Fresh produce company Calavo Growers (NASDAQGS:CVGW) fell short of analysts' expectations in Q1 FY2024, with revenue down 43.6% year on year to $127.6 million. It made a non-GAAP loss of $0.01 per share, improving from its loss of $0.08 per share in the same quarter last year.

Calavo (CVGW) Q1 FY2024 Highlights:

- Revenue: $127.6 million vs analyst estimates of $252.7 million (49.5% miss)

- EPS (non-GAAP): -$0.01 vs analyst estimates of $0.17

- Gross Margin (GAAP): 9.8%, up from 6.4% in the same quarter last year

- Market Capitalization: $521.5 million

A trailblazer in the avocado industry, Calavo Growers (NASDAQGS:CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

The company's story began in 1924 when a group of farmers in the fertile region of Santa Paula, California formed a cooperative to market and distribute avocados. Their goal was to raise awareness and create a thriving market for this then-unfamiliar fruit among Americans.

Through innovative marketing campaigns and efforts to educate the public on the culinary uses and health benefits of avocados, Calavo Growers played a pivotal role in its integration into American cuisine. Today, avocados have become a staple ingredient in countless dishes and are celebrated for their nutritional benefits.

While avocados lie at the heart of Calavo Growers's business, its product portfolio extends far beyond. The company offers a diverse array of fresh foods, including tomatoes, papayas, pineapples, and pre-packaged guacamole. This diversification allows it to serve the evolving needs and tastes of consumers, making it a versatile player in the fresh produce industry.

Calavo Growers operates across North America, Mexico, and other international markets, and its extensive distribution network ensures products are readily available in grocery stores, restaurants, and food service establishments.

Packaged Food

Packaged food stocks are considered resilient investments because people always need to eat. These companies therefore can enjoy consistent demand as long as they stay on top of changing consumer preferences. But consumer preferences can be a double-edged sword, as companies that aren't at the front of trends such as health and wellness and natural ingredients can fall behind. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors in the fresh produce category include Dole (NYSE:DOLE), Fresh Del Monte (NYSE:FDP), and Mission Produce (NASDAQGS:AVO) along with private companies Chiquita Brands International and Sunkist Growers.Sales Growth

Calavo is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

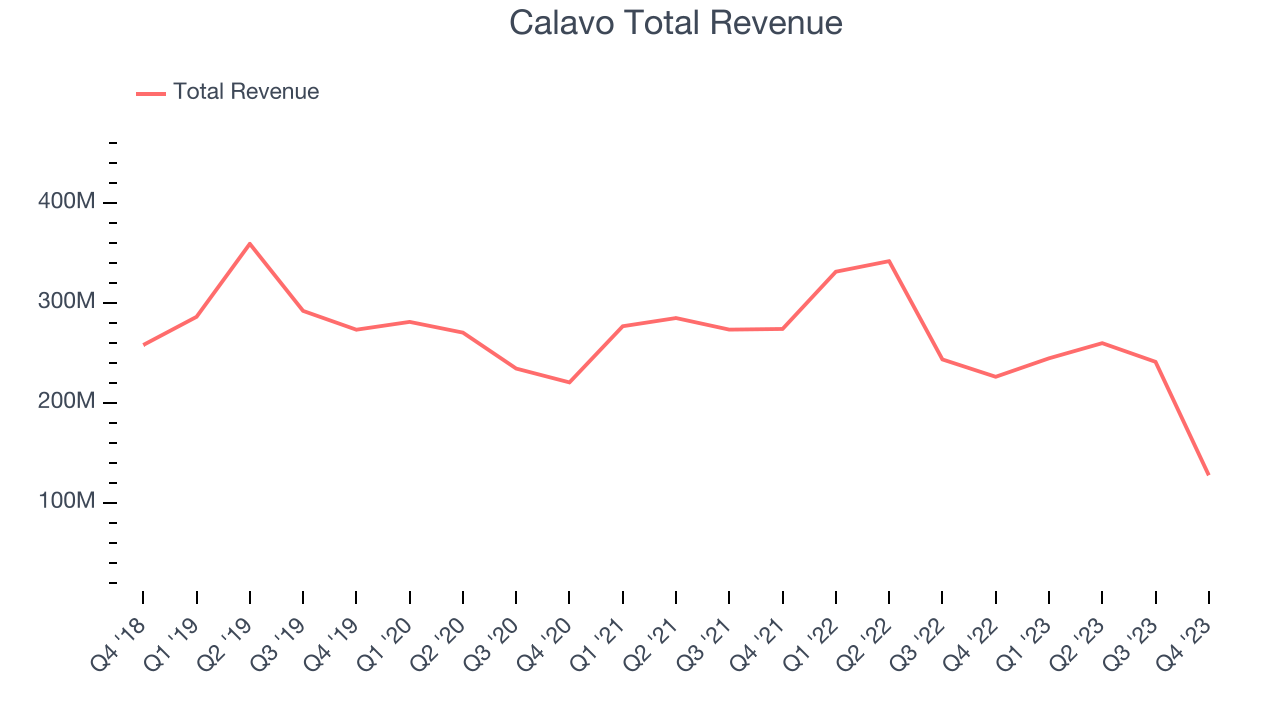

As you can see below, the company's revenue has declined over the last three years, dropping 4.6% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Calavo missed Wall Street's estimates and reported a rather uninspiring 43.6% year-on-year revenue decline, generating $127.6 million in revenue. Looking ahead, Wall Street expects sales to grow 12% over the next 12 months, an acceleration from this quarter.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

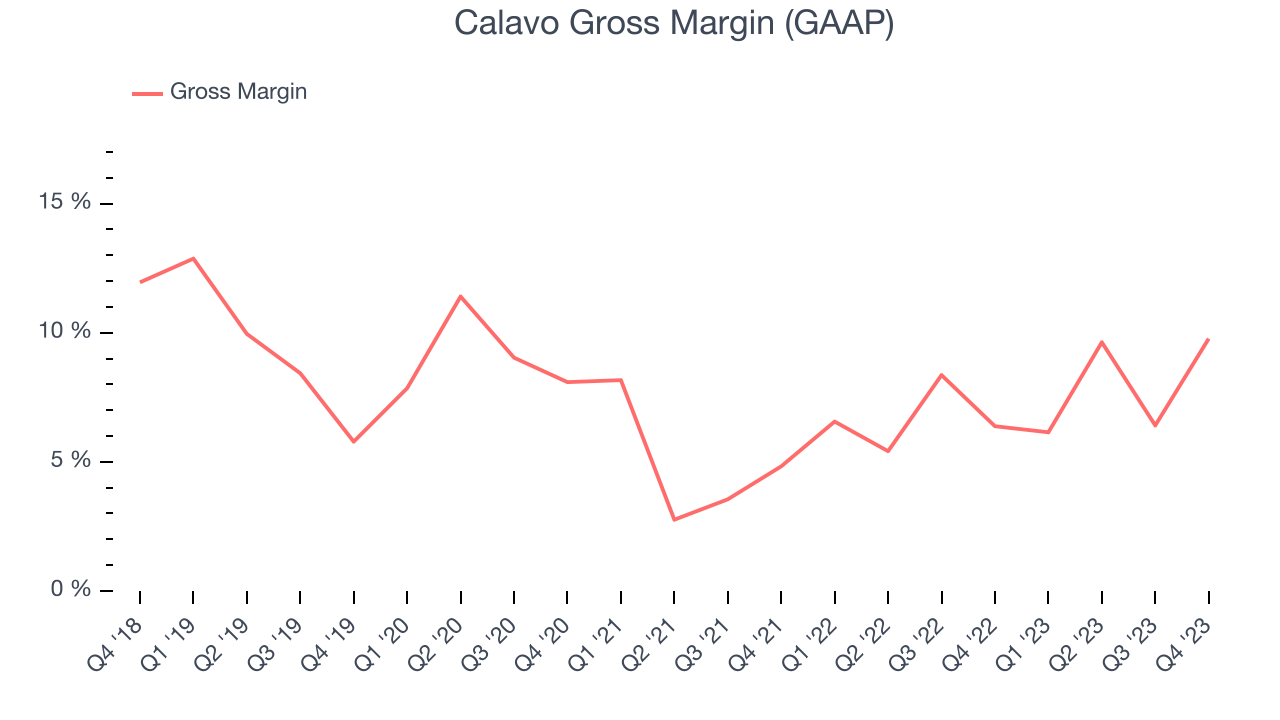

This quarter, Calavo's gross profit margin was 9.8%, up 3.4 percentage points year on year. That means for every $1 in revenue, a chunky $0.90 went towards paying for raw materials, production of goods, and distribution expenses.

Calavo has poor unit economics for a consumer staples company, leaving it with little room for error if things go awry. As you can see above, it's averaged a paltry 7.1% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 25.3% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

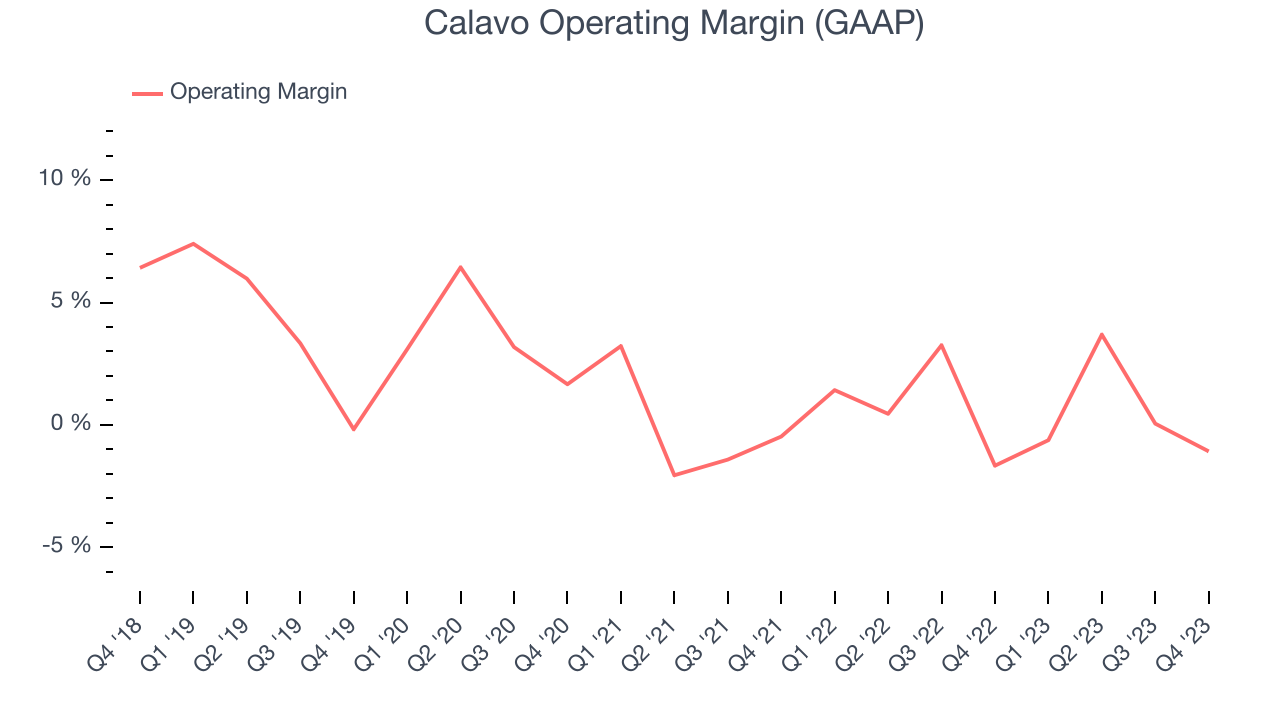

This quarter, Calavo generated an operating profit margin of negative 1.1%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Calavo was roughly breakeven when averaging the last two years of quarterly operating profits, weak for a consumer staples business. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.

Zooming out, Calavo was roughly breakeven when averaging the last two years of quarterly operating profits, weak for a consumer staples business. Its margin has also seen few fluctuations, meaning it will take a big change to improve profitability.EPS

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

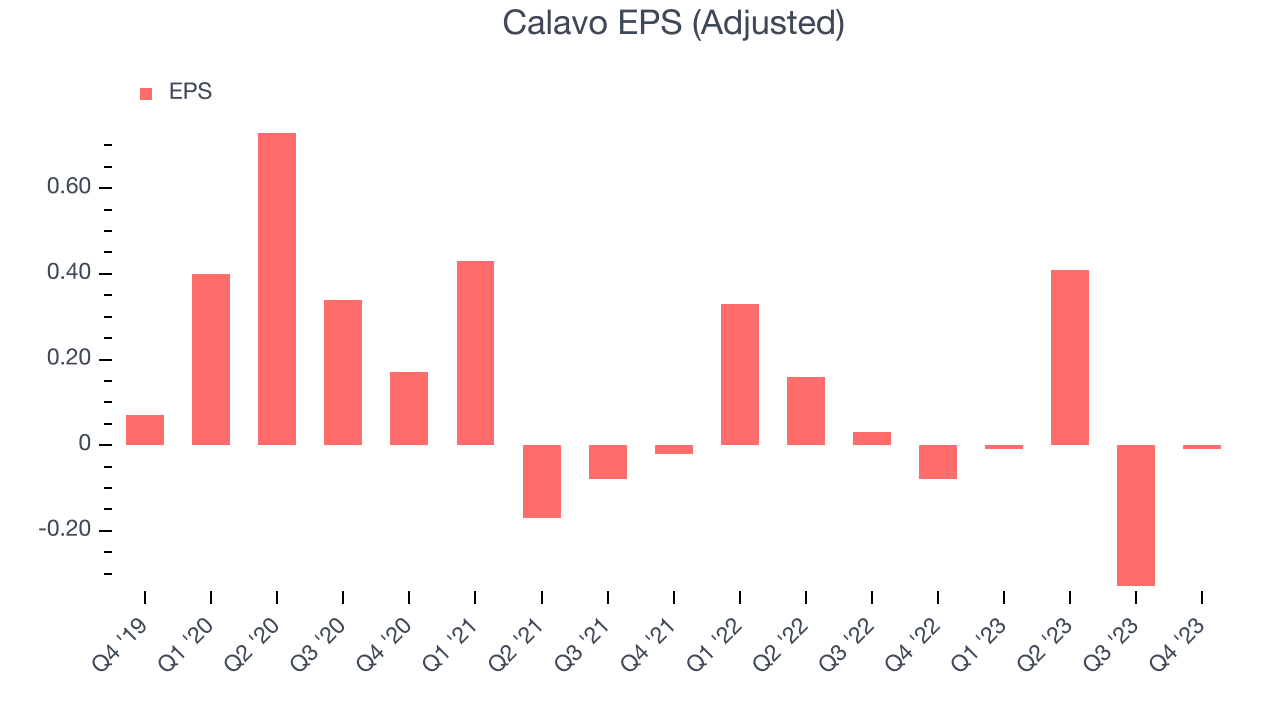

In Q1, Calavo reported EPS at negative $0.01, up from negative $0.08 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2021 and FY2024, Calavo's EPS dropped 96.3%, translating into 66.8% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 2,028% year-on-year increase in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Calavo's five-year average ROIC was 4.7%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Calavo's ROIC over the last two years averaged 10.7 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Calavo's Q1 Results

We were impressed by how significantly Calavo beat analysts' gross margin expectations this quarter. But that's where the good news ends. Its revenue missed Wall Street's estimates by a huge margin, and its operating profit and EPS were not spared either. Next quarter, the company expects to complete the sale of its "fresh cut" business. Overall, this was a bad quarter for Calavo. The company is down 1.3% on the results and currently trades at $28.2 per share.

Is Now The Time?

Calavo may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Calavo, we'll be cheering from the sidelines. Its revenue has declined over the last three years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last three years makes it hard to trust. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses.

Calavo's price-to-earnings ratio based on the next 12 months is 22.4x. While we've no doubt one can find things to like about Calavo, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $33.50 per share right before these results (compared to the current share price of $28.20).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.