Cloud storage and e-signature company Dropbox (Nasdaq: DBX) reported Q1 FY2021 results topping analyst expectations, with revenue up 12.4% year on year to $511.6 million. Dropbox made a GAAP profit of $47.6 million, improving on it's profit of $39.3 million, in the same quarter last year.

Get access to the fastest analysis of earnings results on the market. Get investing superpowers with StockStory. Signup here for early access.

Dropbox (NASDAQ:DBX) Q1 FY2021 Highlights:

- Revenue: $511.6 million vs analyst estimates of $505.1 million (1.27% beat)

- EPS (non-GAAP): $0.35 vs analyst estimates of $0.30 (15.6% beat)

- Free cash flow of $108.8 million, down 31.3% from previous quarter

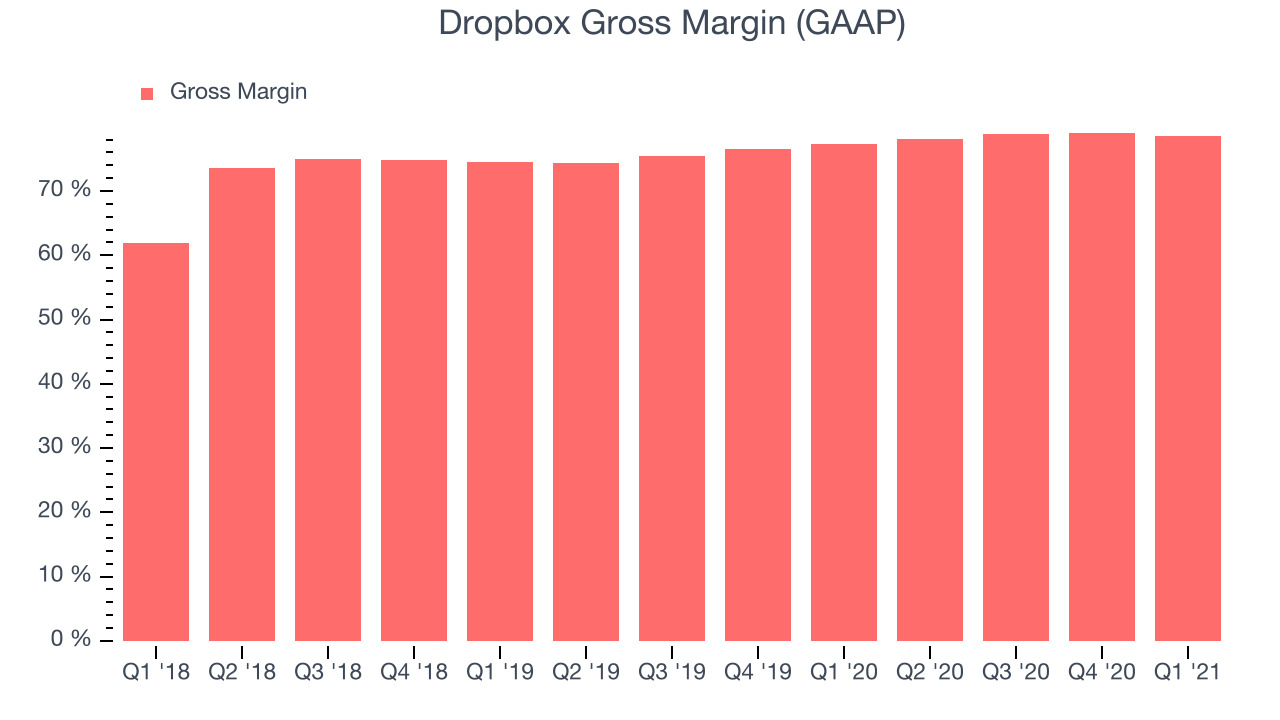

- Gross Margin (GAAP): 78.6%, in line with previous quarter

“We kicked off the year with a profitable Q1, along with strong revenue growth and free cash flow,” said Dropbox Co-Founder and Chief Executive Officer Drew Houston. “We welcomed DocSend to the team, saw great momentum with HelloSign, and continued to make meaningful progress against our 2021 priorities. In this new era of distributed work, we have a big opportunity to deliver more value to our customers and shareholders, and I’m excited for what’s ahead.”

The Beginning Of Ubiquitous Cloud Storage

Dropbox was founded by Arash Ferdowsi and long-serving CEO Drew Houston in 2007. Houston came up with the idea when he realised he didn't have his work USB, while sitting on a bus to New York for a weekend. He saw that a shared folder on the cloud would remove the need for a work USB and he started coding the product (for himself) while still on the bus. And so blossomed a passion for the file-sharing product, which he named Dropbox after the communal folder he and his friends would use during LAN parties, back in their teens. Today, over half a million organisations use Dropbox to securely store and collaborate on all manner of file types.

From its inception, Dropbox saw viral growth because when one person used it to share a folder with another, the second person would have to create a dropbox account. From the early days it was clear that Dropbox would face a crowded field, but by moving first and growing free users quickly, the company was able to become a trusted name in cloud storage. Since then, it has expanded into electronic signatures, but to this day organisations can sign up and try the solution for free, at least initially.

Over time, as more knowledge workers leave centralised offices, cloud storage and collaboration platforms like Dropbox will only become more important. That should mean robust demand. On the other hand, Dropbox faces competition from iCloud, Google Drive, and others, so revenue growth is an important marker that its product and brand both remain healthy.

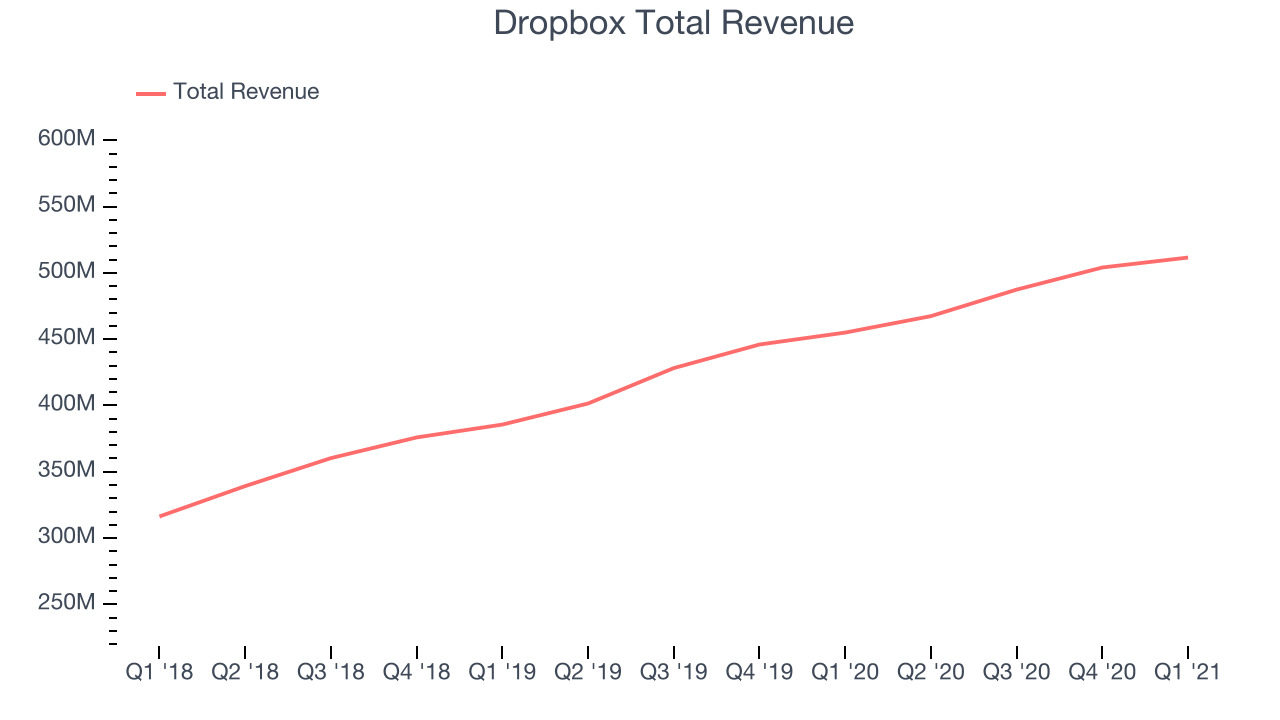

As you can see below, Dropbox's revenue growth has been solid over the last twelve months, growing from $455 million to $511.6 million.

This quarter, Dropbox's quarterly revenue was once again up 12.4% year on year. We can see that revenue increased by just $7.5 million in Q1, down from $16.7 million in Q4 2020. So while it is nice to see Dropbox grow generally, we have no doubt shareholders would like to see the company add more than that when it reports next.

Profitability With Scale

When you consider that Dropbox has to actually store large amounts of data, you wouldn't expect it to have top class software margins. However, scale can be a serious advantage.

Dropbox's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 78.6% in Q1. That means that for every $1 in revenue the company had $0.78 left to spend on developing new products, marketing & sales and the general administrative overhead. This is a good gross margin that allows Dropbox to fund large investments in product and sales during periods of rapid growth and be profitable now when it reached maturity. It is good to see that the gross margin is staying stable which indicates that Dropbox is doing a good job controlling costs and is not under a pressure from competition to lower prices.

Key Takeaways from Dropbox's Q1 Results

With market capitalisation of $10 billion, more than $1.91 billion in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

Dropbox topped analysts’ revenue expectations this quarter, even if just narrowly. On the other hand, the sales growth has slowed down over the years and Dropbox is now in the slower phase. Zooming out, we think this was a decent quarter. Dropbox was already worth watching, and while these results didn't make us much more excited about the company they also didn't hurt.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.