The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the productivity software stocks have fared in Q4, starting with Dropbox (NASDAQ:DBX).

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 16 productivity software stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 2.27%, while on average next quarter revenue guidance was 0.93% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows and while some of the productivity software stocks have fared somewhat better that others, they have not been spared, with share prices declining 8.54% since the previous earnings results, on average.

Dropbox (NASDAQ:DBX)

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ:DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

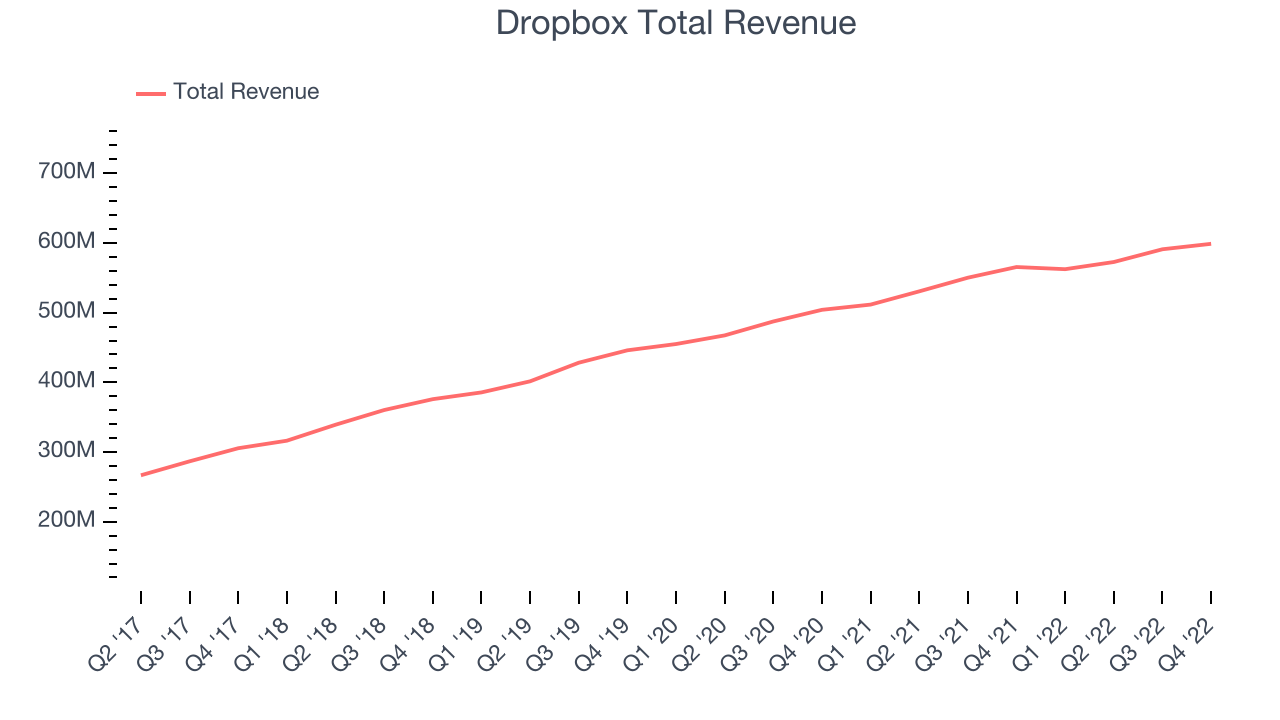

Dropbox reported revenues of $598.8 million, up 5.89% year on year, in line with analyst expectations. It was a mixed quarter for the company, with accelerating customer growth but slow revenue growth.

"2022 was a solid year for Dropbox amidst a challenging macroeconomic environment,” said Dropbox Co-Founder and Chief Executive Officer Drew Houston.

The stock is down 13% since the results and currently trades at $20.86.

Read our full report on Dropbox here, it's free.

Best Q4: monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

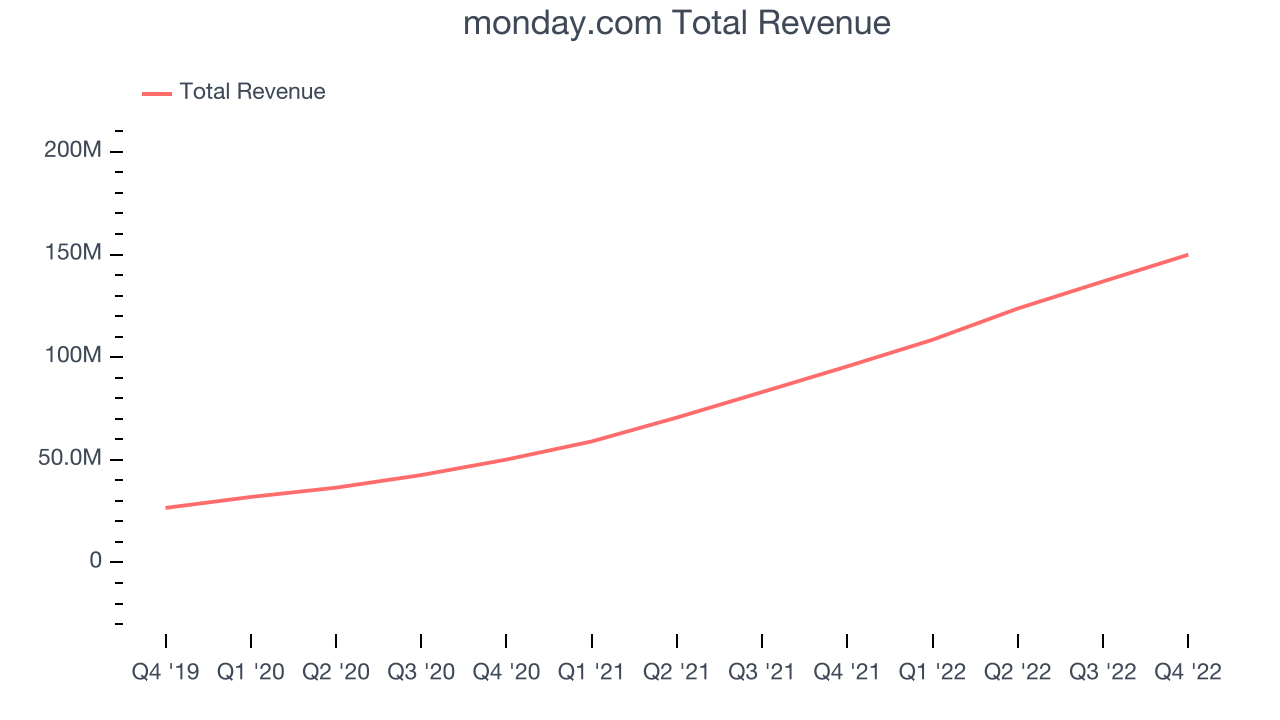

monday.com reported revenues of $149.9 million, up 56.9% year on year, beating analyst expectations by 5.85%. It was a decent quarter for the company, with exceptional revenue growth but underwhelming guidance for the next year.

monday.com scored the fastest revenue growth and highest full year guidance raise among its peers. The company added 151 enterprise customers paying more than $50,000 annually to a total of 1,474. The stock is up 3.66% since the results and currently trades at $135.79.

Is now the time to buy monday.com? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Box (NYSE:BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE:BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

Box reported revenues of $256.5 million, up 9.91% year on year, missing analyst expectations by 0%. It was a weak quarter for the company, with full year revenue guidance missing analysts' expectations.

The stock is down 24.1% since the results and currently trades at $25.49.

Read our full analysis of Box's results here.

Atlassian (NASDAQ:TEAM)

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ:TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

Atlassian reported revenues of $872.7 million, up 26.7% year on year, beating analyst expectations by 2.74%. It was a mixed quarter for the company, with a decent beat of topline estimates but decelerating customer growth.

The company added 4,004 customers to a total of 253,177. The stock is down 16.1% since the results and currently trades at $153.

Read our full, actionable report on Atlassian here, it's free.

Everbridge (NASDAQ:EVBG)

Founded as a reaction to the catastrophic events of 9/11, Everbridge (NASDAQ:EVBG) supplies software that helps governments and businesses keep people and infrastructure safe in emergencies.

Everbridge reported revenues of $117.1 million, up 13.9% year on year, in line with analyst expectations. It was a slower quarter for the company, with underwhelming revenue guidance for the next quarter and the full year.

The company added 96 customers to a total of 6,513. The stock is down 3.48% since the results and currently trades at $32.75.

Read our full, actionable report on Everbridge here, it's free.

The author has no position in any of the stocks mentioned