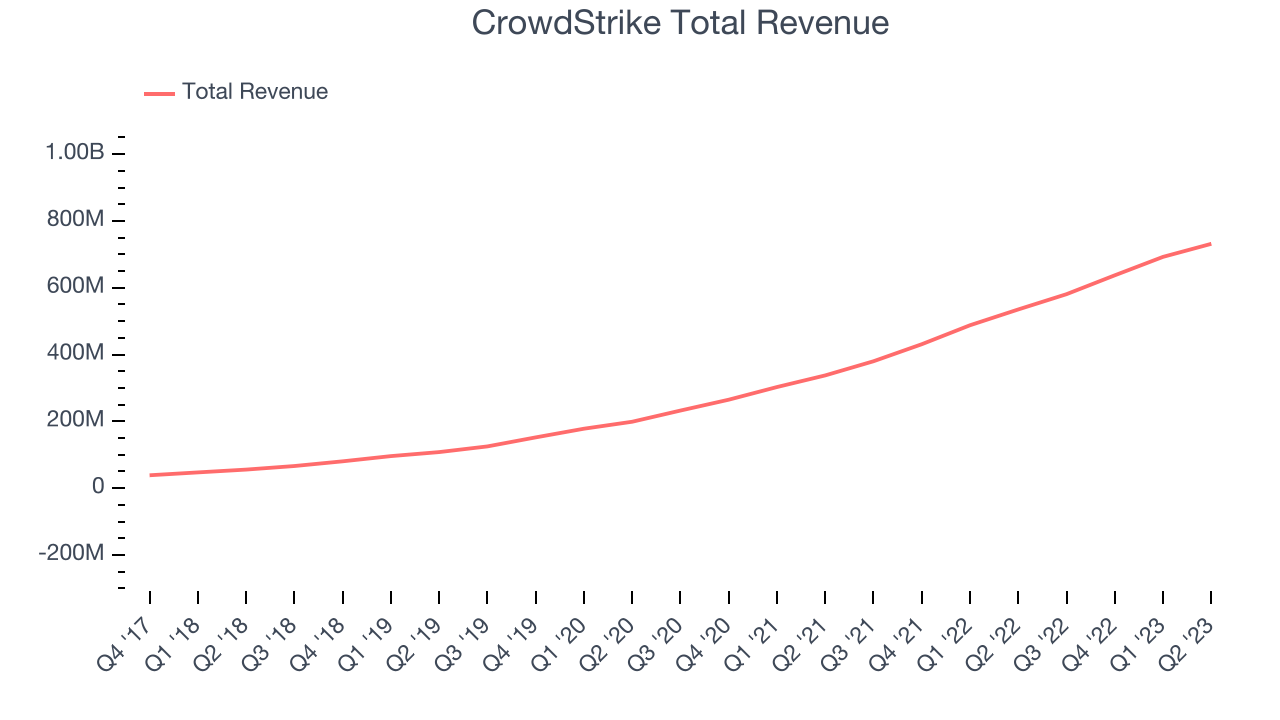

Sales Growth

As you can see below, CrowdStrike's revenue growth has been exceptional over the last two years, growing from $337.7 million in Q2 FY2022 to $731.6 million this quarter.

Unsurprisingly, this was another great quarter for CrowdStrike with revenue up 36.7% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $39 million in Q2 compared to $55.2 million in Q1 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that CrowdStrike is expecting revenue to grow 33.7% year on year to $776.7 million, slowing down from the 52.8% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 30.1% over the next 12 months before the earnings results announcement.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

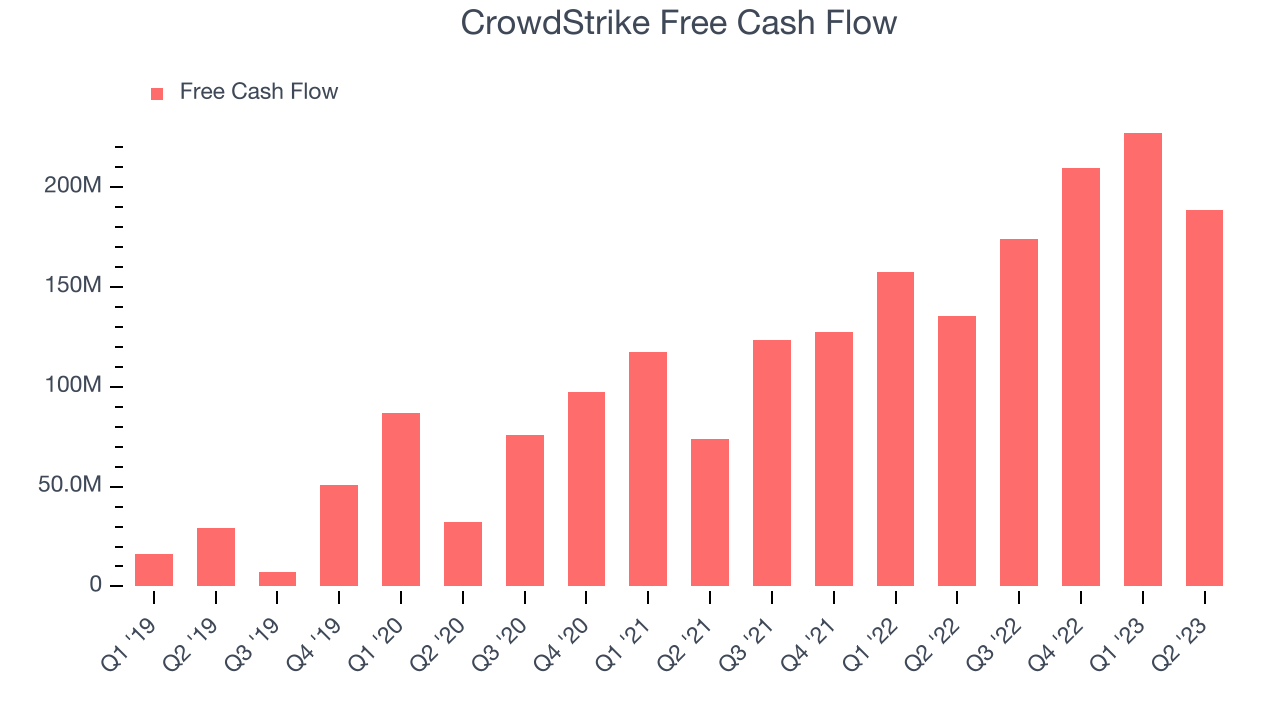

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. CrowdStrike's free cash flow came in at $188.7 million in Q2, up 39% year on year.

CrowdStrike has generated $799.7 million in free cash flow over the last 12 months, an eye-popping 30.4% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from CrowdStrike's Q2 Results

Sporting a market capitalization of $34.8 billion, more than $3.17 billion in cash on hand, and positive free cash flow over the last 12 months, we believe that CrowdStrike is attractively positioned to invest in growth.

Revenue beat slightly and non-GAAP operating profit beat more handily. Guidance for the next quarter was in line for revenue but above for non-GAAP operating profit. Full year guidance was raised. Some minor negatives included ARR (annual recurring revenue, a leading indicator of revenue) that was just in line. Investors were likely expecting more, and the stock is down 1.05% after reporting, trading at $147.7 per share.

So should you invest in CrowdStrike right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.