Hotel and casino entertainment company Caesars Entertainment (NASDAQ:CZR) missed analysts' expectations in Q1 CY2024, with revenue down 3.1% year on year to $2.74 billion. It made a GAAP loss of $0.73 per share, down from its loss of $0.63 per share in the same quarter last year.

Caesars Entertainment (CZR) Q1 CY2024 Highlights:

- Revenue: $2.74 billion vs analyst estimates of $2.83 billion (3.1% miss)

- Adjusted EBITDA: $853 million vs. analyst estimates of $916 million (6.9% miss)

- EPS: -$0.73 vs analyst estimates of -$0.08 (-$0.65 miss)

- Gross Margin (GAAP): 50.9%, down from 53.3% in the same quarter last year

- Market Capitalization: $8.13 billion

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ:CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

The company was founded in 1973 as Eldorado Resorts and rebranded to Caesars Entertainment following a transformative merger with Caesars Entertainment Corporation in 2020. This move marked a key development in its journey, establishing the company as a major player in the gaming and hospitality industry by combining gaming expertise with a broad range of hospitality and entertainment offerings.

Caesars Entertainment oversees an array of properties, including casinos, hotels, and resorts. The company's operations include not only gaming but also hotel services, dining, live shows, and other leisure activities. This multifaceted approach caters to a diverse customer base seeking various entertainment and hospitality experiences, from gaming enthusiasts to vacationers.

The company's revenue is generated from multiple sources: gaming operations, hotel bookings, food and beverage services, and entertainment ventures. In gaming, the company has both physical and online gaming platforms (iGaming).

Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Competitors in the gaming and hospitality sector include MGM Resorts (NYSE:MGM), Las Vegas Sands (NYSE:LVS), and Wynn Resorts (NASDAQ:WYNN).Sales Growth

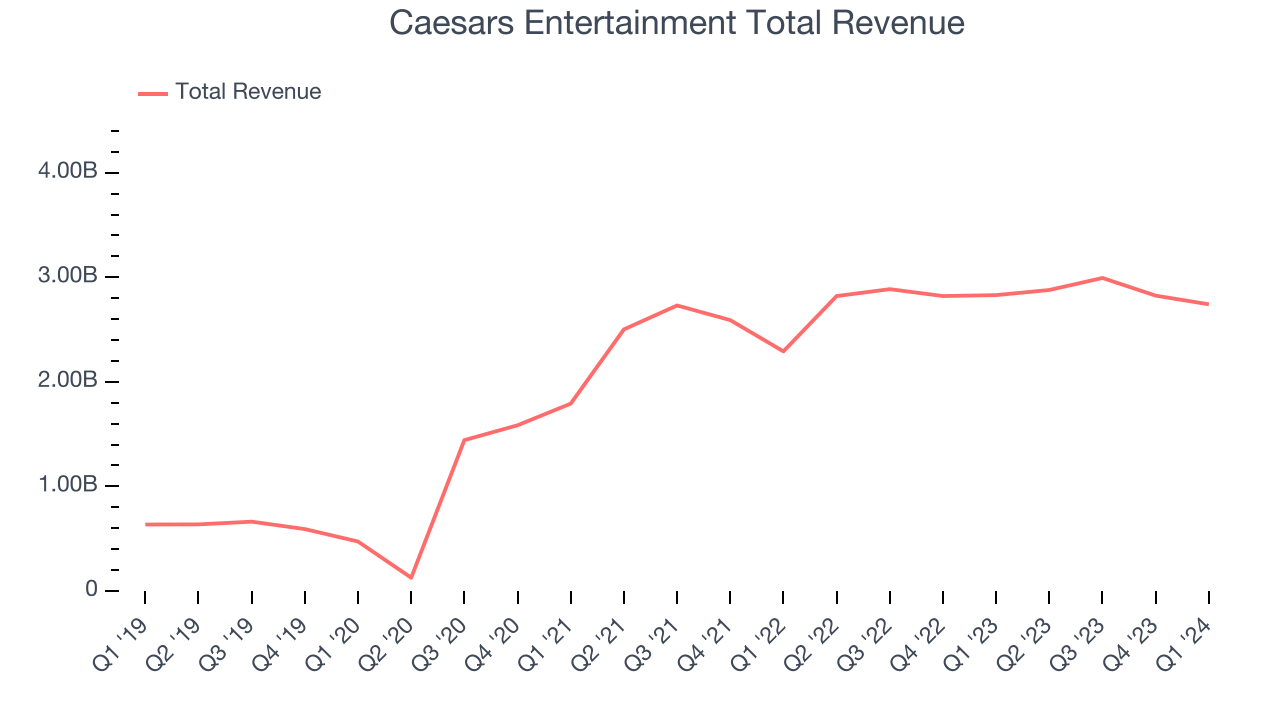

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Caesars Entertainment's annualized revenue growth rate of 38.4% over the last five years was incredible for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Caesars Entertainment's recent history shows its momentum has slowed as its annualized revenue growth of 6.3% over the last two years is below its five-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Caesars Entertainment's recent history shows its momentum has slowed as its annualized revenue growth of 6.3% over the last two years is below its five-year trend.

This quarter, Caesars Entertainment missed Wall Street's estimates and reported a rather uninspiring 3.1% year-on-year revenue decline, generating $2.74 billion of revenue. Looking ahead, Wall Street expects sales to grow 3.7% over the next 12 months, an acceleration from this quarter.

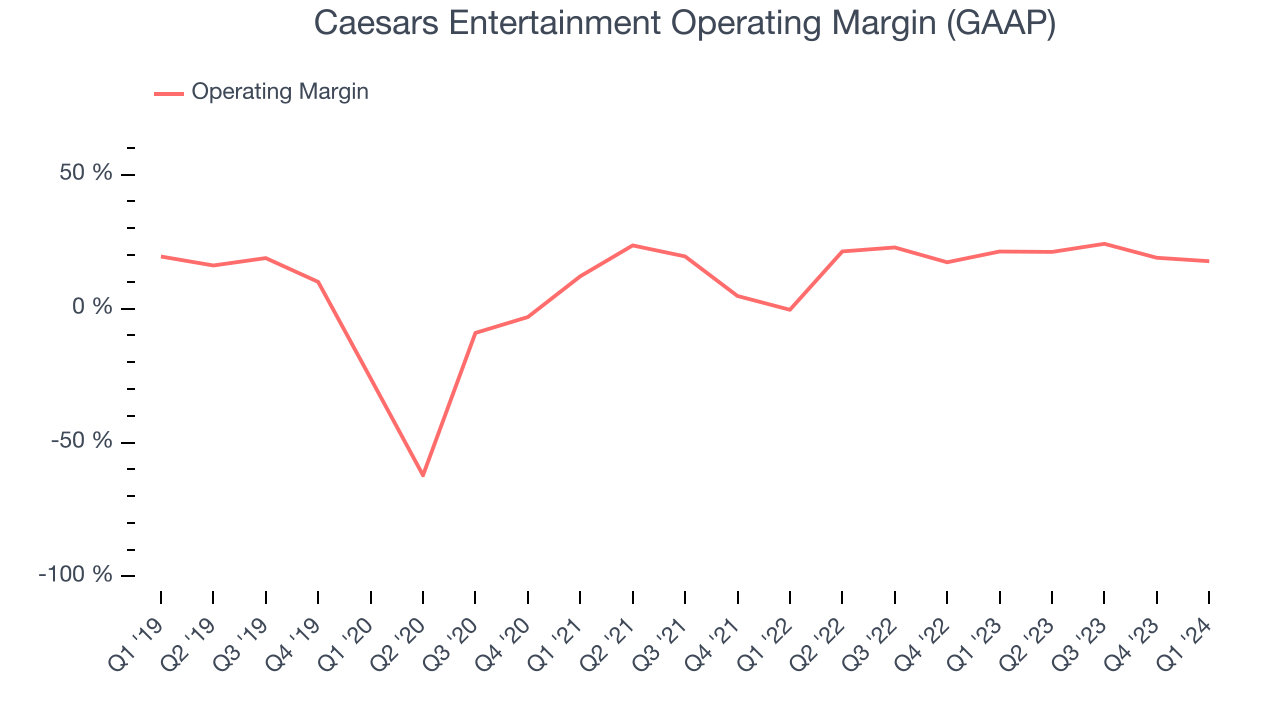

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Caesars Entertainment has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 20.6%.

This quarter, Caesars Entertainment generated an operating profit margin of 17.7%, down 3.6 percentage points year on year.

Over the next 12 months, Wall Street expects Caesars Entertainment to become more profitable. Analysts are expecting the company’s LTM operating margin of 20.6% to rise to 22.8%.EPS

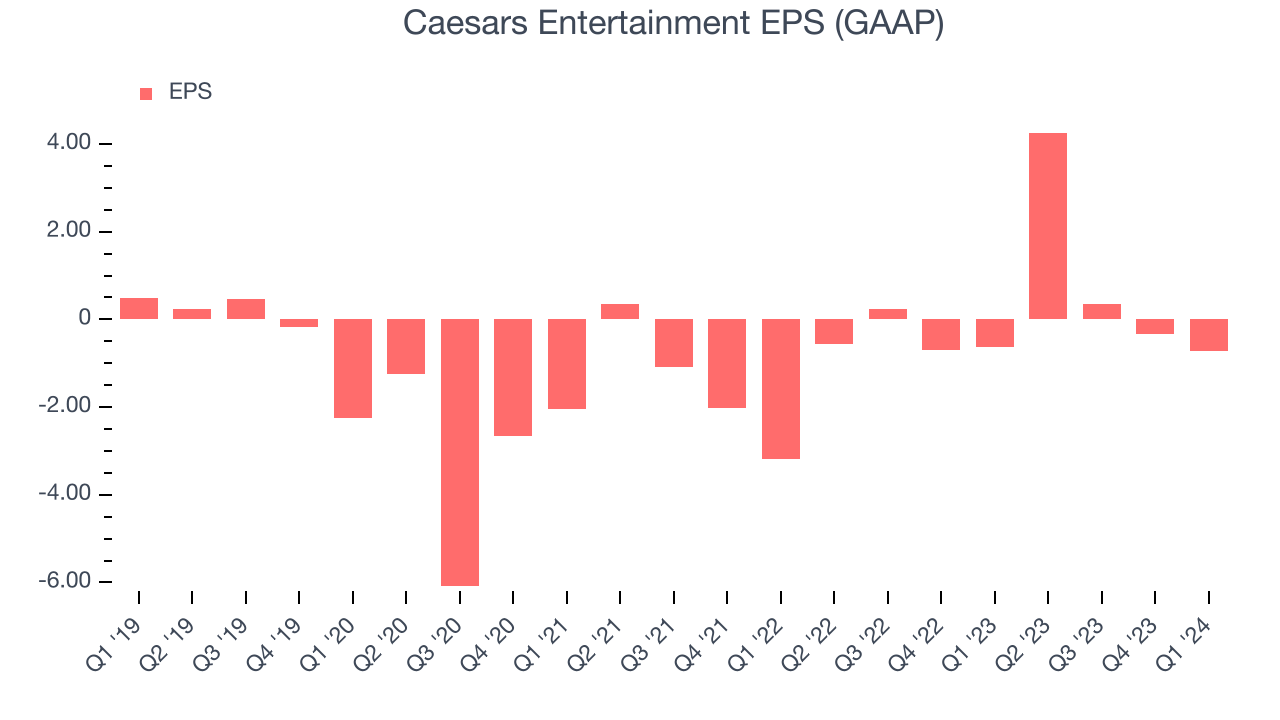

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Caesars Entertainment's EPS grew 146%, translating into a remarkable 19.7% compounded annual growth rate. This performance, however, is worse than its 38.4% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

Caesars Entertainment's operating margin has declined 1.8 percentage points over the last five years, leading to lower profitability and earnings. Taxes and interest expenses can also affect EPS, but they don't tell us as much about a company's fundamentals.In Q1, Caesars Entertainment reported EPS at negative $0.73, down from negative $0.63 in the same quarter last year. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Caesars Entertainment to perform poorly. Analysts are projecting its LTM EPS of $3.54 to shrink by 57.6% to $1.50.

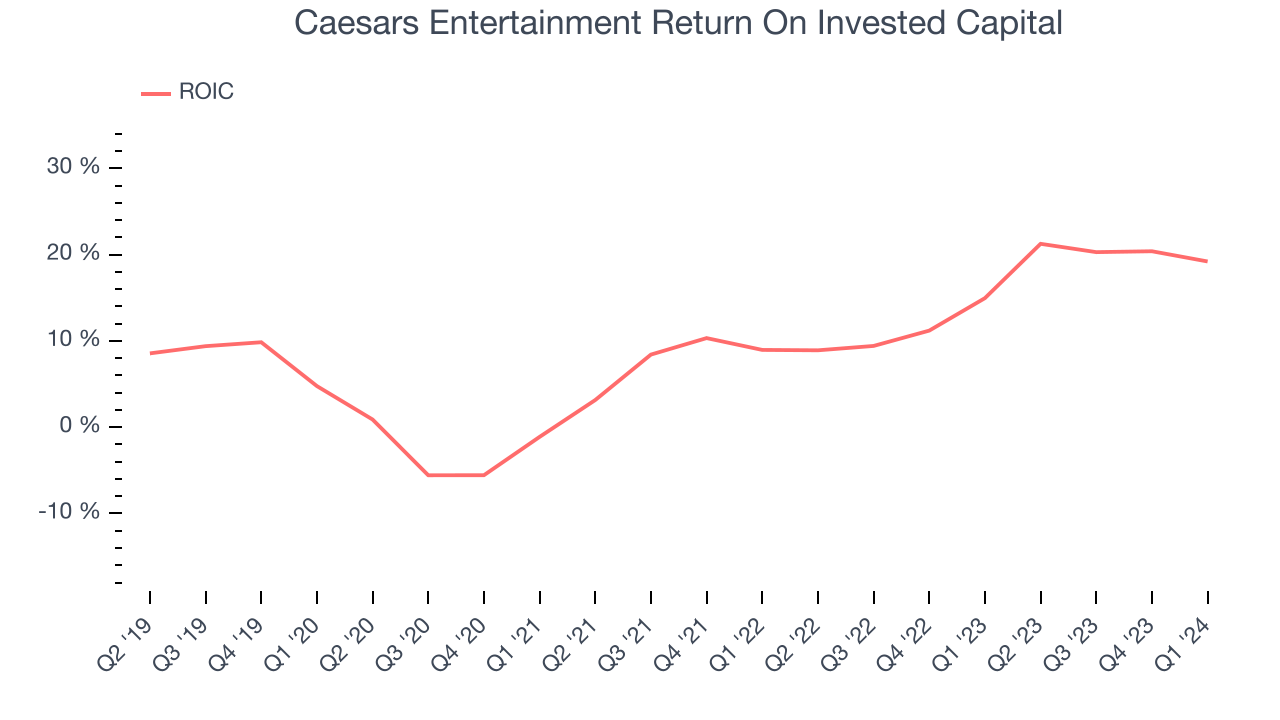

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Caesars Entertainment's five-year average return on invested capital was 9.4%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Caesars Entertainment's ROIC has significantly increased. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Caesars Entertainment reported $726 million of cash and $12.44 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $3.68 billion of EBITDA over the last 12 months, we view Caesars Entertainment's 3.2x net-debt-to-EBITDA ratio as safe. We also see its $2.34 billion of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Caesars Entertainment's Q1 Results

We struggled to find many strong positives in these results. Its revenue, adjusted EBITDA, and EPS all missed Wall Street's estimates. Overall, the results could have been better. The company is down 3.3% on the results and currently trades at $34.68 per share.

Is Now The Time?

Caesars Entertainment may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Caesars Entertainment isn't a bad business. First off, its revenue growth has been exceptional over the last five years. And while its projected EPS for the next year is lacking, its strong operating margins show it's a well-run business.

Caesars Entertainment's price-to-earnings ratio based on the next 12 months is 26.2x. In the end, beauty is in the eye of the beholder. While Caesars Entertainment wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $58.69 per share right before these results (compared to the current share price of $34.68).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.