Wrapping up Q2 earnings, we look at the numbers and key takeaways for the productivity software stocks, including Dropbox (NASDAQ:DBX) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 16 productivity software stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 0.5% below.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be assessing whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

In light of this news, productivity software stocks have held steady with share prices up 2.9% on average since the latest earnings results.

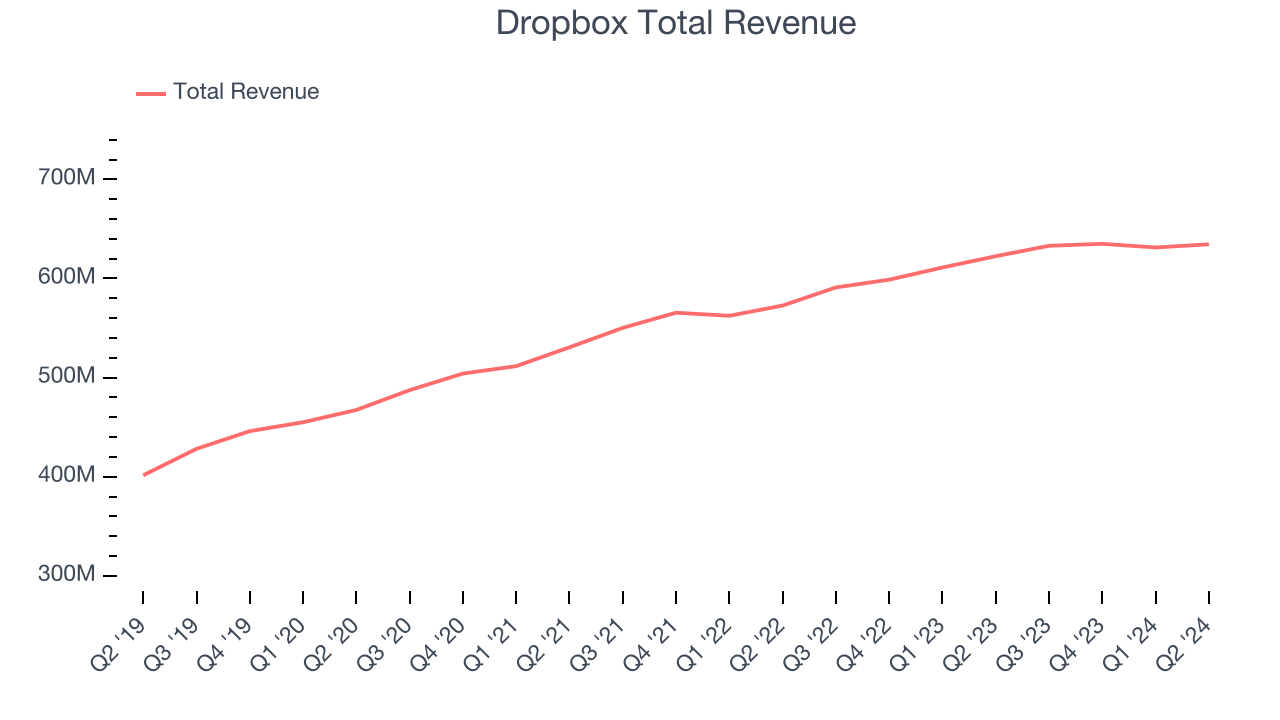

Dropbox (NASDAQ:DBX)

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ:DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

Dropbox reported revenues of $634.5 million, up 1.9% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with accelerating customer growth but a miss of analysts’ billings estimates.

Interestingly, the stock is up 14.1% since reporting and currently trades at $24.80.

Is now the time to buy Dropbox? Access our full analysis of the earnings results here, it’s free.

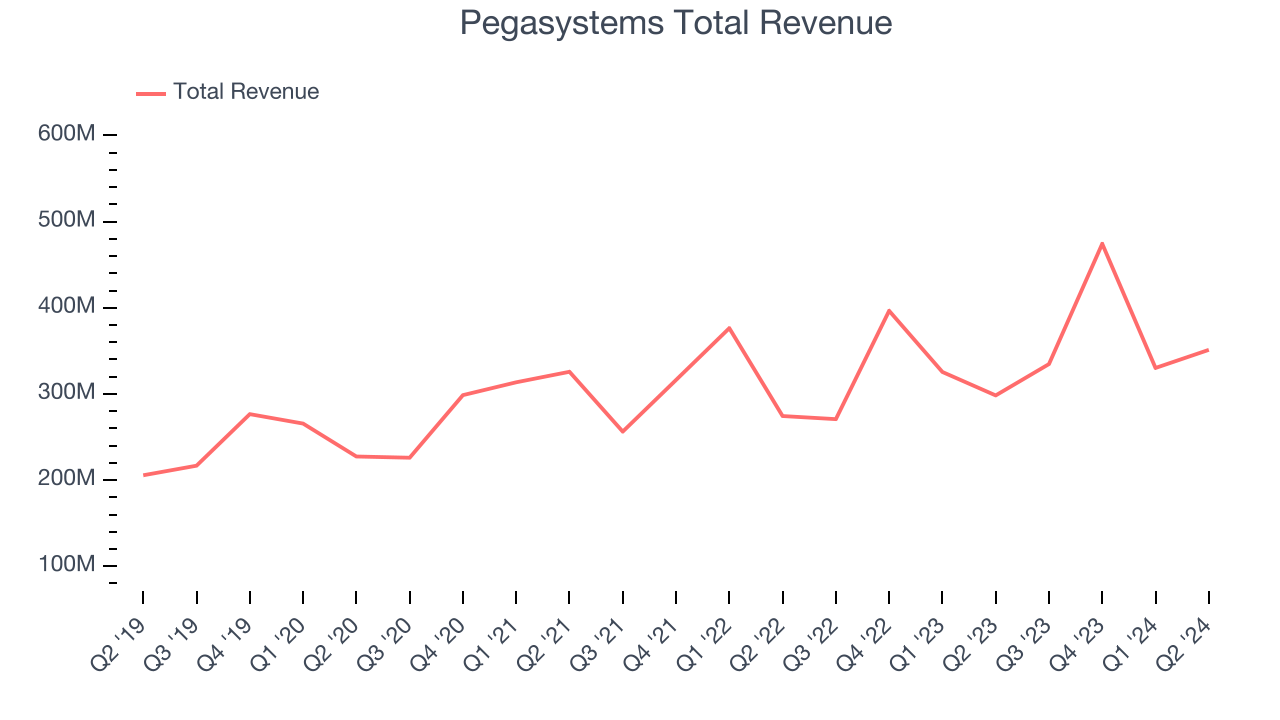

Best Q2: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $351.2 million, up 17.7% year on year, outperforming analysts’ expectations by 8.1%. The business had a stunning quarter with an impressive beat of analysts’ billings estimates and an improvement in its gross margin.

Pegasystems achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 21.7% since reporting. It currently trades at $74.40.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: 8x8 (NASDAQ:EGHT)

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

8x8 reported revenues of $178.1 million, down 2.8% year on year, in line with analysts’ expectations. It was a softer quarter as it posted underwhelming revenue guidance for the next quarter and a miss of analysts’ billings estimates.

8x8 delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 24% since the results and currently trades at $1.96.

Read our full analysis of 8x8’s results here.

RingCentral (NYSE:RNG)

Founded in 1999 during the dot-com era, RingCentral (NYSE:RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

RingCentral reported revenues of $592.9 million, up 9.9% year on year. This result beat analysts’ expectations by 1.1%. Zooming out, it was a satisfactory quarter as it also produced a decent beat of analysts’ billings estimates but a decline in its gross margin.

The stock is down 9.6% since reporting and currently trades at $30.24.

Read our full, actionable report on RingCentral here, it’s free.

ServiceNow (NYSE:NOW)

Founded by Fred Luddy, who wrote the code for the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE:NOW) offers a software-as-a-service platform that helps companies become more efficient by allowing them to automate workflows across IT, HR, and customer service.

ServiceNow reported revenues of $2.63 billion, up 22.2% year on year. This result was in line with analysts’ expectations. Overall, it was a strong quarter as it also recorded accelerating growth in large customers and a solid beat of analysts’ billings estimates.

The company added 55 enterprise customers paying more than $1m annually to reach a total of 1,988. The stock is up 22.5% since reporting and currently trades at $895.99.

Read our full, actionable report on ServiceNow here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.