Cloud monitoring software company Datadog (NASDAQ:DDOG) beat analyst expectations in Q1 FY2021 quarter, with revenue up 51.2% year on year to $198.5 million. Datadog made a GAAP loss of $13 million, down on it's profit of $6.47 million, in the same quarter last year.

Get access to the fastest analysis of earnings results on the market. Get investing superpowers with StockStory. Signup here for early access.

Datadog (NASDAQ:DDOG) Q1 FY2021 Highlights:

- Revenue: $198.5 million vs analyst estimates of $186.6 million (6.38% beat)

- EPS (GAAP): -$0.04

- Revenue guidance for Q2 2021 is $212 million at the midpoint, above analyst estimates of $196.5 million

- The company lifted revenue guidance for the full year, from $830 million to $885 million at the midpoint, a 6.62% increase

- Free cash flow of $44.4 million, up 167% from previous quarter

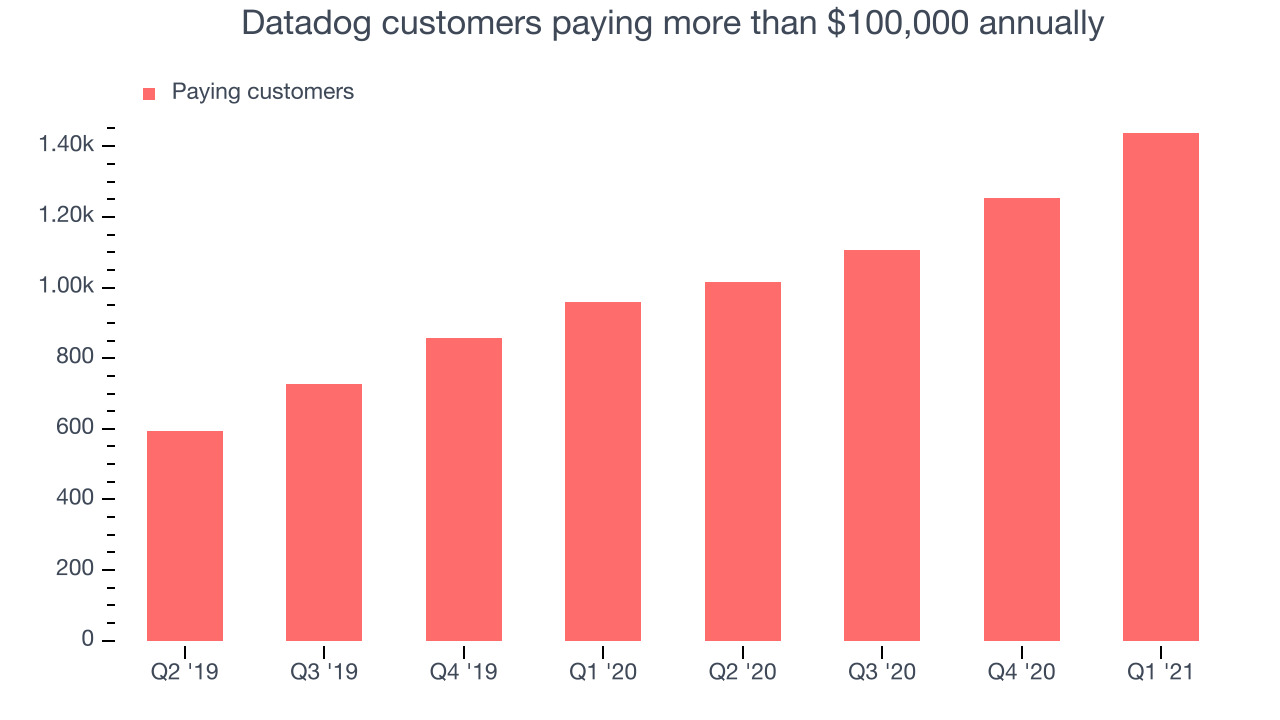

- Customers: 1,437 customers paying more than $100,000 annually

- Gross Margin (GAAP): 76.4%, in line with previous quarter

“We are pleased with our strong first quarter results, an excellent start to the year that demonstrated continued high growth at scale,” said Olivier Pomel, co-founder and CEO of Datadog. “We continue to innovate at a rapid pace, delivering new products and features that leverage the strength of our observability platform to create value for our customers." Pomel added, “Businesses are planning for a post-pandemic world. Digital transformation projects are being prioritized, as the need to be digital-first and agile is more prominent than ever. We believe we are in a strong position to benefit from this trend as the most complete and cloud-native end-to-end observability platform.”

Watching The Clouds

Datadog (DDOG), named after a database the founders had to painstakingly look after at their previous company, is a software as a service platform that makes it easier to monitor cloud infrastructure and applications. Datadog seamlessly integrates into a company’s tech stack and pulls all the metrics that matter for different cloud services and databases and makes them available in a single real-time dashboard. The shared dashboard then makes it easy for different teams in the company to collaborate when investigating why a service broke down or became really slow.

The demand for services like Datadog is driven by the ongoing adoption of cloud technologies, as a lot of the legacy monitoring tools don't work well in modern cloud or hybrid environments. Cloud infrastructure monitoring is becoming a competitive space and Datadog is competing with offerings from New Relic (NYSE:NEWR), Elastic (NYSE:ESTC) and Splunk (NASDAQ:SPLK) and the simpler monitoring tools made by the cloud providers themselves.

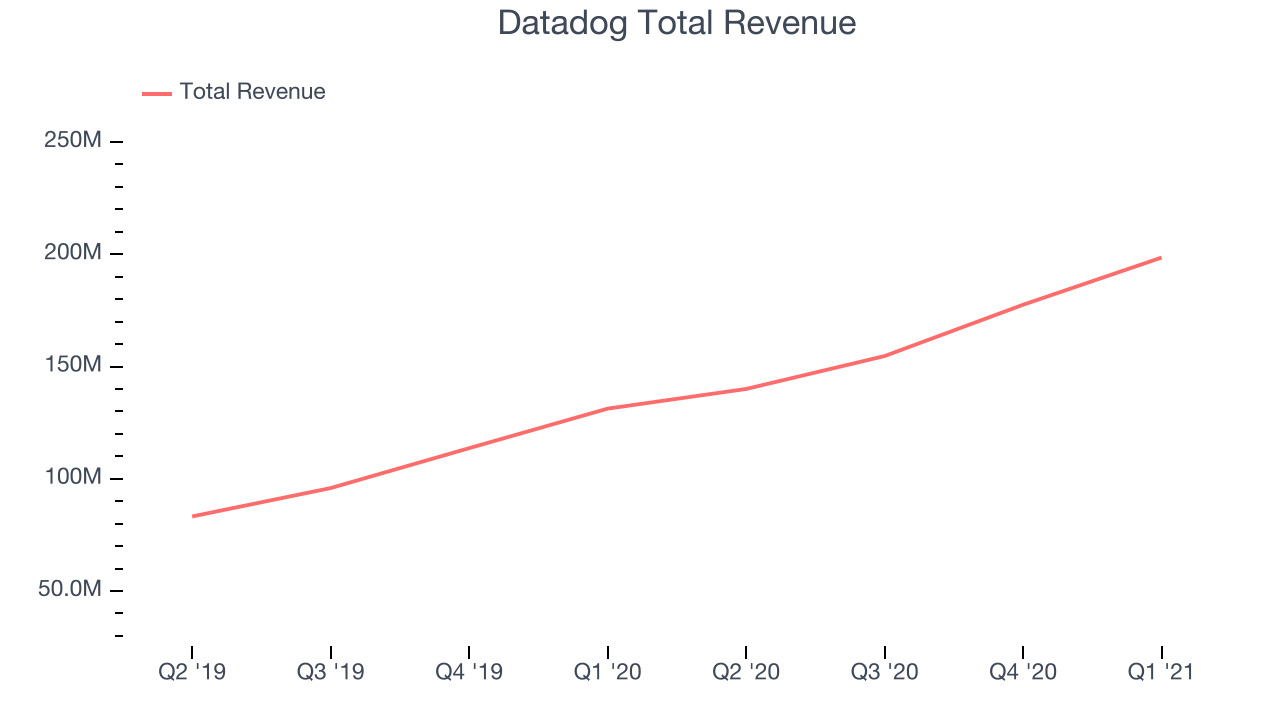

As you can see below, Datadog's revenue growth has been exceptional over the last twelve months, growing from $131.2 million to $198.5 million.

This was another standout quarter with the revenue up a splendid 51.2% year on year. Quarter on quarter the revenue increased by $21 million in Q1, which was roughly in line with the Q4 2020 increase. This steady quarter-on-quarter growth shows the company is able to maintain a strong growth trajectory.

Datadog Is Growing Its Customer Base

Datadog has a highly efficient go-to-market model, which consists of a self-service plan, a high velocity inside sales team, and an enterprise sales force. The self-service plan, free trial and the fact that the platform is so easy to setup that customers can start using it within minutes of signing up make adopting Datadog almost frictionless. However lately the majority of the revenue growth has been coming from larger customers.

You can see below that at the end of the quarter Datadog reported 1,437 enterprise customers paying more than $100,000 annually, an increase of 184 on last quarter. That is quite a bit more contract wins than last quarter and quite a bit above what we have typically seen lately, demonstrating that the business itself has good sales momentum. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is working very well.

Key Takeaways from Datadog's Q1 Results

With market capitalisation of $23.6 billion, more than $1.54 billion in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

We were impressed by the exceptional revenue growth Datadog delivered this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. Therefore, we think Datadog will continue to stand out as a very compelling growth stock, arguably even more so than before.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.