As we are wrapping up Q2 earnings coverage, we look at the results and key takeaways for the cybersecurity stocks, including CrowdStrike (NASDAQ:CRWD) and its peers.

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in insecure environments are also contributing to increasing demand for modern cybersecurity software.

The 10 cybersecurity stocks we track reported a strong Q2; on average, revenues beat analyst consensus estimates by 6.73%, while on average next quarter revenue guidance was 3.58% above consensus. On average the share price was down 3.31% the day after the earnings.

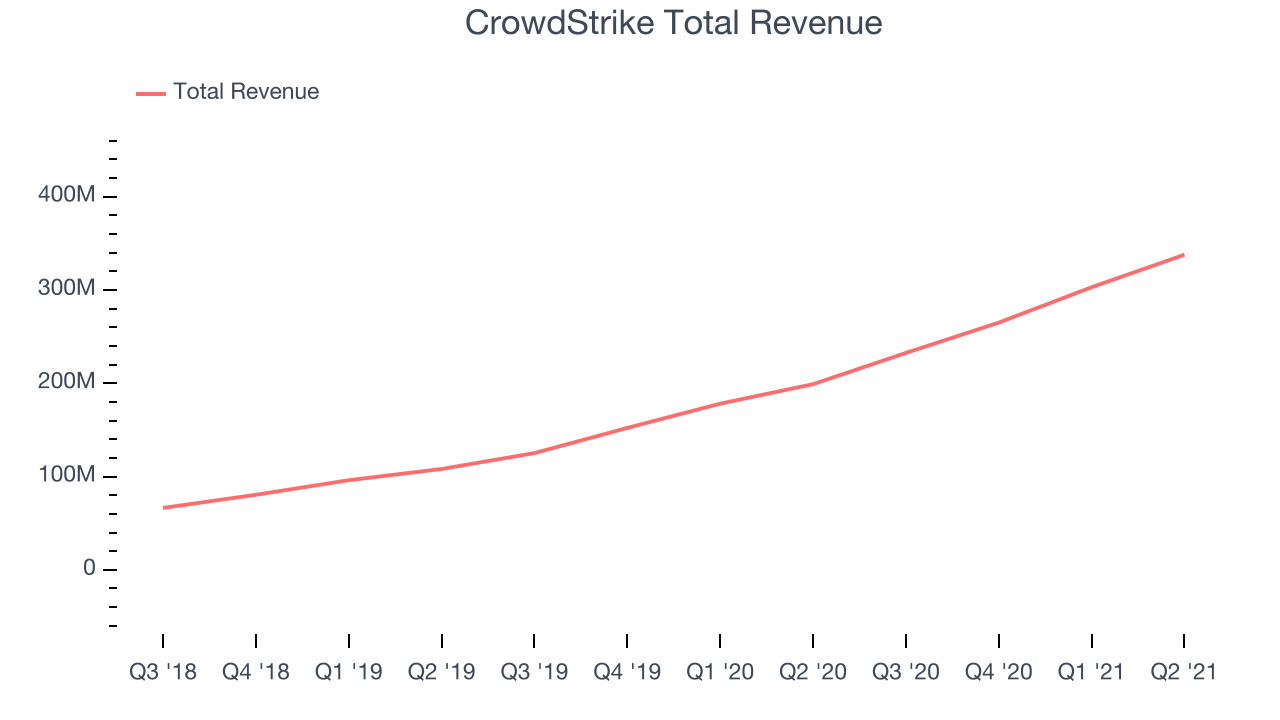

CrowdStrike (NASDAQ:CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $337.6 million, up 69.7% year on year, beating analyst expectations by 4.37%. It was a strong quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the next quarter.

"CrowdStrike delivered an outstanding second quarter with rapid subscription revenue growth and record net new ARR generated in the quarter. We saw strength in multiple areas of the business, added $151 million in net new ARR and grew ending ARR 70% year-over-year to exceed $1.34 billion. The success of our platform strategy and our growing brand leadership have led to a groundswell of customers turning to CrowdStrike as their trusted security platform of record. We believe that our extensible Falcon platform, purpose-built to leverage the power of the cloud, collecting data once and reusing it many times, is a fundamental cornerstone to building a durable growth business over the long-term," said George Kurtz, CrowdStrike’s co-founder and chief executive officer.

The stock is down 3.9% since the results and currently trades at $261.

Read why we think that CrowdStrike is one of the best cybersecurity stocks, our full report is free.

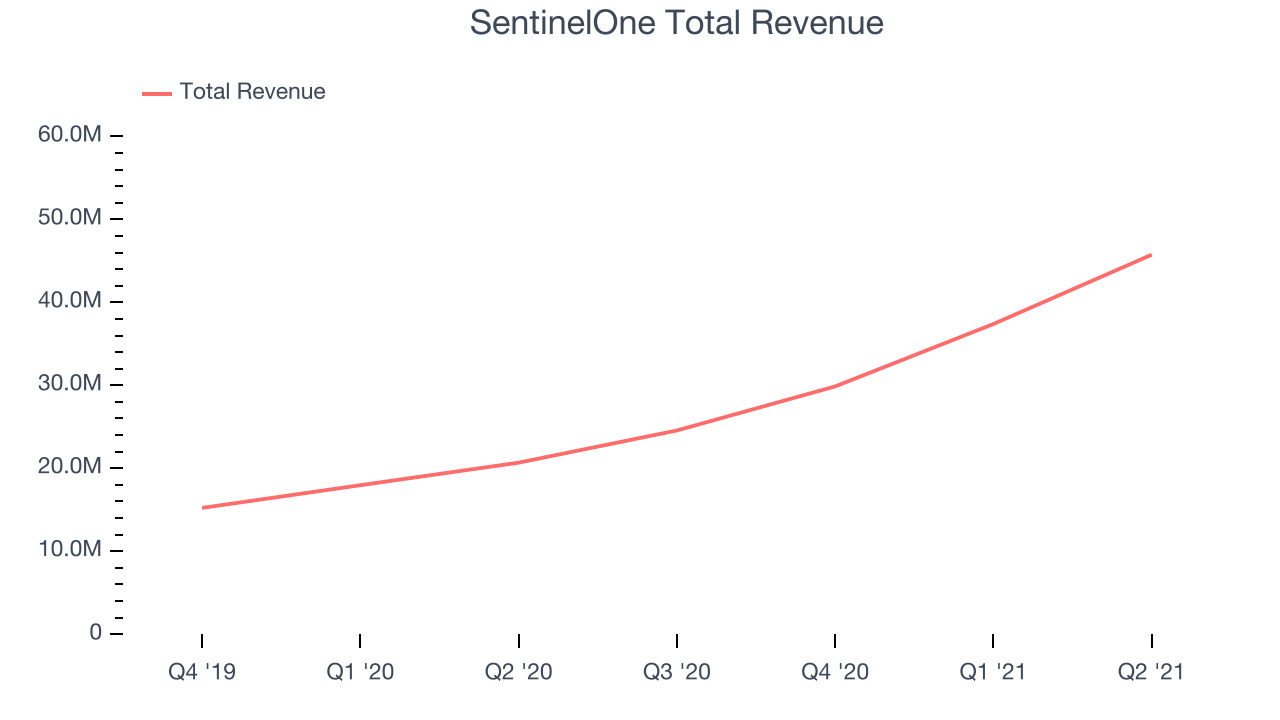

Best Q2: SentinelOne (NYSE:S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $45.7 million, up 121% year on year, beating analyst expectations by 13.3%. It was a exceptional quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

SentinelOne delivered the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is down 3.11% since the results and currently trades at $65.20.

Is now the time to buy SentinelOne? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Sailpoint (NYSE:SAIL)

Founded in 2005 by Kevin Cunningham and Mark McClain, SailPoint (NYSE:SAIL) provides software for organizations to manage the digital identity of employees, customers, and partners.

Sailpoint reported revenues of $102.4 million, up 10.8% year on year, beating analyst expectations by 3.2%. It was a weaker quarter for the company, with some shareholders hoping for a better result.

Sailpoint had the weakest performance against analyst estimates and slowest revenue growth. The stock is down 8.92% since the results and currently trades at $45.70.

Read our full analysis of Sailpoint's results here.

Zscaler (NASDAQ:ZS)

Founded in 2007 by Jay Chaudhry, Zscaler (NASDAQ:ZS) offers software as a service that helps companies securely connect to applications and networks in the cloud.

Zscaler reported revenues of $197 million, up 56.5% year on year, beating analyst expectations by 5.13%. It was a very strong quarter for the company, with an exceptional revenue growth.

The stock is down 3.35% since the results and currently trades at $279.50.

Read our full, actionable report on Zscaler here, it's free.

Okta (NASDAQ:OKTA)

Founded during the aftermath of the financial crisis in 2009, Okta is a cloud-based software as a service platform that helps companies manage identity for their employees and customers.

Okta reported revenues of $315.5 million, up 57.3% year on year, beating analyst expectations by 7.61%. It was a solid quarter for the company, with an exceptional revenue growth.

The stock is up 2.69% since the results and currently trades at $257.67.

Read our full, actionable report on Okta here, it's free.

The author has no position in any of the stocks mentioned