Earnings results often give us a good indication what direction the company will take in the months ahead. Heading into the new earnings season, let’s have a look at how Dropbox (NASDAQ:DBX) and its peers performed in Q3.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 16 productivity software stocks we track reported a solid Q3; on average, revenues beat analyst consensus estimates by 3.89%, while on average next quarter revenue guidance was 2.94% above consensus. Technology stocks have been hit hard on fears of higher interest rates and productivity software stocks have not been spared, with share price down 29.3% since earnings, on average.

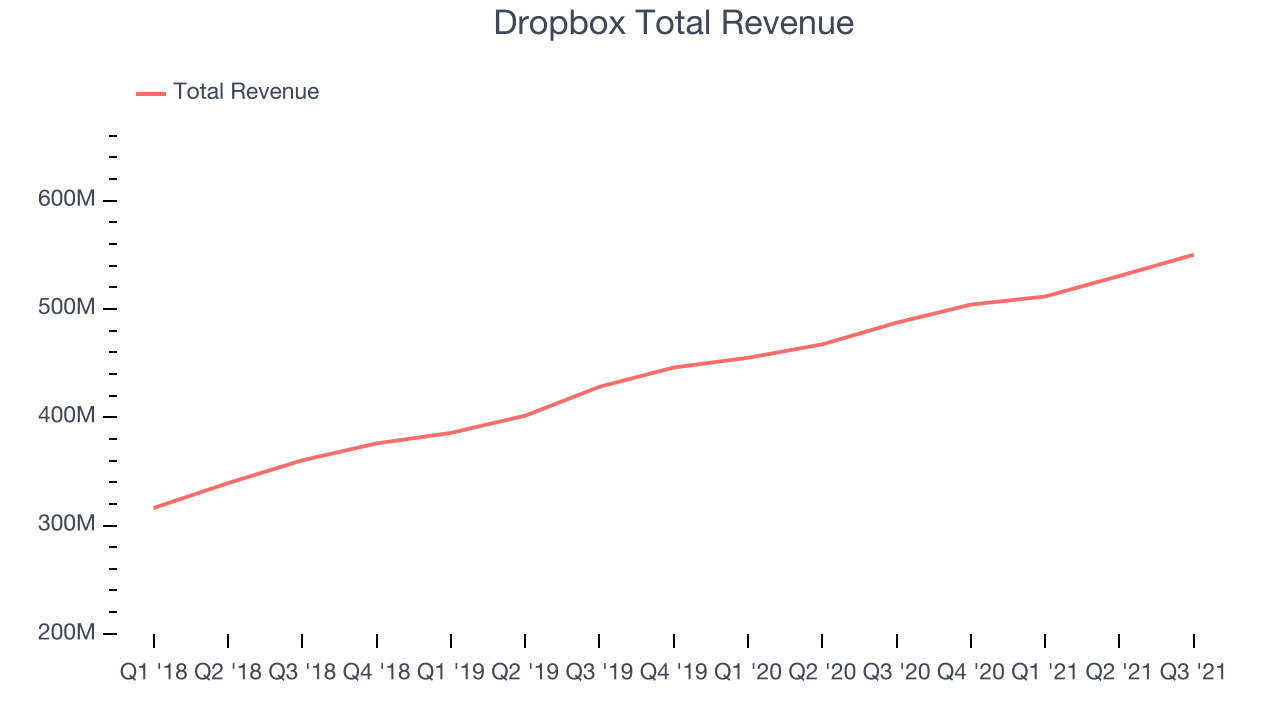

Dropbox (NASDAQ:DBX)

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ:DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

Dropbox reported revenues of $550.2 million, up 12.8% year on year, beating analyst expectations by 1%. It was an OK quarter for the company, in line with estimates and with accelerating customer growth.

“Q3 was another solid quarter with record free cash flow, strong revenue growth, and great progress against our strategic objectives as we focus on delivering more value to our customers and shareholders,” said Dropbox Co-Founder and Chief Executive Officer Drew Houston.

Dropbox delivered the smallest earnings surprise and slowest revenue growth of the whole group. The company added 350,000 customers to a total of 16.5 million. The stock is down 20.8% since the results and currently trades at $24.55.

Read our full report on Dropbox here, it's free.

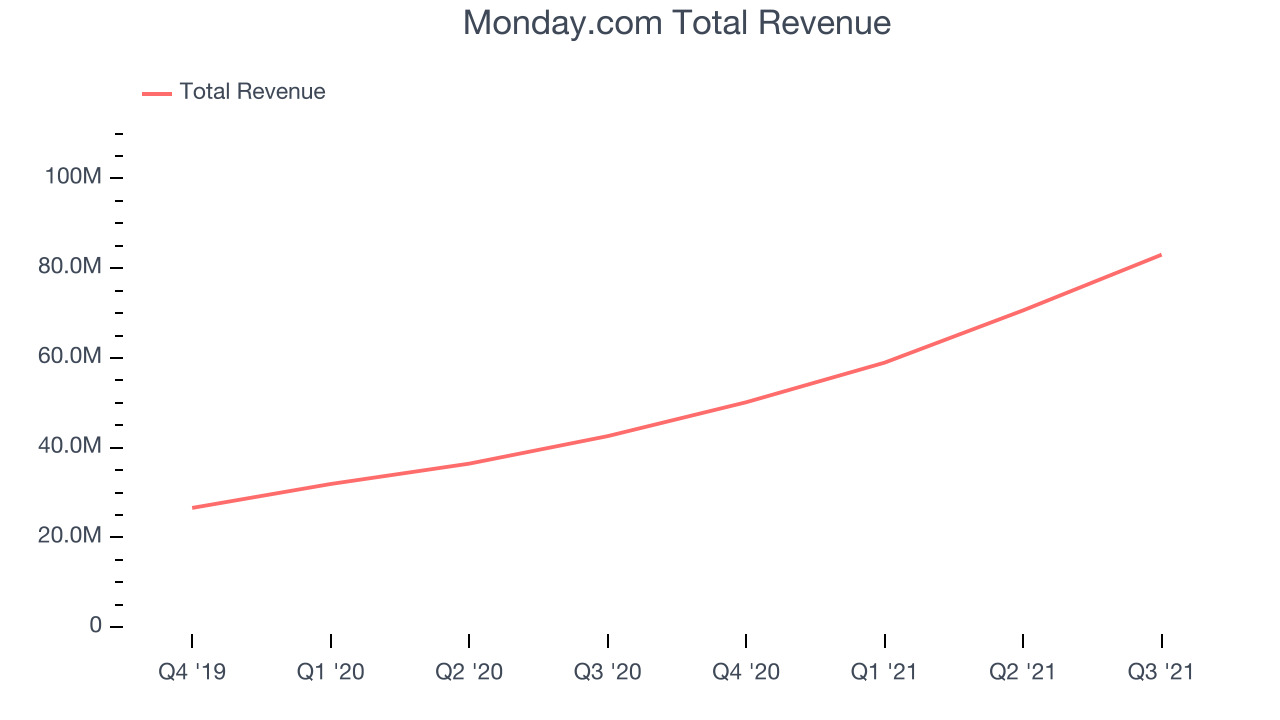

Best Q3: Monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

Monday.com reported revenues of $83 million, up 94.9% year on year, beating analyst expectations by 11.1%. It was an exceptional quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Monday.com achieved the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 143 enterprise customers paying more than $50,000 annually to a total of 613. The high-flying stock is down 52.5% since the results and currently trades at $211.33.

Is now the time to buy Monday.com? Access our full analysis of the earnings results here, it's free.

Weakest Q3: 8x8 (NYSE:EGHT)

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

8x8 reported revenues of $151.5 million, up 17.3% year on year, beating analyst expectations by 2.39%. It was a weaker quarter for the company, with a meaningful improvement in gross margin but decelerating growth in large customers.

The stock is down 32.1% since the results and currently trades at $15.72.

Read our full analysis of 8x8's results here.

Five9 (NASDAQ:FIVN)

Started in 2001, Five9 (NASDAQ: FIVN) offers software as a service that makes it easier for companies to set up and efficiently run call centers, and offer more tailored customer support.

Five9 reported revenues of $154.3 million, up 37.6% year on year, beating analyst expectations by 5.21%. It was a very strong quarter for the company, with a very optimistic guidance for the next quarter.

The stock is down 11.8% since the results and currently trades at $127.91.

Read our full, actionable report on Five9 here, it's free.

Asana (NYSE:ASAN)

Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE:ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work.

Asana reported revenues of $100.3 million, up 70.3% year on year, beating analyst expectations by 6.85%. It was a very strong quarter for the company, with an optimistic guidance for the next quarter.

The company added 1,337 enterprise customers paying more than $5,000 annually to a total of 14,143. The stock is down 41.7% since the results and currently trades at $53.

Read our full, actionable report on Asana here, it's free.

The author has no position in any of the stocks mentioned