Cybersecurity company CrowdStrike (NASDAQ:CRWD) reported results in line with analysts' expectations in Q4 FY2024, with revenue up 32.6% year on year to $845.3 million. The company expects next quarter's revenue to be around $904 million, in line with analysts' estimates. It made a non-GAAP profit of $0.95 per share, improving from its profit of $0.47 per share in the same quarter last year.

CrowdStrike (CRWD) Q4 FY2024 Highlights:

- Revenue: $845.3 million vs analyst estimates of $840 million (small beat)

- ARR: $3.44 billion vs analyst estimates of $3.40 billion (1.2% beat)

- Operating Profit (non-GAAP): $213.1 million vs analyst estimates of $187.8 million (13.5% beat)

- EPS (non-GAAP): $0.95 vs analyst estimates of $0.82 (15.3% beat)

- Revenue Guidance for Q1 2025 is $904 million at the midpoint, slightly above what analysts were expecting (non-GAAP EPS guidance for the period more convincingly ahead)

- Management's revenue guidance for the upcoming financial year 2025 is $3.96 billion at the midpoint, slightly above analyst expectations and implying 29.5% growth (vs 36.7% in FY2024) (non-GAAP EPS guidance for the period more convincingly ahead)

- Free Cash Flow of $283 million, up 18.4% from the previous quarter

- Gross Margin (GAAP): 75.3%, up from 72.4% in the same quarter last year

- Market Capitalization: $75.36 billion

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

Unlike the legacy antivirus products which are typically rules-based and on-premise, CrowdStrike's Falcon platform is cloud-based and uses prevention-and-detection technology based on machine-learning and artificial intelligence that looks for behavioral attack patterns and indicators of attack to identify bad actors. As a result, it is easier and cheaper to deploy, works on any device and it has superior efficacy rates in detecting threats compared to the legacy competitors.

The story of CrowdStrike started in 2011 when the founder George Kurtz watched a fellow plane passenger turn his laptop on and wait 15 minutes for the antivirus software to stop scanning before he could use the computer. Despite the existence of several antivirus software at that time, CrowdStrike has enjoyed huge success over the years due to its ease of deployment and its expanding focus on the growing market of cloud applications and infrastructure.

Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

CrowdStrike is competing with legacy security platforms that are expanding their cloud security capabilities, such as products offered by Microsoft (NASDAQ:MSFT) and Symantec, and also with cloud-native solutions such as SentinelOne (NYSE:S) and Zscaler (NASDAQ:ZS).

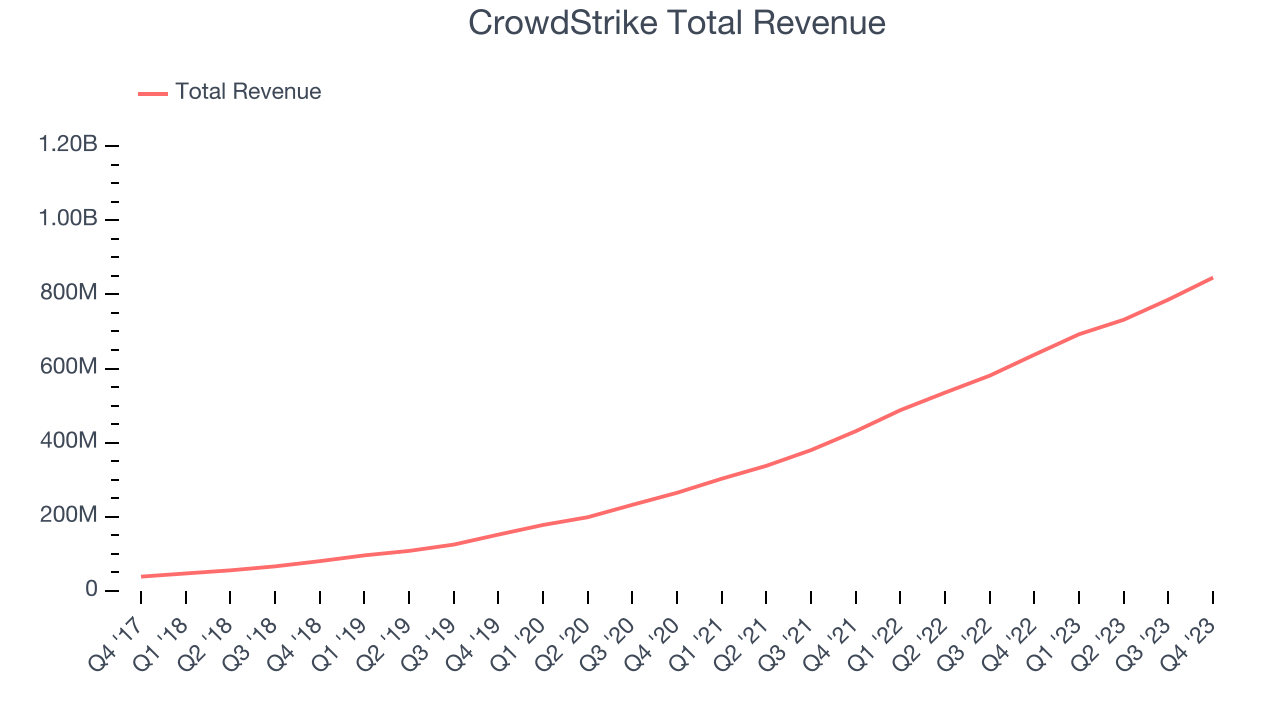

Sales Growth

As you can see below, CrowdStrike's revenue growth has been impressive over the last two years, growing from $431 million in Q4 FY2022 to $845.3 million this quarter.

Unsurprisingly, this was another great quarter for CrowdStrike with revenue up 32.6% year on year. On top of that, its revenue increased $59.32 million quarter on quarter, a solid improvement from the $54.39 million increase in Q3 2024. This is a sign of slight re-acceleration of growth.

Next quarter's guidance suggests that CrowdStrike is expecting revenue to grow 30.5% year on year to $904 million, slowing down from the 42% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $3.96 billion at the midpoint, growing 29.5% year on year compared to the 36.3% increase in FY2024.

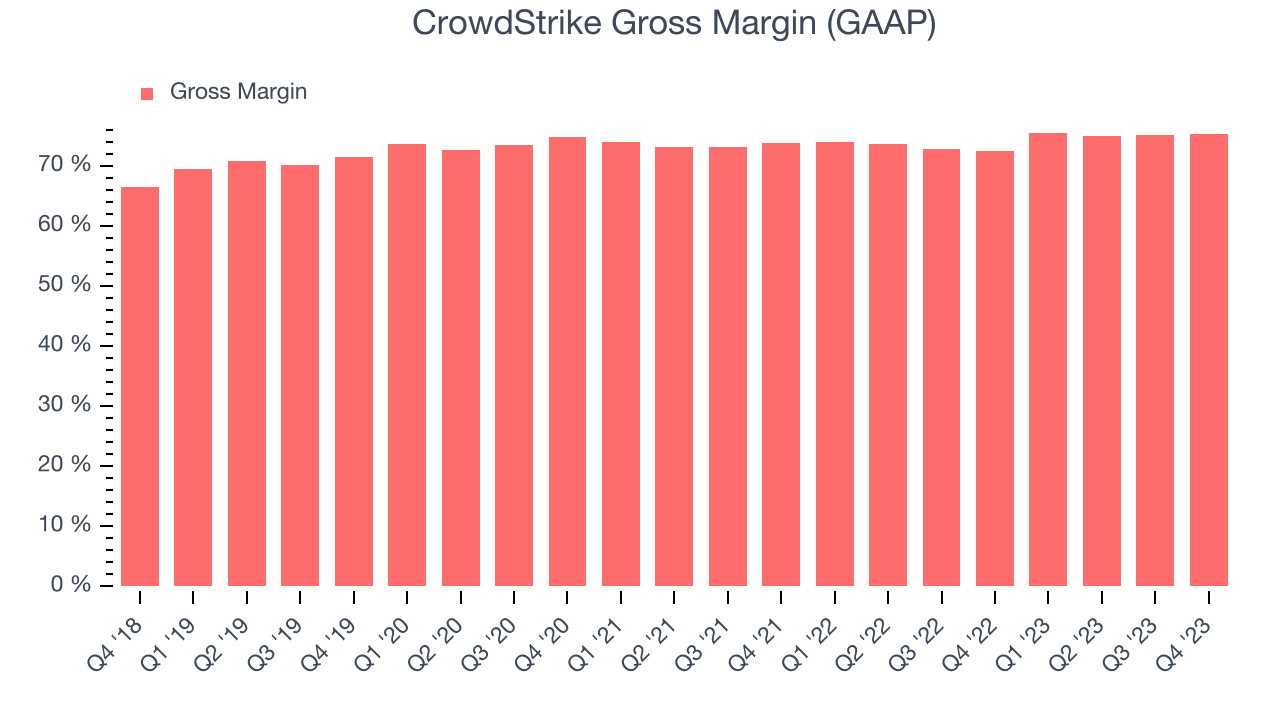

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. CrowdStrike's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 75.3% in Q4.

That means that for every $1 in revenue the company had $0.75 left to spend on developing new products, sales and marketing, and general administrative overhead. Trending up over the last year, CrowdStrike's impressive gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

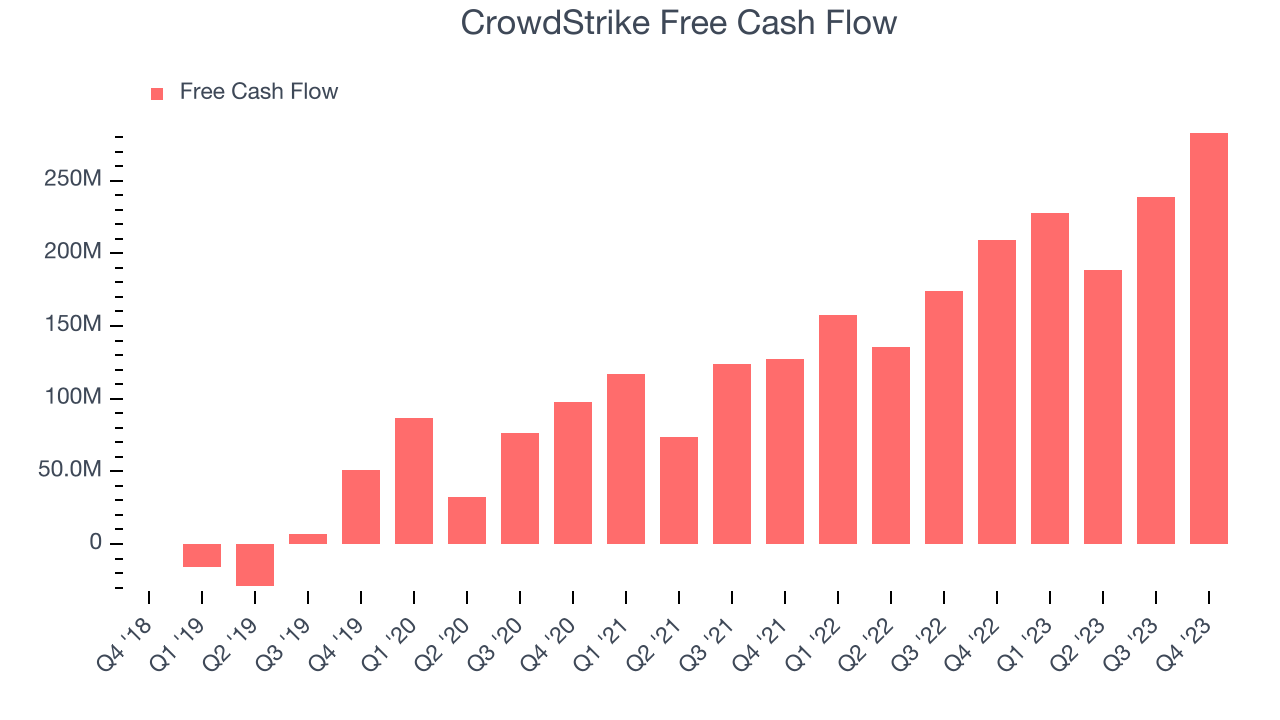

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. CrowdStrike's free cash flow came in at $283 million in Q4, up 35.1% year on year.

CrowdStrike has generated $938.2 million in free cash flow over the last 12 months, an eye-popping 30.7% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from CrowdStrike's Q4 Results

This was a strong quarter for CrowdStrike, with the company beating slightly on revenue and ARR but very convincingly on operating profit. Keeping with that theme, while forward guidance for next quarter and the full year were only slightly above expectations, non-GAAP EPS guidance was more convincingly ahead, showing better-than-expected profitability. Lastly, Palo Alto Networks (NASDAQ:PANW) warned of weakness in security spending a few weeks ago when it reported earnings, sending waves of caution across the sector. Cybersecurity peers that reported after Palo Alto put up mixed results, which kept investors on edge for CrowdStrike's results. The stock is up 16.5% after reporting and currently trades at $347 per share.

Is Now The Time?

When considering an investment in CrowdStrike, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are several reasons why we think CrowdStrike is a great business. While we'd expect growth rates to moderate from here, the absolute numbers its putting up are still very strong. Additionally, its bountiful generation of free cash flow empowers it to invest in growth initiatives, and its very efficient customer acquisition hints at the potential for strong profitability.

There's no doubt that the market is optimistic about CrowdStrike's growth prospects, as its price-to-sales ratio based on the next 12 months of 18.7x would suggest. And looking at the tech landscape today, CrowdStrike's qualities really stand out. We are big fans at this price, even more so considering the company is actually trading at a multiple .

Wall Street analysts covering the company had a one-year price target of $325.77 per share right before these results (compared to the current share price of $347).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.