Diner restaurant chain Denny’s (NASDAQ:DENN) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 2.1% year on year to $111.8 million. Its non-GAAP profit of $0.14 per share was also 8.8% below analysts’ consensus estimates.

Is now the time to buy Denny's? Find out by accessing our full research report, it’s free.

Denny's (DENN) Q3 CY2024 Highlights:

- Revenue: $111.8 million vs analyst estimates of $115.5 million (3.2% miss)

- Adjusted EPS: $0.14 vs analyst expectations of $0.15 (8.8% miss)

- EBITDA: $20.02 million vs analyst estimates of $22.3 million (10.2% miss)

- EBITDA guidance for the full year is $82.5 million at the midpoint, below analyst estimates of $83.19 million

- Gross Margin (GAAP): 32.2%, down from 40.2% in the same quarter last year

- Locations: 1,586 at quarter end, down from 1,644 in the same quarter last year

- Same-Store Sales were flat year on year (1.8% in the same quarter last year)

- Market Capitalization: $341.1 million

Kelli Valade, Chief Executive Officer, stated, “Our third quarter sales results directly reflect ongoing brand investments and dedicated focus on value that resulted in outpacing the category. Denny’s domestic system-wide same-restaurant sales** outperformed the BBI Family Dining index for the third consecutive quarter driven by the relaunch of our fan favorite $2-$4-$6-$8 value menu and the continued expansion of off-premises with our third virtual brand, Banda Burrito. Keke’s also experienced significant sequential improvement in same-restaurant sales** as our initiatives to enact foundational marketing strategies and expand the alcohol program continued our efforts to close the gap to the competitive set. We are also very excited to be hosting an Investor Day today.”

Company Overview

Open around the clock, Denny’s (NASDAQ:DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

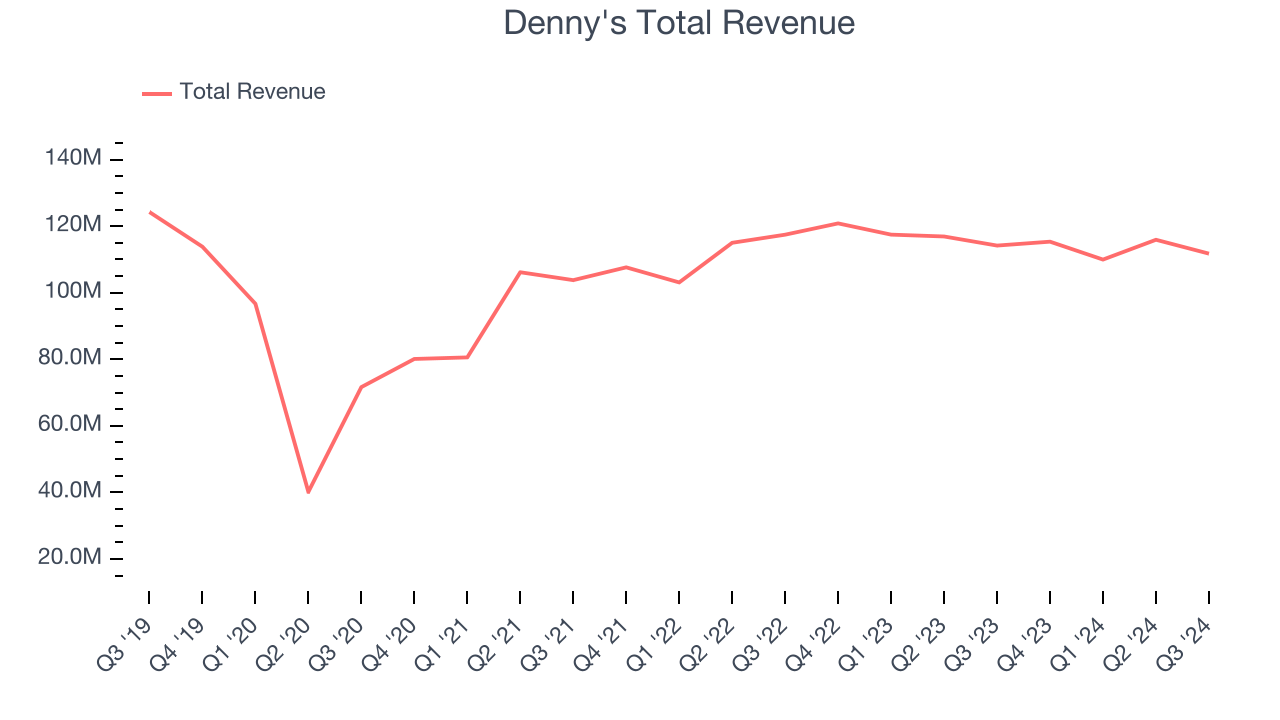

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Denny's is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

As you can see below, Denny’s revenue declined by 5.1% per year over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it closed restaurants.

This quarter, Denny's missed Wall Street’s estimates and reported a rather uninspiring 2.1% year-on-year revenue decline, generating $111.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, an acceleration versus the last five years. While this projection shows the market thinks its newer offerings will catalyze better performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

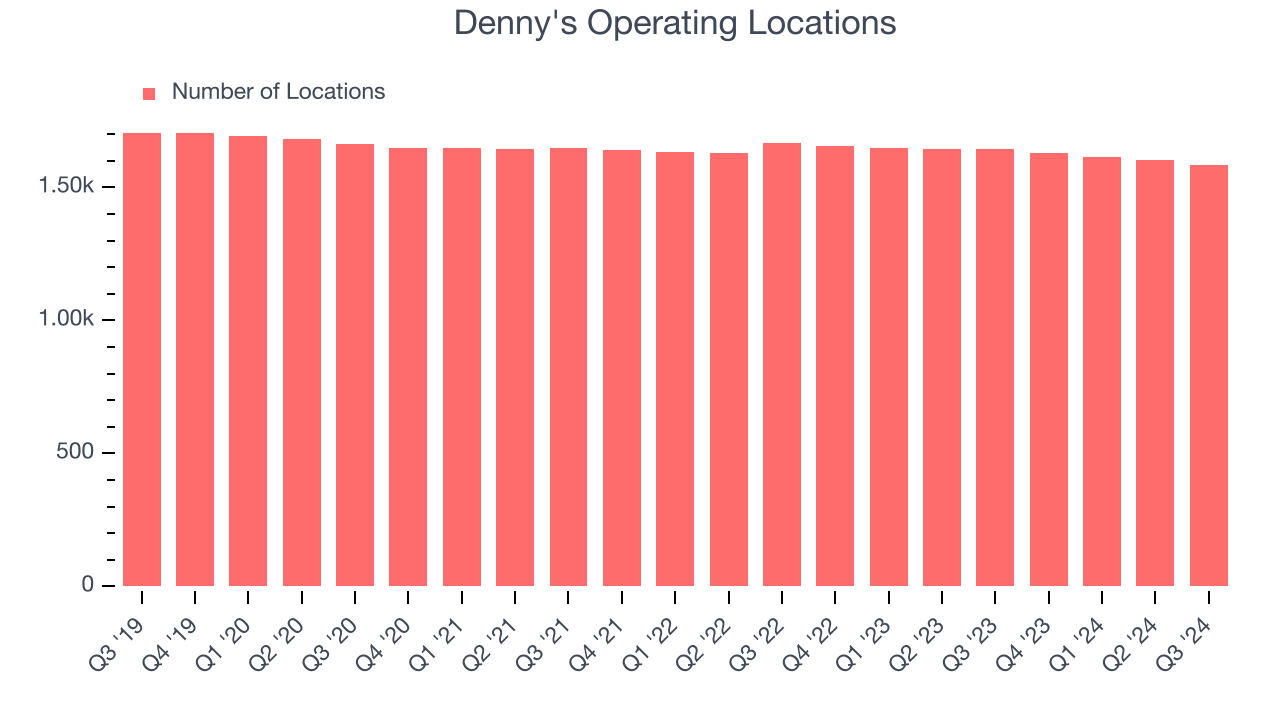

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Denny's operated 1,586 locations in the latest quarter. Over the last two years, the company has generally closed its restaurants, averaging 1% annual declines.

When a chain shutters restaurants, it usually means demand for its meals is waning, and it is responding by closing underperforming locations to improve profitability.

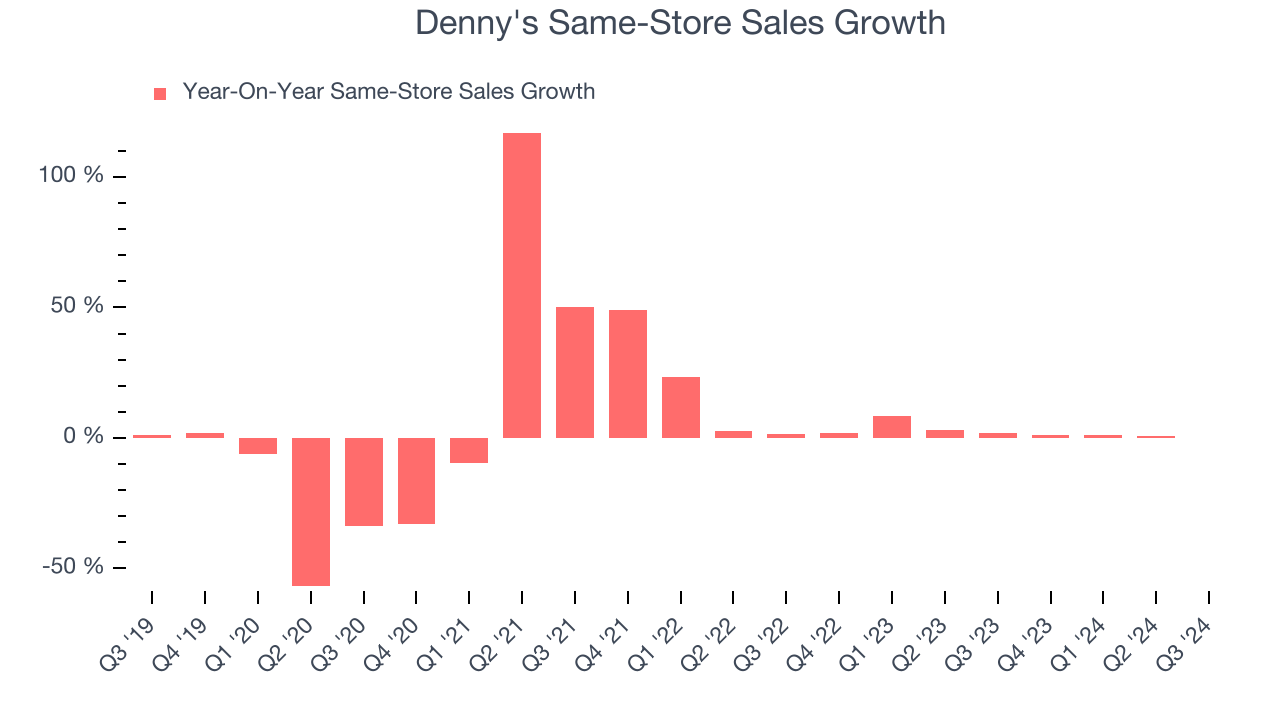

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Denny’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2.3% per year. Given its declining restaurant base over the same period, this performance stems from a mixture of higher prices and increased foot traffic at existing locations (closing restaurants can sometimes boost same-store sales).

In the latest quarter, Denny’s year on year same-store sales were flat. By the company’s standards, this growth was a meaningful deceleration from the 1.8% year-on-year increase it posted 12 months ago. We’ll be watching Denny's closely to see if it can reaccelerate growth.

Key Takeaways from Denny’s Q3 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed analysts’ expectations and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $6.61 immediately following the results.

Denny's may have had a tough quarter, but does that actually create an opportunity to invest right now?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.