Data backup provider Commvault (NASDAQ:CVLT) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 9.7% year on year to $223.3 million. Guidance for next quarter's revenue was also better than expected at $214.5 million at the midpoint, 1.9% above analysts' estimates. It made a non-GAAP profit of $0.79 per share, improving from its profit of $0.73 per share in the same quarter last year.

Commvault Systems (CVLT) Q1 CY2024 Highlights:

- Revenue: $223.3 million vs analyst estimates of $212.5 million (5.1% beat)

- EPS (non-GAAP): $0.79 vs analyst estimates of $0.73 (8.2% beat)

- Revenue Guidance for Q2 CY2024 is $214.5 million at the midpoint, above analyst estimates of $210.5 million

- Management's revenue guidance for the upcoming financial year 2025 is $909 million at the midpoint, beating analyst estimates by 3.1% and implying 8.3% growth (vs 7% in FY2024)

- Management's operating margin (non-GAAP) guidance for the upcoming financial year 2025 is 20.5% million at the midpoint, below analyst estimates of 21.6%

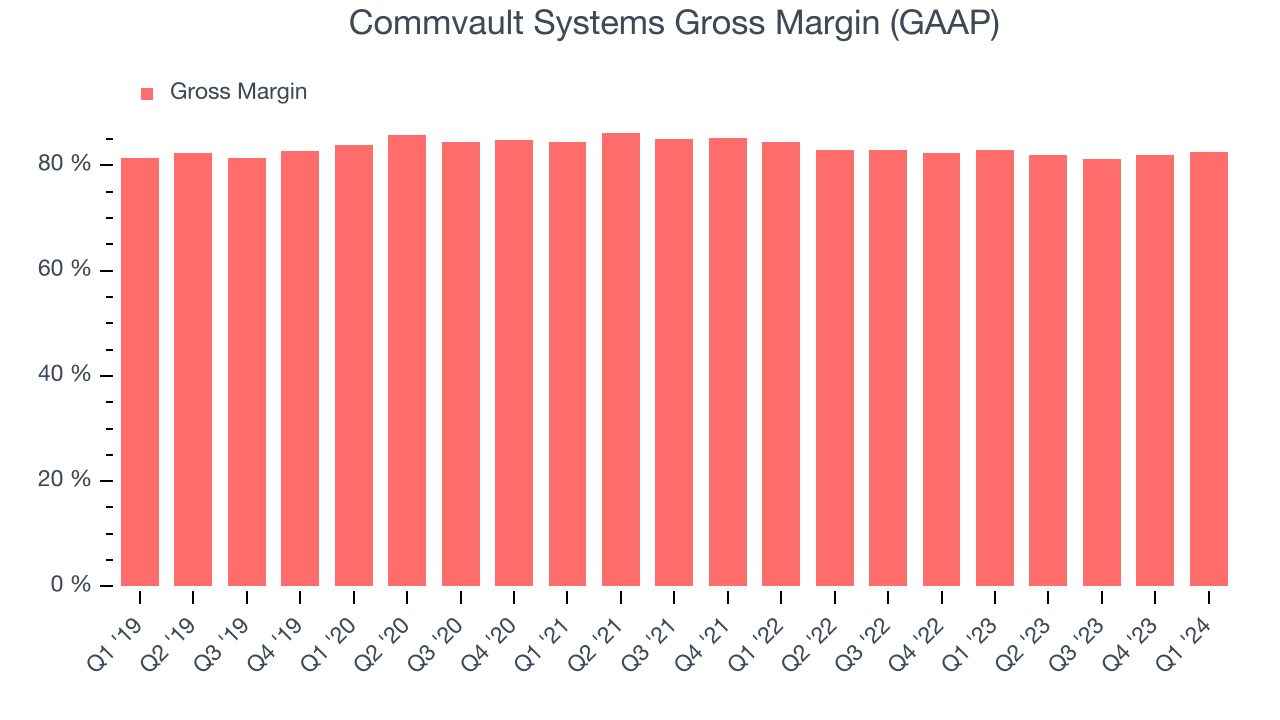

- Gross Margin (GAAP): 82.5%, in line with the same quarter last year

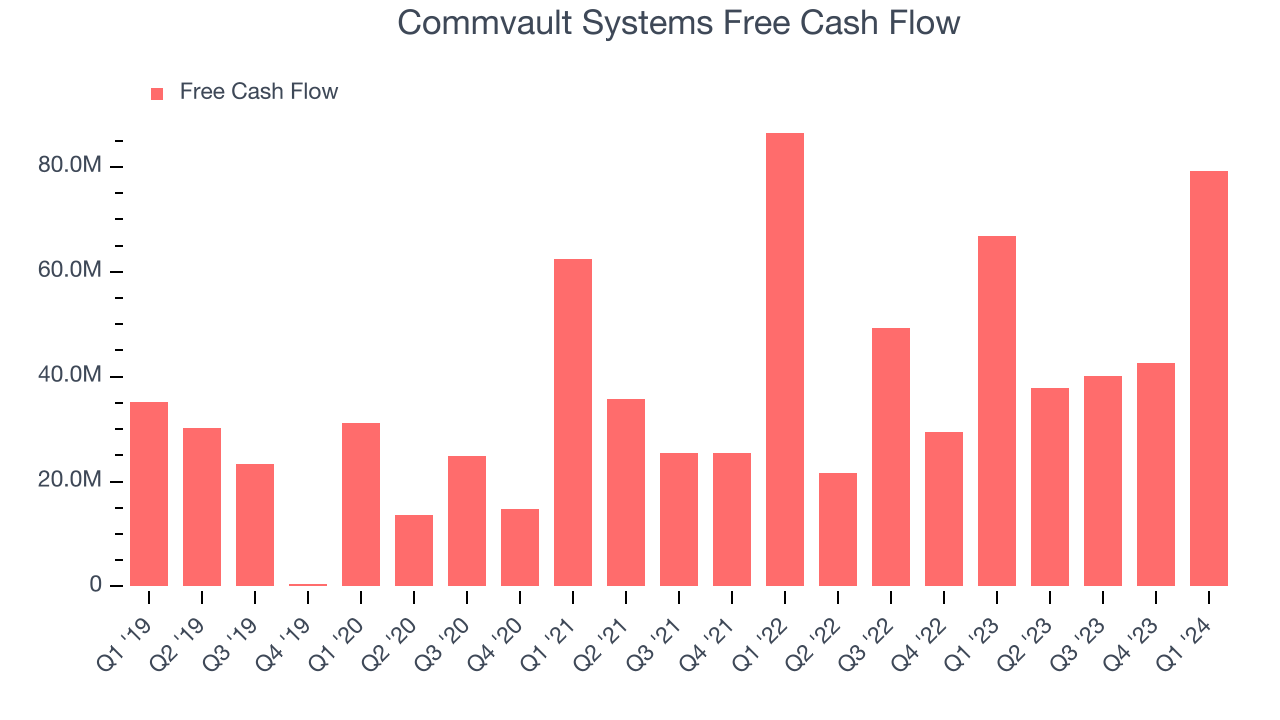

- Free Cash Flow of $79.13 million, up 85.6% from the previous quarter

- Market Capitalization: $4.34 billion

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention, and compliance.

In today’s digital economy, companies rely on data to predict customer behavior, guide operational efficiency, and drive corporate strategy. The trouble is, your data grows, morphs, and fragments – digital bits and bytes in a constant state of movement and evolution. And data moves from on premise data centers to the cloud and back. Corporate data needs to be protected in case of disasters or from cyber criminals. And it needs to be done in a cost effective and easy to use manner.

Commvault Intelligent Data Services help enterprises drive greater efficiency by transforming how they protect, store, and use data. Commvault’ offerings are organized into three categories - Data Protection, Data Insights and more recently Storage. All of its products operate through a single simple to use interface on the Commvault Command Center, where IT professionals identify content and data they want to protect, and run automated backups. In 2020 Commvault acquired Hedvig and Metallic to expand their storage capabilities to include public cloud architectures, containers, and virtual machines.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

Commvault’s public competitors include IBM (NYSE:IBM), Microsoft (NASDAQ:MSFT), and VMware (NYSE:VMW) while its private company rivals include Cohesity, Rubrik, Veeam, Veritas Technologies, Arcserve, and Acronis.

Sales Growth

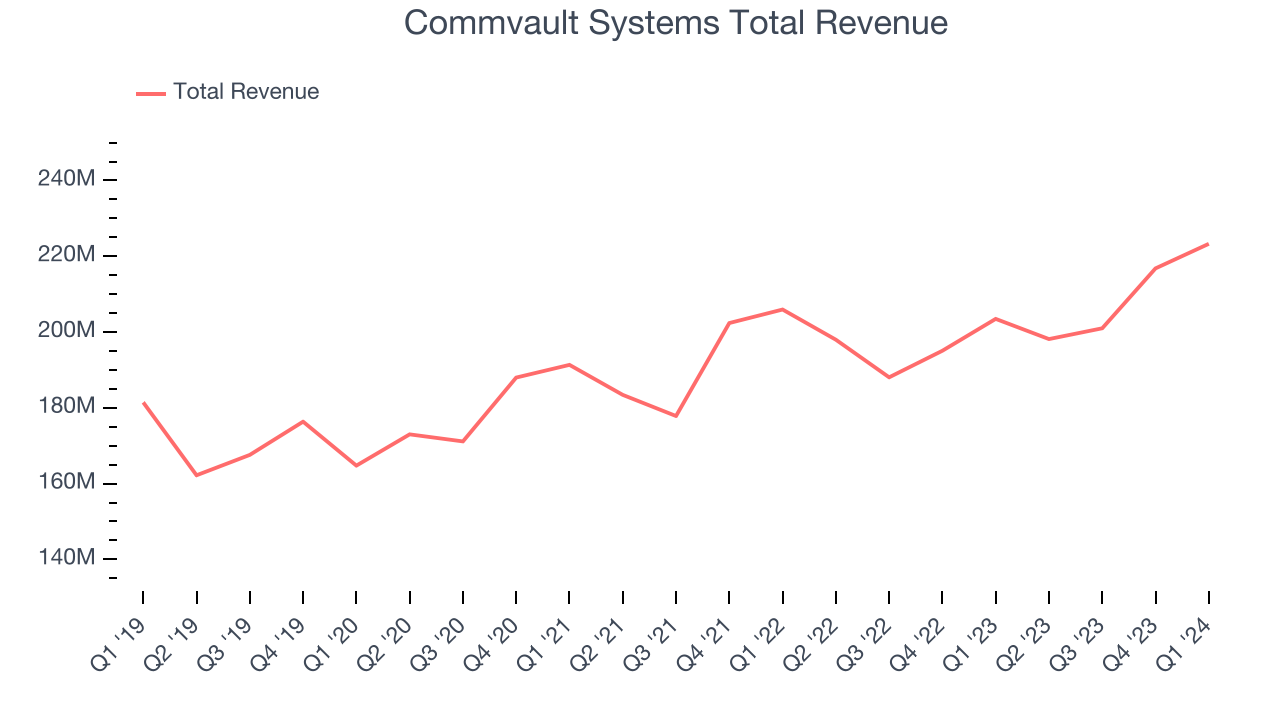

As you can see below, Commvault Systems's revenue growth has been unimpressive over the last three years, growing from $191.3 million in Q4 2021 to $223.3 million this quarter.

Commvault Systems's quarterly revenue was only up 9.7% year on year, which might disappoint some shareholders. Additionally, its growth did slow down compared to last quarter as the company's revenue increased by just $6.48 million in Q1 compared to $15.81 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Commvault Systems is expecting revenue to grow 8.3% year on year to $214.5 million, improving on the 0.1% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $909 million at the midpoint, growing 8.3% year on year compared to the 7% increase in FY2024.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Commvault Systems's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 82.5% in Q1.

That means that for every $1 in revenue the company had $0.82 left to spend on developing new products, sales and marketing, and general administrative overhead. Commvault Systems's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that Commvault Systems is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Commvault Systems's free cash flow came in at $79.13 million in Q1, up 18.5% year on year.

Commvault Systems has generated $199.7 million in free cash flow over the last 12 months, an impressive 23.8% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Commvault Systems is a well-capitalized company with $312.8 million of cash and $12.09 million of debt, meaning it could pay back all its debt tomorrow and still have $300.7 million of cash on its balance sheet. This net cash position gives Commvault Systems the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Commvault Systems's Q1 Results

We were impressed by how strongly Commvault Systems blew past analysts' billings expectations this quarter. We were also glad next year's revenue guidance implies robust growth and is above expectations. The only negative was that next year's operating margin guidance came in below expectations. Zooming out, we think this was still a solid quarter that shareholders will appreciate. The stock is up 3.5% after reporting and currently trades at $103 per share.

Is Now The Time?

Commvault Systems may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for everyone who's making the lives of others easier through technology, but in case of Commvault Systems, we'll be cheering from the sidelines. Its revenue growth has been weak over the last three years, and analysts expect growth to deteriorate from here.

Given its price-to-sales ratio of 5.1x based on the next 12 months, Commvault Systems is priced with expectations for long-term growth. While there are some things to like about Commvault Systems and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $98.65 right before these results (compared to the current share price of $103), implying they didn't see much short-term potential in Commvault Systems.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.