Fresh produce company Calavo Growers (NASDAQ:CVGW) reported results in line with analysts’ expectations in Q2 CY2024, with revenue down 30.9% year on year to $179.6 million. It made a non-GAAP profit of $0.57 per share, improving from its profit of $0.41 per share in the same quarter last year.

Is now the time to buy Calavo? Find out by accessing our full research report, it’s free.

Calavo (CVGW) Q2 CY2024 Highlights:

- Revenue: $179.6 million vs analyst estimates of $178.6 million (small beat)

- Adj EBITDA: $13.5 million vs analyst estimates of $13.4 million (small beat)

- EPS (non-GAAP): $0.57 vs analyst estimates of $0.43 (32.6% beat)

- Gross Margin (GAAP): 11.2%, up from 9.6% in the same quarter last year

- EBITDA Margin: 7.5%, up from 5.1% in the same quarter last year

- Market Capitalization: $429.5 million

Management Commentary “Our third quarter results reflect continued momentum in our flagship avocado business,” said Lee Cole, President and Chief Executive Officer of Calavo Growers,

A trailblazer in the avocado industry, Calavo Growers (NASDAQ:CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

Calavo is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

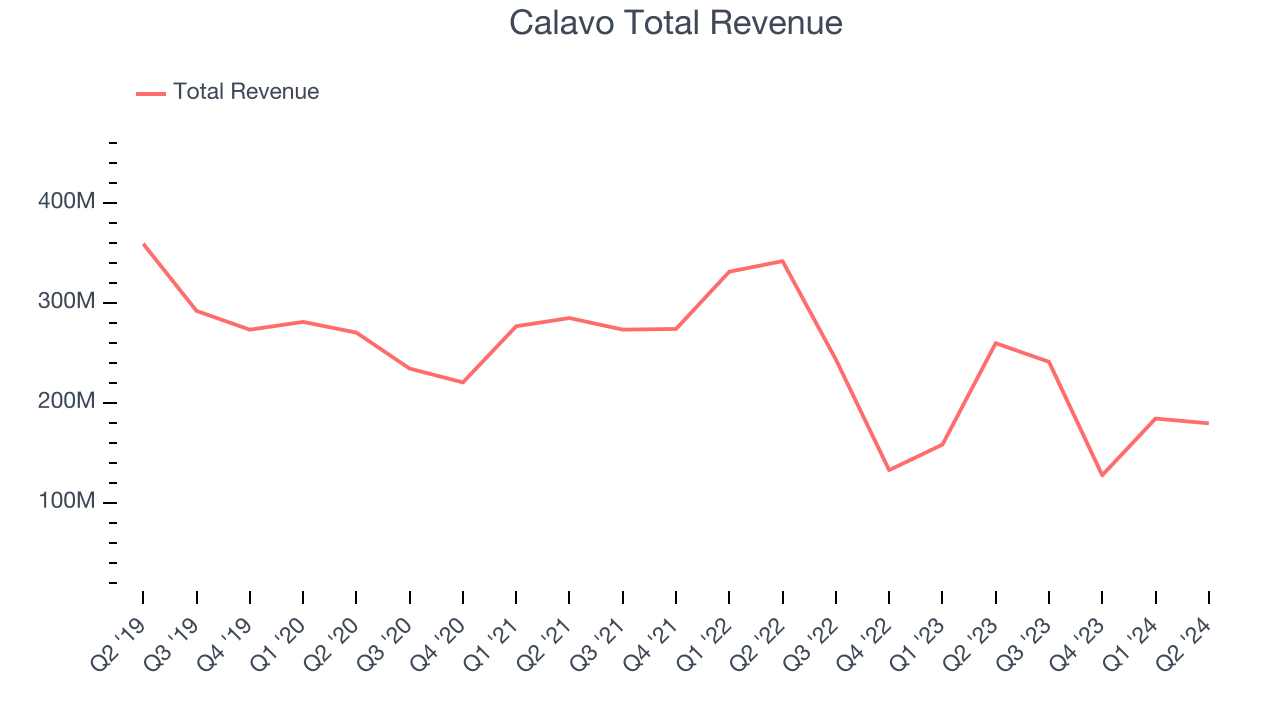

As you can see below, the company’s revenue has declined over the last three years, dropping 10.3% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Calavo reported a rather uninspiring 30.9% year-on-year revenue decline to $179.6 million in revenue, in line with Wall Street’s estimates. Looking ahead, Wall Street expects revenue to decline 11% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

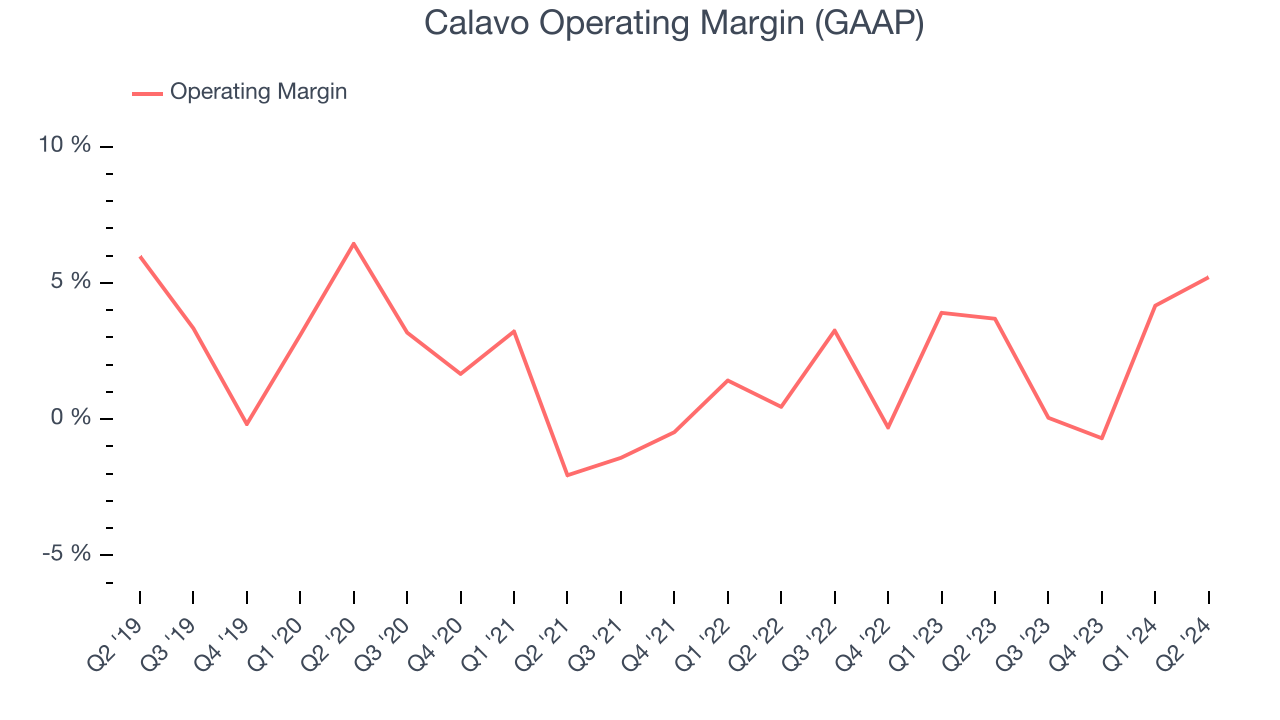

Calavo was profitable over the last two years but held back by its large expense base. It demonstrated paltry profitability for a consumer staples business, producing an average operating margin of 2.6%. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Calavo’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last two years, which doesn’t help its cause.

This quarter, Calavo generated an operating profit margin of 5.2%, up 1.5 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Key Takeaways from Calavo’s Q2 Results

We liked that revenue and adjusted EBITDA beat expectations, even if the magnitude of the beat was small. Management commentary was constructive. "“Our third quarter results reflect continued momentum in our flagship avocado business...Despite temporary industry supply disruptions from Mexico during the quarter, we generated strong financial results due to our operational flexibility." Lastly, peer Mission Produce (AVO) also reported strong results today, showing that the industry seems healthy. The stock traded up 5% to $25.25 immediately after reporting.

So should you invest in Calavo right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.